In this blueprint, we provide insights on how to build a sales organization structure that yields results. The changes in SaaS require that we no longer look at salespeople as individual contributors, but rather a team that crosses disciplines, not just within sales but also across other departments such as marketing and product. In this article, we talk about optimal sales team structures, and how to choose the right one for your organization.

A winning sales force structure plays a critical role within a business organization. First, it ensures that roles are clearly defined. Also, it helps sales reps and companies reach their goals.

An efficient sales department structure has numerous benefits, such as:

- Reduced employee conflict

- Improves the communication between employees and with clients.

- Maximizes employee performance

- Improved decision making

Having discussed the benefits and importance of an efficient sales force structure, let’s define what a sales organization structure is.

What is a Sales Organization Structure?

A sales department structure refers to the design of the sales team. It comprehensively outlines the objectives and responsibilities of all members of a business organization. A sales organization structure can also be defined as the segmentation of a sales team into specialized groups, each with their distinct role.

Sales team structure may be determined by factors such as :

- Regions served

- Size of your sales team

- Number of products/services offered

- Size of customers

7 Types of Sales Organization Structures

1. The Assembly Line

In the assembly line model, the sales team is organized according to an individual’s job title. Leads are handed off between specialized teams, just like in an assembly line. The goal of this sales structure is to move prospects through the different stages of the sales cycle.

PROS

-

- Promotes specialization.

- Sales Representatives become experts within their respective fields.

CONS

-

- Risk of poor customer experience due to many handoffs.

- Additional costs from specialization.

2. The Island

In the Island model, one representative is charged with the responsibility of managing their prospect from the lead generation stage until they become a customer. This sales organization structure is frequently used by smaller sales teams looking forward to increasing their output. Sales departments which benefit through one on one customer interaction may also adopt this sales structure.

PROS

-

- Creates a competitive culture.

- Maximizes individual output.

CONS

-

- Managing numerous accounts may be stressful.

- Places priority on individual success over team effort.

3. The Pod

The Pod is a combination of the island and the assembly model. A pod consists of specialized representatives who handle prospects through various stages of a sales cycle. This sales organization model is primarily used by large business organizations as it divides the sales team into smaller groups.

PROS

-

- Enables smooth handing off of leads.

- Allows adjustments to sales teams according to skill.

CONS

-

- Often shields poor performers behind successful teammates.

- Makes individual motivation more challenging.

Aside from the Assembly, Island and Pod organizational models, there are four models which can be divided by:

- Geography/ territory

- Product/service line

- Customer/account size

- Industry/vertical segment

4. Geography & Territory Structure

This sales team structure allows members to become familiar with their geographical surroundings. The sales team may even develop a rapport with local businesses and conduct research on their competitors.

It makes evaluations for sales representatives easier by focusing on performance and potential of a specific location.

5. Product & Service Line Structure

Sales teams are organized according to the services and products they sell.

It helps sales reps to align with like-minded individuals in terms of product/service and even geographically.

Sales teams become specialized in their products, mastering the sales process, consequently increasing revenue.

6. Customer & Account Structure

This is a popular sales team structure that aligns well with account-based marketing (ABM).

In companies with strong ABM team structures, sales teams structured by customer or account can master the ins and outs of working with a particular account, putting them in a much better position to meet the specific needs of the client.

7. Industry & Vertical Structure

Another way a sales team can be structured is by industry, or vertical.

Sales teams specialized in a particular industry would have more experience and understand the nuances of that industry, resulting in higher close rates.

If your organization handles sales across multiple industries, we recommend breaking your sales team structure by vertical.

The Winning By Design Blueprint Series

The Winning By Design Blueprint Series provides practical advice for every part of a SaaS sales organization.

CASE IN POINT: Over the past decades, B2B salespeople were referred to as individual contributors.

Reps were hired, trained and compensated to perform as an individual to hit a quota. This comes from a time when enterprise sales people left the office on a Monday to return to base on Friday with signed purchase orders, submit expenses, update the funnel, etc.

In today’s world, this may sound like something from a movie; however, most sales organization structures have not been updated since these days.

Traditional vs. Modern Sales Team Structure

Traditional Sales Organizations – Growth of headcount in sales was structured around revenue per individual contributor (IC). The model used a waterfall-like model that ramps up over the course of a year, in which an individual contributor brings in $2M/IC per year.

