The GTM Podcast is available on any major directory, including:

Paul Williamson is a seasoned go-to-market leader and advisor best known for helping Plaid scale from $3M to $300M ARR. As Head of Revenue, he built and evolved Plaid’s go-to-market roadmap across product-market fit, upmarket expansion, and new verticals. With deep experience aligning GTM with product, he now advises founders on sequencing bets, building forward-compatible roadmaps, and scaling revenue organizations with intention.

Discussed in this Episode

- Why GTM roadmaps should be “forward-compatible”

- Iteration cycles in GTM vs. product roadmaps

- Early lessons from Plaid’s rudimentary qualification process

- Recognizing high-value clients vs. anti-patterns in inbound leads

- How daily standups created fast GTM learning loops

- Shifting from PLG to sales-led motions with SDRs and routing

- Sequencing GTM expansion: fintech → enterprise FSIs → embedded fintech

- Compensation design mistakes and their impact on sales behavior

Episode Highlights

00:00 — Why GTM roadmaps should be built “forward-compatible”

Watch: https://www.youtube.com/watch?v=mRHUnrX6d_I&t=0

01:53 — How Plaid iterated through 9–10 GTM versions in the first year

Watch: https://www.youtube.com/watch?v=mRHUnrX6d_I&t=113

05:12 — Plaid’s early qualification process: 4 simple questions

Watch: https://www.youtube.com/watch?v=mRHUnrX6d_I&t=312

07:28 — Why most inbound leads weren’t equal—and how Plaid spotted patterns

Watch: https://www.youtube.com/watch?v=mRHUnrX6d_I&t=448

10:01 — Using daily standups twice a day to refine GTM qualification

Watch: https://www.youtube.com/watch?v=mRHUnrX6d_I&t=601

14:32 — How Plaid’s GTM roadmap evolved from monthly to yearly cycles

Watch: https://www.youtube.com/watch?v=mRHUnrX6d_I&t=872

20:46 — Moving beyond partnerships to diversify top-of-funnel channels

Watch: https://www.youtube.com/watch?v=mRHUnrX6d_I&t=1246

24:53 — Scaling into enterprise financial institutions with tailored product needs

Watch: https://www.youtube.com/watch?v=mRHUnrX6d_I&t=1493

27:09 — Entering phase three: embedded fintech with customers like Tesla

Watch: https://www.youtube.com/watch?v=mRHUnrX6d_I&t=1629

30:00 — Compensation design mistakes that slowed deals and created risk

Watch: https://www.youtube.com/watch?v=mRHUnrX6d_I&t=1800

Key Takeaways

-

Build GTM like product. Plaid treated go-to-market as an iterative roadmap, evolving from v0.1 scrappiness to multi-year strategic planning.

-

Forward-compatible beats backward-compatible. Each GTM version should enhance and extend the last, not require rework.

-

Not all inbound is equal. High lead volume is a false signal unless paired with value-based qualification and pattern recognition.

-

Anti-patterns matter. Plaid avoided over-investing in low-value ACH add-ons, instead routing them through PLG and focusing on high-value accounts.

-

Rituals accelerate learning. Twice-daily standups created rapid GTM feedback loops in the early days.

-

Overbuilding is risky. GTM leaders should feel slightly behind the company’s needs—not over-engineered ahead of them.

-

Comp plans shape behavior. Plaid learned that SMB-style comp delayed enterprise deals and unintentionally increased competitive risk.

-

GTM expansion must align with product readiness. Scaling into enterprise required product investments in SLAs, uptime, and access controls.

-

Embedded fintech unlocked phase three. Plaid moved from serving fintechs to powering financial features in industries like auto and telecom.

-

Documenting roadmaps creates clarity. Writing down GTM plans helped Plaid focus and communicate priorities with technical founders.

This episode is brought to you by: Harmonic

Harmonic helps you discover the best startups way ahead of the competition. We use it at GTMfund, as do thousands of investors at firms like USV and Insight. GTM teams at companies like Notion and Brex also rely on the platform to stay ahead.

Harmonic tracks millions of startups and lets you search using simple filters or natural language to match exactly what you’re looking for. When you find a company that looks interesting, Harmonic pulls everything into one place (founder backgrounds, traction, and market data) so you can quickly evaluate and understand if it’s a fit.

At GTMfund, we even have a private Slack channel called #companywatchlist powered entirely by Harmonic.

Get 2 dedicated sessions with their team to help you test and structure the perfect searches here.

Recommended Books

- Atomic Habits by James Clear — Helped Paul think about building repeatable, compounding habits in GTM and leadership.

