Pay mix. Variable OTE. Quota attainment. Base salary versus bonus. If you don’t have an economics degree, decoding the sales compensation plan on offer can make your head spin.

But your money — aka, the output of your precious time and energy — depends on it. And since you don’t have time to get an economics degree, I’m going to walk you through it.

There are 3 key questions you must ask your hiring manager or recruiter when offered a sales role to maximize your earnings and career potential. They are:

- What is the pay mix?

- What does the payout curve look like?

- What is historical attainment at your company?

You owe it to yourself to get this right.

I have over a decade of sales compensation and strategy experience, including my new course, The Practical Guide to Sales Compensation. In this article, I’ll teach you how to understand comp plans using these three key principles.

Related: 8 Things to Review Before Accepting a Sales Commission Plan

Congrats! You have two sales job offers — how to pick?

So you’re a sales professional interviewing for your next role.

After lengthy one-on-one interviews, panel interviews, role plays, and presentations, you land offers at two different amazing companies you would happily work at. Congrats!

- Company A offers you $115,000

- Company B offers you $100,000

It’s a no brainer, right? One offer pays $15,000 more than the other.

So you quickly accept the $115,000 offer from Company A and start texting your friends that drinks are on you tonight!

Related: 5 Steps to Get Your First Sales Job in 2023

Fast forward a year — you take a look at your earnings and pace to promotion. You realize… you were played.

Had you accepted Company B’s offer, you could have earned way more compensation and could have been on track to earn a promotion to senior.

What went wrong?

Here’s the first question you should have asked:

1. What’s the pay mix in this compensation plan?

First, let’s talk about pay mix.

Pay mix is the percentage of the on-target earnings (OTE) that is in base salary vs. variable compensation. Returning to our example:

Company A: $115,000 OTE at a 70/30 pay mix.

What this actually means: The offer is a base salary of $80,500 with a variable bonus plan that is designed to pay you exactly $34,500 if you meet your sales quota

At first glance, having a pay mix that is weighted more towards base salary may sound like a good thing. This is guaranteed compensation!

However, it comes at an expense: There is less skin in the game for you if you over-perform on your sales quota.

Most sales professionals want a pay mix that has more compensation on the variable side. If you are betting on yourself to exceed your sales quota, then you can expect larger variable payouts.

Company B: $100,000 OTE at a 50/50 pay mix.

What this actually means: This means the offer is actually a base salary of $50,000 with a variable bonus plan that is designed to pay you exactly $50,000 if you meet your sales quota.

While your base salary is lower with this offer, you have more dollars in your variable component, which will result in much bigger payouts when you over-perform on your sales quota.

Takeaway: When you’re reviewing any sales job offer, ask the recruiter or hiring manager what the pay mix is. If you want to maximize your earnings and believe you can out-perform your peers, then you should opt for a pay mix that has nearly 50% of the OTE in variable.

If you want to maximize your earnings and believe you can out-perform your peers, then you should opt for a pay mix that has nearly 50% of the OTE in variable.

⛔ Word of warning: Be wary of offers where the variable mix is higher than 50%. It’s not ideal to take on that much risk and pressure.

Related: The Ins & Outs of Variable Pay Compensation Structure for Sales Teams

2. What is the payout curve? (aka payout table, or variable OTE % table)

Second, let’s talk about the payout curve.

All bonus plans are “pay-for-performance,” meaning: If you over-perform on your sales quota there should be upside, and if you under-perform there is downside.

Every bonus plan has a curve that outlines how you will be paid based on your performance to quota. These curves vary dramatically based on the company sales culture, compensation philosophy, and budgets.

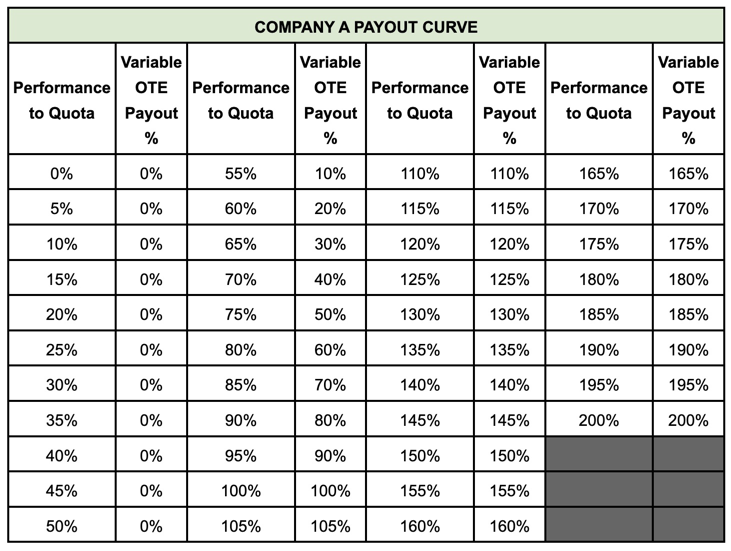

Look at Company A’s bonus plan, below. If your eyes glaze over, don’t worry — I’ll talk you through it.

