The State of Venture in 2025

Hello and welcome to The GTM Newsletter by GTMnow – read by 50,000+ to scale their companies and careers. GTMnow shares insight around the go-to-market strategies responsible for explosive company growth. GTMnow highlights the strategies, along with the stories from the top 1% of GTM executives, VCs, and founders behind these strategies and companies.

In 2021, capital was abundant, valuations were soaring, and venture moved fast. Founders raised rounds in days. Metrics mattered, but not nearly as much as momentum.

2025 is a different world.

Today, capital is still there. But it’s more selective, more disciplined, and more demanding. Valuations are climbing at the seed stage, but follow-on conversion is dropping. IPOs haven’t returned in full force, but liquidity has (mostly through secondaries and M&A). And for the companies that break through? The exits are getting bigger, much bigger.

This is some of the insight that we went through at GTMfund’s Annual General Meeting (AGM) last week in NYC.

This piece unpacks that further – where venture is, where it’s going, and what it means for early-stage founders building now.

The bar is higher, but so are the stakes

“This isn’t 2021. The environment is leaner, but the outcomes are larger.”

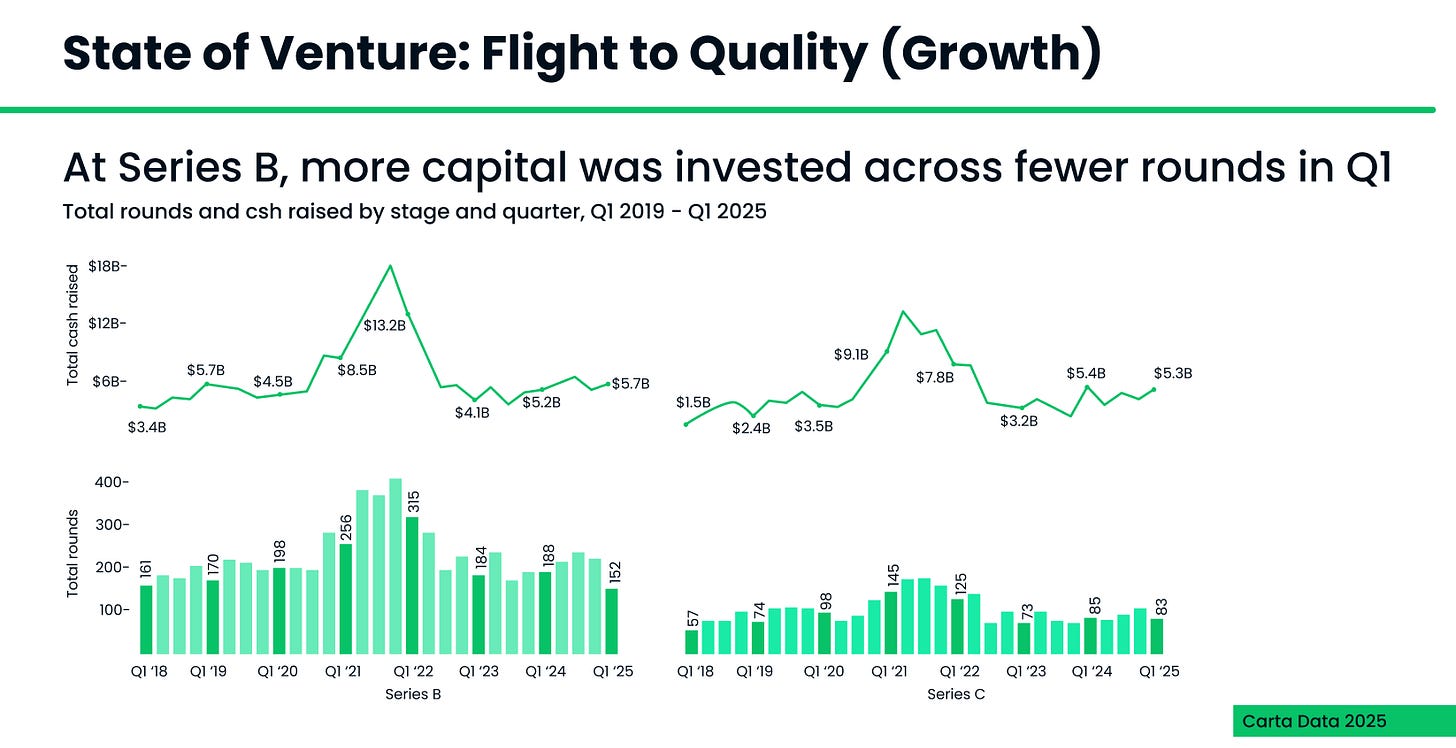

The venture market in 2025 is more bifurcated than ever. Fewer companies are getting funded, but those that do are commanding premium terms. We’re in a true flight to quality.

This is visible in two places:

- Startup formation is down – just 40% of 2021’s peak, according to AngelList.

- Capital is still flowing – but into fewer rounds, at higher dollar amounts.

At the Series B stage, Q1 2025 saw more total capital raised than previous quarters, despite fewer deals closing. More conviction, fewer bets.

This is the paradox: it’s harder than ever to raise, but for the right company capital is still abundant.

The real bottleneck is Series A

Raising a priced seed round is no longer the milestone it once was. The real crucible is graduating to Series A.

According to Carta, graduation rates from Seed to Series A have dropped significantly. For cohorts in late 2022 and 2023, only ~6–9% of companies raised a Series A within a year. Even after 2 years, fewer than 20% had graduated.

This has real implications for founders:

- You need to build GTM traction earlier.

- Narrative, clarity, and category leadership matter more than ever.

Meanwhile, seed valuations are climbing.

The median pre-money valuation in Q1 2025 is $16.1M for digital companies. Median cash raised is above $4M. This means the bar for post-seed performance has also risen—because investors expect more from a higher entry point.

