GTMfund on the State of the Market

Hello and welcome to The GTMnow Newsletter – the media brand of VC firm, GTMfund. Build, scale and invest with the best minds in tech.

“What are you seeing across the early-stage venture market?” This is the question that we get asked all the time. If we zoom out and look at the overall state of venture, the early-stage market is heating up again. We’re seeing 9 important trends:

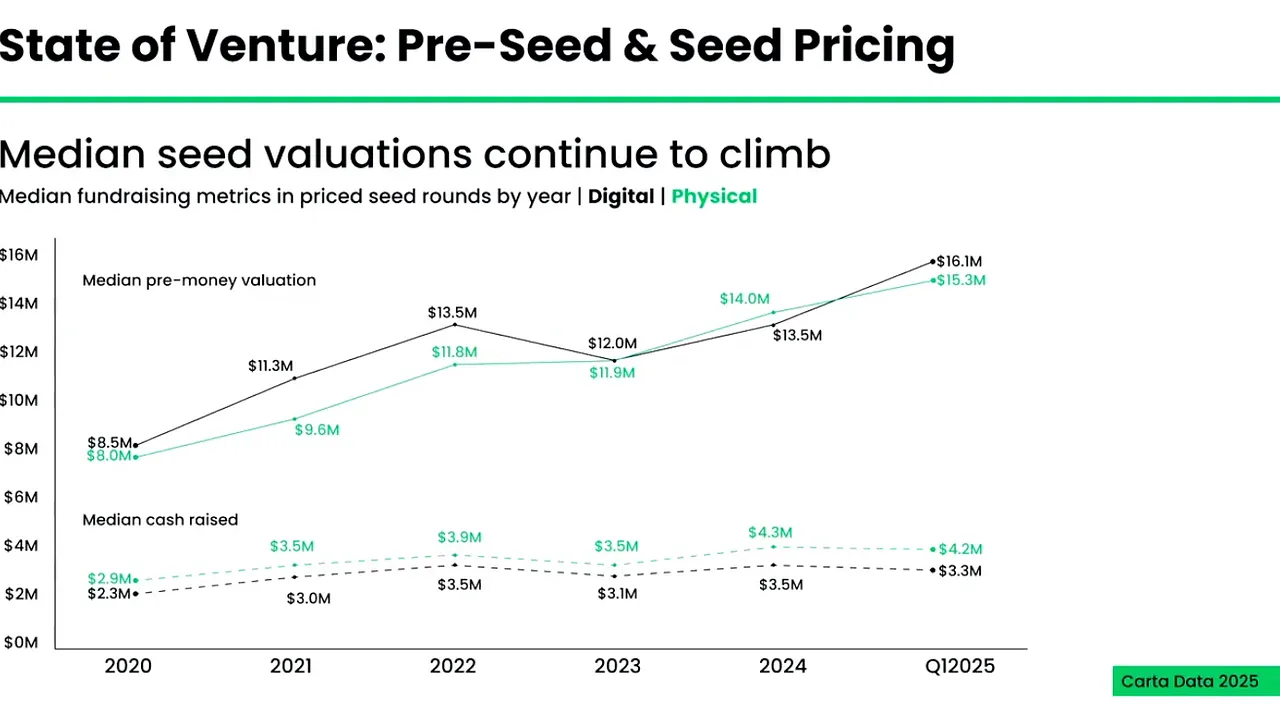

Seed valuations are pushing all-time highs

Post-money medians are hovering around $18–$20M. There’s real demand for top-tier founding teams, especially in AI. According to PitchBook data, more than 60% of the largest seed rounds in H1 2025 were AI-related, signalling concentrated investor appetite around AI-native startups.

And founders are raising more, earlier.

It’s a flight to quality

Fewer deals are getting done, but the ones that are? They’re commanding premium terms. If you’re building something real, the capital is there. If you’re not, good luck. Venture has always been a game of haves and have-nots, and that gap has never felt wider than today.

Carta’s Q2 2025 data shows new financings down about 13% year-over-year, yet seed valuations hit $15M–$17M. Fewer deals, higher prices. The market is heating up for top-tier founders even as it cools for everyone else.

Series A is harder than ever

Despite high demand for Seed rounds, graduation rates from seed to A are down significantly. It’s not enough to raise a strong seed — if you’re not showing breakout momentum, your next round will be a grind. This is a hurdle most founders underestimate, and something we prep our Pre-Seed and Seed founders on from day one.

M&A is back

Q4 2024 through to now has been the most active M&A period we’ve seen in years. Big Tech is shopping again. You can feel it in the headlines and the underlying numbers.

Good to see GTMfund companies getting great offers, such as OfferFit being acquired by Braze for $325M.

Secondary markets are booming

Over $120B is projected in secondary capital this year alone. That would mark the biggest vintage in secondary capital in history, and that number continues to grow. That’s creating real liquidity options for early investors and employees. You no longer have to wait for an IPO or exit to get liquidity on your position.

