8 Predictions for 2026

For as long as I (Max) can remember, I’ve intentionally used the holidays to reflect and write my predictions for the future. This year, AI is a dominant theme, but how can it not be? It’s one of the biggest platform shifts in history. It’s still early, so it should only get even more exciting in 2026. Here we go!

1. The big players come back in a big way

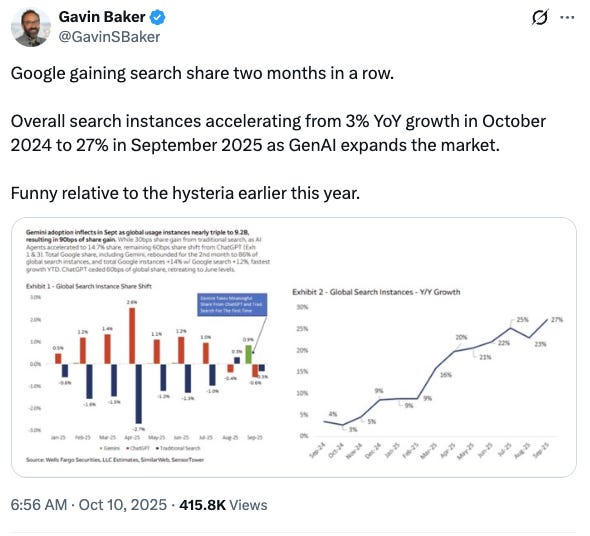

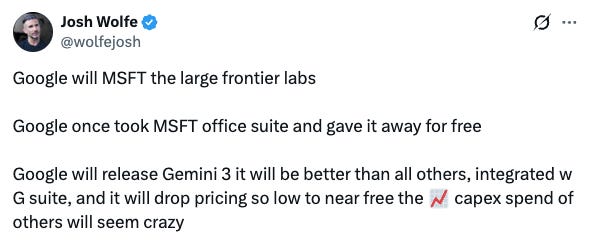

We’re already starting to see it with Google and OpenAI, but the incumbents let the newcomers into the castle, and they’re finally waking up to the fight.

With AI, it’s easier than ever to build a product, but real innovation comes from strategy (GTM), networks, data, and competence (defensibility). It’s hard for big companies to drive urgency the same way as a founder in a smaller business, but we are starting to see there’s so much more that big companies can do to innovate as long as they are willing to do it.

Sometimes it means scraping previous products or cannibalizing revenue streams. The outcomes on the other side are worth it, and Google is a soaring example. In early 2025, people were ringing the alarm bell on Google. AI was driving traffic away from traditional search. If Google wanted to compete, they needed to destroy the tenants of “ten blue links,” cannibalize one of the most dominant product lines in the history of capitalism (search and ads), and become AI native. They’ve done exactly that. It may have hurt the search platform in the short term, but it set up Google to compete at the highest level in the most important technology innovation of our lifetime.

We’re seeing the start of this, and 2026 should compound. Here are a few other incumbents to make meaningful strides in 2026:

- Microsoft: This month, Satya Nadella announced he’s taking on product responsibilities with Copilot. After showcasing early capabilities, Copilot has fallen woefully behind the market. Satya’s decision to get his hands dirty—like Sergey at Google—is a signal to the market. Product will catch up, and Microsoft still holds one of the largest built-in distribution moats in technology.

- Meta: this is a gut prediction. You can fault Meta’s AI execution along a number of fronts, but you can’t fault them for a lack of aggression. Recent talent acquisitions, continued capital expenditure, and the benefits of a founder-led company will begin to pay off for Meta.

- Uber: Waymo dominated the headlines in 2025, and for good reason. We believe the market is underestimating Uber, especially along one important vector: data. As AI continues to push into the physical world, Uber is collecting one of the deepest and most compelling data sets of the physical world. That will pay off in 2026 (and beyond).

All of the examples above are why we’ve never been “traction investors” at Seed. It’s a great signal, but it’s not everything. A fast start does not guarantee long-term success.

2. The CFO says it’s time for consolidation, but significant TAM expansion keeps the party alive

It feels like another 2021 in the sense that every company is in the market buying AI right now. The problem is, at some point, the buyers will stop experimenting and start consolidating.

While we’re still in the early innings of AI, I do think, as per our first prediction, companies start to say, “Well, this other vendor we use for X also does this, so why not just bundle it there?” Or “How many app builder tools are we using? Can we just get an enterprise license across the business for 1 of them?”

I do think there will be pain in the reconciliation of this. A lot of companies and investors are making decisions on the basis of extrapolating short-term growth rates forward. There are reasons to doubt the durability, and we believe those concerns will come home to roost in 2026.