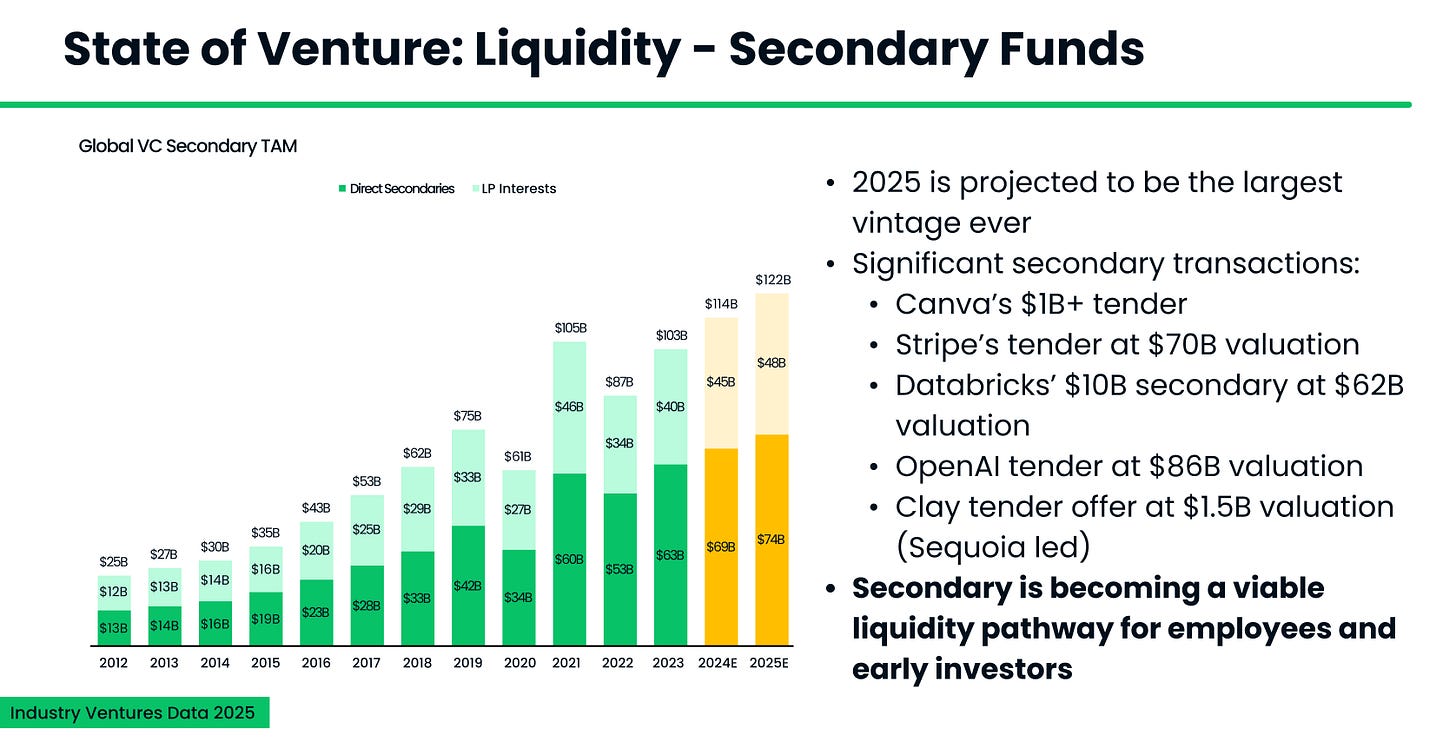

Liquidity is back – and it’s not just IPOs

Liquidity is strong, even without a robust IPO market. There are two major drivers behind this:

Secondaries are booming

2025 is projected to be the largest year ever for global venture secondaries. Stripe, Canva, OpenAI, Databricks, and others have all participated in major tender offers. There’s projected to be over $120B in secondary volume – creating real, early liquidity options for employees and early investors.

This is reshaping how long people stay at companies, how firms return capital, and how much patience is required to get liquidity.