Remember, Company A offered you $80,500 base and up to $34,500 variable. But look at the numbers you have to hit to get that $34,500 based on your performance to quota.

…until you hit 55% of quota, you don’t earn a penny.

This is a preview. Click here for full image.

Let’s compare this against Company B’s payout curve.

This is a preview. Click here for full image.

From the jump, you can see it’s different: You can start earning money as soon as 5% to quota. And the differences don’t end there.

Company A

If you do well and finish the year at 150% performance to quota, then your payout is $51,750 ($150% * $34,500).

What this actually means: But if you do poorly, just 75% performance to quota, then your payout is $17,250 (50% * $34,500)

vs.

Company B

If you do well and finish the year at 150% performance to quota, then your payout would be $100,000 (200% * $50,000).

What this actually means: If you performed at 75%, then your payout would be $37,500 (75% * $50,000).

The verdict

Company B’s payout curve is much more advantageous for you!

The upside on Company B’s plan is much better than Company A. You can see that they really will pay a lot of your bonus to you for over-performing. They understand that it’s wise to pay their sales professionals healthy upside for effectively doing the work of 1.5-2 people.

The downside on Company B’s plan is also much better than Company A. Company B doesn’t overly penalize you if you perform poorly — they will continue to pay you some level of variable despite poor performance.

By contrast, Company A has a cliff at 50% performance. You’re not “in the money” or eligible to earn anything until you at least at 50% performance.

Recap: When considering the pay mix in both offers as well as the payout curves, you can see how having more compensation in variable with healthier payout curve is incredibly advantageous for you when you overperform.

This compounding factor is why it’s so important to understand all the pieces of the offer and not just get fixated on one item or just the OTE.

Takeaway: So when you’re reviewing any sales job offer, ask the recruiter or hiring manager what the bonus plan’s payout curve (aka payout table or variable OTE % table) is.

If you want to maximize your earnings and believe you can out-perform your peers, then you should opt for a payout curve that accelerates payouts once you’re at quota and isn’t too punitive if you happen to miss your quota.

Note: Be wary of companies that aren’t willing or able to share this level of detail with you. It’s a common ask, and should be easily available. Lack of transparency here is a big red flag.

Related: Sales Compensation Plans – Templates and Examples

3. What is the recent historical attainment rate at this company?

Third, let’s talk about historical attainment.

Historical attainment is the average performance-to-quota of sales reps. Every company has different historical attainment rates. This information will help you calibrate the OTE that is being presented to you.

Company A: Historical attainment is 80% for the past year. (Meaning: The average performance for a sales rep at this company is o80% to quota.)

What this actually means: The way sales quotas are set at Company A is quite high — the average sales rep doesn’t actually meet or exceed their sales quota.

…so the average sales rep at Company A isn’t earning their $115,000 OTE. And, due to the punitive nature of the payout curve, they’re actually earning much less than $115k.

By contrast.

Company B: Historical attainment is 100% for the past year. (= the average sales rep is meeting quota.)

What this actually means: The average sales rep is earning the full $100k OTE.

What historical attainment rates REALLY tell you

There are many reasons historical attainment rates vary — and by asking about the historical attainment, you can learn a lot about how much money you’ll make.

Company A: Historical attainment of 80%

What this tells us: First, it’s possible Company A purposefully sets sales quotas high in order to advertise high OTEs. This allows for them to appear to have attractive compensation packages.

(Remember: In reality, since the sales quotas are so high, the true earnings for sales reps is closer to $100,000. )

Now, it’s possible that this isn’t intentional. It could reflect Company A’s poor brand awareness in the market, its pricing strategy, or the value of the product. (Spoiler: All of these are bad signs.)

Whatever the reason, if the recent historical attainment is 80%, then it’s safe to assume it’ll continue to be 80% when you join their company.

Company B: Historical attainment of 100%

What this tells us: Sales quotas are set fairly in that they are attainable. This tells you the OTE that is being advertised is real.

This also has implications on career progression. In order to be promoted to a senior level or to the next team, you need to be exceeding your sales quota in your current role. And at Company B, it’s likely you’ll be in a position where you are exceeding your goal.

The takeaway: When you’re reviewing any sales job offer, ask the recruiter or hiring manager what the historical attainment rate is to maximize your earnings and set yourself up for future promotions.

Join the conversation: How to answer quota attainment question during interview?