All that being said, it’s not all doom and gloom in AI. Fortunately, total addressable markets are expanding rapidly as technology adoption is enabled in new regions, verticals, and segments of the market. This will carry the best products, companies, and teams through slightly turbulent air in 2026. For us, the TAM expansion piece is massive when underwriting a new investment.

Bonus addendum: we will see a re-underwriting of benchmark AI growth rates. The past two years have been characterized by headline-grabbing ARR numbers and growth. Under the surface, there is churn, non-recurring revenue quoted as ARR, and markets with shifting adoption cycles. There are also plenty of companies growing fast, but within the constraints of typical enterprise deal cycles. We believe the investing market will catch up to this in 2026. While we won’t call it the return of triple-triple-double-double, we will see some reversion to equilibrium with AI growth rates.

3. The AI leap to hardware is wildly under-discussed

We are still quite a bit away from commercialization of robo-fleets, but we are starting to see use cases where AI can augment what we do in the physical world.

Wearables for trades service workers that allow them to diagnose in real time, and they get guided workflows on how to fix their work (Plasma – more on that one next year). Specific customer support operating systems like Telemetron that help customers triage wifi-connected devices they have at home. Communication between unmanned and manned aircraft as our skies become more and more congested (Oureon). We’re seeing an expansion of edge computing as well. On the largest scale, you have companies like Armada building containerized, durable data centers for governments and enterprises operating in the harshest environments on the planet. On the other side, we’re seeing an acceleration of focus on on-device AI models for phones, laptops, or any other personal computing device. Waymo is taking over San Francisco!

There are so many more use cases. We’re excited about the AI advancements in the physical world around us, not just through the screen. We expect 2026 to be the year when the physical world is brought into the forefront of the discussion around AI.

4. Pricing and packaging is becoming the Cinderella of the new AI era

We’re going to experience a material shift in the standard SaaS seat-based pricing. It’s been talked about plenty, but this is the year the rubber meets the road. We’re seeing high-growth companies get creative with credits via outcome-based pricing, action-based pricing, and even credit-based pricing associated specifically with POCs and churn risk accounts.

In 2026, this will go mainstream. What will be interesting is how incumbents react. If customers only have to pay when the product works, they will get pretty used to that. If they’re choosing between two vendors and one is seat-based and one is outcomes-based, all else being equal, they will most definitely pay per outcome. Paid.ai is building the piping for these outcome-based pricing companies, grounded in their traction.

