Lessons from Sales Hire #1 – $400K to $30M ARR

It’s been a whirlwind week.

From Vancouver – SF – LA – Denver and now sending this out from sunny Las Vegas.

Thanks for reading The GTM Newsletter! Subscribe for free to receive new posts and support my work.

We were lucky to bring together some of the top GTM operators/founders in each city to share their knowledge, network and think through the future of go-to-market.

Here are the 3 recurring themes that kept coming up in conversation:

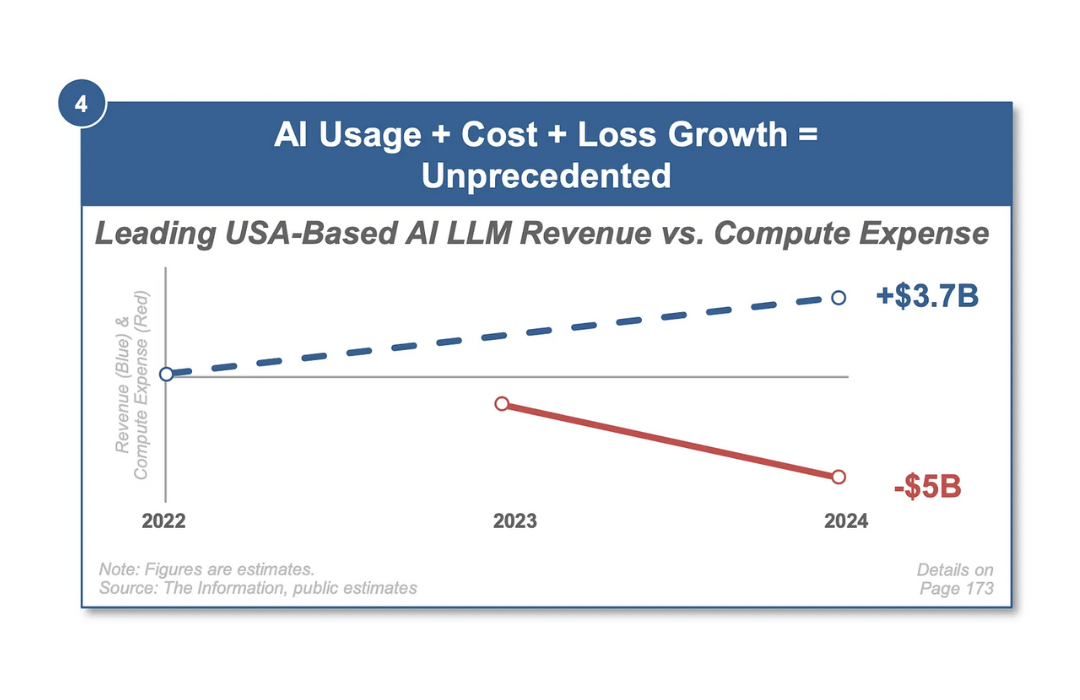

1. AI’s influence on the GTM stack/process

2. How partnerships/referrals will play a huge role in the future of pipeline creation/deal velocity

3. How tech companies will finally break into more non tech industries

More on the topics above in future newsletter editions.

This week, we’ve brought in a guest writer to tell his tale and all the learnings that have come with it.

Let’s get into it.

Lessons from Sales Hire #1 – $400k to $30M ARR

This week I’m going to pass the ✍️ to one of our GTM community members to share his story and learnings from a historic 6.5 year run (he also writes one of my fav. tactical newsletters out there right now called ‘Prospecting From The Trenches’:

Florin Tatulea here.

I’m currently part of the GTMfund Community and the Director of Sales at a Seed Stage company called Barley.

I was lucky enough to be the first sales hire (SDR) and employee #7 at Loopio early on in my career journey and rode an incredible wave that lasted 6.5 years and propelled my career from SDR, AE to Sr. Manager, Sales Development (and a few other steps in-between).

Since then, I’ve been building sales programs at various Seed – Series A companies, whether that was full-time or in a consulting capacity.

I’ve also been focusing a lot of my work on copywriting, messaging and sequencing workshops – having trained reps at some of the world’s best SaaS companies like Shopify, Zendesk, LivePerson & Docebo.

