5 Things You Need to Know from the Latest Friction Report

Hello and welcome to The GTMnow Newsletter – the media brand of VC firm, GTMfund. Build, scale and invest with the best minds in tech.

If distribution is the final moat, friction is the silent killer.

The latest Friction Report from Cleverbridge shows how hidden gaps in checkout, payments, and renewals are draining revenue.

Before you say, “checkout payment? That’s for D2C,” keep reading.

Ecommerce and digital sales motions have exploded across B2B SaaS. PLG and “Buy Now” options on a company’s site are the clearest use cases, but companies are increasingly weaving ecommerce checkouts into expansion and renewal flows also. In fact, 98% of software vendors now sell their products online, with more than half generating the majority of their revenue through ecommerce.

Today, buyers expect seamless online purchase experiences. But sellers aren’t keeping pace. Friction shows up in pricing clarity, payment methods, localization, and renewals. Global ambition is high, but execution gaps are draining growth. For SaaS founders and operators, reducing this “friction tax” is a GTM imperative.

Given how much is at stake, we did a deep dive on the report. It uncovers where deals fall apart, why churn is rising, and what high-growth sellers do differently.

Here are the five things from the report you need to know.

1. Global expansion is surging. But, most companies aren’t ready.

Of those surveyed, 60% of software companies sell in fewer than 10 countries, despite trillions in GDP available outside the top 10 markets. Only 4% sell in more than 100 countries, showing just how much white space remains untapped.

At the same time, the ambition to go global has never been higher. 83% of software sellers say international expansion is a top priority in the next 12 months. But ambition alone won’t get them there: only 56% feel confident they can scale successfully. The confidence gap is real and costly.

So where are sellers stumbling? Execution. The report shows that integrations, compliance, and localization are the biggest obstacles. Cross-border tax rules differ country by country. Payment preferences shift dramatically by region – Pix and OXXO in LATAM, Alipay and WeChat Pay in APAC, PayPal outranking cards in parts of Europe. Yet fewer than half of sellers consistently localize checkout to meet these buyer expectations.

For buyers, these details matter. 96% say local currency display is important, and 43% won’t purchase if checkout isn’t in their language. It doesn’t matter how strong your product is, if the transaction feels foreign, buyers will simply move on to a competitor who makes it feel seamless.

Global expansion is about execution. If international growth is in your roadmap, bake these elements into your stack early.

