Angel Investing & Advising 101

Some of the most common questions I get these days revolve around:

-

Angel investing

-

Advising

Usually from folks curious about how they should structure their first advisory role or what to look for when making an angel investment.

Thanks for reading The GTM Newsletter! Subscribe for free to receive new posts and support my work.

There’s a lot to cover today so not a whole bunch of time for niceties…

Let’s get into it.

Angel Investing and Advising 101

I’m going to tackle this subject by answering the most common questions I get.

-

What 3-5 metrics are most important to ask for each stage of an investment? Seed/A/B etc. – or do they change?

The factors you weigh at each stage evolve, but there’s also a lot of core metrics you would look for at every stage – exceptional founder / team, big market opportunities, happy customers, etc.

It’s also worth noting that metrics and factors may change depending on the type of company you’re investing in.

You’ll evaluate a marketplace differently than a B2B SaaS company than a consumer app.

My experience and the fund’s experience is mostly in early stage B2B SaaS so remember most of the below will be through that lens.

Seed / Pre-Seed

-

Exceptional Founders with a competitive advantage to solve the problem they’re attacking

-

Large market opportunities if executed well

-

Long-term vision

-

Early customer love → solving need to haves and early customer evangelists

-

“Why Now” – why this product? Why is today the perfect time?

Series A

-

Same Qualitative metrics: Strong founders, big market opportunity, “why now”

-

1M + ARR (and high-quality ARR. Almost 100% recurring, core product ARR)

-

3x + YoY Growth

-

120%- 140% NRR

-

Healthy pipeline of customer adoption

-

Efficiency: Burn Multiple: <1 or 1 – 1.5

Series B+

-

Not where we focus, so you may want to look elsewhere for investors who specialize in this arena but roughly:

-

2 – 3x YoY growth (triple – triple – double – double)

-

140% NRR great ; 120% NRR good

-

Efficiency: Burn Multiple <1 or 1 – 1.5

-

Realistic Exit Comps and revenue multiples

-

Other important metrics, but are far more dependent on business structure:

-

LTV : CAC – 4x is top quartile. Should improve as you scale.

-

ACV

-

Sales Cycle Length – product of ACV

-

Customer Concentration (how much ARR is tied in top customers)

-

Rule of 40: Profit Margin + Growth = 40%+

-

Young companies beat this with high growth. Mature companies with slower growth need to win with profit margin

-

-

What are the questions they ask every time (or if each depends on the situation/company)?

*we think about it in a similar way but Signature Block’s newsletter did a great job compiling Qs into 6 easy-to follow buckets. We pulled some of this from there. It’s a great read for anyone interested in reading more about investing.*

Founders / Team / Backstory

What’s the backstory? Of all the things you could be building, why this?

How did you get to this idea? What ideas were you exploring before this?

How did the core team come together, including the founders? What will the team need to look like and evolve into as milestones are achieved?

What to look for:

-

Have the founders done impressive things?

-

Can you see yourself working for this founder?

-

Can you see this founder convincing other investors, employees and customers to come onboard?

Problem / Target Customer / GTM

What is the specific problem you are solving? Who has this problem?

What’s the key insight about your user that led you to build this business?

Who, exactly, do you sell to, and what words do you use to make them want your product?

How do you think about distribution, vertically or horizontally?

What to look for:

-

How deeply do they understand the problem?

-

Do a lot of people have this problem? If not, will a lot of people have this problem in the future as the result of an underlying shift?

-

Is this an intense, frequent, and urgent problem for their customers? If not, will it be in the future?

-

Do they have any insights or advantages they can use to acquire users?

-

Do they have lots of ideas on how to acquire users? Are they testing, learning from, and iterating on ideas on how to acquire users?

Their Solution and Why It’s Better

What does the user journey look like? Can you share a demo?

What is the “before and after” for customers using this solution? What KPIs are you moving for them?

What differentiates your solution from alternatives?

What to look for:

-

Is the solution fundamentally new or 10x better for customers?

-

Are early users intensely using the product?

Progress & Traction

What are the biggest milestones the team has accomplished so far? (could be revenue, recruiting, product, etc.)

Tell me about your first few customers (or pilots). How did you find them and how did you get them to say yes?

What have your biggest learnings been so far?

What to look for:

-

How fast do founders put their ideas into action?

-

Does the founder have a strong grasp of their metrics?

Underlying Shifts / Trends / Timing

What has changed in technology that makes this possible only now?

What makes the timing right for this company to succeed now?

What to look for:

-

Is there a strong “Why Now”?

-

Are they building on real trends or fake ones?

Big Vision and Biggest Risks

What do you think has to go right for this to be a massive outcome? What are the biggest risks?