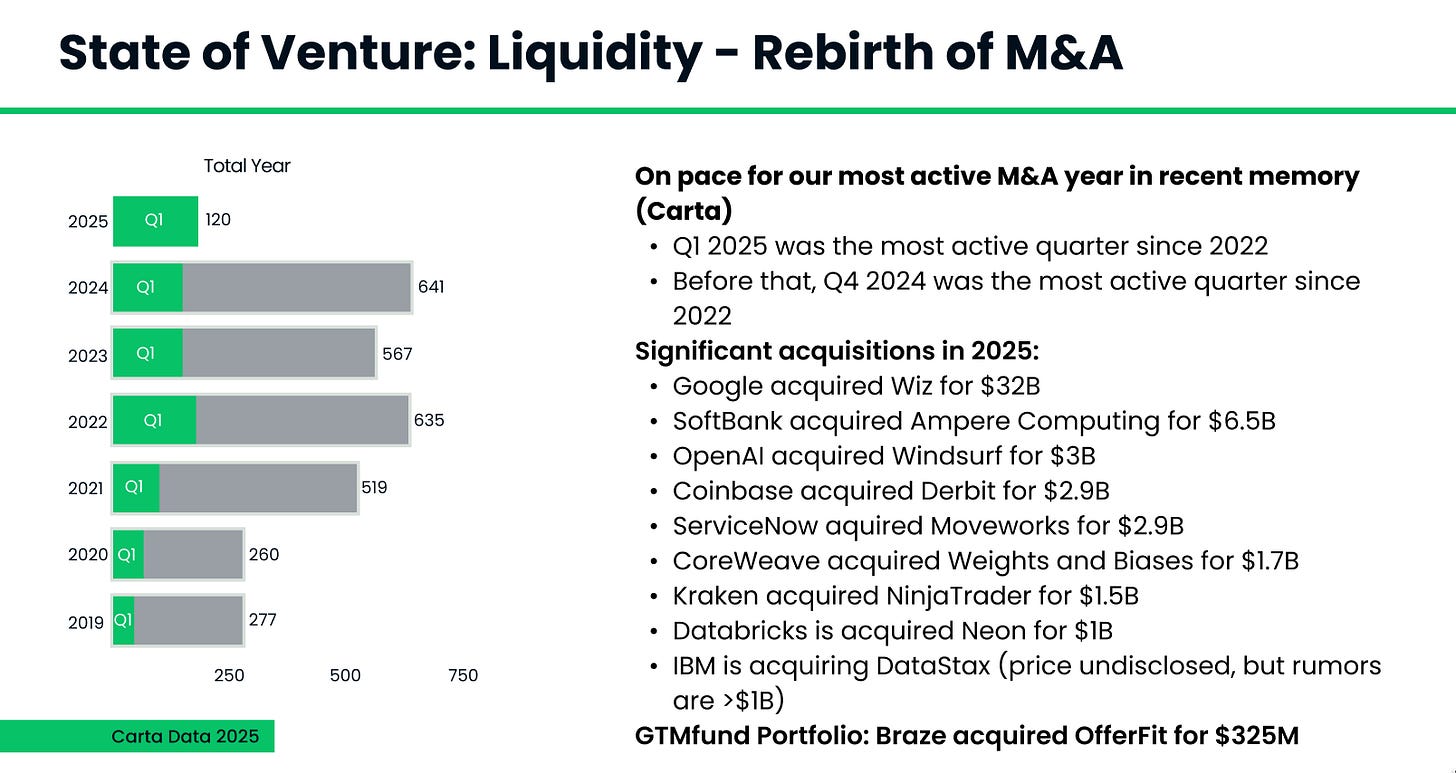

M&A is accelerating

According to Carta, Q1 2025 was the most active M&A quarter in recent memory. Q4 2024 wasn’t far behind.

Private companies are increasingly being acquired by strategic buyers, and the return of M&A has created additional options for founders looking for outcomes before a public listing.

For example, GTMfund portfolio company OfferFit was acquired by Braze for $325M this year.

