How to Price Your AI Product: A Practical Guide for Early-Stage Founders

Pricing is one of the hardest decisions founders make. And in the AI era, it’s become one of the most critical to get right. Costs move quickly, usage patterns shift unpredictably, and buyers are suddenly much more sensitive to how value gets delivered. What used to be a simple question of “What should we charge?” now carries much higher stakes. Companies used to be able to “afford” to get pricing wrong. Now, pricing is a foundational part of your go-to-market and can make-or-break how you scale.

The urgency and importance can be felt and seen in every founder conversation. We felt this firsthand in a session that GTMfund recently hosted on pricing strategies as part of a founder breakfast event.

Drawing from Spyri Karasavva’s experience leading pricing at Stripe and now building Dealops to help GTM teams make smarter pricing and quoting effortless, this edition breaks down the exact frameworks early-stage teams can use to avoid the most common pricing mistakes.

You’ll learn how to define the value you create, how to choose the right pricing metric, how to structure pilots and design partnerships, and how to avoid the common mistakes that slow teams down.

HockeyStack is the AI platform for modern GTM teams. It unifies all your sales and marketing data into a single system of action. Built-in AI agents help teams prospect the right accounts, improve conversions, close and expand deals, and scale what works.

That’s why teams like RingCentral, Outreach, ActiveCampaign, and Fortune 100 companies rely on HockeyStack to eliminate wasted spend, take better decisions, and make space to think. Learn more at hockeystack.com

1. Understand the value you create (before you even think about pricing)

The biggest mistake founders make is jumping into metrics, tiers, or price points before they understand the value their product actually creates. Especially in AI, where workflows span multiple teams and value can be abstract, you need a clear view of how your customer will benefit from your product.

Spyri recommends looking at value through two lenses:

1. What metric are you actually moving?

Think: tickets resolved, meetings booked, hours saved. This is the “observable activity” that your product changes.

2. What financial outcome does that metric create?

How does resolving those tickets faster save money?

How does increasing meeting volume grow revenue?

What’s the full cost of the problem you’re eliminating?

Once you understand the value, you can estimate how much of it you want to capture.

A useful rule of thumb:

- Buyers typically buy at ~6x ROI

Put in another way, vendors generally can capture 15–20% of the value they create

It’s a simple framework, but it helps you avoid two common traps: charging too little because you’re unsure in the value, or charging too much because the numbers “feel” big.

Ultimately, the goal is to align value creation with value capture.