- Scaling Through Chaos by Index Ventures — A practical guide for founders (and GTM leaders) on navigating early-stage challenges; Paul contributed to it.

Referenced

- Harmonic: https://harmonic.ai

- Stripe: https://stripe.com

- Dwolla: https://www.dwolla.com

- Venmo: https://venmo.com

- Robinhood: https://robinhood.com

- Acorns: https://www.acorns.com

- Tesla: https://www.tesla.com

Guest Links

Host Links

- LinkedIn: https://www.linkedin.com/in/sophiebuonassisi/

- X (Twitter): https://x.com/sophiebuona

- Newsletter: https://thegtmnewsletter.substack.com/

GTMnow Links

- Website: https://gtmnow.com

- LinkedIn: https://www.linkedin.com/company/gtmnow

- X (Twitter): https://x.com/GTMnow_

- YouTube: https://www.youtube.com/@GTM_now

- Podcast Directory: https://gtmnow.com/tag/podcast

GTM 161 Episode Transcript

Paul Williamson: 0:00

The way that we build a go-to-market roadmap is that we want our roadmap to be forward compatible. Something today that we build into the business is something that we would then want to build on top of as we go over time. What’s the actual problem that we’re solving for the customer and where does that fit in terms of like the value for them?

Sophie Buonassisi: 0:19

Thank you A quick word from a tool that we use. Harmonic helps you spot the best startups before anyone else. We use it at GTM Fund, as do top investors at USV and Insight and go-to-market teams at Notion and Brex. The platform tracks millions of startups and lets you search with simple filters or natural language. In seconds you get founder backgrounds, traction and market data all in one place. At GTM Fund, we even have a company-watchless Slack channel powered by Harmonic. Their website is harmonicai. Get two free sessions with their team to help you structure the perfect searches if you use the link in the show notes.

Sophie Buonassisi: 1:09

Most startups obsess over building the perfect product roadmap, but few treat go-to-market with the same intentionality. Paul Williamson joined Plaid at $3 million in AR and helped scale it to $300 million by building and evolving a go-to-market roadmap that served as the blueprint for growth. In this episode, paul shares how he first built that roadmap, how it evolved through product-market fit and upmarket expansion, and why every founder needs to treat go-to-market as intentionally as product. You’ll learn how to sequence the right bets at each stage, avoid over-engineering too early and use simple rituals to keep go-to-market aligned as you scale. All right, let’s get into it. How would iteration cycles function with a go-to-market roadmap Very similarly to a product roadmap. Are there nuances and differences that?

Paul Williamson:1:53

anyone should know. Look, I think a lot of people talk about, you know, sprints and things like that from an engineering perspective, and a sprint might be, you know, two weeks or four weeks or six weeks or whatever that structure might be. Look, I think in some cases when you’re doing early go-to-market work, you actually want to think about your kind of go-to-market roadmap in kind of short, incremental bursts from that standpoint. You know, for example, like when I first joined Plaid back in you know 2017, you know we had a very rudimentary sales organization at that point and we really thought about. You know 2017, you know we had a very rudimentary sales organization at that point and we really thought about you know kind of you know zero, like version 0.1 of our go-to market when I first arrived, and we really thought about iterating on that go-to market structure consistently over the course of the year.

Paul Williamson: 2:40

But in the first 12 months that I was there, we probably went through nine to 10 different sort of sub versions of what go to market and our go to market motion would look like, because our business at that point in time necessitated the need to kind of rapidly change and rapidly evolve the way that we essentially approach go to market Now, over time, as a business continues to kind of scale, as a business continues to kind of scale, as a business continues to mature, you might not be doing it with like that same level of maybe monthly cadence in terms of the change or update, and the window between essentially kind of version changes of your business will probably start to get longer as the business kind of gets more scalable, more consistent, more repeatable, which is a good thing, right, Like we want to see a business continue to kind of find structure. We wanted the business to find patterns inside the organization. But what we really want to be thinking about, and one of the things that I talk a lot with founders about, is that the way that we build a go-to-market roadmap is that we want our roadmap to be forward compatible. Something today that we build into the business is something that we would then want to build on top of as we go over time.

Paul Williamson:3:56

You know a lot of people, from a technical standpoint, kind of talk about when product is built it’s backwards compatible. Does the thing that we’re building now work with the things that we’ve already built? And you could probably apply that concept, but I prefer to kind of talk about it as like we’re going to continue to kind of build on the foundation that we’ve got. Each iterative version should be an enhancement or an improvement on the thing that we’ve done before.

