The GTM Podcast is available on any major directory, including:

Mark Goldberg is a Managing Partner and Co-Founder at Chemistry, a new early-stage venture firm with a $350M debut fund backing standout software companies from Seed to Series A. Prior to Chemistry, Mark was a Partner at Index Ventures, where he led early-stage investments across software and fintech for nearly a decade. Before Index, Mark was one of the first business hires at Dropbox, helping the company navigate hypergrowth.

Discussed in this episode

- Why Mark studied international relations, and why venture feels like “the liberal arts of jobs”

- Index’s US “invisibility” era and what that taught him about building a new firm

- The Chemistry spinout thesis: “take great multi-stage DNA, reconstitute it with focus”

- Fund design: pre-seed → seed → A, light reserves, and concentrated doubling-down

- Hiring strategy: network access > spreadsheet diligence

- Culture principles: excellence, performance, “no one takes themselves too seriously”

- Conviction-based investing vs consensus IC, and why omissions are the real killer

- The hardest lesson in venture: managing co-founder dynamics (and when to just listen)

Episode highlights

00:00 — “A+ people want to work with A+ people.”

Watch: https://www.youtube.com/watch?v=BWJtUftS8W8&t=0

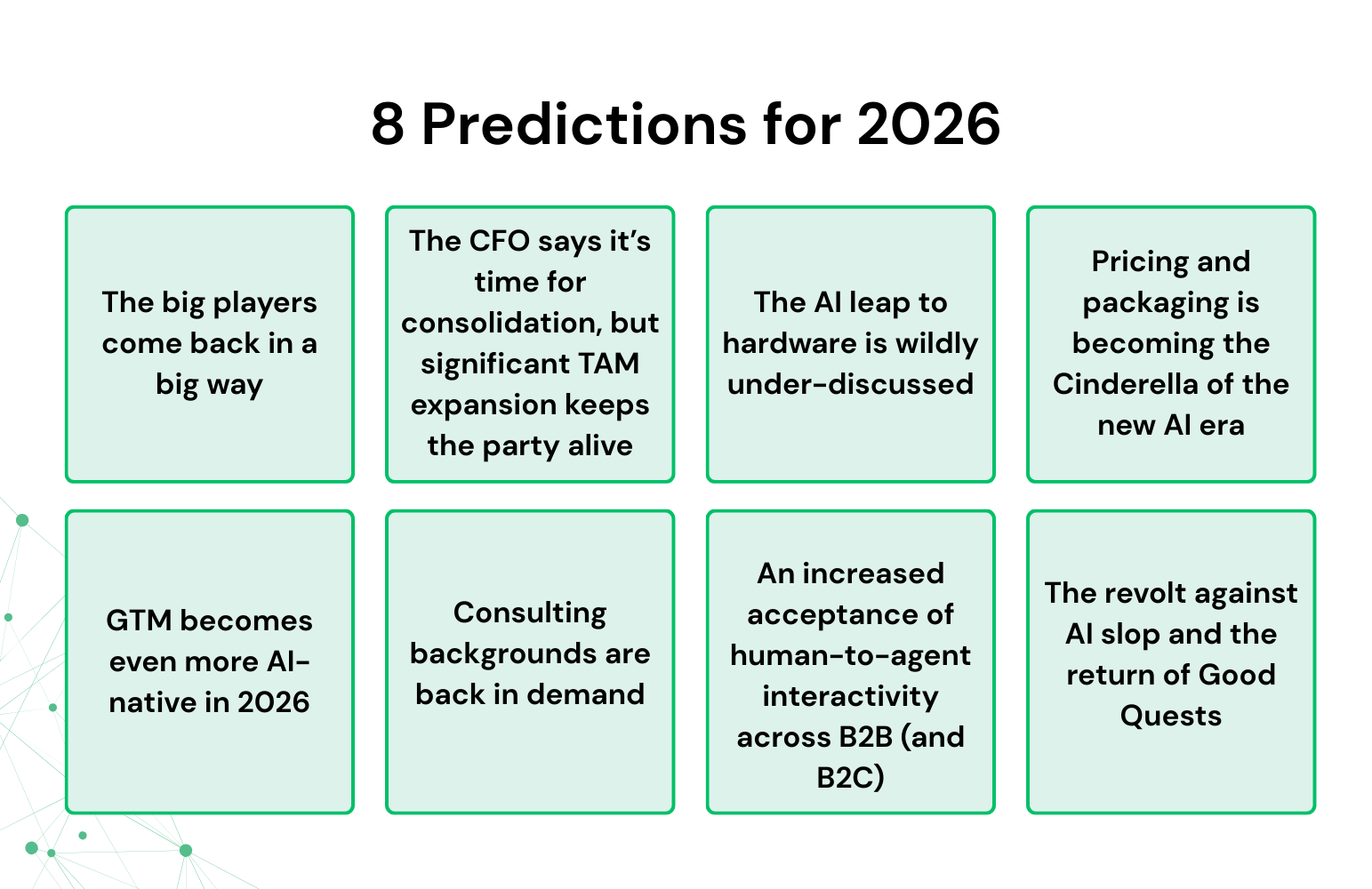

01:46 — GTMfund’s 2026 prediction: big players come roaring back (Google, Meta, Microsoft, Uber/Waymo).

Watch: https://www.youtube.com/watch?v=BWJtUftS8W8&t=106

14:51 — GTMfund platform metrics: thousands of support items, intros, hires, and fundraising connects.

Watch: https://www.youtube.com/watch?v=BWJtUftS8W8&t=891

26:29 — Why Mark left Index to build Chemistry: big-fund lessons, rebuilt with focus.

Watch: https://www.youtube.com/watch?v=BWJtUftS8W8&t=1589

33:39 — Chemistry’s strategy: early-stage focus, light reserves, and building for “product-market discovery.”

Watch: https://www.youtube.com/watch?v=BWJtUftS8W8&t=2019

44:05 — “Venture doesn’t scale well.” Why Chemistry stays small to avoid bureaucracy.

Watch: https://www.youtube.com/watch?v=BWJtUftS8W8&t=2645

49:59 — Events that actually work: chess tournaments, surfing, and hobby-driven gathering > happy hours.

Watch: https://www.youtube.com/watch?v=BWJtUftS8W8&t=2999

54:56 — Investment process: conviction, not consensus—optimize for outliers, not averages.

Watch: https://www.youtube.com/watch?v=BWJtUftS8W8&t=3296

1:10:32 — Hardest lesson in venture: co-founder dynamics, and learning when to listen (not “advise”).

Watch: https://www.youtube.com/watch?v=BWJtUftS8W8&t=4232

Key takeaways

1. Focus becomes your unfair advantage.

Chemistry’s bet is that a tightly scoped stage (inception → Series A) creates sharper instincts and faster execution. You don’t win by “covering the map,” you win by being the best partner in one specific chapter.

2. Your biggest loss won’t be the deal that went to zero.

Mark’s framing is brutal and true: the career-defining pain is the omission. So the whole system needs to reduce “missed outliers,” not optimize for safe averages.

3. Conviction scales better than consensus at seed.

Early-stage outcomes are driven by weirdness and edge cases, not committee-approved comfort. A conviction model keeps the fund open to non-obvious bets that look wrong (until they don’t).

4. Reserves are a strategy, not a default.

A light reserve model forces real decisions: pick the few you’d aggressively back, not a little bit of everything. It’s harder emotionally, but cleaner mathematically.

5. Brand gets you in the room; hustle keeps you there.

Index’s early US years trained Mark for the “prove it every day” reality of a new firm. The carry is earned through volume of reps: meetings, events, and fast follow-through.

6. “Access hires” beat “analysis hires” early.

Chemistry intentionally hired people who expand the network surface area, especially among younger, emerging founder pockets. In seed, the best insight is often just being earlier.

7. Culture is performance, not perks.

Dropbox taught Mark that A+ people stick around to work with A+ people, and winning becomes the glue. Everything else is decoration.

8. Management is often just noise reduction.

The “umbrella” model is simple: protect the team from distractions so they can do the core job. If you’re micromanaging, you hired wrong.

9. AI is now table stakes, so differentiation must be real.

If every deck says “AI company,” then the job becomes isolating what’s fundamental vs what’s marketing. “AI whitewashing” raises the bar for clarity.

