The first goal of sales at a startup isn’t to bring in revenue — it’s to get customer feedback.

I’ve spent the last year working to find product-market fit for my startup, Dock. I’ve used our sales process to iterate our way to product market-fit and wanted to share what I’ve learned along the way.

Related: Founders: Before You Hire a Sales Team, Consider These Options

Sales conversations as a way to get customer feedback

My guiding light has been Y Combinator’s mantra of “build something people want.”

Find 10 people, then 100 people, then 1,000 people who love your product.

Get a few paying customers who really love your product and build from there.

But finding product-market fit is harder than it sounds. The days of building a point solution in uncharted territory are over. Software markets have matured to a point that every viable category has multiple solid competitors and any new markets get commoditized quickly.

“Build something people want” is no longer enough.

“Build something people want” is no longer enough.

You need to figure out your wedge into your buyer’s tech stack while showing how you’re different (and better) than existing tools.

In short, your solution needs to get people to pay attention to your startup — let alone adopt the product and pay for it.

Even if you have a great solution, the lack of a track record or case studies makes it harder for buyers to take a bet on your early-stage company.

So how do you get there?

Use sales conversations as a tool to get product feedback.

You’re looking to answer the questions:

- What can I build that people want?

- How will this product fit into someone’s tech stack?

- Am I building it for the right person?

- What are they willing to pay for it?

The 6 layers of sales feedback

Customer feedback is fuel for startups. It’s how you build a strong product. The lessons that customers share inform your product roadmap and dictate your sales success.

The tricky part of collecting feedback in your early sales conversations is that you’ll get different types of feedback that you have to pattern-match into different buckets.

Early sales calls might be more appropriately named “user interview calls,” as you’re trying to get inputs to inform your product strategy and product roadmap.

The product feedback you get in your early sales calls can be mapped to one of these categories:

- Vision: Am I building in the right general direction?

- Ideal Customer Profile (ICP): What types of companies am I building for? What titles or departments?

- Urgency: How important of a problem am I trying to solve for this persona? Will they prioritize my solution?

- Money: Are they willing to pay for this problem? How much?

- Features: Am I building the right things in my product?

- Adoption: Are people able to figure out how to use the product? What do I need to improve to help them to figure it out?

Here’s how we approached answering each of these questions.

1. Vision: Am I building in the right general direction?

The fastest path to product-market fit is to use customer feedback to narrow your vision.

You need to make sure you’re building in the right overall direction. Then you can iterate on the details over time.

When we first launched Dock, we started with a broad vision to build a horizontal product. We thought our concept of “business-to-business collaborative workspaces” would work for a variety of use cases ranging from sales to customer success to fundraising to recruiting.

We described Dock as “the best way to work with people outside your company.”

This vision sounded great in theory. But it made finding product-market fit difficult.

We tried to solve too many problems for too many people. This wide vision put a strain on our product development, and we weren’t always attracting the right personas.

We tried to solve too many problems for too many people. This wide vision put a strain on our product development, and we weren’t always attracting the right personas.

As I started to have sales conversations, I noticed the best prospects were in sales or customer success roles (and mainly at tech companies). These folks would have serious buying-vibe conversations. They had real pain points and seemed to be genuinely interested in what we were building.

Whereas the other use cases—recruiting, fundraising, freelancers, etc.—didn’t feel like they had the same urgency to solve a problem.

These sales calls helped us narrow our vision to focus on building tools for revenue teams.

We now describe Dock as a way to help “revenue teams collaborate with customers.” This narrower focus has helped us attract the right customers, and more clearly articulate who we help and how we help — making all of our sales conversations much easier.

2. Ideal Customer Profile (ICP): Who am I building for?

The hardest part about responding to feedback is figuring out who is worth listening to. Not all feedback is created equally.

You need to build for your ICP. But at the beginning, you don’t even know who your ICP is yet.

There are two core components to figuring out your ICP:

- Company type: size, industry, location, etc.