Sophie Buonassisi: 4:19

You join at $3 million. What was the state of go-to-market and how did you actually outline that roadmap?

Paul Williamson:4:25

Yep million. What was the state of go-to-market and how did you actually outline that roadmap, yep? So look, when I joined Plaid, as you mentioned, we were doing about 3 million in ARR. At the time, we had approximately about 100 clients who were working with us at that point in time. And, by the way, we had some amazing clients in those early days Venmo, robinhood, acorns, like household names now from a FinTech perspective. But you know, when I walked in the door, we had two things that we were really fortunate about is that we built a product that was really valuable for people. That was part one. And part two is we actually had a fairly good amount of inbound that was coming into our business today because we were solving a pretty important problem that hadn’t really been solved that well before.

Paul Williamson: 5:12

However, to call our go-to-market motion in those early days sophisticated would be a massive overstatement when I first turned up and we had a couple of founding employees kind of working in go-to-market at that point in time had a couple of founding employees kind of working in go-to-market at that point in time. You know, for example, our qualification process was really rudimentary. We asked four questions and it feels laughable to talk about these four questions now. But the four questions that we asked were you know, have you downloaded our API keys? Have you read our technical documentation? Where are you at in terms of your build out of your application? And the fourth part was like when do you expect to go live? That was qualification for us in the early days and obviously, like most people would probably laugh at that level of qualification and, looking back, we do as well but the thing is like that was kind of like that was what felt like was the right approach for us at the time. But what we weren’t really seeing, what we weren’t starting to understand, is what’s the actual problem that we’re solving for the customer and where does that fit in terms of the value for them from that perspective?

Paul Williamson: 6:22

And I’ll talk about one big thing as I said, we used to have a lot of inbound. Often like hundreds of inbounds on a weekly basis were coming into us, and that was because we built some strategic referral partnerships in the early days with people like Stripe and Douala, and so we had a quite an effective top of funnel flow coming into the business. But the thing about that is that, like, of the hundred leads that we were getting a week. A lot of those leads were not equal. However, our behavior in terms of the way that we were working with those prospective clients, we were treating all of those opportunities as equal. And so what we were looking for in the early days is to starting to sort of like recognize patterns in the business, like good patterns for us, and then the anti-patterns, like what are the things that we don’t like see a lot of value in. And the example for us in those early days is, you know, of the hundred leads that were kind of coming in a week, you know 90 of those were kind of like payment partner referrals, like, as I mentioned, with Stripe and Douala.

Paul Williamson: 7:28

And what was happening in that instance is that you know, those prospective customers were thinking about ACH, so bank-to-bank money movement, as an additive feature to their payment stack. At that time, ie, hey, we already take a credit card and all these other things of which credit card might have represented, you know 95 of the the money movement volume that they needed for their business. And then ach was this small fractional component of what it is that mattered to their business. And so what we recognize is like that’s an anti-pattern, like that wasn’t a good pattern for us to go invest significant time, energy and effort into. So we had to ask ourselves a question like do we want to spend time on that opportunity, on on on a client like that? In fact, like the answer for us was that this is actually a much better client to actually reroute back to a plg motion because because that was actually going to be the most effective strategy for us, both in terms of how our product worked and operated, but also that was the most cost effective way for us to acquire those customers.

Paul Williamson: 8:35

And what we needed to get to a quicker understanding of is hey, there was probably about 10 really important prospective clients that were coming through for us in those early days that wanted us to actually like ACH was the core funding reason for them to be using Plaid, and they wanted to do other more enriched services like validate the person’s identity.

Paul Williamson: 8:56

On the other side, maybe understand things like you know how much money they had in their account so that they wouldn’t have an NSF or an overdraft if they were doing things like funding their Venmo account or funding a trading account like Robinhood and things like that, and so, again, it was one of those things where you know we could have become very enamored with the hundred leads that were coming in every week and try to treat everyone equally, but what we quickly realized is like we couldn’t and we shouldn’t be treating everyone equally because our prospective clients were not equal in terms of the value that they would receive from the platform, from us, and also the value that we could then invest back into working with those early prospective customers.

Sophie Buonassisi: 9:37

How did you think about evaluating that value? Yeah, because I think what we hear a lot of the time is it’s hard to get those triggers in a timely manner. So you’ve got your ideal customer behavior on the product side once they become a customer, and you take those insights and loop it back to your ICP and kind of have this post sales to pre sales movement. But how did you actually find the evaluation process went?

