4.5 Years of Building GTMfund: From Conviction to Consensus

Hello and welcome to The GTMnow Newsletter – the media brand of VC firm, GTMfund. Build, scale and invest with the best minds in tech.

This is a bit of a reflection on building a VC firm over the past 4.5 years.

We’ve been super intentional from day one about how we’ve built GTMfund.

From the start, we’ve held a clear, bullish view on where the market was heading. Over time, more voices, data, and frameworks have emerged that validate what we’ve believed (and operated against) from the beginning. It’s rewarding to see the broader market begin to converge on ideas we’ve been championing for years.

Recent coverage reinforces the core pillars that continue to shape how we invest and support founders – 1) Capital is a commodity. 2) Distribution is the final remaining moat. 3) Founders need go-to-market support earlier than ever.

The coverage showcases where venture is headed, and why.

We’re deep in event planning right now, as no doubt many of you are.

Whether it’s an offsite, conference, or any other kind of event, BoomPop makes that happen with end-to-end planning all in one place.

They handle everything from venues to experiences, so you can focus on the delights of meeting in person, not the logistics.

Being part of GTMnow, you’re eligible for full-service event planning for just $99 per person (terms apply). Head to boompop.com/gtmfund to explore seamless support for your events.

The three pillars

1. Capital is a commodity

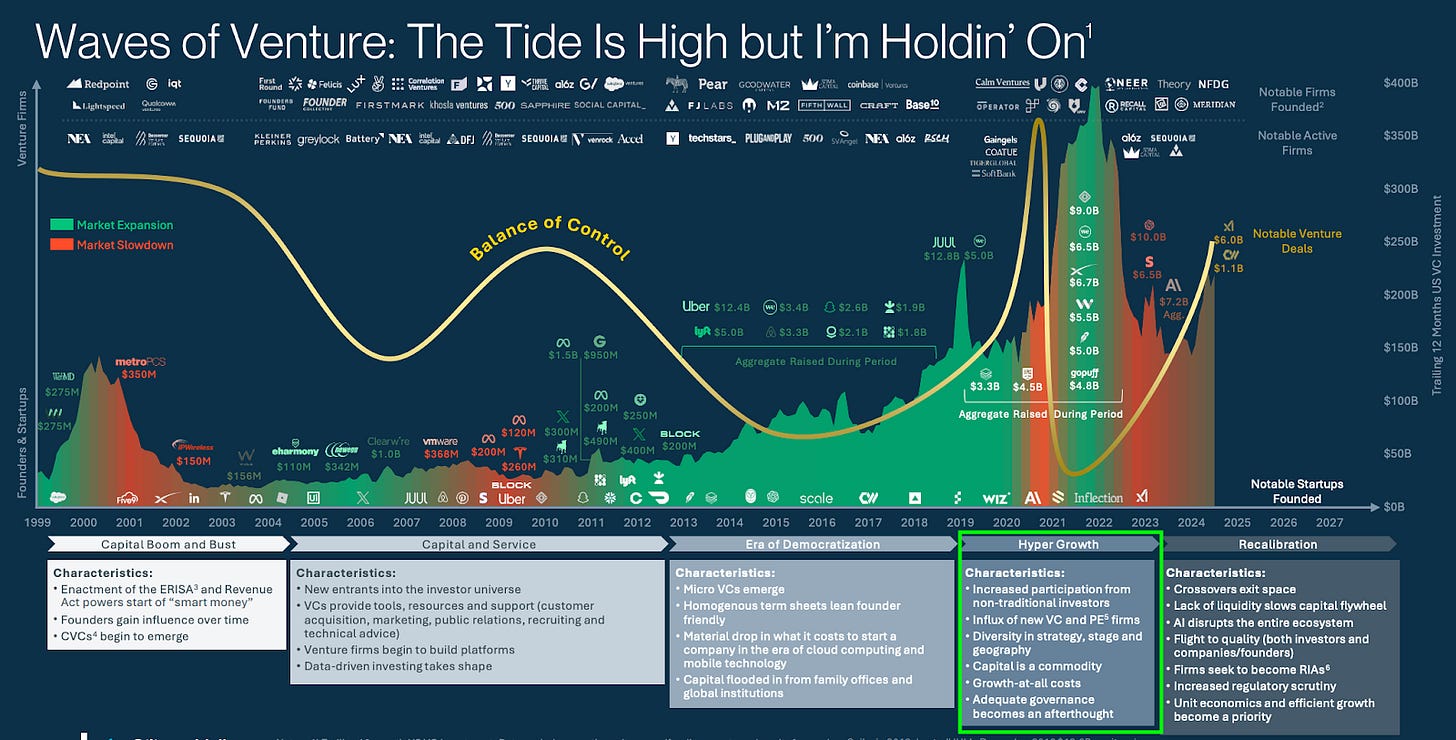

The number of active funds has tripled, LP capital has become global, and new vehicles – from rolling funds to crossover funds and more – are here to chase AI.

According to SVB data (pictured below), this shift started accelerating during the hypergrowth era of 2019-2023, when an abundance of capital collided with hype, creating a market where capital itself stopped being the scarce resource.

The best founders choose where their capital comes from. You need to add value beyond the dollars in the door.

That’s how we’ve been building for five years. And now, we’re starting to see the largest players catch up.