- Persona: titles and departments

I’ll walk you through both.

ICP part 1: Company size

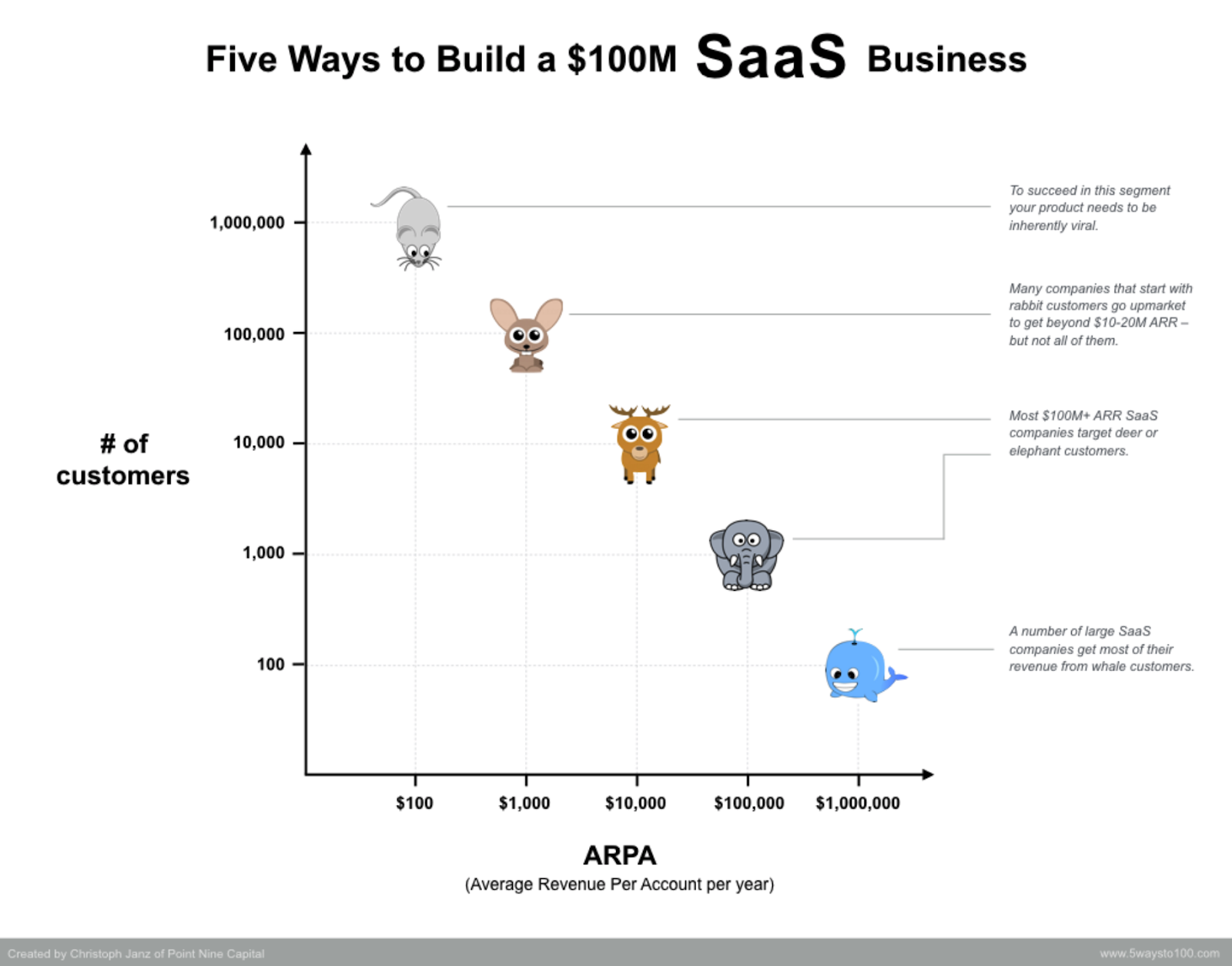

My favorite framework for answering the company question comes from Christoph Janz, who shows the five ways to build a big SaaS company:

Christoph’s point comes down to answering the question: How big of a company do you want to go after?