How does your business get bigger as it gets stronger?

What to look for:

-

Does the business have a compounding advantage over time?

-

Could this be a $1B+ outcome if it works?

-

Do the founders understand their biggest risks?

3. When you do DD (due dilligence), what are you mainly looking for in those documents?

From a high-level, you’re looking for confirmation. Does everything I’m seeing, thinking, and hearing line up with the founder’s vision and ability to pull it off?

A few different areas:

-

Data Room: you’re going through customer case studies, revenue results and models, cash flow, cap table, and legal documents to make sure everything confirms what you’ve covered so far. You’re looking for anything out of order.

-

Deal Memo: write out your thinking. How do you view the business? The market? The team and opportunity? Do all of those align with what you’ve gone through so far with the founder? We have an IC, but it’s worth reviewing your deal memo with others as well to get feedback.

-

External DD: call or email with potential customers, current customers, and people in your network that understand the space. What are your blindspots? How are you looking at the opportunity vs. how experts in your network see it? How about customers?

4. What are the best ways to create access to deal flow as a new investor?

A few different areas:

-

Get involved with a venture fund or syndicate. The best thing to do is just get started, and ask around your network.

-

Be available to support founders you know or are invested in. They will recommend your expertise to other founders in your network who are raising. It really is a small network and good work travels fast.

-

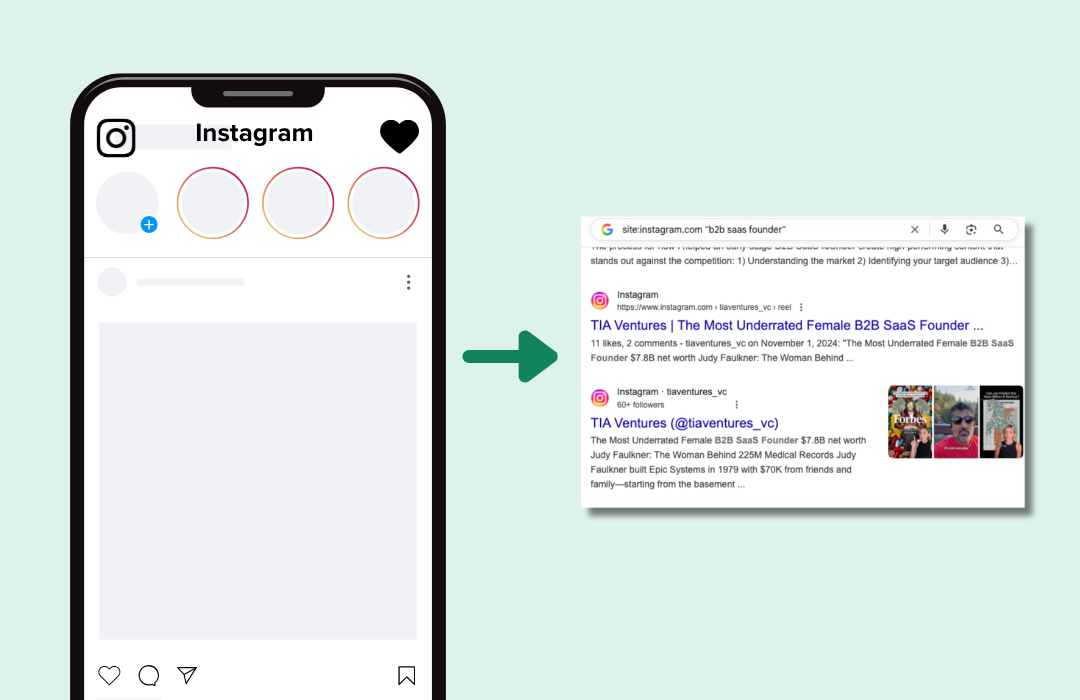

Build a platform for yourself. LinkedIn, Twitter, Communities – platforms can be very helpful to good founders. The larger your platform, the more likely deals come your way.

5. How do you weigh investing in first time founders versus multi-time founders?

There’s a few schools of thought here, and none are necessarily wrong. Your thinking changes depending on Founder experience and background.

-

First Time Founder: they should have a competitive edge to solve the problem. Why did they want to become a founder? Could you envision people following them and their vision? Would you work for them? Are they coachable?

-

You want to focus on different areas if this is a Founder’s first time

-

-

Second Time Founder (okay first exit): done it before, but didn’t land as big as they wanted the first time. We know some investors who seek out these people specifically. They’ve learned their mistakes, had an exit before, but they are hungry for more.

-

Focus on: what happened with their first company? What did they learn and what are they doing differently this time?

