Products and markets may be unique, but the path to finding product-market fit is not. Its formulaic, and I’m going to share the formula with you here in the coming months, starting now.

But first, it’s important to understand why now more than ever when it comes to sales, founding teams need to be thinking early about market development, and not just product development.

Related: Using Sales Conversations to Find Product-Market-Fit

Welcome to the Age of Applied Technology

In the past, technology was expensive and complex. Product talent was sparse. So, the biggest risk for startups was in the product itself. Nowadays – generally speaking – the costs and complexity of technology are greatly reduced and product talent is plentiful. The risk now lies in capital efficient market development, not product development.

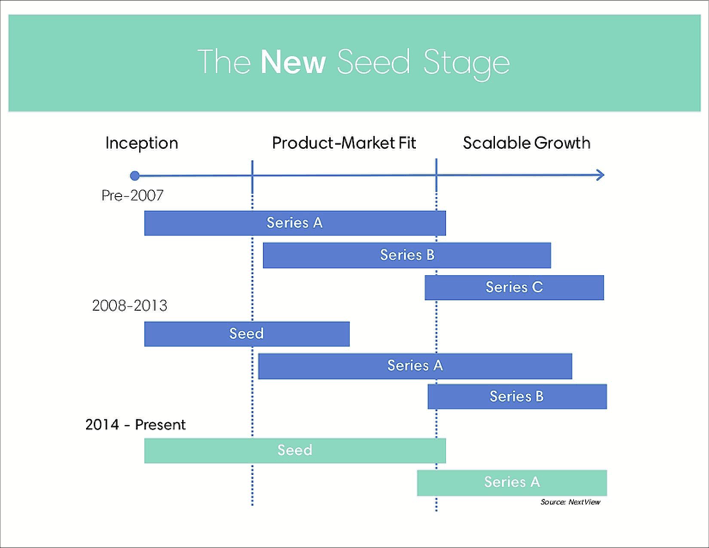

The New Seed Stage

My partner Andrew Goldner likes to say that, “In Silicon Valley, ‘A’ is the fourth letter of the alphabet.” It’s true! Before your Series A, you now raise a Pre-Seed, Seed, and Bridge round, all before Series A. This graph illustrates the point and the distance startups must go before raising an A round:

You can now bootstrap yourself through the product prototype stage, utilizing a relatively small amount of capital to go to market. But with more players on the field, there’s a tradeoff. The traction milestones required at every stage of the funding lifecycle are getting higher and harder to reach.

[Tweet “Traction milestones at every stage of the funding lifecycle are getting higher and harder to reach.”]

Product-Centric Founders Beware

Unfortunately, while the seed stage has changed, the way startups work has not. Most founders are incredibly product-focused, pouring time, energy, and money almost exclusively into product development.

Many founders lack the knowledge and experience to efficiently and effectively bring a product to market. Business accelerators perpetuate this problem when they help founders build their product and raise money, at the expense of helping founders market their product and make money.

Learning is Critical to Success

At GrowthX, our experience has shown that during the early stages of a company, having a data-informed and market-validated awareness of the predictability, profitability and scalability of revenue is far more important than the sheer volume of revenue.

[Tweet “Data-informed awareness of predictability and scalability of revenue is more important than volume”]

If you follow a proven method of learning, testing, measuring and validating, you’ll be able to decide whether you should iterate or scale. This process allows you to find the proverbial product-market fit, and begin to generate predictable, profitable and scalable revenue, and hit the traction milestones you need to ultimately secure your Series A funding.

We call this process Market Development and it unfolds in two parts comprised of six distinct phases:

- Market Foundation

- Resource Review (Preparation)

- Market Discovery

- Market Messaging

- Market Execution

- Instrumentation (Preparation)

- Market Outreach

- Market Results

I’m going to reveal more of the formula in the coming months but I want to hit on the first two phases in this post.

If you agree that data is essential to finding a product-market fit, you’ll understand why due diligence is so important. We begin with Market Foundation.

Phase One – Resources Review

In preparation for market discovery, you’ll want to take full inventory of all available resources, with the goal of creating a roadmap of the people, processes and technologies necessary to create and support a functional learning organization.

Step One: Resource Review Mapping and Planning

What To Do: Review the current market development team and skill sets.

Outcome: Determine preliminary recommendations to maximize sales throughput and effectiveness.

Step Two: Marketing & Sales Process Analysis

What To Do: Review the current marketing and sales processes.

Outcome: Determine preliminary recommendations to optimize by removing any blockers, friction points or bottlenecks that can be eliminated through simple process change.

Step Three: Current Marketing & Sales Technology Stack

What To Do: Review the systems, tools and rules in place today to effectively manage the market outreach programs.

Outcome: Determine preliminary recommendations as to whether they should be maintained or replaced.

Phase Two – Market Discovery

Your goals here are threefold:

- Understand your current customer lifecycle and prioritize, in order to establish the foundation for retention and growth;

- Understand the current customer profiles, how they’re acquired, the resulting acquisition costs (CAC) and the projected lifetime value (LTV) of those customers; and

- Understand and define customer acquisition channels, pricing strategy, and data acquisition in preparation for Market Outreach later in this process.

Step One: Current Account Mapping and Pipeline Review

Create comprehensive account and pipeline lists by interviewing relevant team members, reviewing existing databases, spreadsheets, and email archives.

Step Two: Discover Ideal Customer Profiles (ICPs)

Define ICPs and determine the first profiles to execute against by conducting a thorough review of all customer account data, identifying patterns, and analyzing revenue potential and the likelihood of winning business.

Step Three: Prioritize Current Pipeline

Review the current opportunity pipeline based on your new ICP hypotheses. Then conduct a strategic account review of high priority opportunities.

Step Four: Review Current Customer Experience

Review the lifecycle of current customer experience, including UX design and onboarding, by customer segments and product type.

Step Five: Business/Pricing Models

Review unit economics to develop rational hypothesis for investable LTV:CAC.

Step Six: Define Customer Acquisition Strategy

Based on ICP above, determine what customer acquisition models will be tested during initial market outreach (e.g. no-touch, light-touch inside, high-touch inside, channel, outside, outside team).

Step Seven: Create a Data Acquisition Strategy

Based on your ICPs, develop recommendations for sourcing prospect data and a budget. Create a process to keep the funnel full.

Stay tuned to this blog, as I’ll be sharing more details on the how-to for every step above, as well as the details of Phase Three of Market Foundation (Market Messaging) and the subsequent phases of Market Execution.