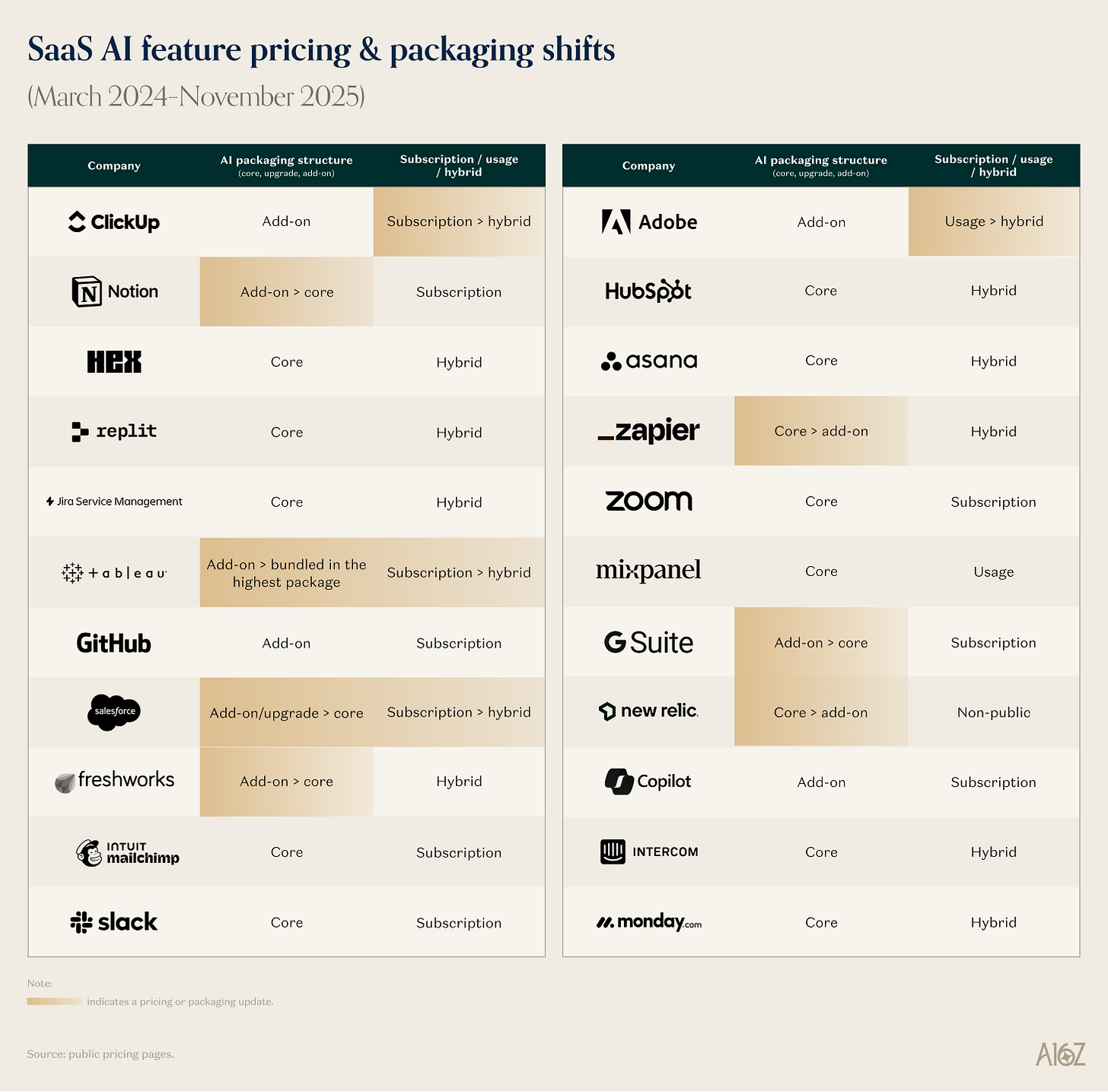

Below is a list a16z put together of iconic companies who shifted pricing meaningfully at the end of 2025. I think we’re going to see that boulder roll down the hill in 2026.

5. GTM becomes even more AI-native in 2026

The world of go-to-market has been reinvigorated in the past 12 months. You have GTM teams that are vibe coding their own tooling. AI bots for inbound leads and support are making significant gains in reliability and speed. SEO is out, and GEO is in. Newer roles like Growth Engineer and Forward-Deployed Engineers continue their uptick in headcount across companies beyond the early adopters.

We are loving the resurgence. The things we did in the 2010s feel so dated now. Heck, things we did in 2024 feel dated now. While the high-level playbooks still work (ICP selection, messaging frameworks, etc.), how we execute has sped up and increased our ability to scale in a massive way.

The best part about this is that GTMfund, our LPs, and now our portfolio companies are all on the forefront of the new trends. It puts us in an even better position to be a value add to our founders. We’re going to be hosting more founder events in 2026 (and beyond) for this exact reason. GTM continues to change as rapidly as we’ve ever seen it, and we’ll be hosting hands-on working sessions with GTM leaders from our network pushing the envelope in AI GTM. More on what those will look like soon!

6. Consulting backgrounds are back in demand

McKinsey alum, rejoice! This is something we started seeing in our own portfolio to close 2025 and expect to see a lot more in 2026 and beyond. Ex-consultants have historically enjoyed success in the startup ecosystem while also being relatively maligned. The trope is that consultants don’t know how to operate in a startup environment—they just know how to tell you how to operate in a startup environment. However, in today’s AI-native world, we’re seeing a renaissance in demand for ex-consultants.

The market factors are fairly straightforward. In MIT’s State of AI report from August, they claimed 95% of enterprise AI deployments were failing to showcase meaningful ROI. A lot of the difficulty was in the implementation process. To succeed, you need to embrace organizational change, embed deeply into workflows, and go beyond flashy demos that don’t penetrate beneath the surface of an organization. Ex-consultants typically thrive in a motion like this. We’re seeing demand across the startup ecosystem for CSMs, enterprise account managers, or forward-deployed CSMs / engineers with consulting experience to help their enterprise customers succeed.

In the future, we expect a lot of software to be managed through an agent-to-agent architecture. You won’t need to implement the deep workflow and change management in order to go live with your AI platform, as most of the work will be done by an agent on the other side. However, for now, consultants once again live in the sun.

7. An increased acceptance of human-to-agent interactivity across B2B (and B2C)

Voice AI has been one of the hottest categories of investment and revenue growth over the past 12 to 18 months. And for good reason. The quality of the underlying models are improving, and as a broader economy, we’re realizing just how much friction and lost economic value occur in the simple practice of human communication and scheduling.

As an example, you’re looking to get in touch with someone in operations at a company, but it’s Friday afternoon. You call, but no one answers. You email but don’t hear back until Monday at lunch. You then schedule a call for Wednesday morning, the next available slot. You just lost 5 days of productivity without blinking. Now multiply that friction by billions of potential communication points per day. It’s enormous.

