Deconstructing Vanta’s GTM: A Journey Through Five Eras of Growth

Hello and welcome to The GTMnow Newsletter – the media brand of VC firm, GTMfund. Build, scale and invest with the best minds in tech.

This is Part II of a series on Deconstructing GTM. You can find Part I here, deconstructing ClickUp’s evolution from a PLG tool to a $4B enterprise company.

In the early days and when Stevie Case joined Vanta as CRO, the company felt electric, and perhaps even a little unruly. Inbound leads poured in, founders begged for help to close revenue-blocked deals, and competitors were already circling. But beneath the buzz there was no real system to catch the surge. In her words: “it was the Wild West.” No CRM discipline, no forecasting rhythm, and a small team flying blind.

Three and a half years later Vanta has crossed $100M ARR, raised a $150M Series D at a $4B valuation, and pulled away from more than forty copycat competitors. Their growth proves a simple truth: execution is the only moat.

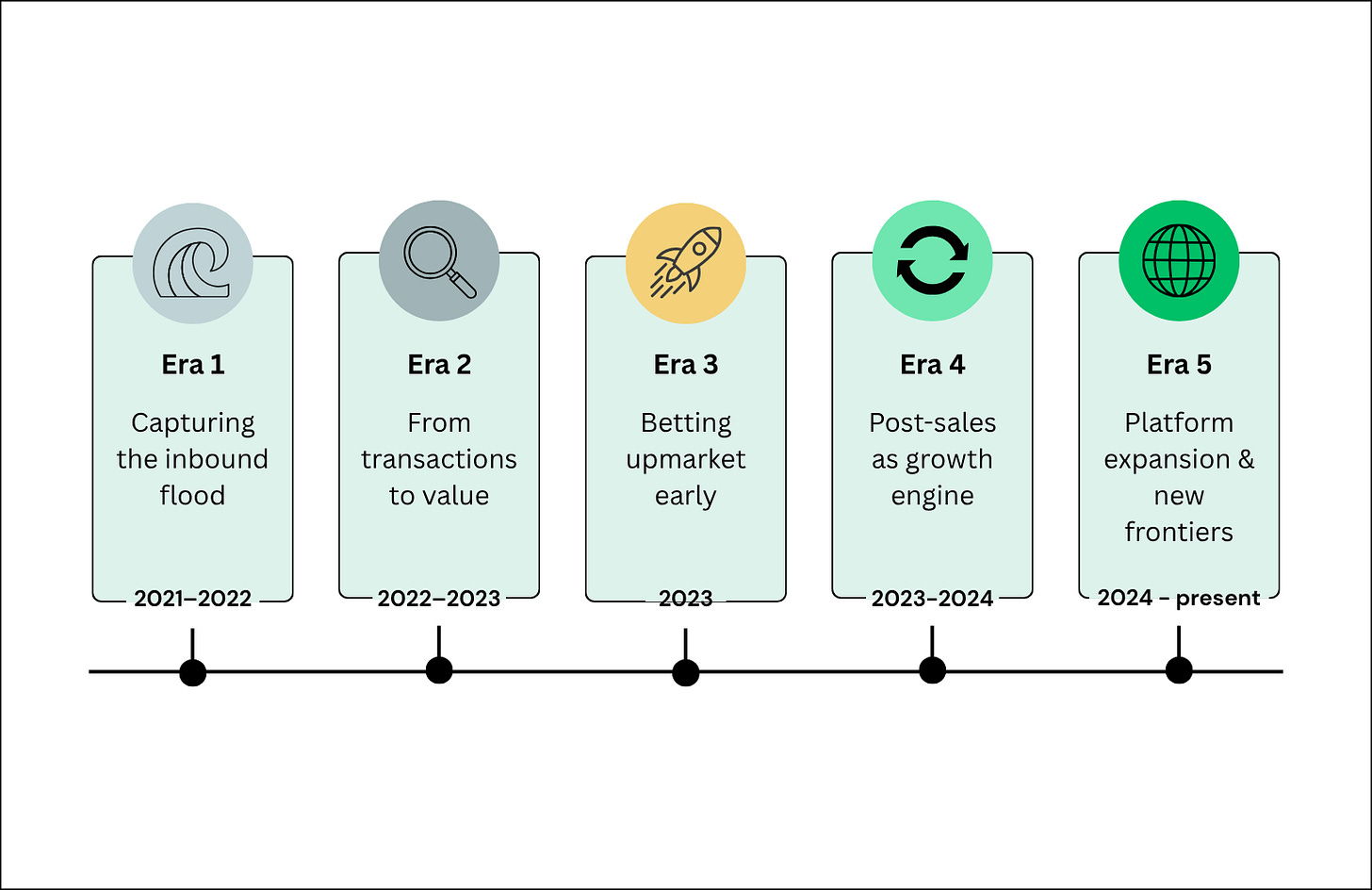

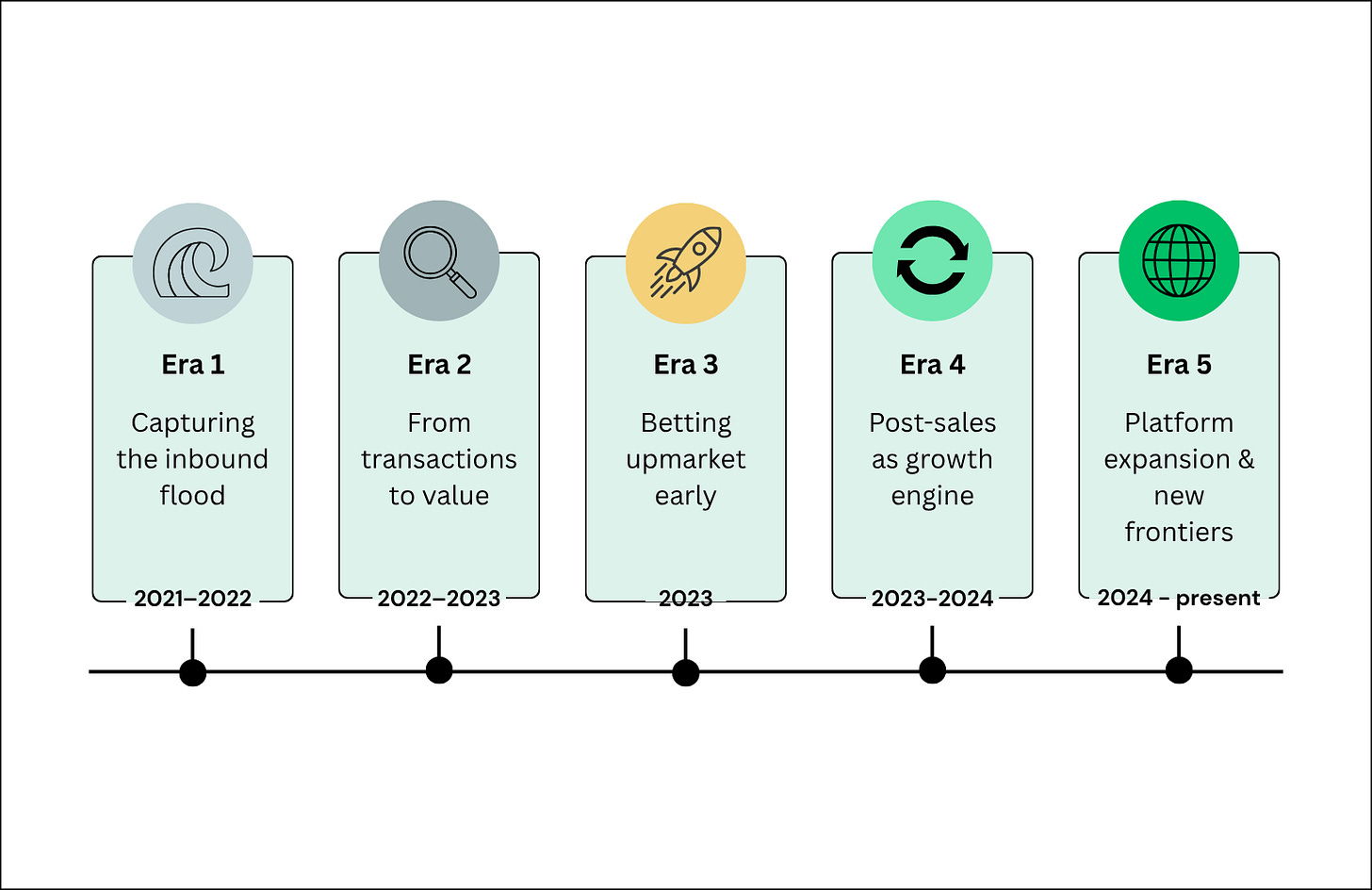

Behind this growth is the story of five eras: (i) capturing the inbound flood, (ii) from transactions to value, and (iii) betting upmarket before product kept up, (iv) turning post-sales into a growth engine, and (v) platform expansion and new frontiers.