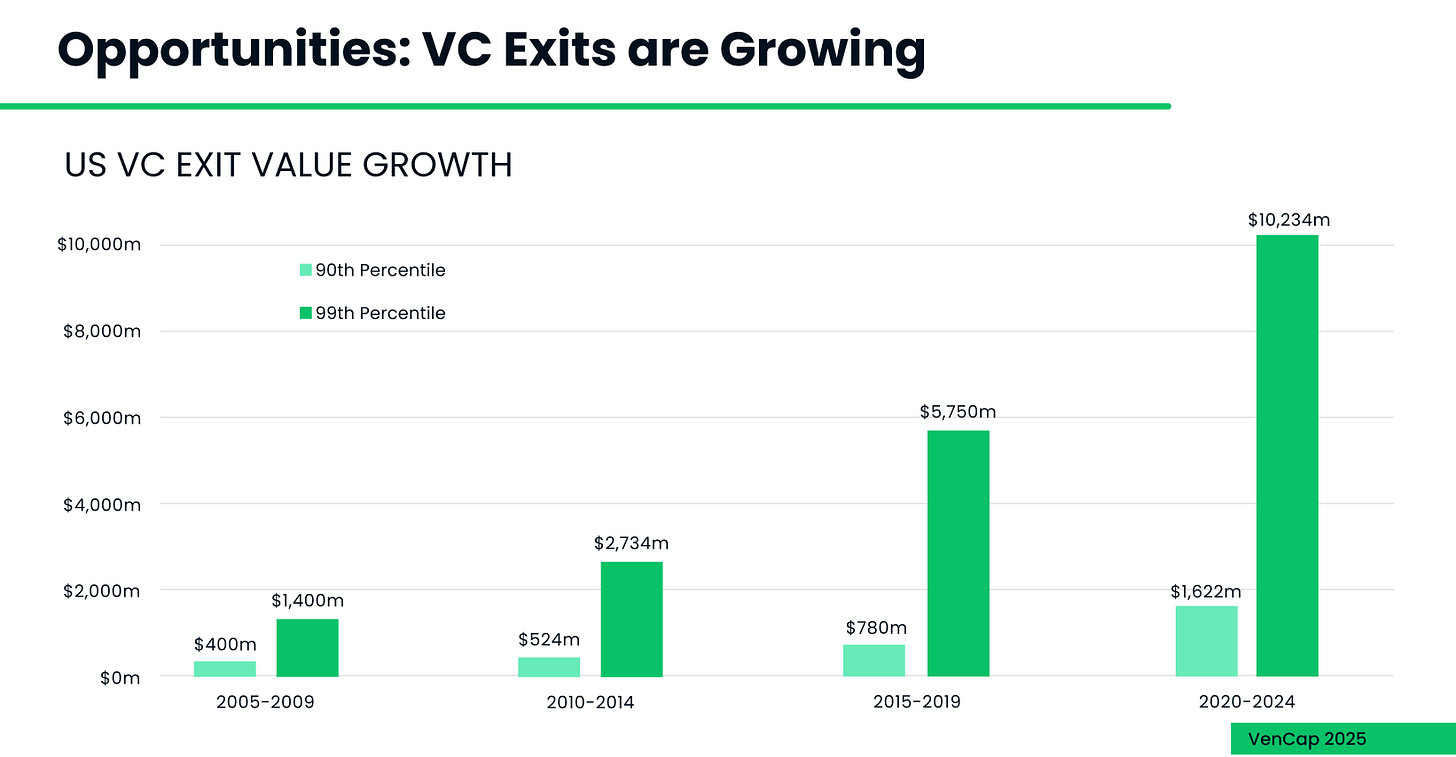

Exits are compounding faster

Liquidity is great, but what about upside?

The data shows that venture outcomes are getting significantly bigger. In fact, the 99th percentile exit today is more than 7x higher than it was just a decade ago.

In 2005–2009, the 99th percentile venture exit was around $1.4B. Today? It’s over $10.2B.

Companies are staying private longer, compounding value further, and exiting at materially higher valuations. The venture model is working – it’s just taking longer and demanding more.