Paul Williamson: 10:01

Yeah, I’d love to tell you again that we were that sophisticated in the early days. Honestly, like for the first I think, three to four months that I was in the business, we essentially did a morning stand up and an afternoon stand up, and particularly as we started to add more people into the business, it became even more important for us. And so really what we were doing in the early days is that we were manually looking for patents inside the business and what worked or what wouldn’t work. And what we started to see quite clearly early on was like there was a clear delineation between like these high value, high impact clients and like low value, kind of like the customers who thought that what Plaid could do was accretive to their business but not, you know, essentially the core to what it is that they wanted to do inside their business.

Paul Williamson: 10:53

And it was great Like we actually would get to the end of the day and literally we would talk through nearly every single deal that we like going through a qualification process on. And particularly because we were also making real time changes to the way that we were doing qualification, it was also a good check-in point for us to say, okay, cool, hey, this V0.1 of our qualification process. Is it working? What would we change? Why would we change it? Is there an extra question that we should add tomorrow? Is there a different way that we’d phrase the way that we would ask that question tomorrow? And then we’d also then kind of recount who had what calls, what did they do, what did we find out on those calls during the course of the day.

Paul Williamson: 11:37

And that was really a great way for us to kind of recognize that Again we weren’t that sophisticated of product feedback loops and all that kind of stuff because, again, we were still really early in terms of our process and I know that the team was probably quite sick of me running a daily stand-up twice a day for the first three or four months, but it was also an amazing way for me to learn the business but also for the team to start to recognize as well what were like good prospective clients and what were less good prospective clients. We obviously wanted everyone to be building on plaid, but there were just prospects that we knew that we should be spending more time with than less and and effectively like we shouldn’t be treating everyone equally because of the value that represented to us and also the value that we represented to them as well makes sense, and this is around 2017, you mentioned You’re running these stand-ups two times a day.

Sophie Buonassisi: 12:31

How many people are in the company overall?

Paul Williamson: 12:34

So Plaid yeah, plaid was about 50 people in those early days total, by the way. So that was go-to-market engineers, all that kind of stuff exactly. And for me on the go-to-market side, we had two initial kind of founding AEs in the business and we had, you know, two people on the account management, customer success side at that point and so, and then we started to add a couple of people to the team particularly. We added two SDRs, pretty much all almost immediately to really become an initial filter for us for those kind of like hundred new prospects that were coming in. Because it was really a initial filter for us for those kind of like 100 new prospects that were coming in, because it was really a good opportunity for us to start to then like route you know where that prospective customer should go.

Paul Williamson: 13:19

Is that something that should be sales-led, is that something that should be product-led and being really prescriptive ultimately and kind of like steering where a prospect should go, because, like there were also, like in some cases we couldn’t do as good a job as what the product could potentially do for a certain segment of customer. But there are also places where we, as a sales led motion or a go-to-market led motion, we could do an inordinately better job than what the product could do from that standpoint, and so we kind of like wanted to. It was human-based routing. At that point Again, we didn’t have like this amazing level of sophistication, at least at this point in time, which sounds like quite rudimentary, right, compared to kind of like where people are today in terms of like revenue operations and revenue engineering. But it was the right thing for us to do at the time and it got us really really close to the business. It got us really close to the use cases and it helped us get really close to the customer and where the value was for the business.

Sophie Buonassisi: 14:15

Did you have a go-to-market plan, a roadmap, outlined at this point, or was it going through this motion at Plaid, where it created the inspiration for writing a go-to-market roadmap?

Paul Williamson: 14:32

it created the inspiration for writing a go-to-market roadmap. Yeah, so I think one of the things that I learned, especially early on in terms of my work with the two co-founders of Plaid, zach and William, is that and this is not just a Plaid-specific thing, this is like nearly every tech early stage tech startup thing is that, you know, vcs invest in highly technical founders who are going to build technical products right, which is fantastic. Really, really smart people have found a way to technically solve a quite a unique problem, and the thesis of vc right right is like let’s go invest in those people and that’s a. It’s a great thesis, and I’m not saying that that thesis is bad, but obviously, in more often than not, those founders that get invested into often have very little understanding about go to market at all. And this is again like I said, this is not just a plaid thing. This is essentially a thing that I’ve seen more broadly across the entirety of the industry, and so, in a lot of cases, what I needed to think about and the reason why this kind of concept of a roadmap became important, is because I also needed to take Zach and William and subsequently other founders after this, like through the process, like they actually did want to know about what it is that we were building, why were we building these things? And it actually made it a lot easier for me to ultimately kind of communicate what was our plan, why it was important and you know kind of like what we needed to build next. And really essentially in the early days, we were making that plan on a month-by-month basis. Hey, we just implemented this new qualification framework. We’re seeing really positive signal about it. Okay, the next thing that we’re actually going to go build around us is a little bit more sophistication in terms of how we price. Now that we’ve gotten better at qualifying our prospective customers, we understand the value that we’re creating for them. We probably need to get a little bit better about how we price, how we write a proposal for someone, because we also wanted to really make sure that we were tying what it is that we did to the value that was being created at those companies as well, and it meant that we just would continue to build into the sophistication over time.