Let’s deconstruct the machine.

There’s a VIP founder lunch at ApolloNEXT!

They’re hosting a private founder lunch at ApolloNEXT during SF Tech Week. 50 founders.

Picture this: mini-chats with Apollo execs who scaled the company from $10M → $150M ARR. No stage, no panels. You sitting close enough to them to ask the questions that actually matter, surrounded by founders who get it.

Here’s how to get your spot:

- Step 1: Register for ApolloNEXT

- Step 2: Apply here for the lunch

- Step 3: Keep an eye on your inbox for updates

Growth is messy and AI is moving fast. This is an opportunity to trade frameworks and tactics with people who have “been there, done that.”

Seats are limited, register and apply now.

Era 1: Capturing the inbound flood

When Stevie arrived, the product practically sold itself. Founders scrambling for SOC 2 compliance would close in a single call. As she puts it, the transaction was as simple as: “do you need a pen? I have a pen” she says. But the operation behind the scenes was unstructured and entirely inbound.

Her first mandate was to catch the wave: hire sellers and scale revenue. But without analytics infrastructure, she was flying on instinct. She hired a wave of junior SMB reps, only to watch win rates slip as competitors surfaced and the sale proved more complex than it looked.

“For nearly a year I couldn’t really see what was going on,” she admits. “That’s my biggest mistake.” The lesson landed hard: never compromise on measurement. Without visibility, even an experienced CRO can misallocate resources and erode team confidence.

Era 2: From transactions to value

By mid-2022, more than 40 copycats (some with slick marketing and bargain pricing) were trying to undercut Vanta. Often, it felt like some of them were winning.

The answer wasn’t louder marketing thought, it was a deeper kind of selling. They rebuilt the motion around value:

- Deep discovery: the sales team was trained on MEDPICC and made second-level and third-level questions a core skill.

- Quantified ROI: Reps tied Vanta’s platform directly to revenue blocked by compliance.

- Competitive “CIA”: A dedicated Competitive Intelligence Agency squad studied rivals, coached reps live, and chased their customer logos.

Premium pricing held because Vanta proved quantitatively that it delivered more value for every dollar. Competitors could copy features, but they couldn’t match disciplined execution.

Era 3: Betting upmarket before product caught up

Six months into her tenure, Stevie spotted something unexpected: mid-market and enterprise leads were quietly showing up in the pipeline. Instead of waiting for a perfect roadmap, she placed a calculated bet: build a small “tip-of-the-spear” sales team to explore the segment and bring insights back to product.

“It was an experiment,” she says. “We treated any revenue as bonus.” Reps were given forgiving quotas and long ramps while they learned the terrain.

For nearly two years, the team gathered proof points. Only after traction emerged did product and GTM jointly secure millions to deepen enterprise features and formalize the segment.

While it worked for Vanta, Stevie warns founders not to copy this move blindly: “Most should go product-first. If you chase enterprise too early, you can randomize your roadmap and lose the core market.” Her conviction came from six years at Twilio, where she had watched the company climb from a handful of big-tech customers to a $1B enterprise run-rate. She knew the early signals and how to build patiently.

Era 4: Turning post-sales into a growth engine

With new-logo revenue humming, the next challenge was net retention. Selling to startups naturally keeps retention around 100%, but to sustain nine-figure ARR it had to climb.

In the early days of Vanta, the post-sales team’s mandate was “everything”: renewals, expansion, education, adoption.

“You can’t succeed when your job is a hundred different things,” Stevie explains.

She and another leader split the group into Customer Success (owning adoption and gross retention) and Account Management (owning renewals and expansion). They built a true sales engine in post-sales and lifted net retention by double digits – a quiet but critical driver of ARR at scale.

Era 5: Platform expansion and new frontiers

Today Vanta is far more than its original compliance wedge. The next chapters will be defined by:

- Standalone products: Vendor risk, customer trust, and access review each get their own funnel and dedicated teams.

- Public sector: After earning FedRAMP authorization, Vanta is building a government business and helping other companies achieve FedRAMP compliance.

- Fortune-100 enterprises: The enterprise motion, once a gamble, is now a core revenue engine.

To keep those bets alive, they deliberately create “space for emerging products,” ensuring teams don’t default back to the core product that sells itself.