-

-

Multi-Time Successful Founder: been there, done that. You don’t doubt they can do it again.

-

Focus area: what’s the motivation to go back to square one?

-

6. Where is the line in believing in the founders to bring success vs the actual product (and vise versa)?

Depends on the stage. Early-on, you’re making more of a bet on the Founder/Team than you are the current state of the product. You’re betting they will be able to react to the market, build and iterate the product.

The later you go, you’re still very focused on the Founder, but you’re putting more weight on the product. How differentiated is it? Is there a moat? How are customers using it? How essential is it to their workflows? What’s the ROI for customers?

In the early days, pivots happen. Products grow and change. You’re betting the Founders will put the best product on the market and iterate the fastest. You’re not betting on a finished product early on.

7. What type of products stand out?

Some great indicators:

-

Need to haves. Essential to your customer’s work.

-

Not overly complicated. Easy to adopt and understand.

-

Solves a clear pain point.

-

The more direct the ROI to top or bottom line, the better.

-

Clear technical moat.

-

Opportunity for network effects.

There is always more context here. How complex is the problem they’re solving? Who are the users? Etc.

8. What is a normal ‘pass to invest’ ratio?

Invest to pass ratio is a context dependent data point. It’s a function of:

-

Quality of your deal flow

-

Concentration of your portfolio

Not uncommon to be 50:1 or more.

9. If it’s pre-revenue, what are the key indicators to success?

We covered this a bit above, but a few key indicators:

-

Quality of Founding team. How special are they? Do they have a competitive advantage to solve the problem? Will they be able to recruit other special individuals?

-

Size of opportunity. Is this a big TAM opportunity? Could this be a 1B+ company?

-

Urgency of problem. Is this a need-to-have? Hair on fire problem?

Quality of investors / advisors. How great are they other people at the table? Do you have the right people surrounding this company?

10. What are the “Why” questions you like to ask yourself when evaluating an investment?

-

Why this team?

-

Why now?

-

Why this product and problem?

-

Why would people pay for this product (and how much would they pay)?

-

How do you personally manage what you allocate to different asset classes?

Very, very context dependent. Ask your financial advisor and someone who really understands your particular situation.

The traditional 60/40 portfolio is evolving. There is a lot more nuance in portfolio construction that is influenced by an individual circumstance. There is also an acknowledgement for the addition of alternative assets to complement traditional Equity + Fixed Income. That would be real estate, private equity, commodities, venture.

Some thoughts. Most people determine their ideal asset allocation as a result of 3 over-arching variables:

-

Risk tolerance

-

Time Horizon

-

Liquidity Needs

A younger, high income individual with low needs for immediate liquidity could have a far more aggressive asset allocation than someone closer to retirement with a high-level of obligations (support children through school, mortgage or fixed payments, etc.).

-

-

And what about advising companies? How is it different, how is it similar?

If you wouldn’t invest your own money in the company in exchange for equity then you should not trade your time for equity. Time = money.

The only exception being that sometimes you need to be a little less strict with the first advisory role you take because that will often open the door to future roles.

I’ve always had success with a “give first” mentality, where I would do some free consulting/advising for companies that I like and that would naturally lend itself to equity stakes down the line. Sometimes they have brought it up, sometimes I have brought it up.

It’s also helpful to be known as the ‘gal or guy that does x really well’ vs. more of a generalist, that way people will seek you out when they have pain in that area.

At the pre-seed or seed stage, it’s common for advisors to get 0.25-0.5% of a percent of the company in in exchange for opening up their network and skillset. I push for no cliff, two year vest. This can become meaningful if they build a big business.

Make sure you have strong SLA in place, what you will do, what won’t you do, how many hours/month, what’s the meeting cadence?

Common is 30min bi-weekly or monthly meeting and 24hr turnaround time on any specific asks via email/text.

👀 More for your eyeballs:

👂 More for your eardrums:

-

Justin Strackany, Principal at GTM Consulting, and I talk though how to navigate the choppy waters post acquisition.

🚀 Start-ups to watch:

Coast, a platform that enables a sales team to demo its company’s APIs via a dashboard that executes live requests visually and in the browser announced their round this week. Using Coast, sales teams can showcase what prospects can build on top of APIs — personalized to a given prospect’s brand and use case. Watch ‘em!

🔥Hottest GTM job of the week:

Product Marketing Lead at Capchase, more details here.

See more top GTM jobs here.

That was a lot to digest…

I hope you can apply some of it to wherever you’re at in your investing/advising journey.

If you’re enjoying reading this newsletter, please share it with a friend/colleague.

Have a great weekend.

Barker✌️

Thanks for reading The GTM Newsletter! Subscribe for free to receive new posts and support my work.