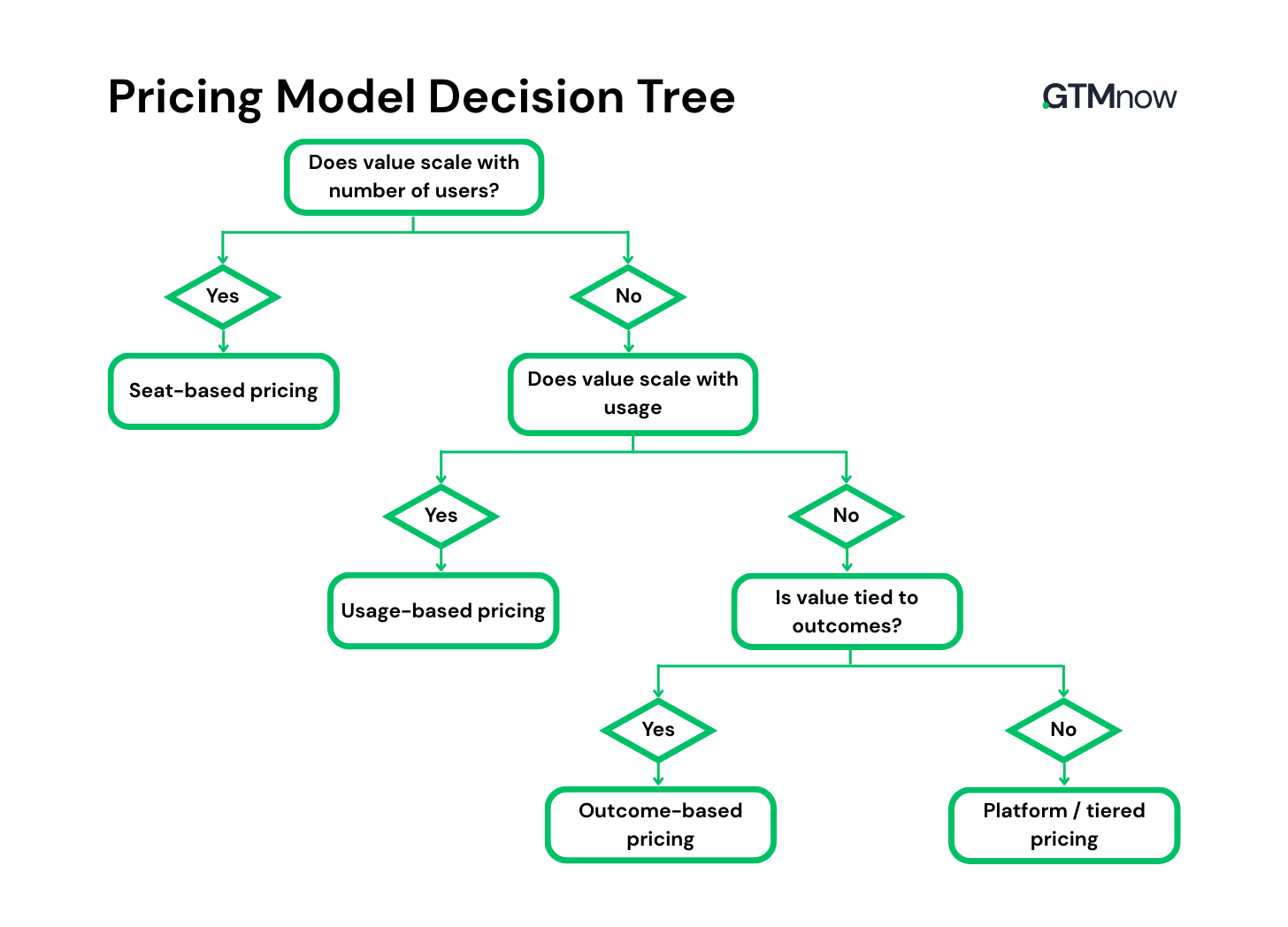

2. Choose your pricing metric carefully (it’s hard to change later)

Your pricing metric is the foundation of your pricing model. It shapes how customers think about usage, value, and cost. And once customers anchor on it, changing it becomes extremely hard.

Founders often pick a metric based on what sounds ideal, now usually something tied to outcomes because it’s at the forefront of AI conversations. But early on, the easier path is often the better one:

- Choose a metric customers already understand and buy (seats, credits, API calls)

- Use future deals to experiment with outcome-based or hybrid models

- Gradually move toward your ideal model as you build trust and proof

Spyri learned this firsthand. Dealops repeatedly increased ACV by ~30% and initially wanted to price based on revenue uplift. The market resisted, not because the value wasn’t real, but because buyers didn’t want to negotiate uplift every month.

Her lesson: start with the market’s reality, not your ideal state. Keep experimenting privately. And let your pricing model evolve with your product.

The other principle to keep in mind is to set your list price higher than you’d initially expect. You can discount early on, but raising your public price later, especially if customers are already anchored low, is one of the hardest pricing moves to execute.

3. Separate design partnerships and pilots

Founders often combine these two phases into a single blurry experience, which leads to scope creep, endless feature requests, and no path to contract.

It’s helpful to separate them cleanly:

Design Partnership: A period of co-creation.

You get insights.

They get influence.

The goal is learning.

This phase can be free, but it should be time-bound, specific, and clearly positioned as step one.

Paid Pilot: A period of validation.

The product is being used to do real work.

The goal is proving value.

Pilots should always be paid, even if the total amount feels small because of the shorter duration. But you have to ask to confirm that you’re speaking to someone who can actually make the buying decision.

Two other best practices:

- Price the pilot using the same metric you’ll use long-term.

- Price the pilot higher than you think because you’ll never go up from the pilot price.

This structure creates clarity for everyone involved and prevents months of unpaid work that lead nowhere.

4. Start contract conversations earlier than you think

Almost every founder waits too long to start commercial conversations. They finish the pilot, and then start talking price. This is the worst possible moment: excitement is lower, urgency is gone, and your leverage drops daily.

A recommended timeline is to start contract conversations halfway through the pilot. If it’s a 60-day pilot, begin discussions around day 30. If you expect their legal reviews to take some time, begin them even earlier.

The goal isn’t to pressure the buyer, it’s to prevent a gap between pilot completion and contract execution. That gap is where momentum dies and deals get stuck.

Think of it as running two tracks in parallel: validating the product and preparing the commercial relationship.