10. The most valuable help is sometimes silence.

Founders don’t always want advice; they want an intelligent witness. Knowing when to listen (especially in co-founder tension) is one of the highest-leverage investor skills.

Brought to you by: AngelList

From starting as a small, operator-led rolling fund, to evolving to an institutional platform, AngelList has been a core partner in every phase of GTMfund’s growth. Their software-first fund admin infrastructure allowed us to scale without sacrificing agility — from onboarding hundreds of LPs seamlessly to handling compliance, capital calls, and reporting as our fund size evolved.

As we expanded from Fund I to Fund II, AngelList took care of the back-office operations, allowing us to stay focused on what matters most: investing in world-class founders and building the strongest go-to-market network in venture.

They’ve scaled with us across funds and into the future.

If your fund is growing in size or complexity, check them out at www.angellist.com/gtmfund.

Follow Mark Goldberg

- LinkedIn: https://www.linkedin.com/in/mark-goldberg-25458110

- X (Twitter): https://x.com/Mark_Goldberg_X (formerly Twitter)

- Chemistry (website): https://www.chemistry.vc/Chemistry

Referenced

- Chemistry (firm): https://www.chemistry.vc

- Mark Goldberg (Chemistry bio): https://www.chemistry.vc/team/mark-goldberg

- Granola (note-taking app) (mentioned in conversation): https://granola.so

- Index Ventures: https://www.indexventures.com

- Dropbox: https://www.dropbox.com

- Bessemer Venture Partners: https://www.bvp.com

- Andreessen Horowitz: https://a16z.com

Follow Max Altschuler (Host)

- LinkedIn: https://www.linkedin.com/in/maxaltschuler

- X (Twitter): https://x.com/HackItMax

- Newsletter: https://thegtmnewsletter.substack.com

Where to Find GTMnow

- Website: https://gtmnow.com

- LinkedIn: https://www.linkedin.com/company/gtmnow

- X (Twitter): https://x.com/GTMnow_

- YouTube: https://www.youtube.com/@GTM_now

- Podcast Directory: https://gtmnow.com/tag/podcast

VC 3 Episode Transcript

Mark Goldberg: 0:00

I went to a few folks that said, I, you know, I’ve got this idea. And everybody said, you know, that’s exciting. You should do that with somebody else. A plus people want to work with A plus people. The hardest lesson I’ve learned has probably been around managing co-founder relationships and co-founder dynamics. You come into the job as an investor and you think people want advice. I think oftentimes they want somebody to listen to them.

Max Altschuler: 0:30

All right, welcome back to the VC special series that we’re doing. I got my partner here, Paul Irving. And um we got a very special guest today, Mark Goldberg from Chemistry. We’re very excited to have him on the show. Gonna do a little um, obviously, table setting that we always do before the show starts with Mark. Uh we’ll talk about, you know, some of the ending to the year last year. We put a 67-page report together for our LPs working through the holidays. And that has our predictions, that has our portfolio company review, uh, you know, all 35, 40 of them that we’ve invested in through fund two. Um, that has a little bit around the evolution of the GTM fund and a lot of the support metrics. Um, so we’ll just talk a little a little bit about our predictions right now, some of the evolution things um that I think are important to call out. And then uh, yeah, obviously some big news in the interwebs with Andreessen, raising it a 15, we’re raising a $15 billion fund, um, which I think kind of connects really well to some of the stuff that we’re doing and and and talking about in this episode. So um, you know, predictions, Paul. First of all, 67 pages. What were we thinking?

Paul Irving: 1:46

When we wrote it the first year, I think it was 19 pages, and we thought this was pretty hefty, but manageable. And I don’t know if we had the foresight to realize as the firm gets bigger and the portfolio gets bigger and we got more exciting stuff to write about that it’s gonna be 67 pages. So maybe we’re gonna have to in future years split it into editions to get released over the course of the month or something like that.

Max Altschuler: 2:10

It’s gonna be like the Dune series. This is like, yeah, we’re gonna have to we’re gonna have to figure that one out. Um, well, our eight predictions, we’ll get right into them. So, you know, prediction number one uh that we wrote about, we we think the big players are gonna come back in a big way, right? So, you know, we’re kind of seeing this with Google and OpenAI to kind of end and round out 2025, but you know, Meta’s uh we wrote this before the meta uh Manus acquisition, but we do think that you know Zuck is hard to beat and he’s gonna come back uh you know strong. Microsoft, obviously, Satya is uh coming in and personally leading co-pilot. And then um, you know, everybody thinks that the self-driving car Waymo uh war is already won, and Waymo is gonna be the winner. And I think you know, you don’t want to count Uber out. They have a real world data advantage that’s unmatched. So, you know, first first one for us there. Um, I think, you know, obviously with with Google gaining share, and I think today they just announced that they replaced uh the Gemini is um on the iPhone, replacing OpenAI. It’s just that’s interesting.

Paul Irving: 3:19

The fascinating thing about that one is I I think because of how fast everything moves here, people forget just how much panic surrounded Google this time last year. And it was Google’s not going to cannibalize you know, one of the best businesses in the hip history of capitalism, which is their search and ad product. You know, Gemini was underperforming OpenAI and some and anthropic on some of the benchmarks, and and you know, Sergei coming in, and uh, you know, this is why finder-led companies have a history of being absolutely incredible. And I think you know, you see that in the meta prediction that we had uh for them to have a big year and the two billion plus acquisition of Manus is a good signal towards that. I wish we got the report out. I think we got it out the same day. I wish we got it out the day before so that looked even more pressant. But um, no, I I I I love those calls. Uh the Uber one, especially, I think, is under discussed where you know we have a prediction in here about physical world and AI, but they have one of the largest and most compelling data sets in the globe. Um, and it’s hard to imagine a world where that’s not incredibly valuable.

Max Altschuler: 4:20

Yeah. Moving on to two, gonna fly through these here. Uh CFO says it’s time for consolidation, but TAM expansion keeps the party alive. You know, we’re seeing little glimpses uh uh of that here and there. I definitely think you know you’re not gonna have a company with maybe four different vibe coding tools. Uh, you know, maybe the CFO says, okay, across the organization, let’s pick one. There’ll be enterprise grade functionality that’s you know build being built at these companies. So I think you’ll start to see more of that. I think uh that that also does not mean that there’s going to be some sort of depression there. I think TAM expansion across the board um is happening and happening rapidly. And so, you know, these spaces are bigger than previously imagined, and and that’ll keep um, you know, potentially all four of those companies, right, you know, feeling really good about themselves, even if they’re getting churned out of a business, you know, here and there. So feel feel pretty good about that one. Um three AI leap to hardware is wildly under discussed. We feel really good about this in our own portfolio. We’re seeing it um, you know, specific customer support operating systems like Telemetron that helps customers try out triage Wi-Fi connected devices that they have at home is an interesting one for us. Orion is another one, fixing communication between unmanned and manned aircraft. Um, I think I just saw you know a post today how uh they’re starting to do deliveries with drones already in certain cities. So um, you know, that’s gonna be super important. Armada uh is another one in our portfolio. We’re just seeing a lot, I think in you know, Obvio, there’s just quite a few that uh you know have already stood out to us.

Paul Irving: 5:59

You know, we just we’re seeing a proliferation of hardware across consumer and B2B. What comes with that is you know AI native on those individual devices or how you know an AI native technology layer interacts with those devices. Uh, and you see you know a reshoring of manufacturing within the hardware ecosystem, more investment and capital going into deep tech, which a lot touches the hardware ecosystem as well. Uh I yeah, I agreed. We think this is going to be a big year for AI physical world and the hardware ecosystem.

Max Altschuler: 6:31

Definitely. Next one, pricing and packaging becoming the Cinderella of the new AI era. I love that headline. But in all seriousness, you know, we’ve been preaching this for a long time. I think seat-based pricing is going to become a thing of the past. I think companies will stand behind their outcomes. I think we’ll see credit-based pricing, action-based pricing. I think you’re already starting to see that. And you’re starting to see that with some of the fastest growing companies. Clay is one in, you know, the GTM world that’s an example with that. But I think, you know, you’ll start to see a lot of these new age companies come out with these credit-based pricing models, these outcome-based pricing models, workflow-based pricing models. And, you know, people will start to get used to not paying for a seat anymore. And um, and so we’re moving into that world. Next one is GTM becomes an even more AI native uh more AI native in 2026. You know, we’re we’re seeing that across the board now. I think it’s just starting to gain momentum. We got a company in the portfolio, Noble, that is um fixing kind of modern SEO, which is now called GEO, generative engine optimization. You talked before about kind of replacing those Tembu links. I think we’re seeing more roles like growth engineers and uh forward-deployed engineers continue their uptick and uh you know in headcount, and those are helping in go-to-market in a massive way. Um anything, anything to add on this one on the GTM side things. You just did the uh TechCrunch podcast on it. So let’s get your mass opinion here.