Fortune 500 companies work very differently than startups, so this answer will impact whose feedback you listen to.

For Dock: Once we narrowed down our ICP to revenue teams at small/mid-sized companies, we started to find traction and more productive sales conversations.

When we talked to Mice ($100 ARPA), the customer was too early to find Dock useful. They didn’t have any content, and a tool like Dock was overkill for an early-stage team still trying to figure out product-market fit for their own business.

On the flip side, when we talked to Elephants ($100,000 ARPA), they had so many different requirements, from integrations to team permissions. We didn’t have enough features to solve Elephant-level problems.

We found that the Rabbits ($1000 ARPA) and Deer ($10,000 ARPA) had just enough traction to find Dock useful. They had a sales/success team, basic sales collateral, and an initial process to build from. This was a perfect opportunity for Dock to come in and add structure to their process and build on an existing foundation.

ICP part 2: Persona

After establishing company size, the other core component around ICP is persona.

What job titles do you need to convince to buy your product? And what seniority level do you need to go after?

The two basic personas for every company to consider are:

- The Admin: the person who sets things up and has purchasing power

- The End User: the person who uses the software as part of their work

A natural instinct is to build for the Admin, since they have all the purchasing power.

But Admins care most about adoption. They don’t want to purchase and mandate software that End Users don’t want to use.

There’s been a growing trend of the consumerization of enterprise software. So in many software markets, the buying power has shifted from Admins to End Users.

In the context of sales conversations, you need to quickly understand whether the person you’re talking to is more of an Admin or an End User. (At small companies, it can be the same person.)

As you get feedback, bucket it into these two personas so that you can consciously build in whatever direction you want to prioritize. Then, as you circle in on your ICP, you can take feedback from certain groups more than others.

At Dock: We had to figure out the right persona to target within revenue teams. Do you start with a sales rep and go bottom-up? Do you start with a VP and go top-down?

After experimenting with different titles, we eventually realized the most successful setups involved a top-down implementation with a senior leader involved (or at least a player/coach role).

We did best when we worked with a “Head of Sales” or “Head of CX” who had some organizational leverage. This person had the power to say, “this is the way we do things now.”

End Users, on the other hand, got quickly caught up in the day-to-day of their jobs and didn’t have the attention span to focus on implementing software or driving change within an organization.

End Users were a great way to get our foot in the door, but to land the “team deals” we were working towards, we needed to get a senior leader involved.

These “Head of” personas bought into our vision of improving how you collaborate and work with customers. They had experienced this pain in previous jobs and were looking for a way to solve it. Dock’s solution resonated with this ICP.

3. Urgency

By asking questions during a sales conversation, you can figure out key moments in the customer’s life where they are encountering real pain and need a solution as soon as possible.

Related: Top 35 Open Ended Sales Questions That Keep Conversations Going (With Examples)

My favorite framework to think through our product is the painkiller vs. vitamin framework.

Vitamins are “nice-to-haves,” but not “need-to-haves.” Everyone knows they should take vitamins, but they’re easy to forget and de-prioritize as you go about your life.

Painkillers solve a desperate need. When you’re in pain, you’ll do whatever it takes to feel better and solve the problem.

The best products in the world are Painkillers.

For Dock: Certain markets are based on a mission-critical system like payroll. You literally can not run a company without a payroll system. That’s an extreme painkiller. When I started to do sales conversations, the level of urgency was a hard thing to figure out. I knew we weren’t as urgent of a problem as payroll.

We would often have a great demo call where the buyer seemed super excited and it seemed like they were going to prioritize solving the problem Dock solves.

But then they would ghost us. Crickets for weeks.

Sometimes, it’s because they went in another direction. But more often than not, the company would resurface. The silence had nothing to do with Dock. It was all some internal mishigas they were dealing with—layoffs, new boss, new projects, etc.