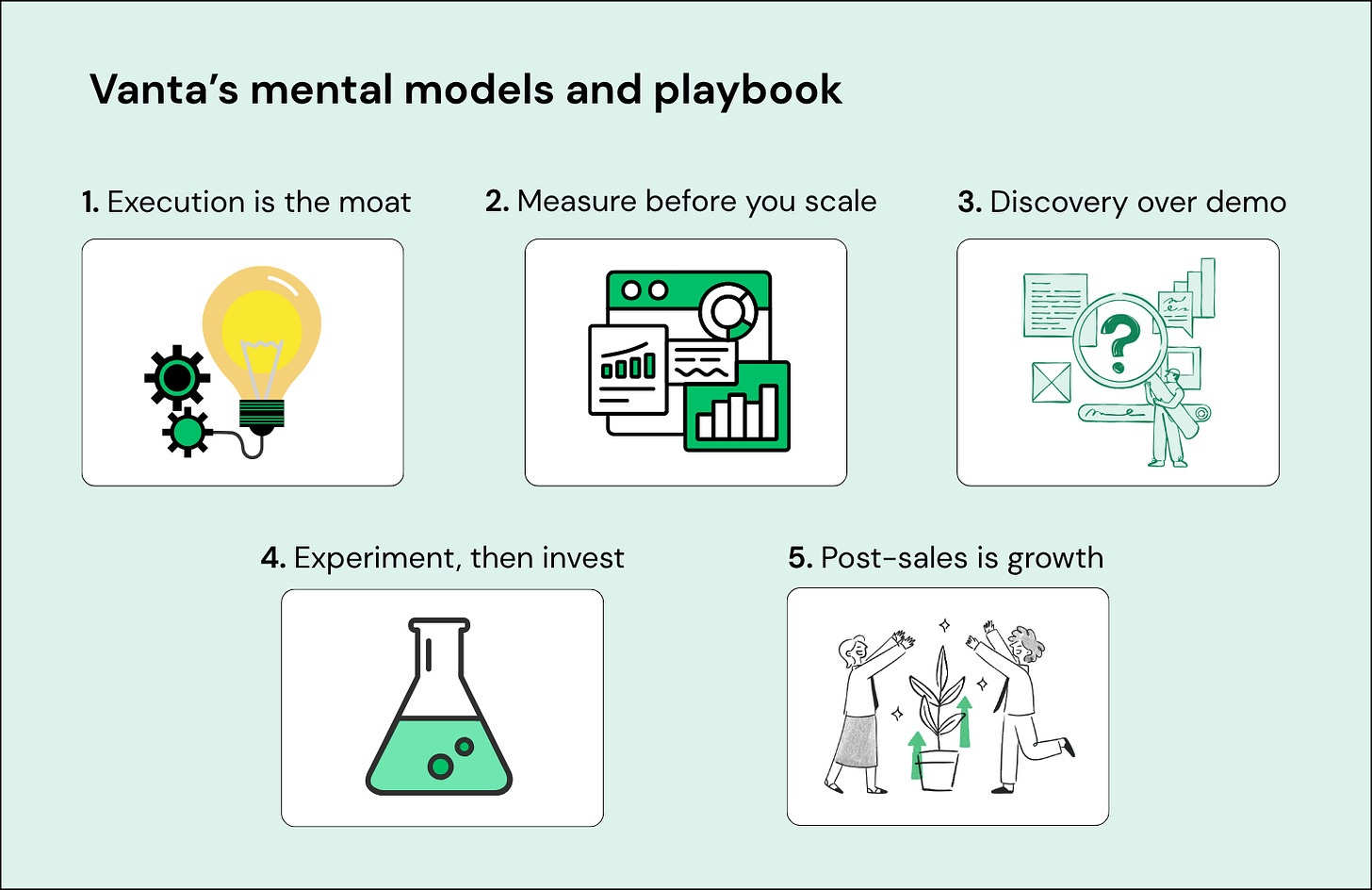

Playbooks and mental models

Measure before you scale.

Build analytics first. Without it, even seasoned leaders hire the wrong profiles.

Discovery over demo.

Deep, quantified discovery powers premium pricing and defensible sales.

Experiment, then invest.

Treat new segments as tests. Forecast conservatively and give teams long runways.

Post-sales is growth.

Split responsibilities early and build an expansion motion. Net retention compounds quietly but powerfully.

Forty competitors tried to copy the product. None could match the discipline (and patience) of Vanta’s go-to-market machine. Execution, after all, became the moat.

Tag @GTMnow so we can see your takeaways and help amplify them.

More for your eyeballs

OpenAI launched Sora 2, a major step forward in video and audio generation that’s more realistic, controllable, and physically accurate. Alongside it comes a new iOS app where users can create, remix, and even drop themselves into scenes with cameos.