To hit $8M, a VP of Sales would hand out $10M in quota @ $2M/IC. This would mean five ICs were needed. Each IC would be assigned to a region. The regions were based on ZIP codes calculated to represent approximately to have the same amount of potential.

With the increase of quota, simply the number of salespeople were added to reflect the increase in quota. ( e.g. $2M per person, and handing out ~20% more quota vs. what the real goal was.)

The root cause of today’s challenges can be traced back to the use of this outdated model based on a low volume of deals at a higher price.

Modern Sales Organizations – Due to lower deal value (ACV), ongoing renewals are required to achieve the same profit. This may take >24 months.

Due to the lower price, it also requires a higher volume of deals to attain a similar kind of growth. What complicates this model is the high-velocity it operates on; many clients commit within 90 days or faster. This high-velocity creates a “manufacturing line” approach.

CASE IN POINT:

Acquisition needs: To grow revenue annually, SDRs need to find business for AEs who attain clients, commitment, and help them on-board to the point they can use the service.

Recurring needs: Today it is obvious that a company no longer can just send in an annual renewal, but through the use of CSMs and AMs, they need to ensure clients are using this AND identifying new opportunities within the account.

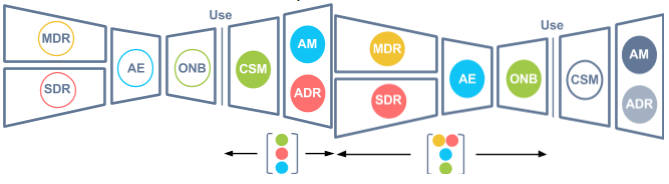

- MDR: Market Development Rep – Follows up on inbound leads, set up a meeting w/ AE.

- SDR: Sales Development Rep – Starts a conversation with a client through outbound actions such as emails/calls.

- AE: Account Executive – Develops SQLs through a series of meetings.

- ONB: Onboarder – Onboards/Integrates a client and achieves first use.

- CSM: Customer Success Manager – Achieves recurring use of the service.

- AM: Account Manager – Creates increased profit developing upsell opportunities.

The Sales POD: A Special Type of Sales Team Structure

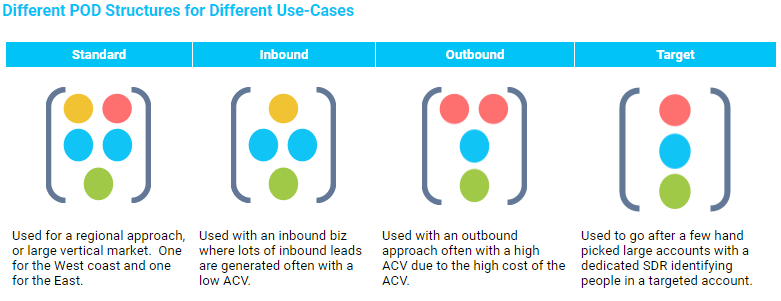

By grouping specialized team members, a self–contained unit is created, also known as a POD. The self–contained unit can operate in a specialized area; such as a market, a region, or a segment. It can do so for the entire time, or rotate through a series of segments (we call these sprints), or address a specific event such as a trade show.

How a POD works:

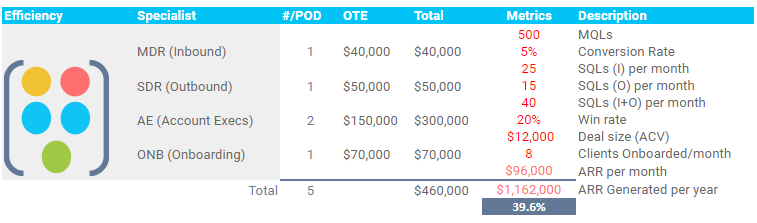

A 2×2 POD is depicted in which a MDR/SDR is partnered with 2 AEs.

The MDR/SDR combo sets up 40-60 meetings for the AEs each month.

From these meetings, the AEs close 6-8 deals per month with an ACV of $18,000.

POD Modeling

Historically, the efficiency of these PODs was not considered an issue due to the extreme focus on winning logos.