This made me feel better about Dock’s progress toward product-market fit, but it also signaled we weren’t solving an urgent enough problem.

To be critical of my own company, the initial version of Dock is an aspirational way to do sales. Digital sales rooms increase close rates and improve your buying experience, but to be honest, you could survive without digital sales rooms in your sales process. We were a vitamin.

We found that there was more urgency for customer success teams to solve how they approached software implementations. Most of these customer teams were still onboarding customers with Google Sheets and found that the time to value would take too long or customers would never get implemented. For them, we were a painkiller.

That said, we did find sales customers who would prioritize our solution. These were innovative sales teams who were tired of the old ways of sales and wanted to provide an amazing buyer experience because they knew it would increase close rates.

As our sales conversations progressed, my biggest focus became looking for ways to solve more urgent problems to move Dock up on a company’s priority list.

We looked at the customer lifecycle and asked ourselves, what are the critical moments that Dock is positioned to support?

Two clear moments stuck out:

- The first was actually closing a deal — so we built an order form product.

- The second was deals getting stuck in security reviews — so we built security profiles into Dock.

Our thinking was that by bundling a bunch of different tools together under one platform, we’d be able to provide greater value for companies and solve more urgent problems.

4. Pricing

An important part of the journey to product-market fit is getting validation that customers will actually pay for what you’re building.

During our beta program, we gave Dock away for free in exchange for feedback. Our goal was to increase our learnings around the product we’re building so we could iterate faster.

But when it came time to ask these early users to pay for Dock, we noticed a steep drop off.

Beta users were happy to give feedback and play around with a new tool. They seemed to have a great experience and gave us positive feedback.

But they were not real buyers. They didn’t have an urgent need to solve. They were using Dock because they were curious about the product and happy to help a startup.

This dropoff made us feel that we were potentially building the wrong solution and made us rethink our progress to date.

Everything changed when we published pricing on our website.

We started to attract buyers who were looking for a solution to a real problem. And once we got on a call with customers, we ended the call with a conversation about pricing.

By setting expectations early on, we saw a huge impact on our ability to close deals at the end of the free trial period. It felt like we hit that next milestone in the journey to product-market fit.

But then an ongoing question became: How much do we charge?

We ended up picking a simple tiered pricing model that was competitively priced in the industry to test how much people were willing to pay. It was helpful in putting a stake in the ground to start to get feedback on how much to charge for Dock.

We quickly realized our pricing, at $49+ per month, was either too high or too low, depending on a customer’s point of reference.

For customers switching from internal productivity tools (e.g., Google Docs), we were seen as a premium service.

But for customers who looked at us through the lens of sales or customer success tools (which are typically more expensive), we were a more-than-affordable solution.

This also really depended on the company size. For small companies, we were expensive. For big companies, we were affordable (but they also wanted custom pricing).

My advice to other founders and sales leaders is to start with simple pricing. You’ll start getting feedback from your customers. Keep your ICP in mind as you think about pricing: You need to make sure that your pricing matches the budgets and buying patterns of whichever animal you choose to go after.

5. Features

Sales calls are an amazing place to understand your feature gaps.

When someone buys this category of software, what are the things they are looking for you to solve? What is your product missing? What should you build next?

The game is making sure that you prioritize features in such a way that you’re:

- building for the right persona(s)

- solving an urgent problem

- solving a problem that people will pay for

The most important thing is that you’re cross-referencing these feature requests against your ICP.

At Dock: In the early days, some people asked us to build integrations with HR systems to support a recruiting use case. Once we narrowed our ICP to revenue teams, we knew we could ignore the requests.

Instead, we focused our integrations on CRM systems, which were more important for revenue teams. We lost the recruiting business, but we were okay with that since we had refined our vision.

From there, we listened for feedback and looked for features that we could thread across our customer success and b2b sales use cases.

