The GTM Podcast is available on any major directory, including:

Mike Walrath is the CEO and Chairman of Yext, a publicly traded digital presence platform that helps businesses manage and synchronize their digital presence across search engines, maps, apps, and voice assistants by ensuring that information like locations, services, FAQs, and brand content appears accurately and consistently wherever customers search.

He also co-founded WGI Group, LLC, to provide growth capital to early and expansion stage startups in enterprise software, consumer internet and digital media industries. Previously, Michael was co-founder and Chairman of Moat Inc. which was acquired by Oracle in April 2017. In 2003, Michael founded Right Media – the world’s first open exchange for digital advertising. He served as Chairman and CEO of the company until its acquisition by Yahoo! in July 2007. At Yahoo!, he was responsible for the operation of the global advertising marketplaces organization.

Discussed in this Episode:

- Why marketers must now structure content not for humans, but for machines.

- How Yext evolved from managing listings to powering AI-ready data pipelines.

- Actionable steps SaaS companies can take to optimize for AI agents and search diversification.

- The role of hyperlocal data, competitive analysis, and personalized content in GTM strategy.

- Why software innovation must start with intelligence, not workflow.

- The decline of seat-based pricing and rise of outcome-based models.

If you missed GTM 145, check it out here: What Happens When a CRO Owns the Entire Customer Journey, How to Build a Unified GTM Engine | Marcy Campbell

Highlights:

07:30 – How the iPhone created geo-aware fragmentation, and how Yext was born.

10:00 – Why Google still checks MapQuest (and what that means for SEO today).

11:30 – “We have to rebuild the digital presence for machines, not people.”

14:30 – The new battleground: how AI engines like ChatGPT shape discoverability.

18:00 – Practical data strategies for local businesses and SaaS marketers.

22:00 – Why structured data is the foundation of AI-first marketing.

26:00 – Bespoke GTM: why no two locations (or campaigns) should be the same.

29:00 – The shift from product-led to intelligence-led SaaS development.

31:00 – Seat-based pricing is dying – how to move to value-based contracts.

34:30 – Mike’s advice: get radically honest about macro changes, not just tactics.

Guest Speaker Links (Michael Walrath):

Host Speaker Links (Sophie Buonassisi):

- LinkedIn:https://www.linkedin.com/in/sophiebuonassisi/

- Newsletter:https://substack.com/@sophiebuonassisi

Where to find GTMnow (GTMfund’s media brand):

- Website: https://gtmnow.com/

- LinkedIn: https://www.linkedin.com/company/gtmnow/

- Twitter/X: https://x.com/GTMnow_

- YouTube: /@gtm_now

- The GTM Podcast (on all major directories): https://gtmnow.com/tag/podcast/

Sponsor: TriNet

Founding a company is hard enough. Navigating payroll, benefits, and compliance shouldn’t slow you down. That’s where TriNet comes in. They work with startups and scaling businesses to help take HR off your plate, so you can stay focused on building product, growing revenue, and hiring great people – the go-to-market engine.

B2B companies like Hivebrite and Equilend trust TriNet to help handle the infrastructure of their workforce, so their teams can focus on execution.

Learn more at https://trinet.com/gtmnow

The GTM Podcast

The GTM Podcast is a weekly podcast featuring interviews with the top 1% GTM executives, VCs, and founders. Conversations reveal the unshared details behind how they have grown companies, and the go-to-market strategies responsible for shaping that growth.

GTM 146 Episode Transcript

Mike Walrath: Doing marketing in the future is gonna be about understanding what’s gonna differentiate you and what’s gonna distinguish you.

We have to recreate the data structure of the internet in a way that’s gonna make it AI ready.

If I’m not gathering, curating, and using data as the first thing that I’m doing when it comes to how I execute my marketing, then I’m behind and I have to catch up quickly.

It’s using the data in a way that we’ve never been able to use the data before, and that feels really intimidating. My biggest advice to revenue leaders is use data to figure this stuff out.

Sophie Buonassisi: Hello and welcome back to the GTM Podcast is your host Sophie Buonassisi, VP at GTMfund and GTMnow, and I’m joined today by Michael Walrath. I’m really excited for this conversation. Michael. Welcome.

Mike Walrath: Hi, Sophie. Thanks for having me.

Sophie Buonassisi: Absolutely. Quick bio for the listeners. [00:02:00] So Michael is the CEO and Chairman of Yext, a publicly traded digital presence platform that helps businesses manage and synchronize their digital presence across search engines, maps, apps, and voice assistance by ensuring that information like locations, services, FQs, brand content appears accurately and consistently wherever customers search.

He also co-founded WGI Group. LLC to provide growth capital to early and expansion stage startups and enterprise software, consumer internet and digital media industries. Previously, Michael was the co-founder and chairman of Moat, which was acquired by Oracle in April of 2017. In 2003, Michael founded Wright Media, the world’s first open exchange for digital advertising.