Now, imagine there’s an AI agent on the other side of that communication line. They’re online 24/7/365. They don’t have time zones or holidays, and they don’t get sick. They’re trained on all the same information a human is, with often more accurate and better recall. At first, the pushback to the explosion of voice AI was simple—does the human really want to talk to a bot?

We will cross that chasm in 2026. The technology has improved to the point where most voice AI platforms sound fairly human and natural. They’re more responsive, more accurate, and at the end of the day, often get you to your desired end state more efficiently. We will see a massive expansion of voice AI across every corner of communication in 2026 – both B2B and B2C. And guess what? Humans will (mostly) enjoy it.

8. The revolt against AI slop and the return of Good Quests

We’re ending on a positive prediction. In 2022, Trae Stephens and Markie Wagner from Founders Fund wrote a seminal blog post: Choose Good Quests. The premise is simple. Our best and smartest individuals should be compelled to choose good quests. Solve hard problems that make the world a better place, improve human conditions, or both.

This principle has informed our investment thesis at GTMfund. You can see it across our Fund II portfolio. Obvio is using computer vision to improve road safety. Oureon is building the advanced interoperability layer for aerospace to make our skies safer. Assemble is building an AI-native workflow and operations platform for hospital systems. Pairtu is revolutionizing patient advocacy.

However, that hasn’t been the case for the entire market. There has been plenty of “AI slop” since ChatGPT launched in 2022. Some are surface-layer businesses designed to capture cash amidst a gold rush. Some are arguably net-negative contributions to technology and end users (for one example, see “Chad IDE” from the most recent YC batch, which allows you to gamble or swipe on Tinder while you code).

In 2026, we’re going to see a return of Good Quests en masse. AI is penetrating every aspect of our lives. We believe there is a cohort of ambitious entrepreneurs on the horizon that will continue pushing the boundaries of technology—for good. They already exist today, but the ecosystem has grown tired of the opposite side of the equation.

In GTMfund’s Fund III (and beyond!), we’ll be searching for the Good Quests – and we expect to see a lot more of them.

Tag @GTMnow so we can see your takeaways and help amplify them.

ZoomInfo CEO Henry Schuck shared how ZoomInfo Copilot hit $250M in ACV just 18 months after launch, while most AI pilots stall out. The playbook was unsexy but decisive: dogfood hard, sell before GA to test willingness to pay, launch narrow with a clear ICP, and scale post-sales capacity early.

TechCrunch digs into how GTMfund is approaching distribution differently in an AI-first world, and a big part of that story is Paul Irving, Partner and COO at GTMfund. Paul has been shaping how the firm operationalizes GTM from day one – from how portfolio companies test, learn, and scale distribution faster, to how GTMfund itself runs with operator-level rigor

More for your eardrums

GTM 173: The PLG → Enterprise Playbook: Turning Product Signals into 9-Figure Revenue with Adam Carr

Get a sneak preview here. For the full thing, listen on Apple, Spotify, YouTube or wherever you get your podcasts by searching “The GTMnow Podcast.”

Startups to watch

HockeyStack – closed more revenue in Q4 than in all of 2024, tripled headcount, landed its first Fortune 10 customer, raised a $26M Series A, and launched Blueprints. They just launched Blueprints, their biggest product release yet. Blueprints analyzes millions of customer journeys to surface the patterns that actually generate pipeline, then tells teams what to do next. Segment mapping, scoring models, and automated workflows turn insight into action, making pipeline creation far more predictable heading into 2026.

Hottest GTM Jobs of the week

- Vice President of Customer Success at CaptivateIQ (Hybrid – Austin, TX / Menlo Park, CA)

- Product Marketing Lead at Atlan (Remote – US)

- Business Development Manager at gaiia (Remote – US)

- Product Marketing Manager, Competitive & Market Intelligence at Owner.com (Remote – US/Canada)

- Product Marketing Manager – Sales Enablement at Gorgias (Toronto, Canada)

- See more top GTM jobs on the GTMfund Job Board.

GTM industry events

Upcoming events you won’t want to miss:

- Above the Fold (for marketers): February 9-11, 2026 (Fort Lauderdale, FL)

- Spryng (for marketers): March 24-26, 2026 (Austin, TX)

- SaaStock USA: April 15-16, 2026 (Austin, TX)

- SaaStr Annual: May 12-14, 2026 (San Francisco, CA)

- GTMfund AGM + Retreat: May 14-16, 2026 (San Francisco, CA)

- INBOUND: September 16-18, 2026 (Boston, MA)

- Pavilion GTM2026: September 28-October 1, 2026 (NYC, NY)

- TechCrunch DISRUPT: October 13-15, 2025 (San Francisco, CA)

- GTMfund dinner chedule coming soon!

GTMnow community love

Some GTMnow community (founder, operator, investor) love to close it out – we appreciate you.