2. Sellers are solving for the wrong buyer problems.

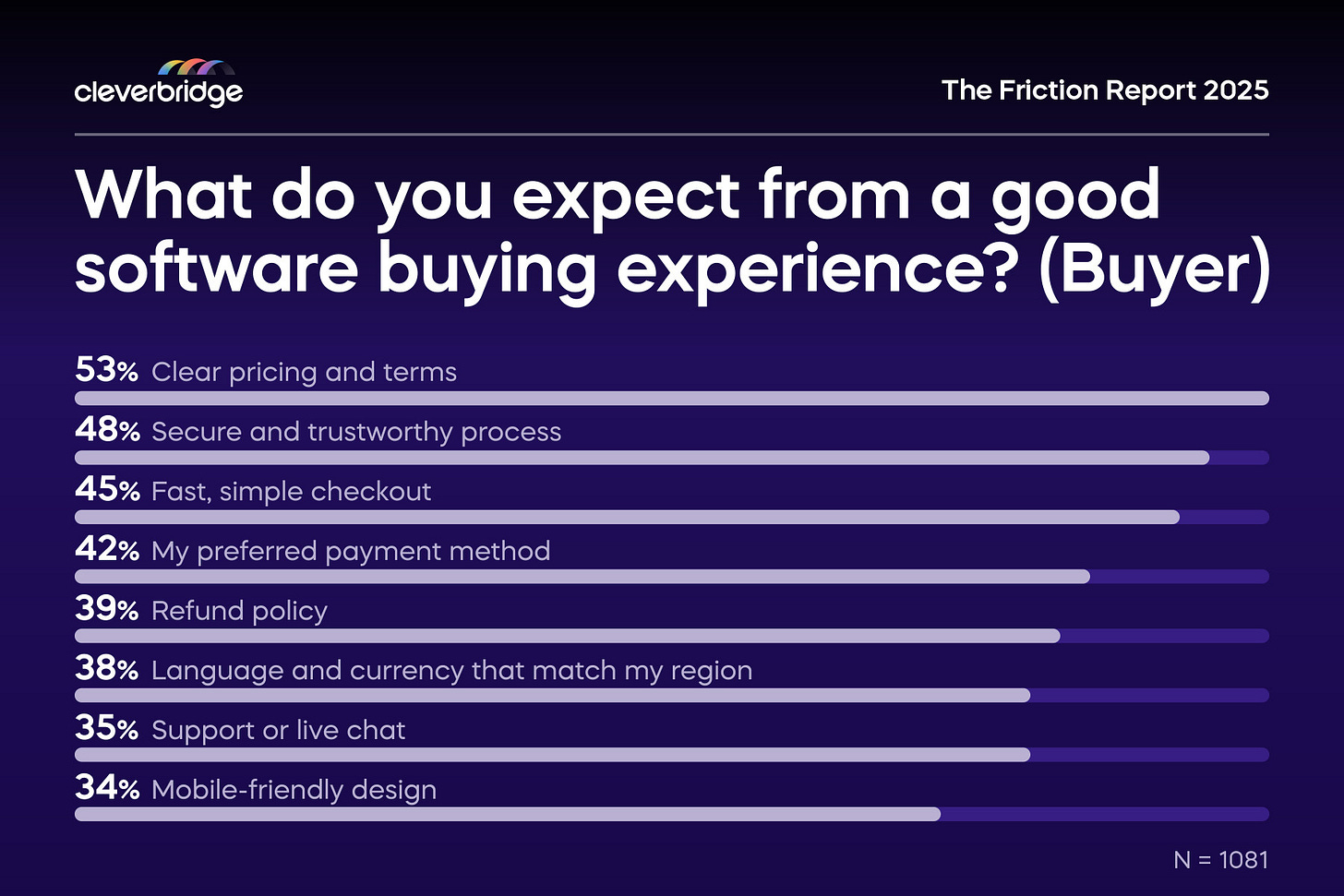

Sellers think they know what buyers want, but the data shows they’re solving for the wrong problems. More than half of sellers believe buyers care most about a fast, simple checkout and strong security. Buyers, however, put clear pricing and terms at the very top: 53% rank it as the number one factor, ahead of both speed and security.

The consequences are costly. Unexpected taxes and fees drive 48% of buyer cart abandonments, while 41% walk away when trust signals are missing. Sellers, meanwhile, fixate on “too many checkout steps,” which is a friction point buyers rank far lower. The result is wasted optimization effort on the wrong problem set, while hidden fees and unclear renewal terms keep leaking revenue.

This misalignment doesn’t stop at checkout. Post-purchase, 48% of buyers say clear billing and renewal information is critical, but many sellers continue to overestimate their performance in this area. Confidence is high on the seller side, but the buyer experience tells another story.

Transparency beats polish. Show the full cost upfront (taxes, fees, renewals included) and make it effortless to pay in the way buyers expect. Solve for clarity and trust, and you’ll convert buyers your competitors are losing.