Paul Irving: 7:56

Uh yeah, did the TechCrunch Build mode podcast last week, and we talked about this. And going into the conversation, it was funny. We were just talking about go-to-market execution and playbooks that are working right now. Didn’t go into it wanting to tear some of the old playbooks or set fire to some of the old playbooks, but you’re really seeing that in the early stage, but uh, I mean, across our operator network, uh, some of the most forward-looking uh revenue operators that we see in great companies in the technology ecosystem are pushing the boundaries of what AI enables to you you to do on the go-to-market organization, everything from clawed code building new clagiants to automate some of the deepest and most compelling research across every corner of the web. Um, you know, form it to your ICP and be able to execute that directly from the platform, data and signaling. There’s just so many unique things that people can do. Uh, and I think we’re gonna see people push the boundaries of go to market even further than we could have imagined a year ago.

Max Altschuler: 8:58

Yeah, I agree. Six, this was an interesting one. I think this was uh uh definitely a Paul one. Uh consulting backgrounds back in demand. You want to you want to take this one?

Paul Irving: 9:10

Yeah, I will. Everyone wants, yeah. McKinsey alum rejoice. Everybody really wanted gold stars for more of our uh McKinsey and BCG folks. But uh, we are seeing this, it’s really interesting. One of the first hires we’re seeing a lot of the fastest growing pre seed seed series AI native startups making is a forward deployed engineer, but also forward deployed customer success, forward deployed account manager. Uh, and a lot of them are looking for people with a consulting background because for enterprise AI, the actual deployment and integration of a lot of these platforms into workflows and as deep as you can into those customer systems is a really consultative motion. Um, and so having people in these early stage startups that know what that motion looks like, know how to speak to the enterprise is in really high demand. So um another day in the sun for our uh consulting folks.

Max Altschuler: 9:59

There we go. Yeah, we’re seeing that reflected in some of the deal flow that we get. So it’s it’s super interesting time and increased acceptance of human to agent interactivity across B2B and B2C. I think that’s an interesting one. As we talk to you know, portfolio companies, there more and more of them are warming up to the AI SDR, AI marketer, you know, AI customer support. And it’s starting to become, you know, even better for the person on the other side. I think that was the worry, is that like, oh, nobody wants to talk to a bot. Well, now it’s like the bot is more knowledgeable than the rep, it’s faster, it’s reliable, it you know, like your the user experience as a customer of the vendor is actually getting better. So they’re preferring it. So, you know, it’s it I think we’re definitely moving into a world where that is not only not taboo anymore, but it’s preferred by the end user.

Paul Irving: 10:55

Yeah, I think that’s the interesting part is maybe the change in sentiment that we expect to happen over the course of this year. Because you were spot on. The initial concern is no one wants to talk to an AI agent. I’m a customer, I want to talk to a person, I’m frustrated. But you see for a certain type of workflow, a certain interaction, a certain uh you know, customer support ticket. AI native platforms, voice AI is way faster, usually more accurate. And I had it happen the other day on Rippling looking to get something sorted for us internally, instantly sorted. Expedia, another thing, we were booking a you know, uh a trip uh you know for GTM Fund and a couple team members, had to get something fixed, instantly fixed. And that’s something you would have to wait for a human support ticket or get someone on the phone. And I I think that’ll be the big change is not just that people are deploying this because that’s been happening for a year, 18 months now, but the end user acceptance of this maybe being the best, the fastest, and most efficient way to get things done.

Max Altschuler: 11:53

Yes, agreed and the last prediction revolt against AI slop and the return of good quests. Love this one. I think you know, you see this across our portfolio and some of the companies we named earlier. Um, assemble transforming hospital operations, pair two revolutionizing patient advocacy, ABO improves improving road safety through computer vision. Um, but then you get some of these things that have been funded or in the news that are literally just like marketing machines. And so I think, you know, there’ll be less of that and kind of getting back to good quests. Uh, I think who was the uh was it Trey Stevens?

Paul Irving: 12:32

Yeah, Trey Stevens and and Marky Wagner from um Founders Fund back in 2022. It’s something we talk about a lot internally as we’re going through diligence and the type of companies that we want to spend the next decade helping founders build is ones that have a huge impact on the world and hopefully an overwhelmingly positive one. But I I’m getting this feeling that people understand the gravity of the technological shift that we’re undergoing now. And as fun as a lot of these hacky tools that had quick RI and ROI and had a flashy demo seemed great in early days of you know post-Chat GPT and early early days of AI. I think people are really choosing hard quests, difficult problems to solve, things that have meaningful impact on the world, on not just customers, but people, our communities. Um, and it’s been exciting to see. I uh so we’re we’re hoping we have been seeing a lot of that, and I think we’re gonna continue to see even more in 26.

Max Altschuler: 13:32

Yeah, I agree. And that leads us into kind of the GTM fund evolution. So we did our predictions. Um, you know, one of the interesting things is it’s been five years for us. Uh fund one, we wrote 50 to 250k checks. Now our average ownership is growing, I think almost 11.9x uh average check size grew seven and a half times um from where we started. We co-led or led 46% of our deals in the last two years. Uh so now being fully deployed on fund two, it’s it’s it’s interesting to look back at the numbers, how far we’ve come. We built XVAL, which is our own kind of internal GPT tool that allows us to feed in all of our information on our LPs and then search and query that to support our founders on the problems that they’re having day in and day out. You look at you know, GTM Now, something that didn’t exist when we started. We bought Sales Hacker, relaunched it, GTM Now, uh 50,000 plus newsletter subscribers, 750,000 plus podcast downloads, top 1% podcast globally. Sophie’s doing a fantastic job there. We’ve got the team, we’ve got did our first AGM last year. So it feels like we’re doing a lot. Tell us about some of the support metrics that we’ve kind of put together as a platform. I think we have like last year’s versus all-time, right?

Paul Irving: 14:51

We did. I’ll do the all-time ones to not not drag us into too many numbers uh for everybody listening. But yeah, we over the years of doing this, we’ve got over 4,200 support items that we logged, and we talk about this constantly. There’s so many for whatever reason that don’t get logged or sort of put in our system the right way. But we track them into different buckets. So, you know, over 825 introductions to our operator network for our founders, uh, over 425 customer and partner intros. So warm intros to potential customers and partners to help accelerate the the revenue acquisition side for these companies. Um, the most uh fundraising warm introductions we’ve ever done in firm history this past year, we had um almost 470 of them um introduced over 1,400 candidates, mostly on the go-to-market side, but really across the business to our founders in early stages as they’re growing and building their teams. Uh, it’s been really cool to see those numbers grow, of course, but the million stories that are underneath each one of those introductions. Um, you know, some of these are pivotal hires that uh end up transforming the way a company does their go-to-market or, you know, a banner customer that is uh an anchor for that company being able to raise Series A.

Max Altschuler: 16:09

Yeah, I think the the the fascinating thing is the timing. You know, we can’t we we had this report come out that you know kind of wraps up Ubuntu, wraps up um 2025 investing. But it talks a lot and showcases a lot of the value of the platform that we’ve created, which to us is very unique and I feel like a massive different differentiator, especially at pre-seed and seed. And then you have Andreessen announcing their $15 billion fund, and a core message of that $15 billion fund is hey, we’re building this infrastructure for startups that we invest in, because they when they raise money from us, they don’t have that themselves. So we have the platform, so they don’t need to worry about it. If they need customer intros or political intros or um, you know, candidate intros, whatever it is, Andreessen’s platform that they’ve invested in will support that money, you name it. And I feel like we’ve done this very well on a obviously smaller scale than them, but perfectly for pre-seed and seed in our world. And it was interesting to just kind of hear how they talk about it, some of the things that we put together and how we’ve been talking about it, very closely aligned there. Um, what do you what are you what are your thoughts? 15 billion obviously is a world of haves and have nots, and that’s a different story, but uh that that’s an incredible sum. And and you know, we we talked in the Slack about I mean, very, very similar to how we talk about it.