He also served as chairman and CEO of the company until its acquisition by Yahoo in July of At Yahoo, he was responsible for the operations of global advertising marketplaces. So definitely the right person to talk to in terms [00:03:00] of what’s going on right now with search and the overall space.

Mike Walrath: You did both. The company summary and my bio better than I ever would’ve, so thank you for that.

Sophie Buonassisi: Absolutely. Well, you make it easy, and I mean, you are the perfect person. I think the company side is really interesting because you’ve really lived through almost a mirroring effect in a company capacity of what the industry is going through. So I’m curious from a, search perspective, what you’ve really seen overall happening in the space now.

Mike Walrath: it’s been a really interesting run and what’s funny is. I started my career nowhere near the search space. So I started my early career at Double Click. I sold ads there. I figured out how to gain the system there to make ads not work that well.

And then left there and started a company called Bright Media, which was Digital Display Advertising Exchange. It was the first. Platform for programmatic media buying, which has become a big thing. And never in any of that did I really think that this idea of search would be part of my background.

[00:04:00] But that changed when we sold right media to Yahoo in 2007. And when I took that, I agreed to stick around for two or three years as you do in an acquisition like that. And within about six months, they asked me to oversee both the display marketplaces, which I was very well-versed in and the search marketplace, which I knew very little about.

And so I kind of had to bone up on the history of, what had gone on between, call it the late nineties and 2007 in the search space, we’re in a moment there in 2008, 2009 where we’re just getting our. Our launch was eaten by Google in every way. And we had this horrible dilemma.

I’m not sure Yahoo was considered an innovator in search at that time, but they had been we had to choose, we could either monetize really aggressively as we had a tendency to do or we had to give up a lot of money and we had to provide a better search experience, more relevant search experience, which is what Google was doing to us.

If you go back to those days, Yahoo had three or four ad units on the [00:05:00] page on the search results page, and Google had one or none. And so every time we cranked up the monetization, we just watched our search share road, and that was the beginning of the Google monopoly where Yahoo went, from mid-teens market share to, I think what’s 1.5% today or something like that.

Sophie Buonassisi: That’s incredible. Yeah. You’ve seen quite the evolution over time, and now of course entering more of the AI driven era. How are you seeing that impact search.

Mike Walrath: Yeah, so it was incredibly unfun at the time being on the wrong side of that trend. So we had lived at a little bit of double click in the late nineties. you had Alta Vista and as Cheese and Lycos, and a bunch of these directory type search engines. and we’re selling banner ads against keywords back then.

It was a very, I’d say simple marketplace. We saw Google, Google showed up and they changed everything. It became all about relevancy. it was like magic, right? And so from 2008, 2007, 2006, I think Google went public in 2005 or something like [00:06:00] that. And they just ate everything.

They not only ate up to 92% of the search share, which is where they peaked about two years ago. But they took over. Reviews, they took over a lot of the reputation stuff. When Yext started our core business as it exists today in about 2009 or 2010 Yelp was something like 65% of all online reviews.

That is today. I don’t know what that number is, but I would bet a lot that it’s less than 20% and Google’s probably close to 65% of all online reviews. And so we went through this really interesting phase where the first phase was a bunch of fragmented directories. The second phase of search was Google total domination.

And the third phase is what we’re getting to today, which is what I believe to be and many believe to be an even bigger re fragmentation of that space, which is largely driven by the magic of all this AI innovation.

Sophie Buonassisi: Definitely. Well, we’re entering the third phase then, as it sounds. you actually saw when Google came into play and now we’re seeing all these different channels take off, It almost feels like a diversification of [00:07:00] channel and there’s never been so many opportunities.

How does that actually impact software companies as there’s just a continuous expansion of channels.

Mike Walrath: Yeah. So I think what it does, what it will do is ramp up complexity. And it’s not hard to imagine what this is gonna be like because we’ve lived through it once before. So, we’ve kind of described three phases of the search evolution here. But there was something else going on also which was throw in the mobile smartphone.

What happened in 2009 was even as Google was consuming all of the kind of consumer search share, we saw the launch of the iPhone and then Android. And what that did was it created this situation where every app became a geo aware directory. So you had this brief moment where Google’s kind of total domination of like consumer search was offset by the fact that everything on your iPhone knew where you were.

Or your Android phone knew where you were. And so it was [00:08:00] like every app became this geo aware search engine. And it created a huge problem for any marketer who was trying to be found locally. Because instead of having a small set of directories that you had to keep your information correct in, you now had to do it across this entire fragmenting set of mobile experiences.

And so that’s where Yext really. Became the company that it is today. And we built our first product, which is is our listings product. And it’s really the ability to syndicate all of your authoritative business information across a network of publishers, many of whom were either created or accelerated by this mobile fragmentation.

So these are the trip advisors and the one I like to talk about is MapQuest, right? So MapQuest was this unbelievable directions engine in the kind of late nineties and early two thousands where. You did this magical thing where you put in where you wanted to go and it printed out a piece of paper that had the directions on it for you, right?