3. Cart abandonment is bleeding revenue.

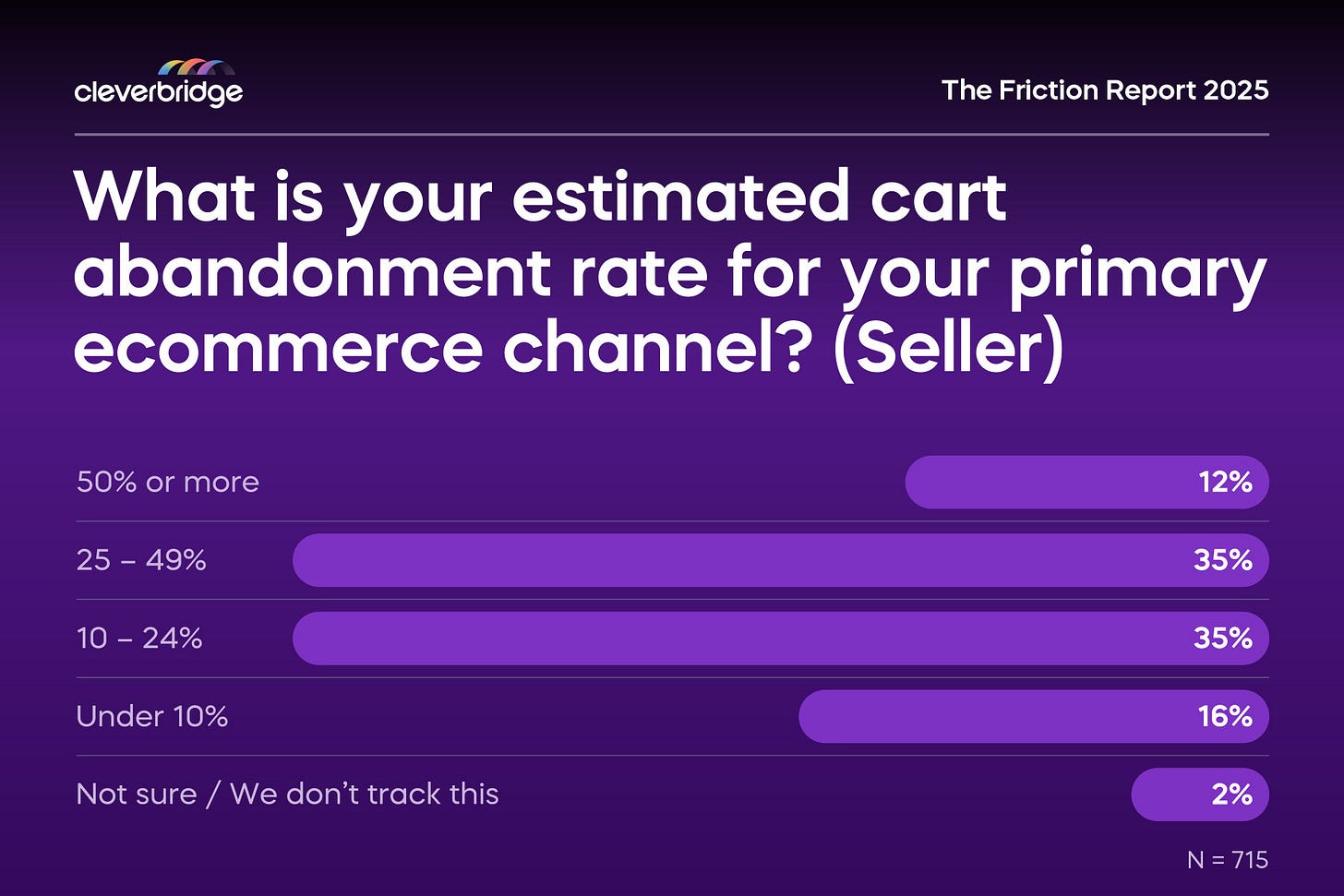

Cart abandonment isn’t just a consumer problem, it’s one of the biggest hidden leaks in SaaS sales. Nearly half of sellers admit they lose at least a quarter of potential orders during the purchase process. Only 16% report abandonment below 10%. For a SaaS company doing $10M in annual online revenue, an average 27% cart abandonment rate translates into $3M+ lost every year. This “friction tax” only scales with growth.

The data also shows how fragile the purchase moment is. More than one-third of buyers will walk away completely if their preferred payment method isn’t offered. Others leave the moment they see surprise costs at checkout, undermining months of marketing and sales work in seconds.

Unfortunately, the problem is often undiagnosed. Laggards test checkout flows only once a year or “as needed,” compared to high-confidence sellers that test monthly. Frequent testing helps catch hidden friction early and keeps conversion rates climbing.

Treat cart abandonment as a revenue leak, not a UX afterthought. Run monthly purchase flow tests, eliminate hidden fees, display strong trust signals, and expand payment options. Every single percentage point recovered goes straight to the top line.

4. Post-purchase friction is killing retention.

Everything is hard work, both pre and post sales. The Friction Report shows that revenue leaks persist after the initial sale. This aligns with what we see from the venture lens.

While 91% of sellers say they’re confident in their post-purchase experience, nearly 8 in 10 buyers report frustrations – from confusing renewal terms to difficulty canceling to slow customer support.

The gap is big. Buyers expect billing clarity, simple subscription management, and fast support. Instead, 36% say they’ve struggled to cancel, 31% couldn’t reach support, and 29% were confused about renewal or pricing. These touchpoints don’t just frustrate customers, they directly drive churn and undermine trust, especially in B2B contracts where retention determines lifetime value.

Much of this churn is preventable. Failed payments, expired cards, and billing errors continue to quietly drain revenue. Yet fewer than half of sellers use tools like automated retries, card updaters, or routing optimization to recover that revenue at scale. Even voluntary churn often traces back to solvable issues: poor support, lack of transparency, or perceived value drop-off.

Renewals and support are core go-to-market levers. Just as you optimize top-of-funnel conversion, you need to obsess over post-sale experience. Companies that do this well build loyalty, reduce churn, and create a compounding growth engine.