Here are some of the most valuable lessons that I’ve learned about early-stage sales in the last decade:

1. Timing in market matters more than any successful sales leader would like to admit.

Every sales team wants to make themselves look like geniuses and the reality is that it’s just not true. Sure, we were a great sales team and that mattered but even after reflecting back on everything with the founders, we happened to hit the RFP Response market at a unique time, rode the SaaS boom from 2014-2021 and were in a category that most people didn’t see as large enough to tackle.

A great sales team alone is not enough to make you a success. We are not magicians.

2. As a founder, it’s just essential that you close the first 10-20 deals before you bring somebody on.

The Co-Founder that was responsible for revenue, was until the day he exited, one of the best sellers of Loopio, period.

He (with some help from the other Co-Founders) closed the first $400K of ARR by himself.

This goes back to my point around sales people (even if great) not being magicians.

As a founder, you have an authentic story, viewpoint and conviction behind why you wanted to solve that problem. If you can’t sell your product/solution, I can almost guarantee that nobody else can do it for you.

3. Your first core group of sales hires are crucial. They should all have relevant sales experience.

SDRs

I notice that a lot of founders want to take the cheaper route and hire an intern or somebody right out of school.

Ironically enough, I was that SDR. I had no relevant SaaS experience and only had 6 months of work experience under my belt. I would even argue that I was potentially not the “right” first hire.

I ended up figuring it out but it took me 6 months to really ramp.

I had to learn how to actually work (calendar, writing emails, talking on the phone with conviction to executives etc.) and this led to a lot of hand holding by the founders.

Just spend the extra $20k and get somebody that’s really good. It will be a significantly better ROI in most cases after you factor in ramp time and the opportunity cost of burnt leads plus your time.

AEs

Your first 5 AEs should ideally have experience selling into a similar buyer and a similar ACV. The AEs that are best in the early days are ones that have sold a product with very little brand recognition and really had to fight for deals.

These are the greatest sellers out there. I would also almost always suggest against hiring an AE that comes from large enterprise companies at this stage.

It never once worked out for us at that point in time and almost never does at any company I’ve worked with.

Nothing against sales reps at large companies, they just happen to be used to selling a product with a ton of brand recognition, inbound leads were they are essentially order-takers, have SEs that demo for them and sales enablement teams that make their lives easier. It’s not the same at all in the early days.

4. Having a strong core group of sales people that stayed together for 4 years was really where the magic happened.

I truly believe that having a core group of SDRs/AEs that stayed together for 4-5 years with next to no employee churn really made a big difference in the trajectory of the company.

Our investors did a wide scale win/loss analysis through a ton of interviews with customers and prospects and Sales Experience was always a big pro for us at Loopio.

How do you keep a core group together for a while? Here are a few things I thought made it a no-brainer:

-

Many reps had worked with each other before. There was a sense of camaraderie

-

Product was truly top-notch. We all knew and believed we had the best product in the market and it gave us conviction on calls

-

Comp plans were very straight forward. No Gimmicks:

SDRs: Paid $ X for Meetings Occurred, $ Y for Meetings Accepted into Pipeline

AEs: X% of ARR on deals won + accelerators -

Our Head of Sales made it clear that he was on our side. He had our back, with other departments and with prospects. He was also a great seller

-

Clear career paths and micro-promotions to keep people motivated

-

A culture of winning. We celebrated when other’s closed deals, but we hated that they just surpassed us on the leaderboard

-

No tolerance for toxic behaviour. If so, reps were gone immediately.

5. Speed to lead is critical and sets your sales cycles up for success

We were lucky at Loopio in that we had great inbound lead flow. Our Inbound SDRs were taking a discovery call because we needed to qualify for the AEs.

If you are lucky enough to be in a situation where you can qualify out demo requests, I would suggest putting some of your strongest SDRs on those calls so that the first contact with the company was great. Otherwise, just route them directly to AEs.

We made sure that our speed to lead was ideally under 10 minutes from the moment a demo request came in.