Paul Williamson: 16:48

And again, like I said, in the early days we were literally going month by month and, like you know, we would like get towards the end of the month and I was sort of like right, like mini brief, about what the roadmap would look like for the next month. And you know, month over month, in that first year and then in our second year it was really like hey, every other month we would be kind of talking about like what was going to come up on the roadmap next. And by you know our third year it was like kind of like a quarterly roadmap. Fourth year, it was like a half yearly. Fifth year, it was kind of half yearly as well. Sixth year, we were really thinking about what the roadmap looked over a 12-month time period because obviously go-to-market had continued to get larger over that time.

Paul Williamson: 17:25

As I said, you know, we were founded and we had about four people when I started. By the end it was close to 200 in the go-to-market organization and so it’s very hard to be operationally changing things month over month with that many people. Like the impact that that would have on the business is actually probably quite negative, like the speed of change at that point. But it really resonated and it was really important for us in those early days to have a real rapidity of change. And the great thing is by also writing down by also documenting these things. It kind of kept me a little bit in check too, of like, hey, am I investing in and putting the effort into the right things at this point in time?

Paul Williamson: 18:10

I think most you know go-to-market leaders, when they start inside an early-stage business and I hear this from former colleagues who’ve all entered into kind of like going from like large tech into early-stage startup, there’s often this like paralysis because there’s just so many things that could potentially be done in a period of time.

Paul Williamson:18:33

And it actually gave me real clarity of thought about being focused on what was important at that moment for us as a business.

Paul Williamson: 18:43

It wasn’t about, you know, taking the playbook that I knew and superimposing that into the business that I was in. The playbooks that I’ve known and learned and had an appreciation for over the course of my career are really just, it’s just information that I’ve got and I need to work out whether the things that I’ve learned and experienced before are applicable to the situation that I’m in today. It’s not about taking the thing that I was at and dumping that on top of the business, because I think overly building process in the early days of companies is nearly as risky as no process and there’s that really healthy balance that you need to have and I think go-to-market leadership probably feel this most acutely out of anyone is like really making sure that we’re building appropriately for the stage of company that we’re at and we’re not overbuilding. In fact, you probably want to feel like you’re just always a little bit behind in terms of, like, your go-to-market structure relative to the rest of the company.

Sophie Buonassisi: 19:49

What came after that, as you started to move away from all the inbounds and really double down on the high quality prospective accounts.

Paul Williamson: 19:58

Yeah. So one of the things that became important for us right as we started to recognize who the most high value clients for us were. Then the question that became is like, okay, cool, what do we need to do to seek out more of those really high value clients for us? And so then we started to think a lot more about what is our acquisition strategy, what is our distribution strategy for us inside the business. You know, we had a you know very positive impact from some early product partnerships that I mentioned. But what we needed to start thinking about is okay, cool, we need to start to diversify our top of funnel. And what does that look like? What are the other channels for us from an acquisition standpoint? Should we do more things from a partnership perspective?

Paul Williamson: 20:46

And this was, by the way, for us in the early days, it was partnership referral, not partnership selling.

Paul Williamson: 20:52

We got to partnership selling much, much later in the journey for us at Vlad, but we really then started to think about okay, cool, what do we need to do to go start generating better, high-quality type of funnel?

Paul Williamson: 21:06

Let’s get more committed to field marketing. Let’s commit more in terms of kind of like our SEO. Let’s start to get into things like pay, let’s start to get into things like outbound, and so we really wanted to then go to start to diversify the things that we did from a top of funnel activity for us, and that was a really critical thing. But it was only once we could see really clear repeatable patterns for us in the business that it then made sense for us to go and invest into these other channels, because we knew that if we put a dollar in the top of the funnel from that standpoint, then the likelihood that it would precipitate into revenue for us was pretty high. We were moving out of this very random Like. We were moving out of this kind of like very random but amazing stage for the business and just bringing in more structure, creating more repeatability inside the business.

Sophie Buonassisi: 21:58

And once you see that repeatability like that’s a really no-transcript incredible, incredible and overall, you know, as you scaled and started to create that repeatability top of funnel, would you say that accelerated your focus on a different type of customer than all your inbounds. So it sounds like you shifted all your inbounds to more of a plg motion. You’re building out more of that sales led motion, including including the two BDRs you hired.