Linear provided liquidity during its first tender offer by inviting current and former employees to sell a portion of their vested options during its Series C financing.

Hightouch launched a tender offer for employees (~$30M in common stock) at a $1.3B valuation.

Deel did a $300M secondary share sale (allowing early investors, possibly employees) as part of a transaction.

Exits are getting bigger

The 99th percentile VC exit is now over $10B. A decade ago, it was $1.4B. Companies are staying private longer, compounding more, and exiting at much higher values.

The game has changed. Capital is there, but only for the best. The outcomes are bigger, but the bar is higher than ever before.

Metrics alone don’t get you funded

Gone are the days of spreadsheet investing. You could be growing triple-triple-double with best-in-class NRR – and still hear “no” if your story doesn’t land.

The incredible opportunity of AI cuts both ways. It also makes investors nervous. Categories that are booming today could be all but eliminated tomorrow with a new model release, change in AI architecture, or rapidly shifting customer preferences. If your company narrative lines up with the VC thesis, you’ll have demand. If you’re building something truly non-consensus, you need to find that singular investor who falls in love with your narrative for the future. It’s a harder path, but historically, a very fruitful one.

If software is eating the world, AI might devour it

When the transition to cloud began, the global software market was $350B. Today, the cloud market alone is over $400B. Truly transformational technologies tend to exceed the size of the markets they’re attacking. AI is no different here.

Where AI can be different is the $10T a year global services market. AI is selling more than software: it’s selling outcomes, headcount, and workflows. If AI is eating into both the global software and services market today, what does that look like 5 years from now? 10 years from now? Buckle up.

Distribution is the final remaining moat

As technology becomes easier and easier to build, distribution is the final remaining moat. What separates winners today? Go-to-market strategy and execution is the operating model that builds and maintains that moat. Founders need GTM support earlier than ever.

Tag @GTMnow so we can see your takeaways and help amplify them.

More for your eyeballs

The Shift: Static Software vs. Living AI Systems. In the world of traditional software, products were built on determinism. AI breaks this assumption. AI products now look more like living systems vs static ones.

The U.S. government just made it harder and more expensive to get H-1B visas, creating short-term uncertainty for companies that hire international talent. But demand for top global talent isn’t going away — employers are already shifting to other visa types.

More for your eardrums

GTM 164: 28th at Stripe → Billions: Cristina Cordova’s GTM Playbook (Linear, Notion)

Get a sneak preview here. For the full thing, listen on Apple, Spotify, YouTube or wherever you get your podcasts by searching “The GTMnow Podcast.”

LeanScale GTM Podcast: Avoid These Founder Red Flags: A VC’s Honest Perspective

Sophie Buonassisi (SVP of GTMfund/GTMnow) on what venture capitalists really look for when investing in startups.

Startups to watch

Centari – raised $14M to build the future of Deal Intelligence. Think M&A, financings, partnerships — deals where billions are on the line and speed and precision matter. Generic AI tools weren’t built for the legal complexity or risk tolerance these transactions require. That’s where Centari comes in.

Pocus – announced its next chapter: moving beyond signal aggregation to true decision-making intelligence. With the new Relevance Agent™ and Intelligent Inbox, Pocus gives reps clear next steps (who to contact, what to say, and when to act), turning data overload into trusted guidance that drives revenue.

Hottest GTM jobs of the week

- Demand Marketing Senior Manager at Cube (Hybrid – New York)

- Head of Product Marketing at Patch (Hybrid – San Francisco)

- Sr. Product Manager, AI Document Management at Vanta (Remote – US)

- Training & Education Specialist at Vividly (Remote – US)

- VP of Technical Services at CaptivateIQ (Hybrid – Austin / Menlo; Remote – Raleigh / Nashville / Toronto)

See more top GTM jobs on the GTMfund Job Board.

If you’re looking to scale your sales and marketing teams with top talent, we couldn’t recommend our partner Pursuit more. We work closely together to be able to provide the top go-to-market talent for companies on a non-retainer basis.

GTM industry events

Upcoming events you won’t want to miss:

- Dreamforce: October 14-16, 2025 (San Francisco, CA)

- GTMfund Dinner (private registration): October 22, 2025 (Austin, TX)

- GTMfund Dinner (private registration): November 18, 2025 (Toronto, ON)

- GTMfund Dinner (private registration): November 19, 2025 (New York, NY)

- GTM x Founder Event (private registration): November 20, 2025 (New York, NY) – if you’re an AI-focused founder in NYC, hit reply to get the details

- Above the Fold (for marketers): February 9-11, 2025 (Fort Lauderdale, FL)

- Spryng (for marketers): March 24-26, 2025 (Austin, TX)

GTM community love

Some GTMnow community (founder, operator, investor) love to close it out – we appreciate you.