Paul Irving: 17:36

Yeah, it’s interesting. And and I recommend for anybody who wants to go deeper, Packy McCormick from Not Boring did a really great deep dive into you know the journey of A16Z to now, from inception to now raising a $15 billion fund and some of the things that have changed in venture over the years. And one of the interesting ones is I don’t think people realize how few and far between platform was as a concept when uh Andries and Horowitz first started. And he had this great quote in here, which I’ll read and then I’ll share a couple stats on the rates because I think it’s also fascinating from a sheer numbers perspective. But the quote was to your point, I think this distinction solves one of the oddest things about venture capital self-image. The venture capital is an industry that sells the world’s most scalable product, money, to its most scalable companies, technology startups, but must not itself scale. And it’s the idea that you’re supposed to have, you know, a handful, half dozen investors investing hundreds of millions of dollars, but not having support systems and functions that are vital to the company’s success, you know, stepping in there and really moving the needle and moving mountains for these companies so they can create magic. And the $15 billion fund is a is a banner number for uh historically and also currently. So that represents 18% of all venture capital raised in 2025. If you split out, so it’s across dynamism, apps, uh growth, uh, bio and health, infra, crypto, if you split out the individual vehicles, four of the funds individually would be in the top 10 of the largest raise in the vintage. The $15 billion is larger than the next two funds combined, Lightspeed and Founders Fund. Um, it really is a testament to scale, I think, the market responding to platform and a bet on the future of technology that can’t help but get you excited.

Max Altschuler: 19:23

Yeah. It’s extremely exciting. Love to see it. Big fans, obviously, of of you know what they’re doing and the scale that they’re doing it at. Um kind of brings us to today’s guest. So Mark uh Goldberg was at Index and now he’s a chemistry. Went from big fund, you know, multiple billions under management, um, in one not even just under management, and the current fund, right? They’re deploying to um obviously much smaller, but still a sizable fund for a kind of a spin out at uh, I think it’s 350 million, you know, the around that. Um with um you know, Ethan and and Christina. And I thought it was pretty interesting to hear their or origin story, how they all came together. And you know, even more how they kind of generate their alpha. You know, you you can’t really rest on your laurels in VC. You don’t get to like bring the brand with you uh that much. Maybe it helps you raise money, but I’m not sure if it helps you really deploy capital. It’s really about your network that you built, your reputation that you built and the ways that you go about building relationships going forward with founders of the future. What were your you know takeaways from the episode and then we’ll get into that.

Paul Irving: 20:40

Yeah, great conversation. Mark is is such a smart guy and him and Christina and Ethan are a great combination. I think one of our favorite you know new emerging funds in the market today. I I thought the event strategy, so they they did 70 events over the course of 2025, which I think is a high number for a large platform fund, let alone you know a brand new fund in the grand scheme of things. And the way that Mark talked about that I thought was fascinating, which events for them is a medium to build meaningful relationships with smart, ambitious founders and to get to know them. And I it it got me thinking of okay what’s the purpose? You know, every fund can take a different strategy. At the end of the day we’re offering a product to founders and the most ambitious founders will get to choose who they want to work with. And uh it sort of as a reflection listening to Mark talk about their event strategy and they’re doing some really creative stuff. This isn’t just you know 70 happy hours he talks about a chess tournament and um doing surfing lessons you know down in Southern California. But that every fund should ask themselves the same question. What is my unique channel to build meaningful relationships with the most important ambitious smartest people in the ecosystem.

Max Altschuler: 21:52

Yeah. Well we’ll get right into it Mark joins us um from chemistry where he’s a managing partner before that he was a partner at Index Ventures did a stint at Dropbox uh in the early days over there so brings um you know operational experience large fund experience and now kind of uh small fund I guess you can call it a smaller fund obviously than index but not too small 350 million is a pretty pretty nice fun one so yeah we’ll kick it over to Mark and I’s conversation and thanks Paul see you on the next one thanks for coming it’s a pleasure to be here. So um you know I did a little research obviously before this and saw you studied international relations what’d you think you were going to be when you grew up when you decided on that were you going to be like James Bond when I see international relations I’m just like where is that gonna go? Are you gonna be like CIA? What’s the what does that lead to?

Mark Goldberg: 22:43

First off you you did your homework. I haven’t been asked about my degree and I graduated I think 17 or 18 years ago. So thanks for starting with a great question. And I just have to say it’s awesome to be here. I’m such a big fan of what you guys are building and the community that you guys have assembled. And international I had no idea what I was going to do when I was in college I was a liberal arts major at Brown which is about as you know hippie and loose a school as you can find. There are no grades if you decide I took very few classes with grades um you can just decide if it’s hard to kind of drop drop the grade aspect of it. And for me international relations was just a way to engage my curiosity. It’s funny I joke that venture is basically the liberal arts of jobs because you just meet smart people and learn all day. And that was kind of my college experience. I did a lot in in uh I I focus on Latin American politics so I lived down in Argentina for a while um I I had no idea what I was going to do as a career I just wanted to spend time focus on the things I was interested in and has it helped like yeah there’s there’s things you learned I’m sure like the things I’ve learned in the there in some ways absolutely not you know the the uh the politics of uh you know Central America and South America in the 80s and 70s probably less relevant to my day-to-day job but uh what we do is global I mean think about like how the trade war is affecting you know the early stage it there are ties here that that I’m glad I have some of that foundation for um so in some ways it’s absolutely irrelevant and in some ways it’s really helpful every day.

Max Altschuler: 24:04

Well index was a European firm came over to the US you were very early on the US side of things so I was wondering if there’s any connectivity there. The James Bond thing was a joke but like what would was that part of kind of the thought process where it’s like this is pretty interesting. This like I can help you know this fund jump the pond so to speak and since then they’ve invested in obviously some pretty amazing companies I think you were in plaid while you were there but they were also in Wiz, Figma a couple big ones that did to the exit so how is that kind of correlated if it is yeah you know it’s funny I’ve I’ve had a lot of conversations with it nobody’s ever tied my degree to index ventures and it’s total it’s a great line of thought that I’m not even sure I considered until just now.

Mark Goldberg: 24:45

Yes um one of the appeals of going to index when I did almost a decade ago was this sense of I can spend a bunch of time in Europe and traveling around the world. I love that I I mean I love that I primarily uh chose to go to index ventures because the people it was a great group of people and a a lot of really strong mentorship at the time and then it was an unusual situation as you described where Index was actually born in Geneva Switzerland. Oh wow I didn’t even know that yeah yeah yeah it was a it spun out of a family office in Geneva Switzerland they started doing venture capital in Europe before anybody had figured it out and then they realized uh maybe a year before I joined that they needed to be in the most important market in the world in the US and so they started to build an office in a team I was part of that early team and I loved the sense of okay I I’m gonna get to see the the world through this job and also there’s this opportunity to take what was really a world class brand in Europe and see if we could compete in the most competitive market in the world. I I’ve always loved competing um I’ve I’ve played a lot of sports I I I like the feeling of competition. Venture’s a great asset class to being a part of you like to compete um and uh that that was a lot of what drew me in.

Max Altschuler: 25:49

Yeah and so you were early there obviously great investments um spun out recently and we’ll get we’ll cover a lot of this in depth but spun out recently and started chemistry what was the impetus for that I mean you had this and and I want to get so deep into this because you had this massive logo behind you obviously that had these big investments and to go from that to now not having that but just having your personal brands and the three of you have very strong personal brands by the way obviously uh proof is in how you were able to raise a very strong fund one how you’re able to still win incredible deals so you know why first of all start your own fund spin out and then how has that gone?