Paul Williamson: 22:32

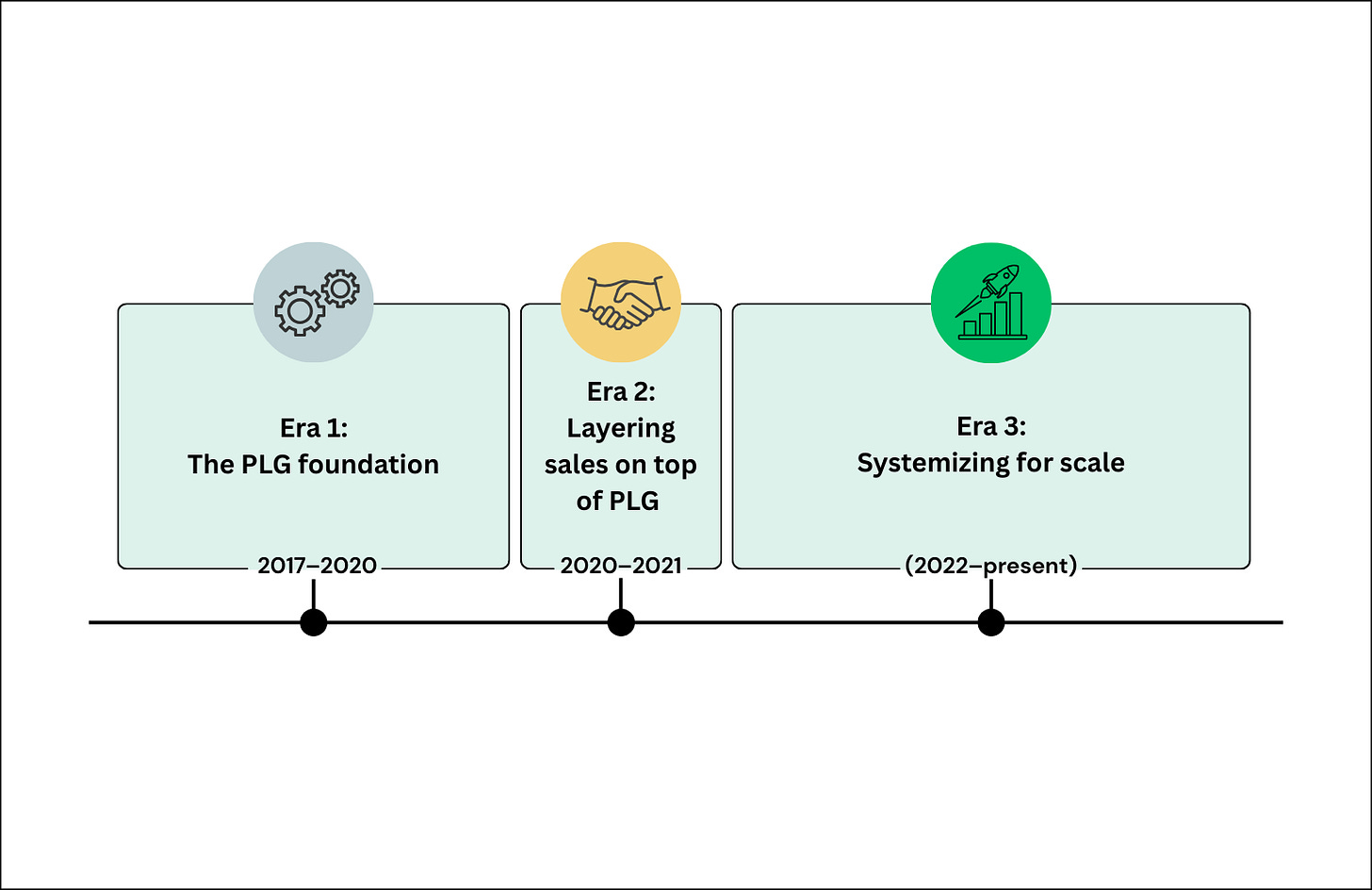

Yeah, exactly. So we went through a series of really interesting stages in terms of Plaid’s go-to-market motion and our areas of focus of the business. In the very early days we were a fintech ourselves, working with other fintechs, like some of the names I mentioned before, and look, that was a very, very fast growing, rapidly expanding part of the market. There were literally hundreds of new fintech applications kind of being built every year and people starting to kind of like bring in inside these fintechs like the kind of data that Plaid could provide to really deliver on a unique product experience. But what we also thought about over time is like obviously, like fintechs will not be the only customer for us here at Plaid and you know what is, you know what does like the next phase of growth look like for us as a company. And we had sort of like two major customer categories that we kind of thought about after the early stage FinTech. The first of that was kind of like going up market in FinTech or financial services that was to go into like the more traditional banks and wealth organizations and things like that. So starting to work with large financial institutions customers. They were obviously the large financial institutions were a big part of the data network that we were providing. But there was also real value in what we could actually provide the traditional financial services businesses as well, because they had massive businesses around savings and account opening and funding to loan originations, like you know, whether it was unsecured or, you know, secured, you know mortgages and home equity lines of credit. So we really wanted to start to kind of like move up market. But in that sense what we also knew is that the likelihood of like those traditional financial institutions coming inbound to us were very, very low. But we really then understood, you know, what our value proposition was. We knew who we needed to go to market with and we knew who we needed to target. And so we got really really clear about like who they were from a prospective standpoint and we started to kind of get more focused on outbound field marketing and other things like that to really go drive ourselves into that audience.

Paul Williamson: 24:53

And so that was sort of phase two for us as a company, which was really exciting. It’s a very, very slow process, at least at that time, selling into like the large enterprise banks and financial institutions, but it was one that we kind of committed to about two years after I started, kind of like late 2018, kind of getting into early 2019 was when we really started to kind of focus on that, because not only was it important for us to start to diversify, we also had a product that was ready to sell into that market and into that space. Because the largest of enterprises especially financial institutions and wealth and things like that they had very, very specific needs from us as a company. They wanted uptime and availability, they wanted service-level agreements, they wanted a lot more enterprise reporting and insights, they wanted things like SSO and rules-based access control and all these other things that in the early days of us, when we were working with a FinTech, those things didn’t really matter, to be perfectly honest. So we needed to not only evolve and change the way that we did our go-to-market, our product also actually needed to evolve, and this was the other big thing about having a roadmap relative to our go-to-market motion. I could then talk about our roadmap and then look, we are now going to start to focus about going up market and we’re going to need these things to become a reality of our product for us to be successful. And so then it became a bi-directional conversation between go-to-market and engineering about what we needed from a product perspective.