5. Your first 10 deals matter more than you think

Early customers don’t just give you revenue, they give you proof. In many cases, they also give you:

- Case studies

- Reference calls

- Logo rights

- Product feedback

- Candidate credibility

- Investor credibility

So your first deals should be structured with this broader value in mind.

Buyers will push on legal and commercial terms. They’ll ask for lower liability caps, more restrictive data usage language, and non-standard billing terms. These asks are common and manageable.

What you want to protect:

- Infinite liability (never accept it)

- Your unit pricing

- A path to expansion

- Your long-term optionality

What you should fight for:

- Logo rights

- A case study

- Upfront payment (when you can get it)

- Clear usage metrics

A helpful rule of thumb: If you give something, get something.

If you discount, ask for a reference.

If you remove an auto-renew clause, ask for a case study.

This keeps deals balanced and aligned.

6. Raising prices later requires one thing most teams skip

Pricing changes used to happen every 5–10 years. In AI, they happen at Seed and Series A. Plus, they carry greater weight than they used to.

This key principle is simple and super important:

You can only raise prices when you add new value.

New features, new modules, new bundles, new performance, new scale.

Price increases without new value feel arbitrary. Price increases with new value feel natural.

A phased rollout is the ideal way to do so.

Start with smaller segments, gather feedback, pause if needed, then scale. And always communicate early, clearly, and personally (especially with enterprise customers).

Pricing is a reflection of how well you understand your product and the value it creates. In a world where AI features can be copied quickly and technical advantages fade fast, pricing becomes one of the few durable ways to communicate what your product is worth and why it matters.

Tag @GTMnow so we can see your takeaways and help amplify them.

More for your eyeballs

Elon Musk is exploring a potential merger between SpaceX, Tesla, and xAI, bringing hardware, software, and AI under one roof. If it comes together, it’s a clear signal that the next wave of advantage may come from owning the full stack, not just the model.

The Inovia State of Canadian Software Report 2025 highlights a maturing Canadian tech ecosystem outperforming major European and APAC markets. From 2024 to 2025, Canada saw 29% YoY VC funding growth, while most global hubs declined by approximately 3% excluding the U.S.

More for your eardrums

GTM 177: Why Most Founders Build the Wrong Company (And Realize It Too Late), with Lou Shipley, Former CEO and Co-Author of Unlikely Entrepreneurs

Get a sneak preview here. For the full thing, listen on Apple, Spotify, YouTube or wherever you get your podcasts by searching “The GTMnow Podcast.”

Startups to watch

Monk – is taking a contrarian approach to revenue automation by building for trust, not just dashboards. Every number is traceable and defensible, with finance teams able to see exactly how cash and collections tie back to reality. It’s an important shift in how revenue tools earn credibility with accounting and finance.

Hottest GTM jobs of the week

- Business Development Representative at Stotles (London, UK)

- Mid-Market Customer Success Manager at Noibu (Hybrid – Toronto, Canada)

- Customer Success Manager – Enterprise – Q1 27 at UserEvidence (Remote – in San Luis Obispo, CA / Denver, CO / Nashville, TN / Salt Lake City, UT / Jackson Hole, WY)

- Sales Operations Specialist at Nectar (Lehi, UT)

- Enterprise AI customer success manager, adoption (East) at Writer (Hybrid – New York City)

See more top GTM jobs on the GTMfund Job Board.

GTM industry events

Upcoming events you won’t want to miss:

- Above the Fold (for marketers): February 9-11, 2026 (Fort Lauderdale, FL)

- [GTMfund Event] 100X Your Campaign Launches Using Claude Code: February 17, 2026 (San Francisco, CA)

- Funnel ‘26: March 5, 2026 (Austin, TX)

- Spryng (for marketers): March 24-26, 2026 (Austin, TX)

- SaaStock USA: April 15-16, 2026 (Austin, TX)

- SaaStr Annual: May 12-14, 2026 (San Francisco, CA)

- GTMfund AGM + Retreat: May 14-16, 2026 (San Francisco, CA)

- INBOUND: September 16-18, 2026 (Boston, MA)

- Pavilion GTM2026: September 28-October 1, 2026 (NYC, NY)

- TechCrunch DISRUPT: October 13-15, 2025 (San Francisco, CA)

- GTMfund dinner schedule coming soon!

GTMnow community love

Some GTMnow community (founder, operator, investor) love to close it out – we appreciate you.