Mark Goldberg: 26:29

How was the fundraise process yeah tell me more about that yeah sure um well let me give you a little context when I joined Index in 2015 the brand now I mean what a br I’m so proud of what that team has done to build a presence and and brand in the US and what an incredible year for Index Ventures. They had uh realizations for uh for some early investments companies like Wiz, Figma, Scale I mean it’s been a really incredible year for the team. But when I joined we were invisible in the US um I I still remember I joined as an associate so I was doing a lot of the sourcing cold emailing people and I would constantly send emails oh I’m Mark at Index Ventures and if I got a response about half the time it would be hey thanks Mark from Insight like you know we’ll get back to you when we’re ready. I’m like oh I’m not insight we’re indexed you know like it’s so it’s it’s always one of these things where you know I’m I’m uh 10 years ago it was really we felt like we were fighting and scraping for every every meeting we were getting and I think that actually was quite helpful in preparing me for the experience of starting a new fund. Um you know the reason I left uh and Christina Ethan and I spun out about a year and a half ago and started the fund almost exactly a year ago was we really felt pulled into the opportunity. We had all lived inside of the big multi-stage funds and we thought that as the funds had had started as kind of smaller partnerships but grown into these big asset managers there might be an opportunity to take some of the best DNA from some of the top multi-stage funds and reconstitute it with focus. And that’s really what we that was the hypothesis we keep around for years and you know I was chatting with somebody yesterday it’s hard to get on the same wavelength in terms of well you know is now the time or is you know a year from now the time um but after some conversations we felt really compelled that this was the moment and uh and and took the jump and uh it’s been really fun. Why them well that’s a great question. And it’s funny I had so much more empathy for founders in their own co-founder dating journeys. Um for me I I knew uh I I just started 40 last year that I wanted to eventually do something on my own. I also knew that I wanted to do it with other people. I think there’s some amazing uh solo GPs out there and God bless is that who I am I’ve always been more of a team team player and uh and I love having that that kind of sounding board pushback uh ability to kind of divide and conquer. So I knew if I was going to start something I was going to do it with a handful of people. I didn’t want to do it with two. I thought that it was two it was just going to be two forever there’s a lot of those examples. I thought if we could start with three or maybe four we could lay the foundation for something that could could kind of you know grow in time and I that was very appealing to me. In terms of the specific people I started with who are the people I most respect in the ecosystem and I had a list of say 10 names that you were already close with. Already close with and the way that I drew the list was and it’d be interesting if you talk to founders about their own journey I I thought there’s no way I’m starting this with somebody I haven’t worked with before.

Max Altschuler: 29:15

It just it’s too much risk. Yeah. You know I you know your job is is right it’s just like massive upside with as little risk as possible, right? So like that’s just adding way more risk but for potentially not as much upside or equal upside to what you already know, right?

Mark Goldberg: 29:29

So that’s exactly right. And you started, I mean if you took a clean slate approach, maybe you’d say let’s get the best resumes you know in the world to that was not my approach was who are the people I wished that I could work more closely with. And it was mostly I started with board members who I’d worked with. I was on I think 23 boards at index when I left. So I had kind of started with you know 50 folks that I’d spent a lot of time in the trenches with um and then just people who I’d been trading deals with forever. And I’m sure I for you and maybe some of the audience who’s investing you kind of build these informal I don’t want to say investment committees but friend groups that oftentimes for me it would act as one of the most powerful sounding boards as I was debating an investment. And oftentimes those were outside of my institution and I went to those circles first I said this is why don’t we make this the real thing? We’re doing this anyway every time I do a deal or I think about a deal I’m calling you for for feedback you’re calling me like we should we should kind of bring this together.

Max Altschuler: 30:21

Was it scary? It was terrifying yeah totally terrifying spinning out in your own I mean like did you have LPs lined up already or deals warehoused or anything?

Mark Goldberg: 30:29

Okay nothing. There was a I I was well you know the the way that the that we actually came together was Ethan uh so so I went to a to a few folks I said I you know I’ve got this idea if we all came together this is kind of the thesis and everybody said you know that’s exciting you should do that with somebody else and and then uh including Ethan and and uh and Christina Ethan uh he’d been at Bessemer for 16 years he was a lifer everyone thought there’s no way Ethan’s gonna leave Bessemer you know he’s been there forever he’s such an important uh figure there but um Ethan called me six weeks later and I was like I can’t I can’t stop thinking about this and he kind of accepted me with this this idea we should we should go explore this and we we met in a coffee shop here in San Francisco and we had drawn lists of the people we most respected because we were already aligned at that point let’s start with a handful of people not just the two of us and Christina Shen was the top of both of our lists uh Christina and Ethan had worked together at Bessemer. Christina and I had been on some boards together. And she went to Andreessen and then they okay then exactly right so she they had been at Bessemer she’d gone to Andreessen for five years and we both we sent her a text message which I probably have somewhere on my phone that was like us holding these kind of cheekily holding these lists saying like you’re the top of both these lists you should reconsider.

Max Altschuler: 31:40

She just had her third kid and she she started to think about it and that then we started to meet a little bit and I think that process of spending time together was um was how we really built the conviction but it was terrifying I mean I remember you know some of these days were we we didn’t have anywhere to work we’d be you know we’d be squatting in the the friend’s office for the fifth time feeling like the guests that kind of overstayed the welcome yeah exactly you know what do we do now like and you know that’s all part of the fun now but yeah from starting as a small operator led rolling fund to evolving to an institutional platform Angelist has been a core partner in every phase of GTM funds growth their software first fund admin infrastructure allowed us to scale without sacrificing agility from onboarding hundreds of LPs seamlessly to handling compliance capital calls and reporting as our fund size evolved. As we expanded from fund one to fund two Angelist took care of the back office operations allowing us to stay focused on what matters most investing in world class founders and building the strongest go-to-market network and venture they scaled with us across multiple funds and into the future if your fund is growing in size or complexity check them out at angelist.com slash gtm fund that’s angelist.com slash gtm fund so I want to know how you came up with the name the thesis and then how the fundraise went because again you lose this kind of big logo behind you but you still have it as you know part of your pedigree part of your resumes then you also have your reputations your board seats your founder references all that type of stuff so you know you’re not starting from scratch by any means um but there are still probably LPs who are like well you know can you even do this at you know on your own without you know index deal flow or whatnot and then um you know and then 350 is a very large fund one and then also the thesis so you know how do you differentiate even beyond your reputations um how did you decide what stage you want to stick to and how the reserve model would be built and and all that so where do where do you go from there? Okay the three of you were in then what?

Mark Goldberg: 33:39

I think uh the the the first thing when we were in was we’re in and aligned on the strategy and the strategy was very clear from the beginning for all three of us which was we’re just to an early stage and we think that focus is going to be a weapon. And uh and early stages precede seed A seed A that’s exactly yeah we say from inception to series A. We got we’ll flex maybe like a late A, early B, but that’s kind of the we we want to be part of that product market discovery journey where we’re in the trenches with you building. And I I think when we looked at it what we loved about the job that was the part we loved. It wasn’t kind of the the stock picking at the later stages it was you know it’s risky but we want to be part of that journey and it doesn’t work doesn’t work. If it works we get this bond that’s kind of you know when you ring the bell on the stock exchange you’re kind of like hey that it wasn’t that obvious remember that co-founder breakup remember when we almost ran out of money like those are the parts we’d all remember when like we were the only ones at the table in the beginning yeah yeah I just actually last night signed a signed a term sheet with a with a series A company and uh we took a picture in the office and they were like you know hey let’s clear out all the there’s all these boxes behind us cardboard boxes let’s clear those out so it looks like it’s like leave them in it’s gonna be that much more fun when there’s a we’re taking this picture five years from now you’re a thousand people the other the background the the the better the more it looks like sacrifices were made exactly yeah yeah um so we we were aligned this is this is what we wanted to do from that we uh we started thinking about the you know the right size to affect the the the strategy we wanted for us it was we think we can handle three or four investments per GP per year and then it was about this check size you know we actually have a very light reserve model our view was we want a lighter reserve model where we’re not just gonna kind of paper our reserves across all the markups in the portfolio it’s we’re gonna pick a handful of winners that we are really high conviction on. And we we kind of built the fund math through that. We then started having some of the conversations with LPs. I think we were very fortunate and that we had done some of the fundraising for the previous funds and so we had some relationships that helped to kind of jumpstart that process. And I think that you know we tapped into some interest in the LP community for a smaller fund that had established GPs but not so much so that you know we were not interested in working really hard. And I think you know the people who we ended up partnering with ended up appreciating the dynamic of yeah we we we love the experience and hustle as a combination and we really want to find a fund that’s small enough we could see you know the traditional venture returns. And when you look at some of the mega funds that are raising billions and billions of dollars it’s harder to imagine 10x funds just based on the size of these vehicles. And I think there were some LPs who saw okay you know with the strategy you’re pursuing you could be right you could be wrong but that supports the ability to to really if you if you hit a few of these big winners uh to to be in really good shape for a really strong strong performance.