This REALLY made a difference. As a matter of fact, research shows that lead qualification drops by 80% if you take more than 5 mins to respond.

Inbound SDRs were largely comped on average speed-to-lead <1 hour.

Inbound leads are too precious to waste and by qualifying out, we made sure our AEs were really only focused on opportunities that were winnable.

To this day, so many companies have a terrible experience for prospects that submit demo requests. This made sure we were always first to talk to prospects, set the stage for a great sales experience and were able to control the conversation around our competitors.

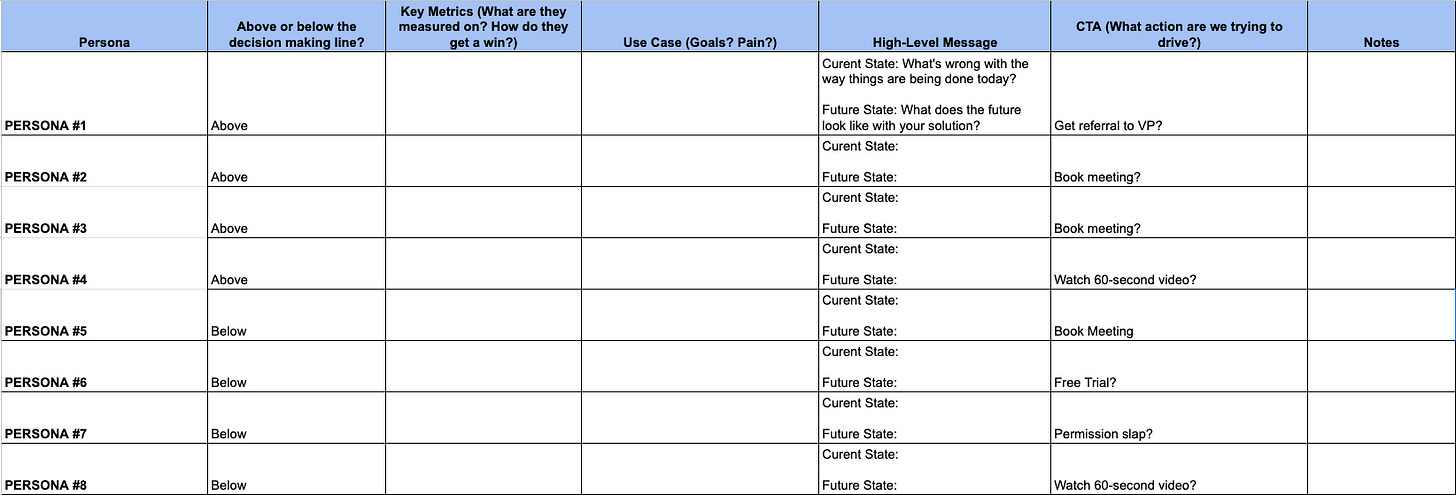

6.Really narrow down your Personas and ICP to build amazing messaging for Demand Gen and also sequences for outbound (template)

I’ve worked with about 50 sales teams over the last 2 years. One of the main problems I consistently see early-stage companies get wrong is that they don’t narrow down their Account Lists & Personas to really focus in.

It’s easy when you are a start-up to tell your sales team to just hit up everybody because it’s so greenfield. That being said, it’s not in your best interest to let junior sales people decide what accounts they are reaching out to.

The whole leadership team and founders should narrow down the attributes that matter (ideally based on data from win rates) and send that list to sales to work.

Saying your ICP is Sales Leaders at High-Growth B2B SaaS companies is NOT specific enough.