Pre-mobile device, pre everybody having a GPS in their car. And it was like considered innovative but it was really important that [00:09:00] your address and your phone number and your hours of operations be correct on MapQuest at that time, because that’s where a lot of users, I think it was owned by a OL at the time, that’s where a lot of users were going to get that information.

And so that was the world where the business that we have today was created. And, the growth curve went on for close to 10 years where marketers were really focused on how do I manage all this, authoritative information across this fragmented landscape.

The last piece of that puzzle is as Google consumed more of it, and as the traffic to a lot of these other applications disappeared. We went into sort of the great debate about does it matter whether you continue to create content on all these other publishers and update content on all these other publishers?

Because at the end of the day, all your traffic’s coming from Google. And so our little corner of the industry has kind of had this ideological war happening, which is rooted in SEO concepts around does it matter that your information be perfected across the entire web?

[00:10:00] We believe it absolutely matters, and we think that it’s very clear that it matters because Google references all of those other places in order to determine what the right answer is. So even though no one goes to MapQuest for directions anymore, Google goes to MapQuest. And what they’re looking for is data fidelity.

They’re looking for the name and the address and the phone number and the menu, and all these other pieces of information the same across all these different. Directories on the web. .

Sophie Buonassisi: Yeah. Yeah. It’s almost like shifting the mindset from more of people behavior to engine behavior. And what’s

actually being indexed.

Mike Walrath: yeah, and that’s exactly where we’re headed, right? people talk about the digital transformation and the way that digital transformation has occurred is, in the late nineties and early two thousands, every business realized, okay I need to bring the digital transformation to my business and I need to have, web presence for all the different ways that I touch my customer.

So my marketing, my website, my social media, my reputation, [00:11:00] all these things have to be. We, in effect, we spent trillions of dollars on IT software and services in order to create the digital presence for human beings. Great. Amazing, awesome. We’ve created a ton of really interesting businesses and business models, and now we’re gonna have to replicate it all and we have to rebuild that entire digital presence now for machines because they don’t wanna consume it the same way.

That human beings do. They don’t want pretty pictures. They don’t want dropdown boxes. They don’t want navigation fields. What they want is pure, unfiltered data. And in a lot of ways that’s a lot like what happened in 2009, only 10 x or a hundred x bigger. We have to recreate the sort of data structure of the internet in a way that’s gonna make it AI ready.

Sophie Buonassisi: Yeah, and you mentioned earlier the network and so the network of different search engines is expanding and Google’s share of search might be a little bit, further down, two to 4%. More

Gen Zs are [00:12:00] using tiktoks chat, DBTs handling, hundreds of millions of weekly users. What does that look like from that diversification?

Are there certain network channels that you would advise operators and startups to really pay attention to?

Mike Walrath: Yeah so I’d advise everybody to pay attention to a couple of things. So the first thing is you referenced the fact that Google search share has started to erode. Interestingly, the way that’s measured today is really just against the other legacy or, traditional search engines.

So what’s not being taken into effect In those studies is the impact of chat, GPT or perplexity or GR or any of these other generative AI platforms because they’re not being measured that way. So all that’s happening there is there’s a little nibbling around the edges where Bing and potentially Yahoo or others are just eating a little bit of Google search share.

And that, that to me feels like the stabilization of the monopoly can get to 92%, but it probably can’t stay there. And so I think that’s what that is. What’s not being measured today, but we’re starting to get some really [00:13:00] interesting signal on, is the fact that if you take a much broader definition of search share, and you say just how you know, where are the questions being asked and the answers being provided, I.

That would include then chat, GPT and search GPT and perplexity and grok Gemini, Google’s kind, own AI experience. And what’s happening there is you’re starting to see traffic patterns that show that a lot more of the referral traffic on your web properties and also the indexing or kind of bot traffic coming from those services are all increasing.

What that tells you is that the questions are being asked much more broadly than the pure search share would measure.

Sophie Buonassisi: That makes sense. And how should SaaS companies rethink their marketing funnels, with that in mind?