Max Altschuler: 36:22

And it was 350 and that’s a three year de three year deployment fun one.

Mark Goldberg: 36:26

So do you have an idea of what you’re gonna do continuing what’s fun two what’s fun three look like yeah so so um we uh we are about let’s see just over a third deployed at this point we’ve got about 120 million in the in the ground um and yeah I think the strategy hasn’t changed uh we we’re gonna continue to stay really stage focused um you know our pitch to founders has been experience and hustle that’s gonna stay the same and we take pride in having a small team uh we’re we’re nine people at chemistry right now that’s six investors and that’s not gonna grow um that was gonna be my next question so are those investors kind of principal level or we we partner we’re we we just have two levels we have GP and non-GP who we just call investors um but they’re fantastic they’re really critical to the operations right now where did they come from other bigger funds or different backgrounds we had a strong thesis that um what we really wanted to solve with the non-GPs was for access I don’t need help doing diligence on a on a you know on a spreadsheet that’s uh I in some ways that feels like an unnecessary addition to the fund. What I need help with is there’s a demographic of 22 year old founders that are um coalescing in this environment or in this community that I don’t feel like I have strong inroads with if we can hire some people who can plug those holes in our network we’re gonna be a better institution. And our pitch to these investors uh was you can join a team where you know we’re gonna have very little hierarchy we’re gonna give you a lot of room to run and I think that combination has worked so very well so far.

Max Altschuler: 38:00

Yeah it’s amazing I mean it’s um it it’s great that you had this connectivity with those two partners beforehand and and you didn’t really have to do the whole like date before you marry type thing. I think that’s very important. And then as you round out the rest of the team were these people that even even the ones you’re bringing in now were they ones you already knew or you ran hiring processes?

Mark Goldberg: 38:22

We we interviewed about 150 associates in the first four or five months of the fund and we ended up with three that we’re very proud to have have brought on. I would say my co-founder Christina’s superpower is her access and network within the junior investment community. I think she has done a really wonderful job over the last 10 to 15 years of just treating people very well and being very approachable for people who want career advice as they were moving up their own journeys. I think that was a real advantage for us as we were going through the hiring motions. And then I think we were also very aligned on the profile we wanted, which was you know we didn’t need the former investment banker turned private equity analyst. We needed people who were kind of in the right pockets of people that could complement our own networks and I think that alignment helped us know what we were looking for.

Max Altschuler: 39:08

Yeah and you’re an industry veteran at this point so you learned a lot of you know the do’s and don’ts so I think you probably apply that to the hiring process but um have you sat down with your GPs um Ethan and Christina at any point in the in the maybe foundational period put down you know your own tenants your core values or whatever that aren’t investment thesis or mandates related but are more like hey here’s how we want to build the brand and what are what are some of the things that you’ve brought from Index, Bessemer and Andreessen to chemistry that um you know that are kind of tent poles or founding pillars that you’re like oh I’m so grateful for this maybe larger institutional experience that now we’re able to to do this in a kind of smaller, more customized way, but you know are foundational you know tenants for you.

Mark Goldberg: 39:58

So I think there’s a few things We have we have some values that we aligned on right out of the gate. Um the first value I have is excellence. This is an industry where performance matters, and I think performance is actually one of those things that sets cultures. Um, my first job in Silicon Valley was at Dropbox. Um and we spent a lot of time when I was at Dropbox thinking about culture in an environment when you’re tripling or quadrupling a team every year. You really have to think about how to tie people together. You know, we thought about the perks that we could offer. We thought about, you know, the quality of the office experience. And in heightened side, I think none of that mattered. I think the only thing that matters uh or the anchor of a culture is A plus people want to work with A plus people, and that performance is what keeps everybody together. And that’s one of the tenets that we set out with chemistry, which is we’re gonna have a lot of fun. And I think that’s one of the things we spike on is nobody takes themselves too seriously. It’s an office where we have a lot of inside jokes, you know, we’re playing pranks on each other. I mean, it’s a fun environment, but we’re working our asses off. And at the end of the day, if we’re not performing, none of it matters. And so the first value is excellence, and everything kind of comes downstream of that. Um, with regard to what we took from the previous institutions, we took a lot and we left a lot behind. Um, I would say it probably manifests the most in our individual investment voices. And I was so grateful for the experience at Index where I still remember showing up to Index my first uh my first day on the job, and they wouldn’t let me bring the um the PC that I was most comfortable doing uh Excel operations on without a mouse. And I was like, how am I gonna do the job here? You you guys hired me to this job, and yet you’re not letting me use the tool that I need to be effective. And I remember I maybe it was Danny Reimer, maybe it was one of the other part of City. I was like, you don’t understand the job. Like we’re we’re we’re looking for great people, and you this is not a growth equity job. This is a job where we need to understand the holistic um, you know, kind of set of criteria that that make this team exceptional.

Max Altschuler: 41:57

Especially yeah, at the early stages, you’re not going off spreadsheet.

Mark Goldberg: 42:01

It’s I I didn’t know what I was doing. First off, so I was already clearly starting. Uh, you know, I was I I was fortunate to be where I was, but clearly didn’t have the most kind. Absolutely. Wouldn’t say that was a um, but it was this, it was this drawing experience. Like, no, no, no, this is you don’t you don’t need that, you know, get rid of that. Like, we you know, get get get the Mac like the rest of us. And uh and and I think that part of the index uh you know attributes that I take away is they they were very good at picking great teams early. I think that’s why you see the performance where it was, and that’s something I look for. Um, you know, my early stage portfolio is very much informed by do I believe in this team? Do I believe in this founder? Not uh thematically, these are the three things I expect to happen in the next two years in fintech or AI or software, and I’m gonna invest behind that. So I’m very grateful for that experience. I’ve taken that with me. I think if you ask uh Christina from Andreessen, I think Andreessen is very good at swinging for the fences. Um you know, they they really think about the upside, not the downside. Let’s make sure we’re in the highest quality assets. And I think that’s a great lesson. And I think Ethan is probably the most structured of the three of us. Um, he almost backs away from situations with heat and thinks more from first principles about, you know, not where is the market pushing me to make an investment, but but more independently, what do I think are the most important things happening right now and how do I invest, even if it feels like it’s really off the beaten path? And I think that mix has been uh it’s been very helpful for our first year in business.

Max Altschuler: 43:25

How are you and these folks managed by the GPs and their businesses? And how are you reflecting that as you manage some of these per people that you hired that are investors at your fund? Because you know, they’re now all of an extension of your brand. Yes. They’re first touch, they’re driving a deal from start to finish. Um, and by the way, like, do is there an IC where the three of you have to have some sort of consensus by the when when a deal is done? I’d love to know kind of how the management styles have, you know, what are the things that you’ve taken from those bigger funds mirrored now at your fund? And then yeah, what does the IC process look like?

Mark Goldberg: 44:05

Well, the first thing I’d say is on a on the management question is one of the reasons the team is small is because we don’t think that venture scales very well. And we felt like some of the mistakes that we’d seen from these large institutions is the mistakes all bureaucracies encounter when they get bigger, which is you lose focus on the main thing. For us, the main thing is finding and back in grade founders as early as possible. And you wake up one day and half your time is spent on internal matters. We wanted to create an environment where we weren’t gonna do that. And so far we we’ve we’ve succeeded in that sense, which is the vast majority of our time is no HR function. We don’t have time for it. It’s we, you know, and we designed this fund in a way where we we just don’t, that’s not gonna be the focus. The focus is gonna be extremely high quality uh people. When we pitched LPs, we said, that are gonna fit around one table. It was funny because we would sometimes pitch this in a room with an LP that had a 40-person table, and we had to clarify that’s not really what we meant. We meant a small kitchen table. Um and I think that has uh made it such that everybody has to stand on their own two feet. We can’t, we can’t kind of carry people that aren’t performing. But when you have high, high performing people together in that that uh you know, you’re you’re you’re a SWAT team. You can move very quickly, and that’s been a real superpower for us. Um I also think, and I’m very grateful for the first manager I had when I was at Index is a guy’s name is Ilya Fushman. He’s one of the GPs of KP Now with Mamoon. Um, I mean, they’ve done such a great job the last five, six, seven years. But Ilya brought me into the industry, and his management style I’m so grateful for. I would describe his management style as a shit umbrella. And by that I mean he said, This is what’s important. I’m gonna block every other noise out of what’s not important, and I’ll deal with that. That’s my job as your manager, and your job is to go find and do great deals. And I love that. I I was so I felt so empowered. Every day I’d wake up and uh I know what I’m doing. I’m gonna go out, I’m gonna meet 40 founders this week, and I’m gonna figure out which the best companies to invest are. And the ability to do that without distraction was such an awesome management technique that I think made me successful, I think made the institution successful. And I think a lot about that now for the last whatever, seven or eight years that I’ve been a manager, certainly a manager of chemistry, where my job is not to micromanage the people under me. If that’s the case, we’ve already gone wrong in terms of the hiring. My job is to create an environment where they can be very successful and to block some of the noise from things. They don’t need to deal with, you know, issues X, Y, and Z on the finance and operations and LPs. They need to be focused on who are the people when you uh see the smartest alumni leaving, you know, uh prod and cursor, you know, who is that individual and how are we well positioned to get behind them as quickly as possible? Um so I I think a lot about a management style that that uh that that’s reflecting and some of the benefits I was given coming up in the industry.