For example, right now at Barley (we sell a compensation management platform) I’ve narrowed down my ICP to:

Personas:

VP People, VP/Director Total Rewards, Head of HR Operations, Head of HRBP, Head of HR Analytics

Account Attributes:

Industry: B2B SaaS, E-Commerce, Retail, Biotech, Healthcare

Employee Size: 200-1000

Location: HQ – US/Canada + Global Presence (We help with Multi-Currency Comp)

Hiring Velocity: Moderate+ (10+ Open Positions on Website)

Growth Rate: Positive within last Month

Technologies: Using BambooHR, Lever, Greenhouse

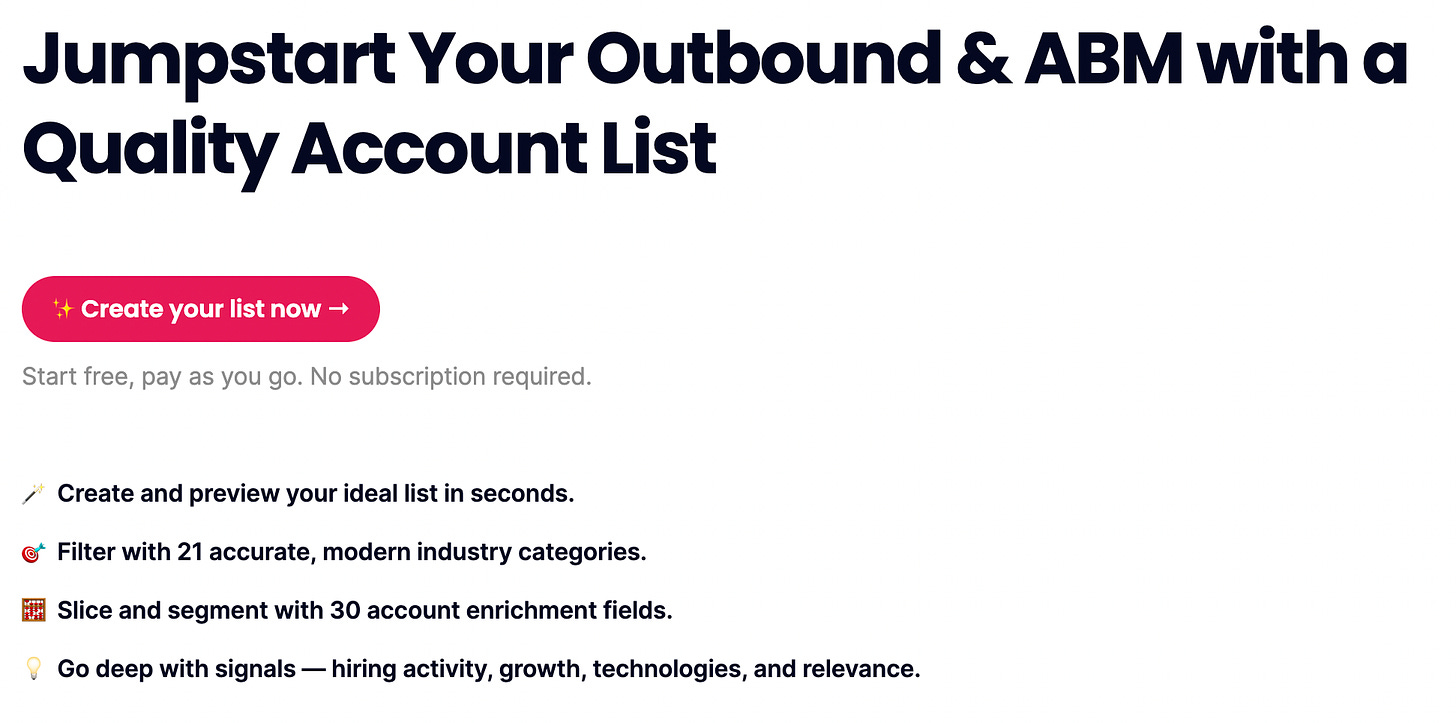

That’s much more narrow and now we can build very specific messaging when you have such a detailed list. I’ve been using Keyplay to help me build these lists.

FREE TEMPLATE:

Here’s a template of an exercise I do with all sales teams before we go through a messaging workshop or we build sequences. I highly suggest filling this out and nailing down your ICP + Messaging.

The US market is huge. You don’t need to go worldwide until $20M+ ARR, maybe even later.

7. Sales knew product insanely well

Our Co-Founder & CTO made sure that the whole company was a product-focused company from the beginning. Every single member of the team was involved in QA testing for the first 2-3 years. For the 3-4 years after that, the sales team would show up to the weekly sprint meetings to make sure we knew what was happening, what the roadmap looked like and that we had detailed understanding of the product.

