The New Bar for Startup Growth in the AI Era

Hello and welcome to The GTMnow Newsletter – the media brand of VC firm, GTMfund. Build, scale and invest with the best minds in tech.

A few months ago, a16z released new growth benchmarks for early-stage companies: What “Working” Means in the Era of AI Apps.

It (rightfully) caused some commotion. Some of that was validation of what a lot of investors and founders have been sharing anecdotally. Companies are growing faster than ever in the era of AI and often getting to market faster than ever with a viable product. Some of the commotion was the ecosystem lamenting the death of the triple-triple, double-double playbook.

It’s an exciting and equally challenging proposition.

“Great” is no longer great anymore.”

The bar has been raised for companies across the entire early-stage ecosystem. And while we agree with the unbridled optimism of what’s possible today for startups, we also think a lot of the takeaways miss an important nuance. More than ever, every company is different. Their GTM motions are different. Their customer buying cycles are different, and their ability to grow at breakneck pace is different.

However, before we get into takeaways, let’s look at some of these numbers. It is undoubtedly an exciting time to build.

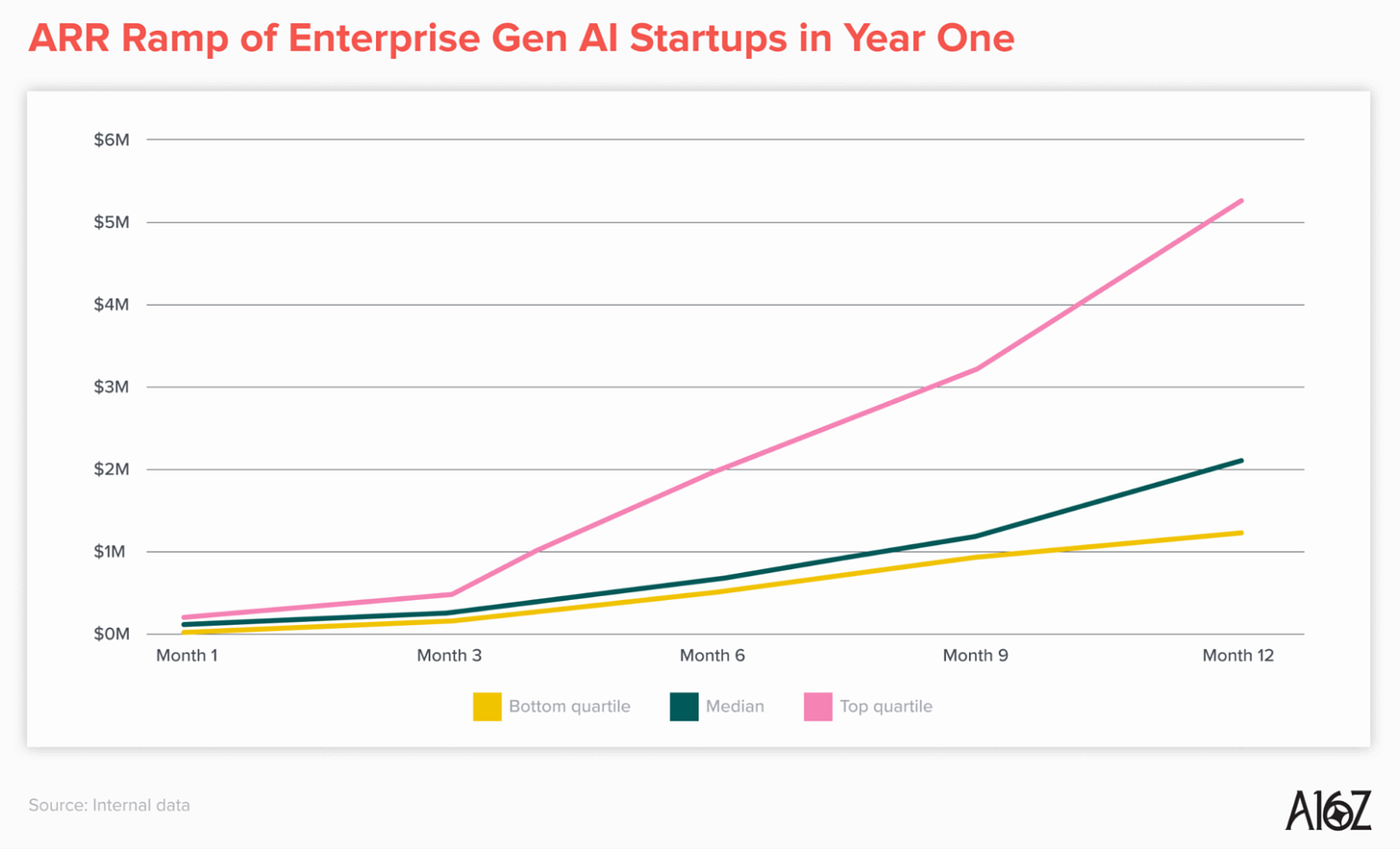

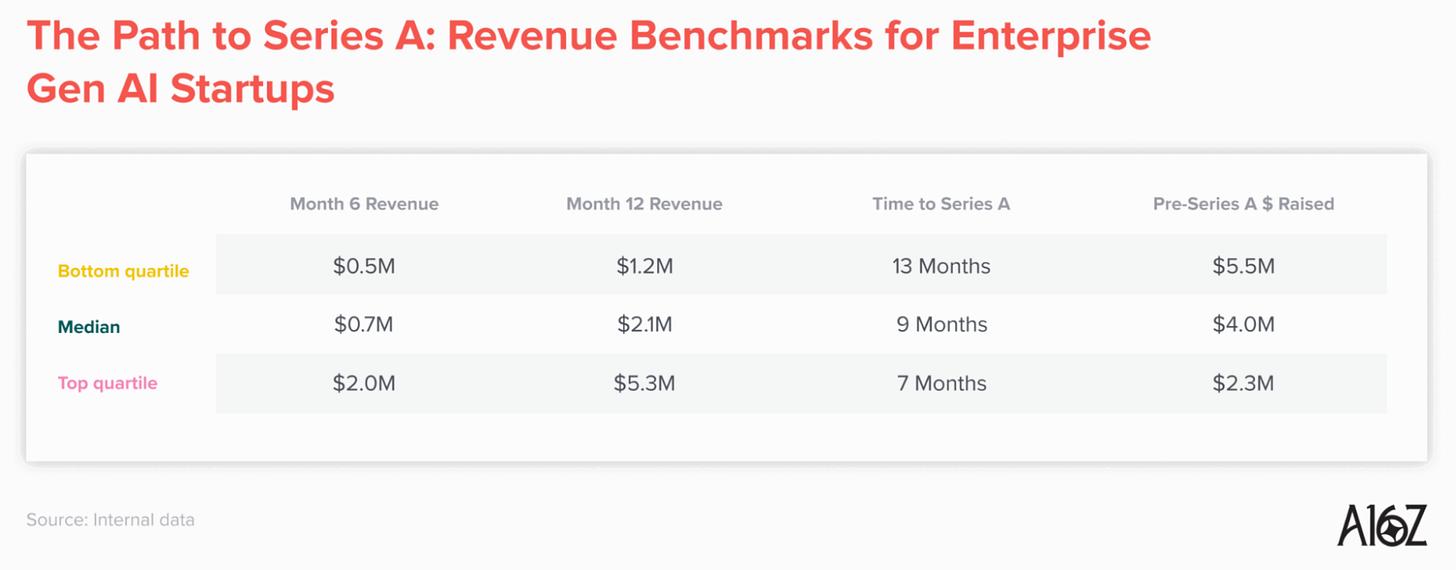

The median B2B AI startup is getting to $2M+ in ARR in their first 12 months of monetization. The median. The top quartile is getting to $5M+ in ARR in their first 12 months. The previous benchmark for “great” was $1M ARR in the first 12 months.

Efficiency has improved as well. The best companies are only burning $2 – 4M to get to the revenue marks above, putting them into an efficiency category we’ve rarely seen before. We’re clearly in a different era.

Even if that is true, we believe there is an important nuance to this discussion to call out:

“Not all B2B companies are the same.”

For the purposes of this report, startups were grouped into two categories: B2C and B2B. The problem is, not all B2B companies are the same.

If you’re an engineering leader buying Cursor, you are an informed buyer. You’ve tested AI coding tools, and you’re aware that you need to make a purchase before your team gets left behind. You’re also comfortable making that purchase without going through an elongated sales process. Your team needed the tool yesterday, and you know what you’re buying. You’re happy to pay $20-$40 per developer, and you want to do it fast.

Most of Anything and Lovable’s customers are signing up with a credit card. Same with Gamma. Mercor is a transaction/commission-based marketplace. They generate most of their revenue through successful placements, and again, you don’t need to go through a traditional sales motion to become a “customer.”