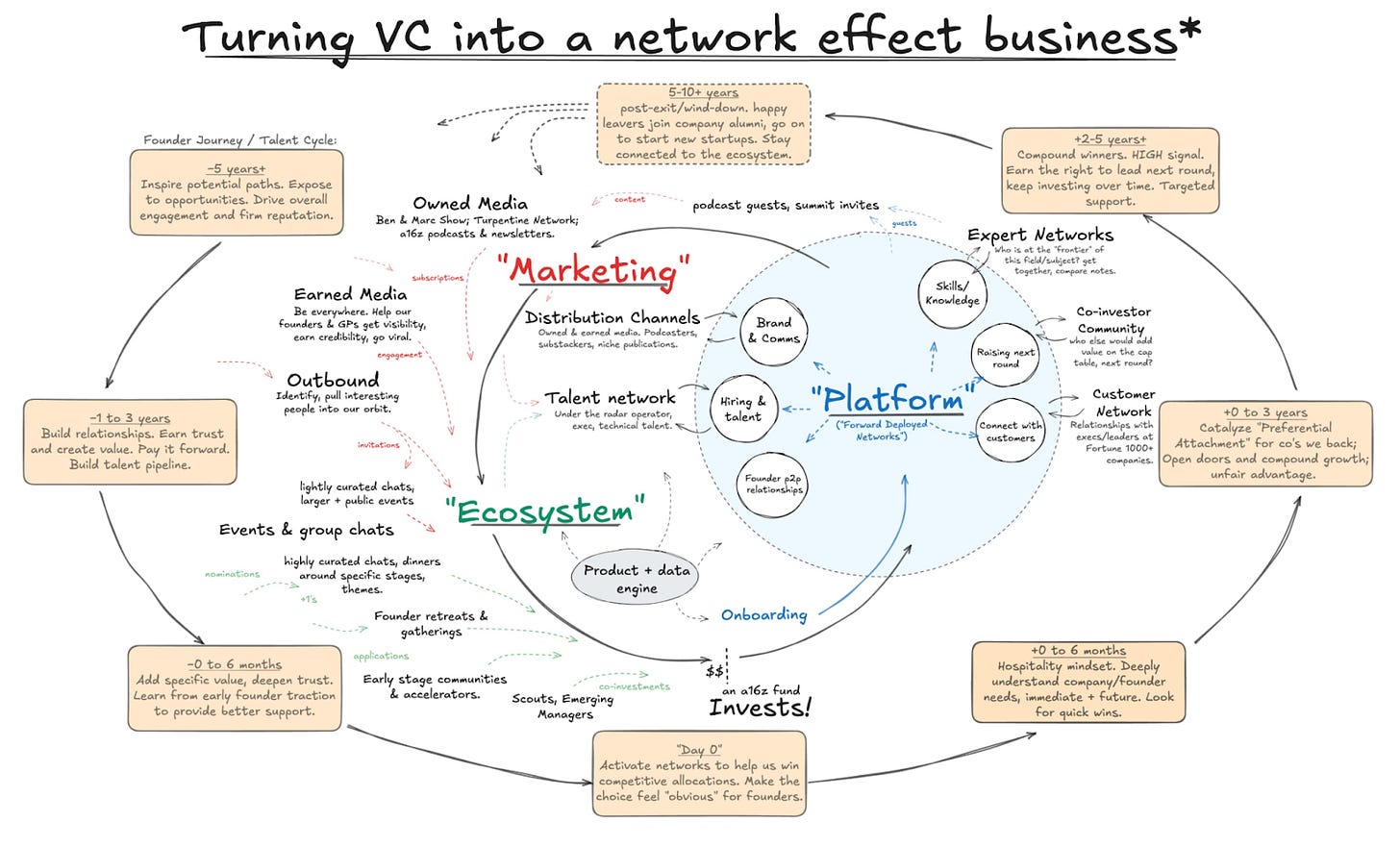

Friend of the fund, David Booth, announced on X that he’s joining a16z as Partner and Head of Ecosystem. In his post, he wrote that VC firms must “think like networked product builders, not just service providers,” creating systems where value compounds as founders, operators, and advisors connect, rather than simply adding more partners for support.

As he put it, financial capital alone is no longer a moat. The next generation of venture firms will win by compounding network capital (people, products, and platforms) instead of scaling headcount. He illustrated this shift with a framework for what a true network-effect business looks like:

This is exactly the model GTMfund was built on: a Fund ↔ Community ↔ Media flywheel that compounds value across every touchpoint. Each operator LP expands our reach, relevance, and expertise. Our media arm, GTMnow, amplifies that through owned distribution.

He also describes venture’s evolution from human networks to networked intelligence. The firms that integrate AI and data into their ecosystem infrastructure will separate from those that don’t. At GTMfund, we’ve already executed on that vision and continue to lean in. That’s xVal: our internal AI platform built to capture and compound the intelligence within our ecosystem and media assets. (“xVal” literally stands for exponential value!)

We’ve been championing this model – and future of venture capital – since the earliest days of GTMfund. It’s a topic we’ve written about time and again. It was nice to see it emphasized and acknowledged by the heavy hitters like a16z.