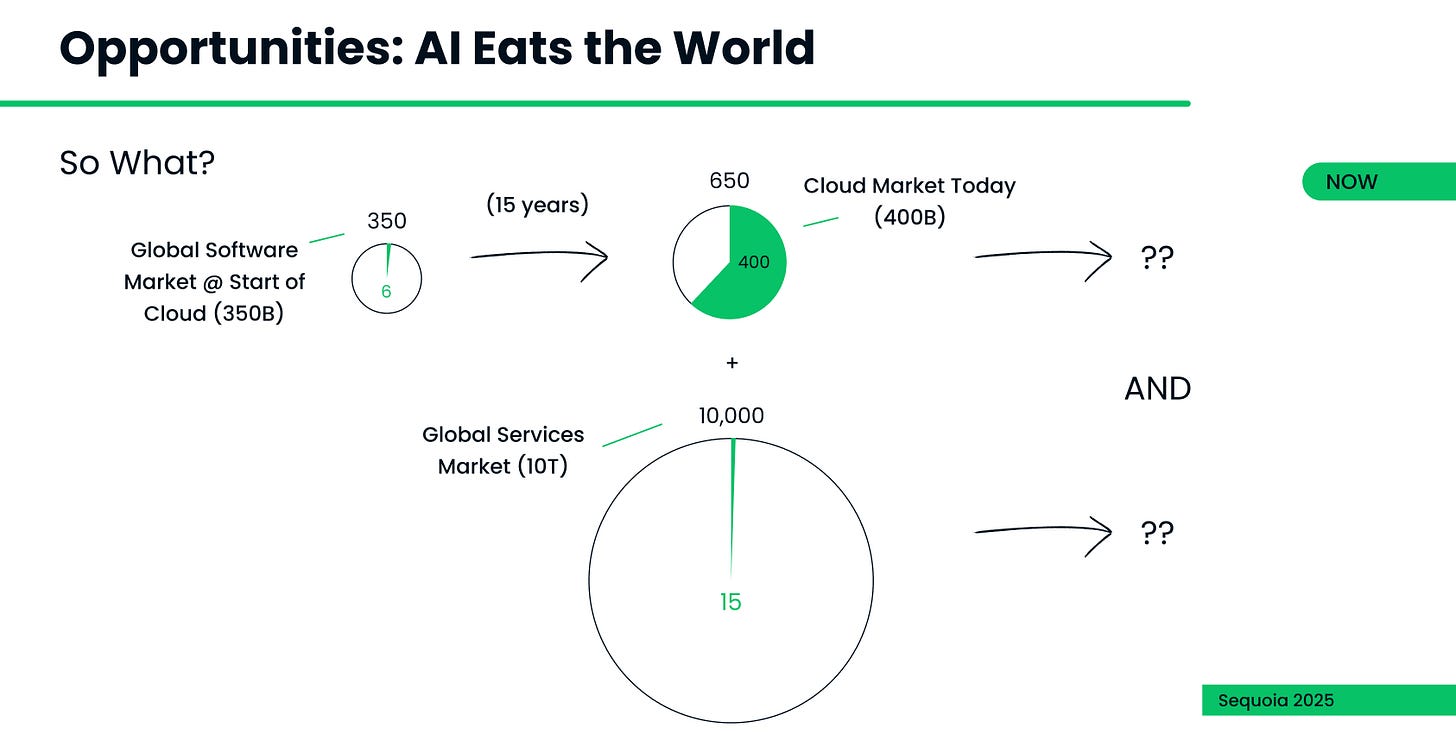

AI is expanding the market beyond software

AI is unlocking opportunity. It’s so much bigger than just cloud or SaaS.

At the start of the cloud era, software was a ~$350B market. It took 15 years to grow the cloud economy to $400B.

AI starts in a radically different place: the $10T global services market.

That means AI isn’t just expanding existing categories, it’s productizing massive swaths of manual services. And the founders who build systems that replace (or reinvent ) those services define the next generation of software.

The TAM is bigger than ever. The stakes are higher. And the tools are more powerful than anything we’ve seen before.

If you’re building something meaningful, there’s capital (and there’s upside). But you need to know the terrain. The climb is steeper, but the summit is higher.

Tag GTMnow so we can see your takeaways and help amplify them.

✅ Recommendations

This report unpacks the findings from 619 B2B buyers, sellers, and marketers to uncover the exact types of customer proof that actually build trust and boost buyer confidence. The TL;DR? They want data, relevance, and actual proof.

67% of sellers have watched deals slip through their fingers because they couldn’t provide relevant, specific customer proof. Learn how to avoid this fate.

Grab this report and learn how to give them the evidence they need.

👂 More for your eardrums

GTM 150: 80% of Exec Roles Aren’t Posted, Here’s How to Land Them Anyway with Andy Mowat

This episode explores how go-to-market leaders can navigate today’s hiring market — and land their next role in a tough market.

Andy Mowat, a seasoned operator and multi-time founder, breaks down what GTM executives need to know to stand out, get hired, and avoid common pitfalls. He shares tactical advice for senior operators re-entering the job market, how to build relationships with VCs and recruiters, and what founders are really looking for when hiring GTM leaders.