Putting it all together: Pay mix, payout curves, and historical attainment

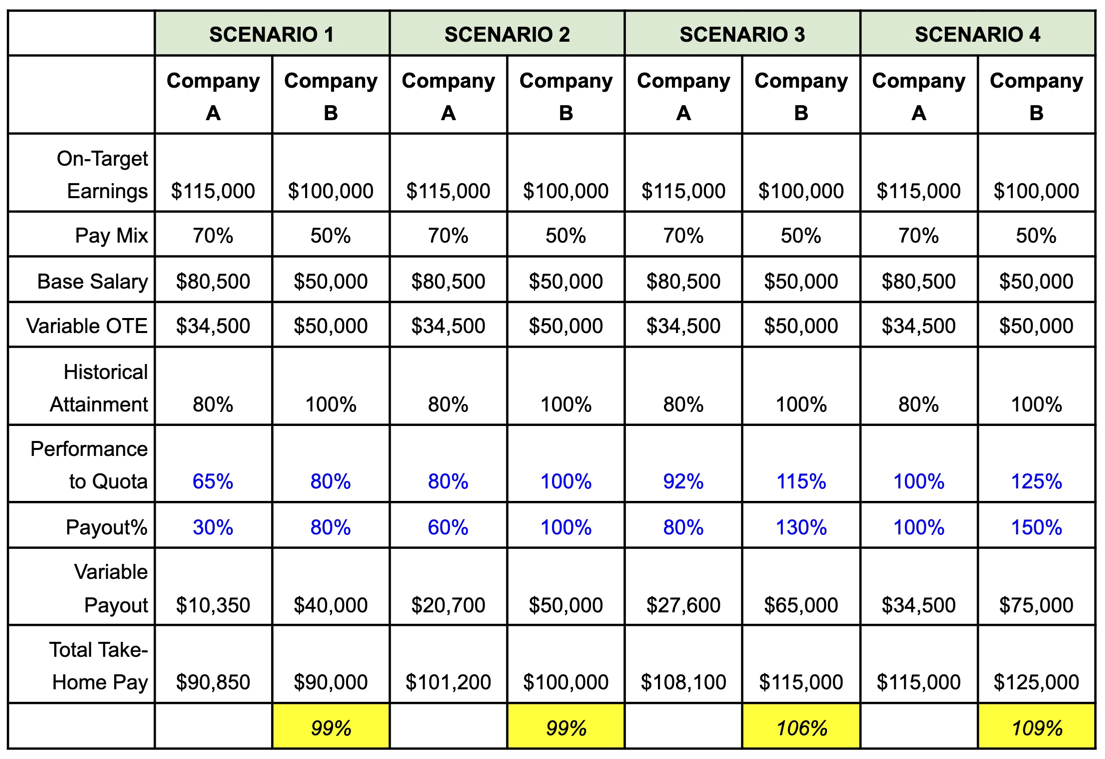

Below, I’ve summarized these three concepts together and calculated a few different scenarios to help illustrate the impact pay mix, payout curves, and historical attainment can have on the advertised OTE.

I’ll walk you through each scenario below.

Scenario 1: You underperform by 20%.

Company A’s reps perform at 80% on average, so underperforming puts you at about 65% to quota — and the payout curve hurts you. Underperforming by 20% at Company B puts you at 80% to quota, with a less punitive payout curve.

If you underperform by 20%, you earn almost exactly the same at both companies.

Scenario 2: You perform as an average sales rep.

Remember, “average” at Company A is 80% — and they have a punitive payout curve. By contrast, “average” at Company B is 100%. As an average rep, you earn almost exactly the same at both companies.

Scenario 3: You perform 15% better than the average sales rep.

Company B’s offer earns you about 6% more than Company A — due to the heavier pay mix on variable and the better payout curve.

Scenario 4: You overperform by 25%.

If you’re a stone-cold quota crusher, Company B’s offer earns you about 9% more — that’s $10,000 — than Company A, due to the heavier pay mix on variable and the better payout curve.

The takeaway: It should be clear that Company B’s offer of $100,000 is materially better than Company A’s offer of $115,000. Company B will always pay at least the same as Company A — and will actually pay more if you exceed your sales quota.

Be fearless: Ask these 3 questions about your sales compensation!

Don’t be afraid to appear difficult by asking these questions. Variable compensation is confusing and no two bonus plans are the same.

Unfortunately, our industry isn’t at a place where all this information is provided proactively and is consistent from company to company. For now, it’s on you to do your homework.

Blindly accepting a job offer without asking these questions will create massive risk for you. By asking the right questions to help you understand the true nature of a sales job offer will help you save thousands of dollars, if not tens of thousands of dollars, in the long-run.

As you can see, I love talking about and teaching sales compensation. You can learn way more here with my sales compensation course. Good luck out there.

Edited by Kendra Fortmeyer @ Sales Hacker 2023

Edited by Kendra Fortmeyer @ Sales Hacker 2023