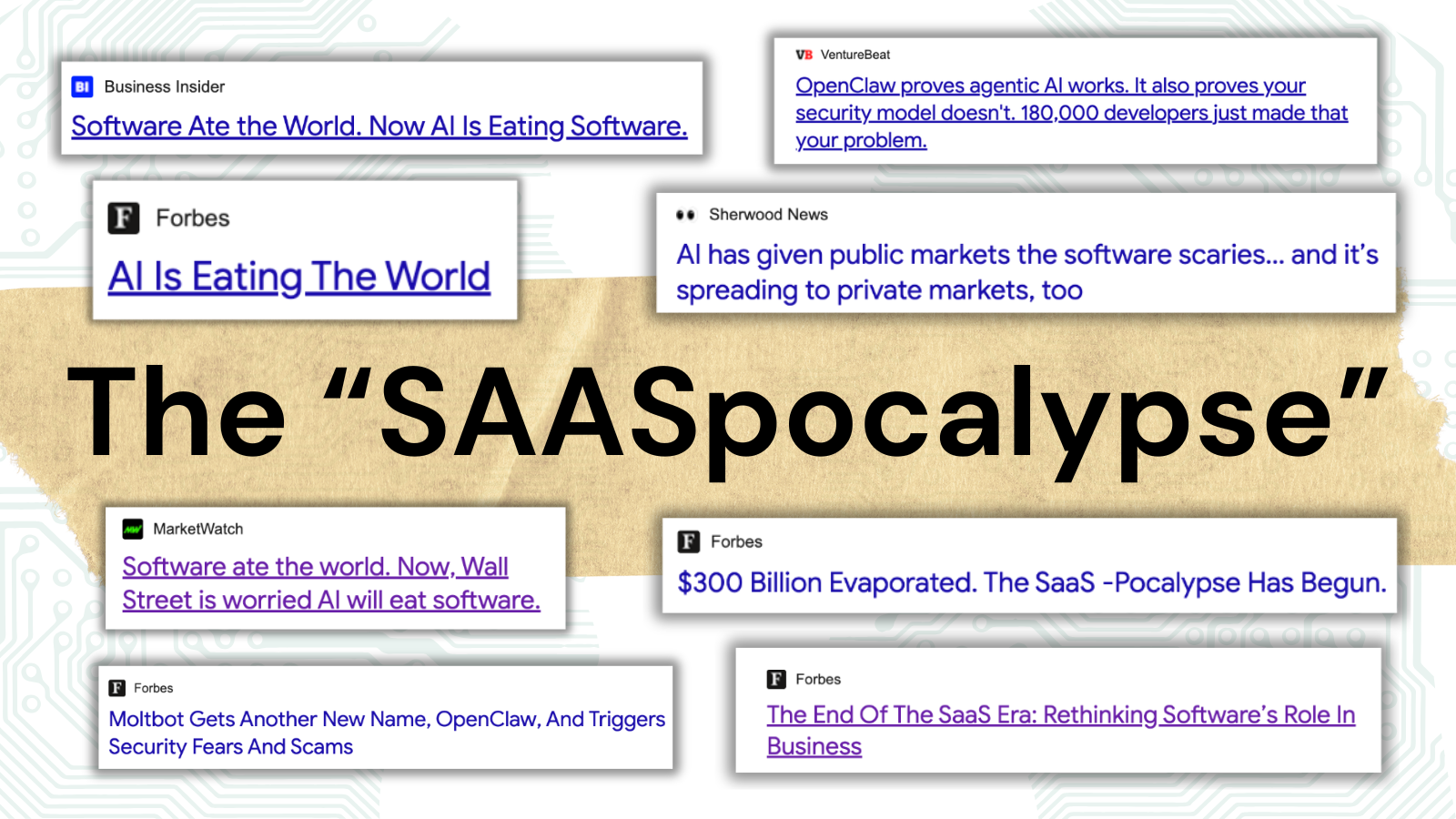

Mike Walrath: Yeah, so I would go broader than SaaS company, so I think every SaaS company probably has a different ICP and a different target. And there’s a whole set of things that SaaS companies need to worry about right now, which is how much of this kind of agentic shift is [00:14:00] going to commoditize or make it more difficult to sell my tools.

I think that’s a whole different discussion. The way we think about it from a marketing standpoint is. Any marketer who has a product or a service or whether it’s financial advisors, dentists, doctors, retail establishments, anything that has a local lens on to on it has to be very alert to the fact that all the rules of how is your product service advisor, dentist, doctor practitioner being discovered, are changing before our eyes.

And there are two shifts to that. One is fragmentation. it’s no longer just what does Google say about my business and what am I doing to make sure that I rank on Google? It’s also, what do the generative AI engine say about my business? What does chat g PT say?

So there’s, and that is, is rank or prioritization, but there’s also sentiment. They tend to express a lot more opinions than Google does. And so in order to focus on that what’s, what businesses are gonna have to understand, especially anybody with a local [00:15:00] lens, is that the answer’s gonna be very different depending on, which street you’re standing on.

take any major city, right? And if you are looking for a cup of coffee and you start walking around the city and you start asking all these different services, Hey ChatGPT where’s the best cup of coffee near me?

ChatGpT is gonna know your location. It might know your preferences, it might know certain things about you, just the same way that Google does. The same way that perplexity or grok or whatever your sort of experience of choice is. As you walk around that city, the answer to that question is gonna change, right?

This is nothing new. This is because the interface is geo aware. The question is, how is that? How is that service or that experience identifying what they should be surfacing as the answer for you and what can go into that is a nearly infinite set of data points that are both around you in the memory of the device and of your prior searches and of questions or things you’ve told it to remember.