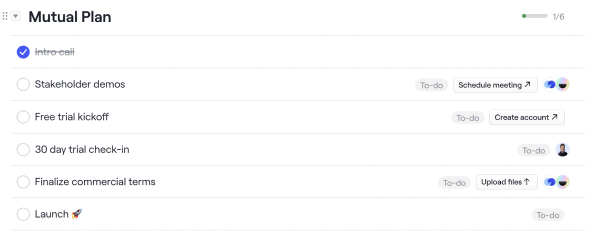

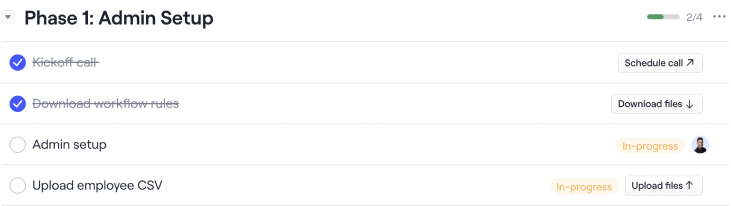

A great example of this are project plans in Dock. When talking to customer success teams, they asked for a better way to manage customer onboarding and software implementations. When we talked to sales teams, they wanted mutual action plans.

We realized we could create a checklist feature that would solve for both use cases. The content of the checklist would be different, but the component would be the same. This insight also forced us to build the checklist in a way that it could be flexible regardless of the use case.

Checklists can be used for mutual plans

But also for customer implementation plans.

Interestingly, customer success teams demanded more features from the checklists than did sales teams. As a result, it actually made our mutual plans much stronger in the market when compared to our competitors.

This is just one example of how sales conversations informed our product development process. This happened hundreds of times over the last year.

If it’s a feature we heard multiple times (or a big important customer was asking for it), then we’d start to work with the product team to figure out how to approach this feature. And then we would figure out where to prioritize this feature on the roadmap.

6. Adoption

Dock is a product-led growth product. Customers can just sign up through the website to start using Dock.

There are many benefits to product-led growth, but we found we needed a sales-assist motion to help customers adopt the product. We needed a human touch to drive adoption.

This was a lesson we observed from watching other PLG companies scale.

In order to drive adoption, we followed the classic advice of “do things that don’t scale.”

For any customer, we offered to set up a Dock workspace on their behalf. The customer shared example collateral and we’d do all the hard setup work to overcome the initial adoption hurdle.

This process really helped us paint the picture of how Dock would work specifically for the customer’s exact use case. This was also a great tactic in the sales process to help our champions show off the power of Dock.

Over time, we took these lessons and built these adoption issues into the product itself.