However starting in 2014, the tides turned as the number of SQLs/SDR dropped from 20-30 to low 10s.

The annual on target earning (OTE) of this POD should not exceed 40% of annual revenue.

Scaling Your Revenue Growth

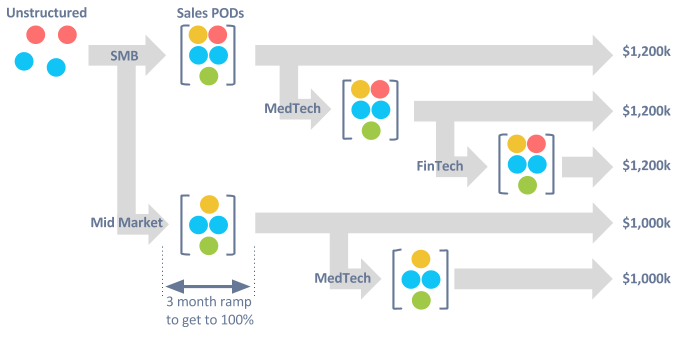

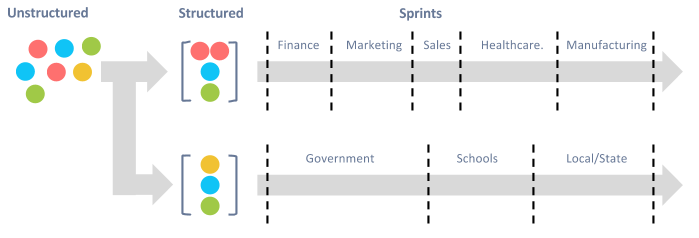

Scaling of the revenue now occurs by scaling the PODs. In the example below, you will notice how at first our teams operate unstructured.

A group of SDRs creates SQLs and they are randomly assigned to a group of AEs.

To grow, the company needs to structure its resources into two initiatives; SMB and MidMarket, each requiring a different approach.

As the business grows, new markets are discovered, and new PODs are launched to call on these markets.

A few metrics to keep in mind for most B2B sales organizations:

- It takes three months to ramp a POD to 100%.

- PODs should operate between 80-120% of quota. Do not keep raising quota – it is designed for a number.

- Once a POD operates efficiently, do not add AEs to it. This messes up the balance.

Use of PODs To Identify Markets

One of the key advantages of PODs is the realization that you can focus the resources. This is very important during the early days of scaling revenue.

[Tweet “Randomly responding to inbound does not allow you to address your sales strategy – @IndoJacco”]

In the example below, you will notice the specialization of Government vs. Commercial. You will also see each POD then going through sub-segments to heat-check markets. This allows each POD to train only on the needed use-cases/value proposition for each sprint. The sprints can vary in length, anywhere from 30 to 90 days.

Example of how to structure a sprint over time:

- Week 1: Train the team on use-cases and role-play a variety of scenarios.

- Week 2: Pursue B-leads first.

- Week 3: Market and organize an event, pursue your A-leads.

- Week 4: Pursue A-leads.

- Week 5: Wrap-up and start the next sprints.

Use of PODs with Different Business Models

You can apply PODs for different business models. The most common application is to land Platform sales, in which the team closes a deal for a CRM/ERP system, etc.

When the deal closes there is not a lot of upsell. Think of a workflow platform; in the initial sales, it may be sold for eight users in business unit X.

A year later, there are 10 users in business unit X and maybe another two seats in a new business unit.

However, in consumption sales, the POD can be deployed post-close. The figure above depicts the use of a POD in a free sign-up model.

In this model, CSMs identify those who have high consumption potential, the ADR develops the leads and the AM upsells. In this model, you may see a 2000% growth in an account.

Scale the Recruiting

We have found that PODs also allow you to scale your recruiting. A new POD can be launched by promoting the top performer of an existing POD (AE of POD 1) to become the new POD leader of POD2. The team leader of POD 1 can backfill the position within the POD and hire a new MDR.

The Importance of the Right Sales Department Structure

You can’t rely on the same sales department structure today as you did five years ago (or even last year, for that matter). The above content shows you why this is the case.

By using this advice, you can create a sales organization structure that best suits you, your team, and your sales cycle.

What does your sales team structure look like? Is it time for a change?