Max Altschuler: 46:47

Love that. Uh resonates deeply. And um, you know, curious, how are you leveraging AI and software in that access process? So you’ve got these investors, they’re chasing deals, you’re chasing deals, you’re you’re, you know, I’m not to give away too much of your secret sauce, but like I know you’re you’ve probably got your um ways of finding things, just like you know mentioned there, where oh, if that we find somebody that came out of Palantir that’s building X, like let’s get to them super early, right? So are there other tools that you’re using that are off the shelf? Is there anything that you’re building internally at the fund?

Mark Goldberg: 47:23

So um I wish I had a secret sauce that I could withhold from this conversation. I don’t. It’s just pure it’s a sweat equity game. Pure awesome. Yeah, it’s to me, especially as a new fund. We’re trying to find the future founders and the early stage founders that they’re gonna create the next generational companies. I have not found a shortcut other than working really hard to spend time with those people. And that manifests in different ways. Um, we’ve done something like 70 events in the first 10 months of the year. Um that’s that’s breathtaking for us. I’ve never been that active in terms of uh kind of the the number of activities where we can kind of create opportunities to meet people, but that’s the ground game we need to be doing to be in front of the best founders. And so we have not found the substitute with data science, with other uh tools um that has uh replaced what feels like the core of the job, which is spending time with with great people. The tool we most use is granola. Um we’ve it’s funny, I kind of fought it when we first started the fund. It felt a little creepy to have something recording a conversation. Granola, for those who who don’t know, is a note-taking um app, but it’s a much more powerful tool than than the rest of the market. Um I uh and so we we’ve really become dependent on on that as the backbone of our institution, where every conversation, internally, externally, uh you know, to the extent people are okay with it, um, is recorded and synthesized, and we learn from those interactions. We have a great way of tracking what we’re doing because of that. And uh that that’s probably the most critical part of our of our internal tools tech. So it sounds like events have though been a big driver for you. So what what are the events? It it totally depends. Um what they’re I’ll I’ll start with what they’re not. And we made this mistake early on. We started with happy hours. Um we first off, uh our our budget when we were doing the budget for for events, uh while the own made it the happy hour uh uh spend because nobody drinks in San Francisco. So we we would go you know with a $3,000 minimum tab somewhere and we would spend $80 on seltzer waters and athletic beers, non-alcoholic beers for people.

Max Altschuler: 49:27

You need like microdose mushroom bar or like a nootropic bar or like a nicotine packets or something like that, whatever the trend of the day is.

Mark Goldberg: 49:35

Exactly. Yeah, exactly. But well, I think what we realized is you you gotta do something a little bit more interesting than let’s get everybody together around a bar. It just people are busy right now. This is a different San Francisco than five years ago when people had time for that. Nobody has time for that. It’s almost adverse selection. They’re like, hey, come come hang out with us at six o’clock at a bar. I’m working, I’ve got another four hours of work. Haven’t you heard of 996? This is in the middle of my 9-9. We’re doing your work.

Max Altschuler: 49:59

Yeah.

Mark Goldberg: 49:59

So I I think we realize that some of these generic things that, you know, five, 10 years ago we would have done just don’t work. Um and so we try to we try to put a spin that’s a little bit more interesting. I think a lot about um ways of meeting people where they are in terms of hobbies um or in terms of interests. Um, I’m in the process or of right now of organizing a large chess tournament, a speed chess tournament, where we’re allowing some of the best startups in Silicon Valley to nominate their top chess players and then having a uh kind of a tournament of sorts to figure out well, who’s the best. Are you playing? Uh I will. I’m very bad. My ELO is very low. I love it. I’m an avid but very bad or mediocre, I would call myself chess player. Uh I uh but but I think something like that where we can kind of stand out a little bit different. Um we’re hosting a surfing event in December that we’re having some founders join, founders and researchers join. So we’re just trying to do things that are a little bit different, that have a little bit of novelty. And uh I think again, as a new brand, that’s something we care about. We’re also trying to invest in um you know some larger events, some some uh some speaker series where we have some great people coming in to talk about their journeys in the industry. And um you would ask me earlier about the name of the fund, and it ties to some of the ethos we create. When we started to talk about why we were doing this, the reason I wanted to work with Ethan and Christina is when I was on those boards, I would ask the founder, you know, who are the best people that you, you know, you go to for advice. It was always Ethan and Christina. Uh, not I mean, I I hope other founders said about me, but the boards I was on, they said Ethan and Christina. And I think that that there was this sense of like they they really are there for me. They really get me and they they they they make the time at 11 p.m. on a Saturday night when I have something important to talk about. And we thought that ethos of being there for ourselves, for our own team, having that chemistry with portfolio companies was kind of the the bedrock that we could build an institution around. And some of the some of the events we’re doing right now, we try to bring that same ethos, which is it’s it’s gonna be a little different, it’s gonna feel a little bit more intimate, and uh and so far that’s been working well.

Max Altschuler: 51:50

That’s great. Um what did you learn from Drew at Dropbox?

Mark Goldberg: 51:56

Oh my gosh. First off, he’s a great guitarist, which I feel like gets kind of uh boss yeah, it gets a little bit lost, and I I I’m uh I’m an interested but not a great guitarist. So it was a little disconcerting. I remember you would sometimes go to his office to, you know, I I was on the the BizOps or the finance team for a while, and I’d come in with a spreadsheet to talk about, you know, the cost of uh, you know, our data center below or something, and it was a little disconcerting because he’d be strumming the guitar, and you’re like, this is this is pretty serious. Like we’re talking about a lot of money right now. Like, are you sure? And just kind of how we focus. Lakumbaya attitude with uh like maybe we need to. The learn is out of control, it’s okay, man. Yeah, but um I think one of the things I learned from Drew was he ran the company with a real sense of empathy. Um, he has a leadership style, and a Rosh had a leadership style as well. That was we want to hear what you have to say. There wasn’t this sense of who are you, young junior person? Uh, for me, I was transitioning from Wall Street. Um, and uh I was really a fish out of water when I first got there. I mean, I showed up for my first interview wearing a suit because I thought that’s what you do. In Wall Street, that’s what you do. And I I was lucky enough to have a friend, Adam Nelson, who’s now a partner at Firstmark on the venture side, who saw me sitting in the lobby in a suit 15 minutes early. And he’s like, You gotta get out of here. If you show up in a suit, the engineers are gonna say no before you even start the interview. And I was staying at a hotel like 20 minutes away, and I I sprinted across you know the one and a half miles to get back there, changed into you know, sitting up uniform, showed up 20 minutes late for the interview, fully sweated and disgusting. Um, but it it it worked out from there.

Max Altschuler: 53:31

So that’s awesome. Yeah. So that was a formative experience for you. Like I won’t one, it was your foray into kind of tech world. Two, you I’m sure you got to understand like what a great founder looks like. I mean, that was probably huge for you going into VC.