Remember that I like vegan food. So even if you don’t say, I’m looking [00:16:00] for a cup of coffee at a place that also serves vegan food, ChatGPT or Grok is gonna say, well, I know you like vegan food and here’s a ca here’s a cafe that has great coffee, but also happens to have vegan snacks. And I think that’s the big paradigm shift that we’re gonna see is that it’s not enough anymore as a marketer just to say, well, this is my location.

Here’s the reviews and ratings around that location, and here are my hours of operation and expect to be found. You have to go deeper and deeper into the core data of your business, and then you have to figure out, how do I distribute that data in a way that the AI bot or the, AI agent is going to decide that this is where I should send Sophie right now.

Sophie Buonassisi: Yeah, that makes sense.

Mike Walrath: Because whatever your ICP is, right? So if for that example, for a coffee shop, it’s people, it’s gonna be presumably people who drink coffee, right? And so they’re gonna think in terms of. How do I make myself most attractive to people who drink coffee, depending on all the different things.

So what gets really interesting is from a marketing standpoint, you can actually start to reverse engineer a lot of these [00:17:00] things using data, right? So for example, if I’m, if I’m a startup coffee shop located in the neighborhood that you’re walking through there and, I’m facing stiff competition from 10 other coffee shops within a five minute walk of, or 10 minute walk of where I am.

One of the things I need to understand is what are they doing in order to create visibility and presence around their business? We’re living in a world that’s changing really fast, and some of the things that we’re helping our customers do is to gather those competitive intelligence insights at a level that’s much more granular than anything they’ve ever had before.

So what you can do now is you can, then we have a new product that does this. I’m not here to pitch products, but it’s a really good example of how this works. You can actually take real. Search data across all these different platforms for very specific queries to your business. And you can aggregate it up across hundreds of different variables.

And those variables can be things like distance, which is really important but there’s very little you can do about [00:18:00] distance. But what you can do things about is how many reviews do I have? What is the rating of those reviews? How many photos have I posted. to my GMB page.

How fast does my website load, how much data is on my website? How consistent is the data that I’m distributing across the universe? And like literally, there are hundreds of these things. And then you can pull, so you can look at it and you can pull the same information for your business and for all of your competitors.

You can then, because of the power of, our ability to capture and parse and then analyze tons of data using ai, we can pull that all down and you can basically find the distinguishing characteristic. So for example, you might find that the reason why one of your competitors is ranking more highly than you are is because they’ve created these highly content rich intent pages.

Around certain menu items, right? So they have a vegan menu and they have a keto menu, and they have a make up your whatever diet, fad diet to shore. They might have 20 different menu pages that are part of their, all they’ve done is they’ve taken like [00:19:00] the core, authoritative.

Data around their business, and they’ve expressed it as a webpage, the next step will be, now it’s not enough anymore just to build a webpage. You should be taking that same data and you should be converting it into a pure data file and it’s unclear exactly the way we’re gonna do this. you have things like model context, protocol and various kind of text based ways of delivering pure, raw data to AI bots and experiences. And so in, at the end of the day, doing marketing in the future is gonna be about understanding what’s gonna differentiate you and what’s gonna distinguish you.

And that’s always gonna be some form of content. Content is always gonna be some form of data in the way that we think about the, this sort of brave new world.

Sophie Buonassisi: And you, in a way, Yext has really mirrored this evolution naturally by nature of the product. What’s next? If you could pick up that magic ball, how are you thinking about that at Yext or even just your personal hypotheses?

Mike Walrath: Yeah, so [00:20:00] we’re thinking a lot about that because I think a lot has been made about that AI will be the end of software. I think that’s far too simple. I don’t think that’s the case, although I do think that there’s a lot of cases where AI is gonna challenge software, vertical software tool sets and things in terms of what is the value within the organization.

What I think is clear or becoming clear is that super intelligence is going to be the top layer. So if I’m not gathering, curating, and using data as the sort of the first thing that I’m doing when it comes to how do I execute my marketing, then I’m behind and I have to catch up quickly. And that means I need to be able to take my business data, I need to be able to structure it.

Then I need to be able to compare that to my competition, and I need to be able to understand what are they doing that I’m not doing? Which then what does that do? That creates more data, right? So that pages, that menu pages is example we talked about. There could be service pages, there could be product pages.

There could be, there’s infinite ways, [00:21:00] and I’m using pages as a proxy for structured data creation. Because then what you’re gonna do is you’re gonna say, okay, we need social media posts around our vegan menu pages. And we need reviews that specifically talk or review response capabilities that specifically talk about every time I respond to a consumer review, I’m creating more data, right?

I’m creating data that’s really consumable by AI agents because they’re gonna say, okay, well, like here’s a negative review about the business not having a vegan menu. And then a response from the business saying, actually, we do have a vegan menu and here’s a link to it. And I’ve now created content that, that bot can index and say, okay, like I now understand that this business has a vegan menu.