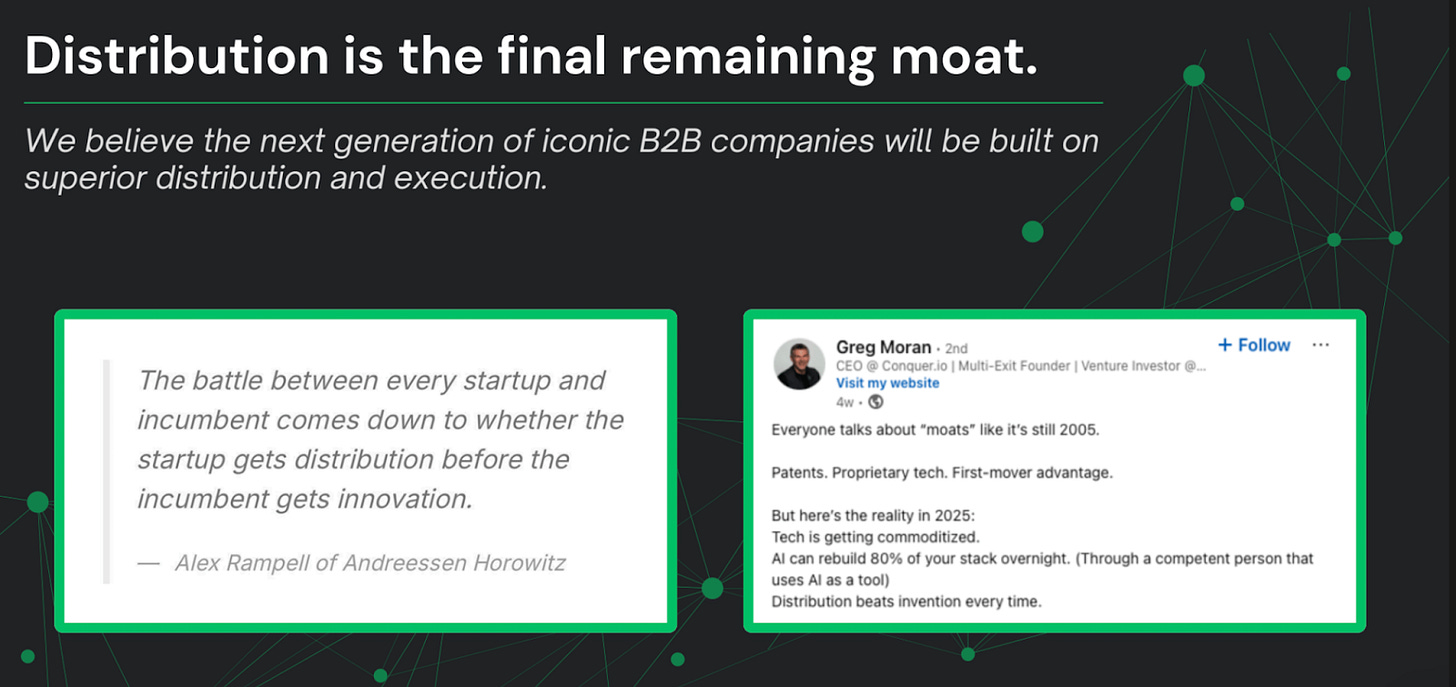

2. Distribution is the final remaining moat

The best product doesn’t always win. Today, that’s truer than ever.

AI coding tools have made it easier than ever to build and ship products. True technical moats are eroding. The best companies will win on distribution and GTM execution.

AI is leveling the playing field faster than anyone expected. What’s left isn’t what you build; it’s how far and how fast it travels.

Distribution and execution are the new competitive advantages, and we’ve had some version of this slide in every GTMfund fundraising deck to date.

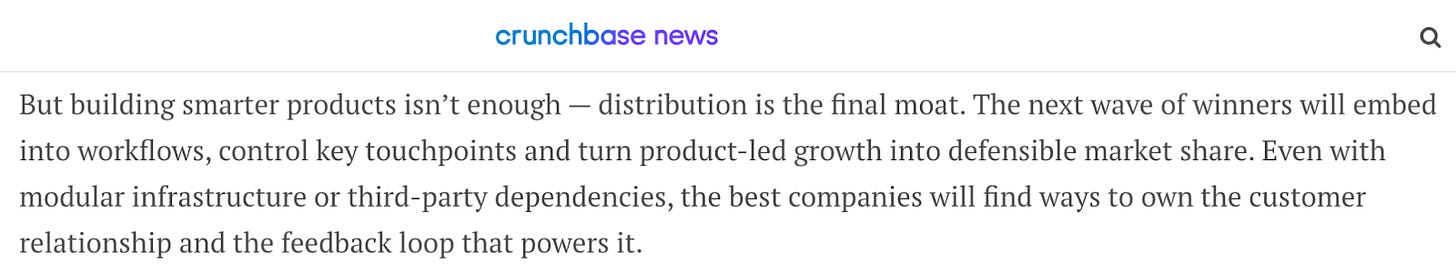

Support for this view keeps showing up across the industry. Other VCs are now echoing it directly. For example, in Crunchbase news earlier this year:

OpenAI’s product lead Miqdad Jaffer put it simply:

“Features can be copied in weeks. Access to foundation models is universal. What separates winners from losers isn’t technology. It’s distribution.”

This summer, a16z released new growth benchmarks for early-stage companies: What “Working” Means in the Era of AI Apps. The data shows elite startups hitting $1M ARR in under nine months and tripling revenue the following year, all while maintaining burn multiples below 1.0. Their advantage isn’t product velocity; it’s distribution velocity.

Going back to David Booth’s announcement about joining a16z, he describes the venture firm’s ecosystem as an “operating system” that continually compounds trust, knowledge, and connections. The VCs that win will be those with the strongest distribution of help – the richest communities, content, and data – enabling their startups to move faster and execute better.

That philosophy aligns with GTMfund’s flywheel that uses ecosystem and content to create a compounding distribution engine for value.

This “hidden operating system of venture” is our connective tissue between firm, ecosystem, and market, which is distribution. GTMnow drives visibility from the top down. The GTMfund community builds trust from the bottom up. Together, they create the infrastructure of compounding credibility, which is the ultimate distribution moat. When marketing and ecosystem move in sync, awareness compounds into trust, and trust compounds into opportunity.