Building pipeline is tough, but 10 GTM plays are working for early-stage teams in 2025. From founder-led content to usage signals, new hire waves, and community, these strategies are driving real conversions.

More for your eardrums

GTM 165: Vibe prompting, AI fluency, and the new rules of go-to-market | Kieran Flanagan

Get a sneak preview here. For the full thing, listen on Apple, Spotify, YouTube or wherever you get your podcasts by searching “The GTMnow Podcast.”

LeanScale GTM Podcast: Avoid These Founder Red Flags: A VC’s Honest Perspective

Sophie Buonassisi (SVP of GTMfund/GTMnow) on what venture capitalists really look for when investing in startups.

Startups to watch

Anything – Raised an additional $11M, now holds a $100M valuation, and introduced Anything Max. Anything Max is an autonomous software engineer that can debug, ship features, and QA on its own. Anything is quickly growing. The company’s initial traction was explosive, reaching $2 million annualized run rate in just two weeks.

Paid – the AI “results-based billing” startup from Outreach founder Manny Medina, raised a $21.6M Seed led by Lightspeed, bringing total funding to $33.3M. Valued at over $100M, Paid gives agent makers a way to charge customers based on value delivered — an alternative to the per-user and credit-based models that don’t fit the AI era.

Hottest GTM jobs of the week

- Growth Associate (M/F/X) at Crossbeam (Paris, France)

- Director, GTM Enablement at Atlan (Remote – US)

- Manager, Commercial Sales at Gorgias (Hybrid – Toronto)

- Sr. People Business Partner, GTM at Vanta (Remote – US)

- Strategic Customer Success Manager, CPG at Writer (Hybrid – San Francisco)

See more top GTM jobs on the GTMfund Job Board.

GTM industry events

Upcoming events you won’t want to miss:

- ApolloNEXT during Tech Week: October 9, 2025 (San Francisco, CA)

- Momentum x Minoa during Tech Week: October 12, 2025 (San Francisco, CA)

- Dreamforce: October 14-16, 2025 (San Francisco, CA)

- GTMfund Dinner (private registration): October 22, 2025 (Austin, TX)

- GTMfund Dinner (private registration): November 18, 2025 (Toronto, ON)

- GTMfund Dinner (private registration): November 19, 2025 (New York, NY)

- GTM x Founder Event (private registration): November 20, 2025 (New York, NY) – if you’re an AI-focused founder in NYC, hit reply to get the details.

- Above the Fold (for marketers): February 9-11, 2025 (Fort Lauderdale, FL)

- Spryng (for marketers): March 24-26, 2025 (Austin, TX)

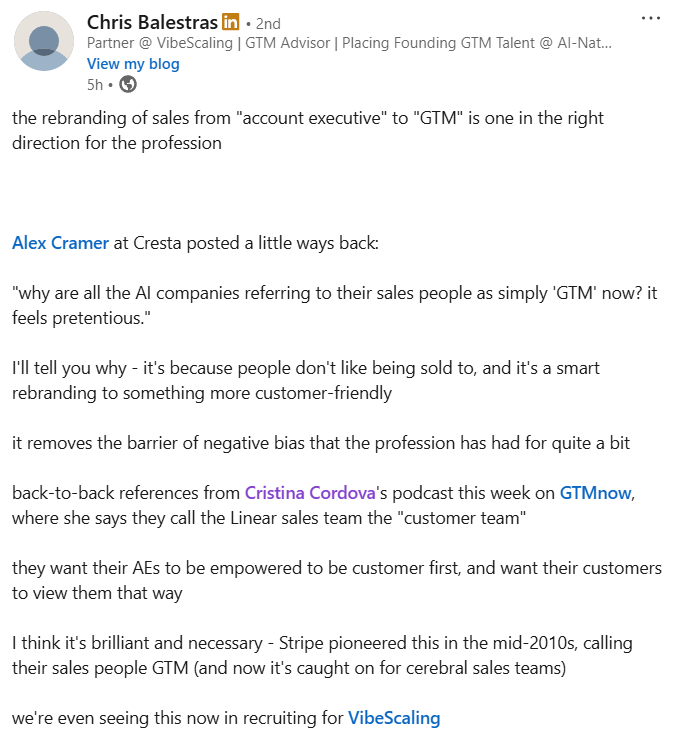

GTMnow community love

Some GTMnow community (founder, operator, investor) love to close it out – we appreciate you.