And so anytime I get a question about a vegan menu, I can recommend this business. And those are just like very simple examples of how this whole world is gonna shift and change. Which means you have to lead with the intelligence because the tools, right? The thing that I just described involves a bunch of tools.

It involves building [00:22:00] webpage and publishing those webpages in ways that are, that’s a tool, right? It involves responding to reviews and understanding that you have negative reviews or positive reviews, and you should respond to those. It involves syndicating your data effectively. Those are all tools.

What makes those tools really powerful is the AI super intelligence layer that you can talk to and you can say, okay hey, I’m number two in my category for my geography for X, Y, Z search query or X, y, Z topic. How do I become number one? Or I see this new competitor who showed up a month ago and they’re they’ve risen from number 12 in the category to number three, I need to protect myself from them.

And what you need is this kind of, think of it as like this army of intelligent. Agents who are out there pulling your data, figuring out, okay, this is the thing you need to do. that’s where this is going. And software companies who figure out how to deliver intelligence first are gonna be the ones who thrive in this world.

Because what they’re gonna do is they’re gonna eat a lot of this services market, which is a totally different market.

Sophie Buonassisi:[00:23:00] Yeah, those silos are disappearing. And with the advent of more tools, what does that do from a headcount perspective,

Mike Walrath: Yeah, so I’m not a big believer that, this is a huge destroyer of jobs. I think what this is this is a huge changer of jobs. And I think what we’ve seen with technological shifts is that it’s always a huge changer of jobs. And so, funnily Uber was supposed to destroy all the taxi jobs, right?

I promise that there are more drivers in. Every city today than there were 10 years ago right now, maybe way. No. Now the current thing is, well, way Waymo’s gonna take all those jobs away. And maybe that’s true, but other jobs will be created. So I think what happens when we get the intelligence layer, right?

And the tools are more automated than the work that we do as marketers or, marketing operations folks or strategists that it all gets upleveled. So I spend a lot less time doing keystrokes and figuring out okay, I need to go. Get a developer to make a bunch of [00:24:00] pages that I can publish about all these different things in my business.

And instead that, that’s just, that’s tool work that happens behind the scenes. The amount of time that’s gonna be spent really analyzing and understanding what is the thing that I should do next, is gonna be, and I’ll give you, I’ll give you a real example of this. So a lot of our customers, they have.

They have thousands or tens of thousands of like unique local presences, right? So you could take like some of the largest, fast casual restaurant chains or some of the largest wealth management and insurance businesses out there. One of the fascinating things that we’re seeing is we aggregate all this data is that the strategy for discoverability and digital presence is, can be fundamentally different for two locations that are in the same town.

Or within five or 10 miles of each other. And so it’s like this things become remarkably bespoke where you might take, a pizza restaurant, that’s 10 miles away from another pizza restaurant, and you start looking at the data and who the competitor [00:25:00] is and how they’re competing and the prescription for improvement.

Or protecting, a great presence position are completely different. And so we go from one size fits all. The type of things that we see today is okay, we’re gonna, we have 3000 pizza restaurants in the United States of America, or maybe globally. And our big initiative for this year is to increase the reputation score of all of those entities.

That, that’s the kind of thing that, we’ve been working on as an industry what happens next is you realize that of those 3000, there’s only a thousand that actually will benefit from a higher reputation score, either because they already have a high enough reputation score or because they just don’t have any competition.

And so you’ll you, you wind up with a world where you can have bespoke marketing recommendations for each one of those stores. So the person who typically was running around store to store going, Hey you have to give everybody this card when they check out or show them this QR code so that they’ll, leave us a good review is now able to [00:26:00] say there’s only 300 stores out of 3000 that need that, but there’s another 300 who need more photographs.

And so I’m gonna work with them on that. And so their work changes and it becomes much more value add and bespoke as the tools automate and the analytics get better.

It’s using the data in a way that we’ve never been able to use the data before, and that feels really intimidating because it’s, if you ask a human being to go through that data file and identify, well, which store needs reputation work, and which store needs photograph work, and which store needs local pages that load faster?

that’s, an incredibly manual and incredibly difficult process to do that’s done in seconds with the right data structure and the right ai.

And how do you think that lends itself specifically, let’s take a Series A, series B software company.

Mike Walrath: Yep.

Sophie Buonassisi: that we can get as prescriptive?

Mike Walrath: I think that. What’s gonna happen is gonna be somewhat evolutionary in the sense that companies who, who realize that what I’m really talking [00:27:00] about here is reversing the way that we create products. So if I think about the way, so Yext, I, I started, I invested in Yext in 2008.

I became chairman in 2010. I was chairman for 12 years. And then, I’ve been CEO now for three. And it’s been some really interesting ride. And if you think about. The way we were developing product in 2009 and 2010, which felt incredibly innovative, is we’re identifying these kind of sectoral trends.

So we identified that Hey, mobile fragmentation is gonna create a huge problem for marketers. We need to build a platform, a set of tools that allows the marketer to put their authoritative information in once and have it pushed to hundreds of endpoints. That was the sort of big innovation that we created.