Treat renewals and support as extensions of your GTM motion. Automate payment retries and card updates, make billing and renewals transparent, and empower customer success teams to intervene before buyers encounter friction. Reducing post-purchase pain is one of the most reliable ways to protect (and grow) recurring revenue.

5. Fragmented tech stacks are slowing growth.

Behind the buyer experience is another source of friction: the internal tech stack. Many software companies are trying to scale global revenue on cobbled-together systems. What looks functional on paper quickly turns into a mess of manual workarounds, brittle integrations, and siloed data. The result: slower growth for the company and more friction for the customer.

The data makes the gap clear. Sellers with fully integrated ecommerce stacks are over 2x more confident in their ability to scale globally compared to those running fragmented systems (81% vs. 34%). These integrated teams can launch in new markets faster, localize checkout more easily, and unify data across the customer lifecycle. Fragmented stacks, on the other hand, leave teams bogged down in troubleshooting rather than innovating.

The cost isn’t just technical debt, it’s opportunity cost. Every hour your engineers spend debugging tax logic or reconciling payments is an hour not spent shipping product. Smaller SaaS companies often try to “DIY” ecommerce to save money early, but the friction compounds as they scale into new markets. By the time they hit growth inflection points, patchwork infrastructure has become a drag on expansion.

Leaders increasingly rely on a Merchant of Record (MoR) or similar integrated platforms to streamline global payments, tax compliance, fraud management, and recurring billing. This shift frees product and engineering teams to focus on building rather than firefighting, while giving finance and GTM teams a clear, reliable backbone for scaling.

Invest early in integrated infrastructure that can scale with you. The payoff is faster market entry, cleaner operations, and a customer experience that feels seamless in every region.

The opportunity

Within the problem lies the opportunity. Companies that invest in removing friction build compounding advantages: higher conversion rates, stronger customer trust, and lower churn. Over time, these improvements add up to a growth engine that’s harder for competitors to replicate than any single feature. Particularly now with tech moats dissolving at the hand of AI, reducing the friction can be a huge go-to-market differentiator.

Tag @GTMnow so we can see your takeaways and help amplify them.

More for your eyeballs

ICONIQ’s State of Software 2025 report shows how AI is reshaping B2B SaaS. AI-native companies are hitting $100M ARR with under 150 people, doubling deal sizes YoY, and flipping GTM orgs with more post-sales roles than sales.

More for your eardrums

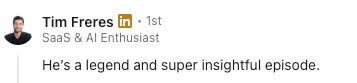

Bonus Episode: Rick Kelley Joined Meta at 900 People and Left at 90,000 (most replayed moment)

Get a sneak preview here. For the full thing, listen on Apple, Spotify, YouTube or wherever you get your podcasts by searching “The GTMnow Podcast.”

Startups to watch

Monk – raised $4M led to help companies get paid faster. The platform turns contracts into invoices and uses AI agents to follow up like a human, helping teams like ElevenLabs and Profound recover cash faster and improve cash flow in under 30 days. Their raise and launch announcement generated hundreds of thousands of views on social posts.

Hottest GTM jobs of the week

- Customer Experience Representative at Alt (Remote – US)

- Head of Product Marketing at Fastbreak (Charlotte, NC)

- Customer Implementation Manager at Gorgias (Buenos Aires)

- Senior Product Marketing Manager – ICM at CaptivateIQ (Remote | Hybrid – Menlo Park / Austin / Raleigh / Nashville / Toronto)

- Strategic Customer Success Manager, Financial Services at Writer (Hybrid – London)

See more top GTM jobs on the GTMfund Job Board.

GTM industry events

Upcoming events you won’t want to miss:

- GTMfund Dinner (private registration): October 22, 2025 (Austin, TX)

- Momentum Book Tour: Leadership Dinner: November 5, 2025 (New York, NY)

- Momentum Virtual Event: Ignite your GTM with AI: November 12, 2025

- GTMfund Dinner (private registration): November 18, 2025 (Toronto, ON)

- GTMfund Dinner (private registration): November 19, 2025 (New York, NY)

- GTM x Founder Event (private registration): November 20, 2025 (New York, NY) – if you’re an AI-focused founder in NYC, hit reply to get the details.

- Above the Fold (for marketers): February 9-11, 2025 (Fort Lauderdale, FL)

- Spryng (for marketers): March 24-26, 2025 (Austin, TX)

GTM community love

Some GTMnow community (founder, operator, investor) love to close it out – we appreciate you.