Listen on Apple, Spotify, YouTube, or wherever you get your podcasts by searching “The GTM Podcast.”

🚀 Startup to watch

Writer – debuts at #22 on the CNBC Disruptor 50 list. Writer helps enterprises build custom AI apps using their own data—on-brand, compliant, and ready to plug into existing workflows. Trusted by 300+ companies, it’s delivering serious ROI where generic AI tools fall short.

Cursor – raised $900 million in Series C funding. Cursor is redefining how software gets built—an AI-native dev environment that’s already powering the next wave of high-growth startups. With nearly $1B in fresh funding and a $10B valuation, it’s an intesting one to keep an eye on

👀 More for your eyeballs

How Generative Engine Optimization (GEO) rewrites the rules of search. A new paradigm is emerging, one driven not by page rank, but by language models. We’re entering Act II of search: GEO. This is something we’re diving deeper into as a community at GTMfund and will report thoughts on.

🔥 Hottest GTM jobs of the week

- Marketing Development Representative at finally (Boca Raton, FL)

- Senior Growth Marketing Manager at UserEvidence (Remote – US)

- Growth Product Manager at Owner (Remote – US/Canada)

- Account Executive – SMB at Gorgias:

- Account Executive at Alt (Remote – US)

See more top GTM jobs on the GTMfund Job Board.

If you’re looking to scale your sales and marketing teams with top talent, we couldn’t recommend our partner Pursuit more. We work closely together to be able to provide the top go-to-market talent for companies on a non-retainer basis.

🗓️ GTM industry events

Upcoming go-to-market events you won’t want to miss:

- GTM 25 Roadshow London (by ZoomInfo): June 19, 2025 (London, UK)

- Pavilion GTM Summit: September 23-25, 2025 (Washington, DC)