And so it was problem yields tool. Then what would happen is we spent 10 years making that tool work better through workflow and seeing, and just making it more seamless and able to do more things and scale. And we automated all the connections out to the end point. So we automated all the connections to all the sources of truth inside a [00:28:00] business.

And so you just it was really easy to get in this world where you’re just innovating through. This sort of problem tool workflow. and then the customers, they always want well gimme some analytics and gimme some ROI proof. And so you built that as like an afterthought, right?

That, and that was really the sort of the reporting data layer and the intelligence of the thing. I think what’s gonna happen in this next generation of SaaS is we have to reverse that. We have to start with the data. So we have to start by saying, okay what’s the data that’s capturable, right?

So if I wanna optimize my social media presence, instead of starting with, well, here’s a great tool that lets me post all the different networks and automates a lot of that and here’s a tool that lets me create a lot of great content. Where I would start with that. And where we’re starting with that is instead give me the data around, gimme hyper localized data around what the sentiment is around the social posts that we’re making.

Right then. Then what I can do is I can understand from the data and from that kind of the intelligence that can be drawn outta that data. What’s the thing that needs to be built? And it may [00:29:00] be that hyperlocalized posting is the thing that needs to be built. And so you work backwards from the analytics and the ROI layer.

To the to the sort of the outcome you’re trying to create. And then because so many of the tools and so much of the workflow can be automated, you don’t need nearly as robust an investment in the tools, in the workflow. And I think that’s really how the innovation curve and software’s gonna change in a really big way from the way, I mean, when I, when we built right, media, go back even further, 2003, we were trying to automate this auctioning of media.

Which in a lot of ways today is just it’s like electricity. It’s just every ad impression on the web is being auctioned at some level. But there, it was like a huge leap and you had to create all this like complex workflow around how you entered a bid and how that bid got changed and shifted and dynamic pricing mechanisms.

And now all that stuff is like fairly commoditized. And so I, I just think that’s the thing that like early stage software companies are gonna need to focus on is, are we starting from the right place? In order to focus on the right thing, which is gonna be the value driving for the [00:30:00] customer more than like building, workflow tool and tools for the sake of building workflow and tools.

Sophie Buonassisi: It’s almost flipped It On’s head

Mike Walrath: Yeah, I think it’s reversed and I think it’s reversed because the workflow and the tool stuff is now so easily automatable, which by the way also means that you have to get out of the seat license business.

Sophie Buonassisi: Yes. Now I feel like we’ve gotta go down this hole. love to hear a little bit more on your take seat-based pricing cause it is inevitably a very highly discussed topic right now, and one that I think the overall narrative is similar to yourself, but curious to hear your thoughts there.

Mike Walrath: Yeah. I mean, to me it’s I think it is both obvious, but also not as simple as it seems. So I. I really look forward to a day where, we have a pretty significant size sales team and client success team. And, I think a really great day is when they just talk to, an assistant and the assistant inputs notes and advances deals, and does all those Go-To-Market things that need to be done?

And what that means is that the, now, like [00:31:00] you’re I think the. The other side of this would be, well, if you have human beings talking to a machine, it’s no different than human beings keying data into a machine. I think what will be different is that the cost of the cost on a per human being basis is gonna have to come down or will be forced down because there are, other people are gonna figure out how to, use the tools and the AI to make that happen.

So the part of this that I think is. Is really operative is if I were pricing, we, thankfully we don’t price on a per seat basis here, so we don’t actually have this problem, which makes it easier for me to say that’s gonna be a big problem. If I were in a business that, that was doing, that, I would be thinking about how quickly can I move to a value-based pricing model to a a jobs to be done to an outcome oriented pricing model.

Because I think what’s gonna happen is that the startups and the innovators are gonna do that. And, the ROI is gonna be built into the contract in a way that like paying per head is not.

Sophie Buonassisi:[00:32:00] Definitely, and I mean, we’re seeing that obviously we come at an earlier stage and how we’re really looking and aligning everything. It’s jobs to be done, outcome oriented, so it’ll be interesting to see how these shifts take place on both spectrums at the more enterprise level and the startup level.

Now, Mike, I’ve got a couple quick questions for you. I’m curious, you’ve

led at Yext for over 15 years. And led the company through some really pivotal points of its trajectory, incredible growth. What’s your advice to other leaders for leading at a company and evolving at a company itself? You almost have to reinvent yourself as a leader.

And I ask because we’ve got a lot of Go-To-Market executives in our audience, a lot of venture leaders that are constantly looking to level up their own career and expertise and grow with a company.

Mike Walrath: Yeah, it’s a big question. Yext has been interesting because for. The better part of 15 or 16 years, I had the best job at the company, which was, I was the non-executive chairman, which [00:33:00] meant I had no operational responsibility. When things went really well, which they did for a really long time, I got more share of the credit than I deserved.