Now, let’s say you sell an AI data platform to enterprise financial services companies. Or perhaps it’s healthcare or pharma companies. Even with a top-tier AI-native product, lean team, and aggressive GTM motion, you still have to go through enterprise sales. You have to go through the procurement, legal, IT, and executive sponsorship stages of the process. Your limiting factor is your customer’s buying cycle.

We have a couple of companies in the GTMfund portfolio that fit this description. They’re both still crushing it in the context of a16z’s new benchmarks, but when we go through board meetings and GTM support, their sales motions still look like enterprise sales motions – just with more urgency.

Will the investor market catch up to this nuance? We’ll see. We believe smart investors already are. Not every B2B AI/software company is the same, because not every B2B customer is the same. To a certain extent, you’re going to be defined by the market you sell into.

A couple of other takeaways we’re watching closely:

1. Founders need GTM support earlier than ever.

Founders are generating revenue earlier and faster than ever, which means the importance of GTM execution is heightened from day one. That’s where we have the best network in venture capital, and that’s where we spend our time supporting. We’ve felt it in every founder conversation we’ve had in the past 12+ months. They’re weighing the importance of GTM support higher than ever before.

2. Churn is higher than ever.

The buyer urgency in many of these categories is palpable. Companies know they need to move fast to adopt AI and reap the benefits of this transformational technology wave. The flip side of that urgency? They seem to be more willing than ever to try and test tools before making a long-term investment. Meaning, early revenue appears to be less sticky than before. A lot of these companies raising Series A less than 12 months after generating revenue have also never been through a full renewal cycle.

We don’t know how sticky these experimental AI budgets are, or how “experimental” they are. Time will tell. We tend to believe the budgets are here to stay, but exactly where the dollars will end up long-term is a bumpier road than previous SaaS scaling journeys.

Tag @GTMnow so we can see your takeaways and help amplify them.

The Friction Report reveals what’s slowing down global software sales, and how to fix it. In this new industry report, Cleverbridge analyzed hundreds of SaaS companies to uncover the key friction points hurting revenue growth. From checkout drop-offs and localization challenges to subscription churn, it’s packed with data-backed insights on how leading software companies are optimizing every step of the digital commerce journey. Check the full report here.

More for your eyeballs

Manny Medina (Founder of Paid, ex-Outreach) argues that ACV is destiny. Most startups chase quick wins and small deals, but real scale comes from solving a CEO’s top one or two problems and owning outcomes end-to-end. Paid only builds what matters most to customers, keeps its core tech free, and deploys engineers until the problem is solved. The result: massive ARR per rep and CAC payback measured in weeks, not years.

Linear scaled to a $1.25B valuation with just 80 people by focusing on clarity, efficiency, and deliberate growth. This is their playbook behind how the company stayed small, profitable, and fast while building one of the most admired products in SaaS.

More for your eardrums

Get a sneak preview here. For the full thing, listen on Apple, Spotify, YouTube or wherever you get your podcasts by searching “The GTMnow Podcast.”

Startups to watch

Oureon – raised a $3.5M pre-seed led by GTMfund and came out of stealth to build a real-time communication layer for the sky. The platform connects manned and unmanned aircraft so they can communicate, predict, and deconflict in real time as 800M new drone flights enter global airspace.

Casium – raised $5M to help employers hire and onboard global talent faster. The platform streamlines international hiring, compliance, and payroll, giving companies a simpler way to expand teams across borders.

Hottest GTM jobs of the week

- RevOps Lead at Ona (formerly Gitpod) (Remote – UK/Germany)

- Named Accounts Manager at Gorgias (Hybrid – Toronto)

- VP, Sales & Success at Pavilion (Remote – New York)

- Head of Partner Marketing at Atlan (Remote – US/London/Ireland)

- Strategic Customer Success Manager, Life Sciences at Writer (Hybrid – London)

See more top GTM jobs on the GTMfund Job Board.

GTM industry events

Upcoming events you won’t want to miss:

- Momentum Book Tour: Leadership Dinner: November 5, 2025 (New York, NY)

- Momentum Virtual Event: Ignite your GTM with AI: November 12, 2025

- GTMfund Dinner (private registration): November 18, 2025 (Toronto, ON)

- GTMfund Dinner (private registration): November 19, 2025 (New York, NY)

- GTM x Founder Event (private registration): November 20, 2025 (New York, NY) – if you’re an AI-focused founder in NYC, hit reply to get the details.

- Above the Fold (for marketers): February 9-11, 2025 (Fort Lauderdale, FL)

- Spryng (for marketers): March 24-26, 2025 (Austin, TX)

GTMnow community love

Some GTMnow community (founder, operator, investor) love to close it out – we appreciate you.