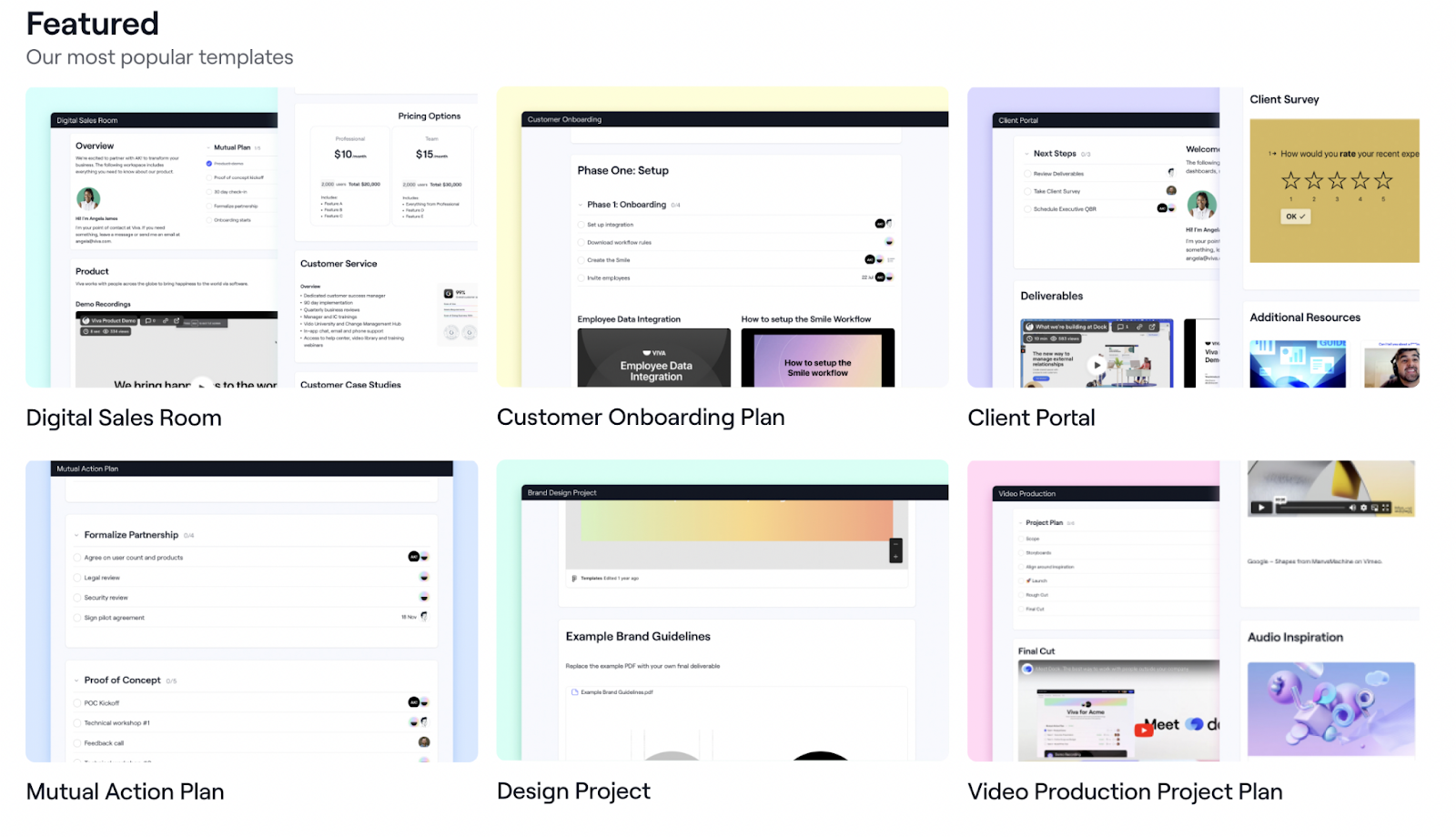

For example, Dock used to start with just a blank page (just like Google docs or Notion). It was hard to visualize all the possible use cases. To solve the blank page problem, we built templates into the product.

Templates allowed our customers to visualize the use cases that we could solve for them while also making it easier for them to get started themselves.

As we scaled the team, we decided not to hire a traditional Account Executive. Instead, we’ve hired folks who are great at working with customers to drive adoption. The profile is closer to Customer Success/Solutions Engineers.

These new hires are not afraid to answer deep technical questions and jump into the product to help customers get started. The sales-assist motion is key to driving adoption and closing a deal.

Sales calls improve as you respond to feedback

Over time, you’ll take this feedback to improve your product, giving you more confidence in future sales conversations.

In the early days of Dock, our feature gaps were laughable. Customers would ask for basic things (image resizing, linking text, etc.), and we couldn’t even do them. But over time, we responded to this feedback and built out these features.

The more we solve what customers in our ICP want to accomplish, the more our feedback sessions get into the weeds.

Our early conversations were, “Do you have a Salesforce integration?” Today, our conversations are about the specific nuances and fields of our Salesforce integration.

As the product gets better, your demo calls will start to change. You’ll see people’s eyes light up on the other side of the Zoom call. You’ll begin to feel product-market fit.

Edited by Kendra Fortmeyer @ Sales Hacker 2023

Edited by Kendra Fortmeyer @ Sales Hacker 2023