The next decade belongs to those who build distribution not as an afterthought, but as a core product capability. Because in a world where anyone can build, ship, and scale faster than ever, distribution is the final remaining moat.

3. Founders need go-to-market support earlier than ever.

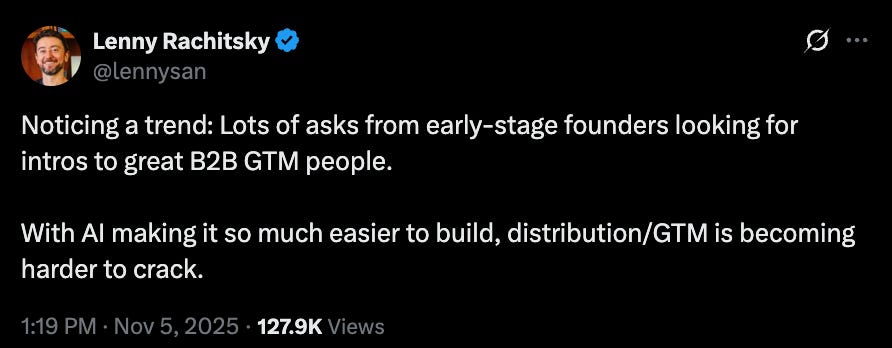

Lenny calls it out directly here:

At TechCrunch Disrupt, we joined the Head of Startups at OpenAI and the CMO of Google Cloud on stage to discuss building a GTM engine. The standing-room-only audience of founders and investors was proof in itself of how critical GTM support has become for today’s founders.

Venture looks different and will continue to, as founder needs evolve.

Tag @GTMnow so we can see your newsletter takeaways and help amplify them.

More for your eyeballs

Tech is on the brink of a gross retention apocalypse, and it’s sparking a customer success renaissance. With renewals slipping and buyers demanding more value post-sale, the next wave of growth will come from teams that treat customer success as a revenue engine, not a support function. A great article by Cassie, the GP of Primary VC.

Scale VP’s new “State of GTM AI in 2025” shows AI is now mainstream in go-to-market: two-thirds of teams use it regularly and ~85% report productivity gains. The next step is Phase 2, where agentic and workflow use cases move real metrics like pipeline, conversion, and win rates, with early adopters 3–5x likelier to see improvements.

At TechCrunch Disrupt, GTMfund founder and GP Max Altschuler joined a panel on “How to Build a GTM Engine That Actually Works.” The discussion broke down how early-stage startups can pair proven GTM fundamentals with AI-driven systems to scale faster, win customers, and turn product traction into real revenue growth.

More for your eardrums

GTM 169: How Airbyte Hit $1B: The Open-Source, Community-First Playbook

Get a sneak preview here. For the full thing, listen on Apple, Spotify, YouTube or wherever you get your podcasts by searching “The GTMnow Podcast.”

Startups to watch

Fastbreak AI – announced a $40M Series A round. Fastbreak AI uses AI to create sports schedules. They work with major leagues like the NBA, NHL, MLS, and SEC to build complex season schedules that balance travel, rest, TV slots, and fairness — something that used to take weeks (or even months) to do manually. They’ve also built a platform called Compete that helps thousands of amateur and youth sports events create and manage their schedules with just a few clicks.

Hottest GTM jobs of the week

- Founding Enterprise Account Executive at Atrix (New York)

- Product Manager at Amper (Remote – Chicago / San Francisco)

- Customer Success Manager (West Coast) at Document Crunch (Remote – US)

- Director, Partner Marketing at Writer (Hybrid – San Francisco)

- Sales Account Executive at Jeeva AI (San Francisco)

See more top GTM jobs on the GTMfund Job Board.

GTM industry events

Upcoming events you won’t want to miss:

- GTMfund Dinner (private registration): November 18, 2025 (Toronto, ON)

- GTMfund Dinner (private registration): November 19, 2025 (New York, NY)

- Founder Breakfast by GTMfund & 645 Ventures (private registration): November 21, 2025 (New York, NY)

- Above the Fold (for marketers): February 9-11, 2025 (Fort Lauderdale, FL)

- Spryng (for marketers): March 24-26, 2025 (Austin, TX)

GTMnow community love

Some GTMnow community (founder, operator, investor) love to close it out – we appreciate you.