You can argue that it’s a waste of sales time, but I disagree. It made us experts on calls. We didn’t need to go to product or engineering to answer questions about Security, Integrations, SSO, or technical functionality because we knew every inch of the platform.

It shortened sales cycles and made us look like we had our shit together.

8. Segment your sales team sooner

At one point as an AE I was working deals from 100 employee start-ups to Bank of America. SMB deals are very different from enterprise deals and the context switching was a lot, especially for me as a relatively junior rep. I also was not fit to run enterprise deals at that point in my career. We probably lost a few large logos that a more experienced seller could have closed.

We should have probably segmented 2 years earlier than we did. If you are starting to see an influx of deals across SMB, MM, ENT – make that switch now.

9. You don’t need to go Enterprise before $10M ARR

Everybody wants to go enterprise but nobody actually understands how big of a beast it is (especially first-time founders).

Enterprise is a company wide initiative. You don’t win Enterprise deals alone and most junior sellers are not fully ready to handle true enterprise deals/accounts.

Enterprise deals require a coordinated effort that includes Enterprise Grade Reporting/Integrations/SSO, Global 24/7 Support, Massive Implementations, RFPs, Procurement, Security, POCs, ABM etc.

It’s not something you just magically decide to turn on one day.

You are setting up your sales team for failure if you don’t have your ducks in order in all departments.

Start hiring people that have done Enterprise before. You can figure it out yourself too, but it will take much longer.

10. US Market is huge (for most). Global expansion might even hinder your sales efforts before $20M ARR

This goes back to focus. I remember there being a lot of pressure on us to go global. Some of our competitors were expanding to EMEA and APAC and we felt like we were going to lose the market.

Looking back, I think the founders made the right call to really focus on the US.

The problem with going global too early on that nobody really talks about is that it causes a lot of issues internally for a small company:

-

You have to either let your sales reps take calls at insane hours or hire reps/leaders in other countries

-

The operating rhythm of the company changes:

-

When do you do full team meetings? If at all?

-

How do you ensure quality of messaging, demos, sales process when you don’t work similar hours

-

Need 24/7 Support

-

Legal Issues, Multi-Currency Payroll, Regulations etc.

-

Have to think through different culture & norms

-

Product Implications: As an example, multi-language support for the product

-

The US Market is so MASSIVE. All the things I listed above are things you can do, but why put a strain on your company so early-on? Wait until you are bigger and can really hire a team to take care of all of that.

To hear more from Florin and get a weekly dose of the best prospecting tips, subscribe to ‘Prospecting From The Trenches’.

👀 More for your eyeballs:

Building (good) account lists is frustrating.

Door #1: Go shopping for a big sales data platform. Annual+ subscription. $10s of thousands. Still the account data is not quite right.

Door #2: DIY. Sheets, Zapier, Phantombuster, Upwork, loads of manual reviews. Still the account data is not quite right.

Keyplay Lists are door #3 (oh and the best part? it’s free!)

👂 More for your eardrums:

-

This episode was personal for me. I brought on my mental performance coach, Kevin Bailey, to talk through how to stay in flow state, habit formation, how to recover well and guided visualization.

🚀 Start-ups to watch:

It’s no secret that AI is disrupting just about every category and industry. The team at Document Crunch has been executing on another level these days and they recently released an interesting take on how AI will revolutionize the construction. Well worth the read.

🔥Hottest GTM job of the week:

Founding Account Executive at Iconic Air, more details here.

See more top GTM jobs here.

I guess the only thing left to do now is ask “red or black?” before I hit the roulette tables….

Thanks as always for rocking with us until the end.

We’re getting close to 5000 subscribers now which is crazy.

And to help us get there, we’re be going to be doing a little giveaway this month.

Every time you share The GTM Newsletter on LinkedIn or Twitter and tag GTMfund, you’ll be entered to win a special GTM edition of Airpod pros. We’ll be announcing the winner at the end of March.

Appreciate you – have a great weekend.

Barker✌️

Thanks for reading The GTM Newsletter! Subscribe for free to receive new posts and support my work.