Mark Goldberg: 53:43

Um Yeah, and I would actually argue more so it was so it was, it was it was my crash course in tech. I mean, I still the vernacular of moving from a uh a private equity fund to an institution where there are designers talking about pixel, it was it was jarring. I mean, I don’t think I understood 80% of what people were saying to me the first three, three, six months. So I feel very fortunate that they took a bet on me and I was able to kind of use that as the education process. What was more important, and I think I had an intuition behind this, but certainly played out later in life, is the group of people at Dropbox was phenomenal. It’s the best network I’ve ever been a part of. Uh the the there are, I think, 15 Dropbox alums in venture. There’s another hundred people that are founders, and the ability to kind of stay close to that community over the last decade um has has been really one of the things I’m most grateful for in my career.

Max Altschuler: 54:33

It’s a great alumni network for sure. The the and they were like super early in kind of the SaaS world. So that even box alum, dropbox alum, I think there were like a handful of companies that were kind of out of around the same time. Um it’s exciting. That’s cool. So your um new fun now. I don’t think I got uh an answer on this part. So I see conviction or consensus.

Mark Goldberg: 54:56

Uh uh, it is uh conviction, not consensus.

Max Altschuler: 54:59

Interesting.

Mark Goldberg: 55:00

Which was uh a very deliberate decision we made. So the way that the model works is any GPE can pull the trigger on a deal within a certain parameter, basically a core deal for us. If you want to put 20% of the fund into a deal, you gotta have more of a conversation. Our view when we looked at our track records over the last 10 to 20 years was our big misses, and I’ve had investments that that went to zero and didn’t work, but our big misses were the omissions, not the bad investments. It was the one where you realize that, you know, Uber was gonna be super exciting early on, but you know, maybe a lot of people thought it was crazy that somebody would get in the backseat of your car, which it was, right? Or you know, Airbnb in your house. Um and so we wanted to create a voting structure where we didn’t solve for an average, we allowed the outliers into the portfolio, and that’s that’s what we’ve done. In practice, it’s very collaborative. Our whole model is we kind of co-work deals together. And um, a lot of the deals that we’re winning, I think we’re probably winning because people see the enthusiasm and energy we’re bringing as a as a full team. But ultimately, we think conviction sits with the individual at the early stage.

Max Altschuler: 56:03

And is one of you three always a the driver for the deal with one of the other partners? Are you taking the board seat? Are they taking the board seat? How’s all that work?

Mark Goldberg: 56:13

So right now it’s the the GPs are the ones taking board seats, but we’re open-minded. I mean, we’re kind of evolving as an institution and we’ll see where that goes.

Max Altschuler: 56:19

And you hire great people. So if somebody that is an investor comes to you and they’re like, we have to do this deal. If they have trouble articulating it, the reasons why, or just unfavorable between the GP, do not do it.

Mark Goldberg: 56:35

So what I would say is we we were so selective in who we chose to work on this team that we have so much respect for. I mean, our junior team is is crushing it. And so um, for us, it’s not, hey, th thanks for bringing this investment that you’re excited about and you know, go pound sand. It’s great. Help us understand. Maybe I don’t see it the same way you help me understand what you’re seeing. So they have to sell you, they they still have to we’re we we have to collaborate on this stuff to to make it effective. But what I would say is more broadly, you know, w we kind of think about the fund as anybody the fund with a good idea, I should put their hand up and do it. We had an example yesterday where uh one of our EAs realized we were about to show up for this important meeting empty-handed to another to an office that all the full investment team was gonna go to. And with without anyone asking her to do it, she ended up getting a bunch of uh you know, donuts and cupcakes that we could bring with us with you know some really fun things with their logo attached. And I love that kind of stuff. That’s amazing. Yeah, shout out to Gianna who did that. And and it’s just kind of the attitude of you know, we’re a small team, we’re a startup, right? Like everybody, I mean, I think the the downside is you gotta you gotta work hard. There is nowhere to hide in a startup. You’re either carrying water or you’re not. Um, so there’s nowhere to hide. But if you like that kind of thing, um, it doesn’t matter if you are you know a founder or an EA or an investor, if you’ve got a good idea, we’re gonna give you some time to run with that. And I think that has been a very effective tool for us so far.

Max Altschuler: 57:56

Everyone should look at that as like the foundation of their career. They this is the time to do it. And it’s it’s funny because like we had the conversation before we started rolling, but like when is when do you get to relax? Like when do you get to vet like chill out? Like, when does it get cushy? It doesn’t. Let me know when you figure it out, yeah. I exactly figured it out. It doesn’t.

Mark Goldberg: 58:14

No, I mean it’s it’s it’s always to me, I’ve always felt like there’s this uh there’s this choice you make. Are are you I I think about things in maybe five to ten year chunks, but I you know I was really fortunate. I got a handful of months off between uh index and chemistry. I spent the whole time with my family. I have now three young kids. At the time I had two young kids, an incredible time. And then now is the season for work. Um I think that in any new job, and for us it’s a new fund, you kind of set the tone in the first year, the first two years. We I I hope we’re great. There’s a lot we gotta get right, but I’m not leaving anything to chance. We’re gonna put everything on the table. Yeah, and uh and and I think we’re gonna give ourselves every, you know, every opportunity to be successful, and and then you know, we’ll see how.

Max Altschuler: 58:56

Absolutely. I mean, do we make great investment decisions? Time will tell. But I’ll tell you what, our founder references will be off the chart.

Mark Goldberg: 59:02

That’s my hope. That’s my whole shame on us. There are things we can control and things we can’t. You know, how hard we work right now is gonna be one of those things we can control, and we had to align on that as we started the fund.

Max Altschuler: 59:11

Speaking of good investment decisions, so we we had a lot of this conversation, it was kind of um about a lot of things you learned from your past that you’re applying to applying to today’s, you know, reality. Um where where are you looking to invest? Are you completely generalist, B2B SAS and AI? What’s the what’s the I’d say like mandate or thesis that you’ve underwritten towards?

Mark Goldberg: 59:35

So it’s generalists. Uh we’re we’re gonna look at anything at the stage. So I would say we’re stage experts, but generalist from a sectoral perspective. Um, each of us brings thematic viewpoints to that that lens, which is I’ve spent a lot of time in fintech, spent a lot of time in AI at this point. So we’re operating under different theses that we and a lot of time a lot of this is is different because we’re publishing a lot of our our viewpoints at this point um in terms of the content we’re putting out. So there are there are perspectives. We have on the industry. But I go back to what I said earlier, which is, you know, you show me a great founder, I’ll show you a great investment. And uh, and and that’s a lot of what I’m looking for, which is how do I find somebody that I’m just so compelled? Um, a question I always ask myself is would I go work for this person? If the answer is yes, you know, that’s a pretty good signal that we should be thinking about this as an investment.

Max Altschuler: 1:00:21

How close have you ever come to like actually doing that?

Mark Goldberg: 1:00:24

You know, I I think that it’s one of these know thyself moments where I love what I do. I don’t really want to operate. Um I I I think that I’ve got the best job in the world.

Max Altschuler: 1:00:33

Because you were a Dropbox, you had the operator experience. I did. I was kind of wondering before we even got into the QA of this, like, I wonder if you’d ever go like start a tech company or like go be a COO or something like that.

Mark Goldberg: 1:00:45

So you know, I have so much respect for especially people in your audience, where I think there’s such a skill to running a large company. Um I think I’d be okay at it. I I think may maybe there are things that I think I would be good at, things I wouldn’t be good at. But in terms of what I love doing, I I I get to talk to you. I get to go after this, I’m meeting six founders over the next five hours. I mean, what I couldn’t think of a more fun thing.

Max Altschuler: 1:01:08

Um LeBron’s a freak athlete, doesn’t mean he should go play football. Like it’s it’s okay.

Mark Goldberg: 1:01:11

It’s uh yeah, we all have our it really hasn’t hasn’t been something. And I think in some way I’ve kind of scratched the edge of a new learning curve by starting this fund, where I had no idea if I would I what I knew is I love investing. I had no idea if I would enjoy building a franchise. I’m having so much fun. I mean, even small things like when we were making the website and thinking about the the design and the ethos, uh the the office layout, things like that, things I never thought about before. I’m you know, I’m sitting there 2:30 in the morning debating this shade of purple or this shade of purple, and it’s because it’s it’s like this is our brand, this is how we’re gonna represent us to the world. I love that stuff. Um and so I I think in some way I’ve kind of scratched that itch right now by but being able to think holistically about you know, how do you take something from a concept to hopefully uh you know a brand that can really stand on its feet for the next few decades?

Max Altschuler: 1:01:56

Yeah.

Mark Goldberg: 1:01:56