Paul Williamson: 26:29

And then the third market for us that we went after, that is, we went from fintech, as I said, into traditional financial institutions. We then went into what we would call this embedded fintech stage, which were companies that weren’t fintechs and companies that weren’t financial institutions, but they wanted to bring in a financial element into the product that they were offering. And a really amazing example there are, like the major telecommunications companies they wanted to actually stop taking things like credit card payments. They wanted to move from credit card into ACH and make a fundamental shift, by the way, in terms of the way that they got paid by their consumers.

Paul Williamson: 27:09

Or another really great example for us in that instance was you know, tesla was an early client on the embedded fintech side, and so you know, what was really interesting about them is like they were. They are building like one of the most modern vehicles in the world, but they were actually you’re paying by check, your down payment and things like that, for your Tesla was by check, so they were you. So this is like the most modern vehicle in history today, but they were using a payment instrument from the 1700s. So it was a really funny kind of like brand dissonance that was happening there, and so we had companies that wanted to make the financial element and elements of their product be more akin to the way that, like their modern tech, their modern stack, their modern products were there and that was really like the next phase of growth for us, as we kind of like truly moved out of just purely servicing fintechs and financial institutions but moving into this kind of like concept of embedded fintech.

Sophie Buonassisi: 28:05

What kind of AR inflection were you at where it made sense to go into this phase three, this embedded tech?

Paul Williamson: 28:13

We were scaling pretty rapidly at that point. So we were probably around about the $100 to $150 million in ARR where that became quite important for us. Obviously, we’d grown very, very rapidly with our fintechs and also with traditional financial institutions at that point, but that was when it became a really important part and that has become kind of like one of the core things of the business today for Plaid, which is really exciting.

Sophie Buonassisi: 28:40

Super exciting. Super exciting and what were some of the biggest challenges?

Paul Williamson: 28:45

We got probably just as many things wrong as we did right. We got probably just as many things wrong as we did right, and probably one of the things that I made probably like, I think, one of my most fundamental mistakes on as a leader and a lot of leaders people talk a lot about kind of like the compensation plan, the compensation structure for their teams. But one of the things to really think about when you’re building the right kind of compensation structure for their teams but one of the things to really think about when you’re building the right kind of compensation structure is also the impact that it actually has on the way that your teams sell to your customers as well. And we made a really big mistake in the early days, particularly as we were moving into, like our enterprise business, we had a commission and payout model that worked really well for high, rapid, high growth, short sales cycle SMB clients. Often people were signing a 20K, 50k, 80k order form, but they were happening pretty rapidly. We were closing deals in the same day to less than 45 days and we had a great compensation plan that really worked and was quite reflective and representative of our SMB business that we were.