And when things didn’t go well, everyone looks to the CEO and the management team and says, well, these guys are screwing it up. So it’s only in the last three years where I have to carry the weight of that. But when I think about Yext or some of the other entrepreneurial endeavors, right?

Media, I. And kinda leading through cycles. I think one of the things that we’re dealing with now is that, tech for all intents hasn’t had a really significant downward cycle since 2002, 2001. In a lot of ways the financial crisis didn’t hit tech the way that it hit other industries.

And so I. It’s been really interesting, I think things started going a little squirrely in software in 2022 maybe late 2021, but there was like a 20 year nirvana like environment that, that preceded that. And so as I think, as things have gotten tougher.

It’s taken longer than it should for us to recognize that okay. Like [00:34:00] things are changing and they’re not snapping back. And there’s a million ways that this kind of, comes in. E even I took this job in March of 20 22, 1 week before I took on the CEO job one week before the first interest rate hike and, taking the job.

There was just this sort of. There was this dogma around Hey, good software companies trade for 10 times a RR. That’s what it is. That’s what they’re worth. That’s what they trade for. Now there’s actually no historical, like data precedent that says that has to be true. Like his historically, actually they don’t.

That was a thing that happened during a really low interest rate period and a really easy to sell and a really high growth period where, it was just like that was considered minimum. And then if you were really great, you got 50 or a hundred times a RR. And so I think, that’s a great example of the number one thing that we have to do to lead, whether it’s good times or bad times.

We have to be really honest with ourselves and with our teams about. What are the fundamentals of what’s happening and how do we react within those fundamentals? And the sooner we see that there’s a shift happening, that we may not be [00:35:00] going back to 10 times error anytime soon.

For good software companies, that might just be something that we look back on and say, Hey, that didn’t make a lot of sense. That only made a lot of sense in a ZIRP environment where, you know. There was so much growth in the dollars that every vertical SaaS business could grow at 30 plus percent.

If you look at the public companies today, I think there’s one or two public software companies who are growing in excess of 27%. If you look at that data from three years ago, if you weren’t growing 30%, you were considered like, you might as well just close up shop. And so I think, again, you asked for advice and I gave you a a lot of history, but to me it’s just one of these where, we have to understand the reality that we’re operating in and we have to get really crisp on that, or we’re not gonna lead well.

Sophie Buonassisi: That’s a great answer. Makes complete sense and that radical honesty and transparency is definitely key.

Mike Walrath: Sometimes told that go a little too radical on that side, but the way it is.

Sophie Buonassisi: true, we’ll put an asterisk on it. And [00:36:00] last question, Mike. I. We’ve talked a lot about what’s working around search, so I wanna ask you, what is one widely held belief that you know, you’d say revenue leaders specifically hold, that you think is bullshit or no longer serving us specifically around how people and companies are going to market.

Mike Walrath: Yeah, specifically revenue leaders. I think one of the things we’ve had to adjust to is we’ve now had three kind of false restarts. I would say after 2022 was a really tough year for revenue leaders. Everyone called, well, okay, that’s, that was awful, so that’s gotta be the bottom right.

And it was this whole thing of we had no pattern recognition for it. So when things went really bad in the middle of 2000. It was like three or four years before we actually saw recovery. But it’s easy when you haven’t been through it to call the recovery. So I think what happened, and I look at the public software set a lot, which is, just what the future looks like for a lot of these great startups is it’s so easy to convince yourself.

Okay. Like it was easy [00:37:00] to sell for 15 years and then it was hard for a year, but it has to get easier this year. And what we saw was just a lot of. Pain because people invested into a sales environment that didn’t materialize in 2023. And then we doubled down on it again at the end of 2023 and we said, okay, so that’s two bad years in a row Now, 20, 24 has gotta be better, right? And the reality I think, is that it gets better when it gets better, and it gets better when businesses start investing again because they fundamentally believe that it’s going to advantage them to invest. And so I. Again, just because of 10 or 15 or maybe even 20 years of like easy selling, I think we, our pattern recognition around like why should it get better got really off as an industry.

And so we kept calling these bottoms and I’m not sure, I mean, and by the way, everyone went into this year thinking like. Well, this is obviously the year we’ve got deregulation coming. we’ve got all these things happening and then what do we get as we get all this tariff stuff?

And so right now I think it’s very difficult for anybody on the revenue side of the house and software to [00:38:00] know, is this gonna be a good selling environment same difficult as we’ve had, or is this gonna be. An even worse selling environment because that depends on, how the tariffs and this trade war stuff impacts our core customer.

And so my biggest advice to revenue leaders is use data to figure this stuff out. Not not the core belief that because we’ve had three tough years that somehow this year has to be better.

Sophie Buonassisi: That is fantastic advice and extends across many different facets. Well, Mike, thank you so much. This has been an incredible conversation. Thank you to all the listeners for hanging out with us and we’ll see you next week.

Mike Walrath: Thanks for having me. It was great talking with you.