Paul Williamson: 30:00

But as we started to move into the upper market where clients would then and our compensation plan really then said hey, the way that you would be compensated is essentially on the initial structure of the deal. What it actually meant was that our sales teams were actually kind of keeping a deal open for a lot longer period of time than what we would have liked. So what did we do? You know, we had incentivized in terms of our structure for the team to keep a deal open for longer, in terms of our structure for the team to keep a deal open for longer. So that meant that a deal was essentially kind of quote unquote on the street for a lot longer than it needed to be, because the way that our compensation structure reflected that was like, hey, we would pay you out on the initial structure of the deal. So what it did is like our AEs were actively delaying and trying to find not just the first use case but the second and the third and the fourth use case to make that initial deal as big as possible, because that’s what our compensation plan was incentivizing them to do.

Paul Williamson: 30:56

That was such a fundamental mistake for us because it actually meant that our deals were staying out there a lot longer than we would have expected, because people were trying to supersize these things, and so what it did is that it just created way more surface area for us to make a mistake in the sales cycle.

Paul Williamson: 31:13

It often meant that it was then that our competitors would actually become involved in the sales cycle, so we actually kind of like created more competition for ourselves in that process, and we essentially were just creating more risk in terms of getting deals done, and so that, for me, is probably one of like the standout mistakes that I made, along with like hundreds of other mistakes that we made over the course of the six years that I was there. But that was probably one of the biggest ones, and we needed to go make that change. And once we again we recognized that that problem existed. We made a wholesale change to the way that our compensation structure worked. In fact, we ran different compensation structures based on the different roles that we had inside the business, because that’s what the business warranted. We couldn’t build a structure that was just one size fits all.

Sophie Buonassisi: 32:03

And that’s great advice for anyone really building out their teams too is to think about that whether a blanket process makes sense, whether it makes sense to build them in silos a little bit more. So very, very helpful and, paul, this has been fantastic.

Paul Williamson: 32:17

We really wanted to kind of like keep things simple, and I think that like that’s a really important thing, especially in a rapidly changing, rapidly evolving environment, and I think that that would probably apply not just for Plaid, but like many, many high growth startups that are out there today great advice.

Sophie Buonassisi: 32:31

That’s fantastic. And, paul, as you are actively advising companies right now and learning and staying up to date with AI and everything of the sort, are there any any books that have made the biggest impact on your career?

Paul Williamson: 32:46

yes, um. So I mentioned before kind of thinking about, you know, essentially, kind of improving the business and, you know, making today just a little bit better than we did yesterday. I’ve always talked about this concept for a really long period of time and it wasn’t until I read this book. I read it a couple of years ago, so it was this book by James Clear called Atomic Habits. So essentially like, how do you go build like repeatable habits inside the business? It really really resonated with me. I think I had sort of like articulated versions of that kind of concept for a really long period of time, but it really really hit home for me personally. I know that it’s a very, very popular read by a lot of people, but it was really impactful. In fact, we actually got James to come to our revenue kickoff in 2021, I think it was, or, yeah, 2021 or 2022, and really spent time with the entirety of the Plaid team and that, for me, was really impactful.

Paul Williamson: 33:53

And I’ll give you a second one A, because I was a contributor to this book, but B, I think it’s a fantastic one. So Index Ventures actually is a fantastic VC, but they’re also a fantastic publisher and they actually wrote a book a couple of years ago and released it and it was called Scaling Through Chaos and I think it’s a really important book for not only founders to read. It’s largely directed at founders, but I think it’s also really important for go-to-market people to read this, largely because it will help get you into the mind of what it is like to work with a founder, some of the pressures and the challenges and issues that they face daily and kind of like where our role is go-to-market leadership should fit relative to founders. So I think that like that’s an important kind of like industry read for anyone.

Sophie Buonassisi: 34:39

Great, great recommendations there. We’ll drop them in the show notes and both fantastic reads. I think the James Clear one I actually got notes of earlier in your conversation, Paul, this has been fantastic. Where can people find you?

Paul Williamson: 34:51

Best place to find me is on LinkedIn.

Sophie Buonassisi: 34:53

Brilliant, that will also be in the show notes, Paul. Thank you so much to all our listeners. Thank you for joining us and we will see you next week.