Top 10 largest Seed and Series A rounds

Hello and welcome to The GTM Newsletter by GTMnow – read by 50,000+ to scale their companies and careers. GTMnow shares insight around the go-to-market strategies responsible for explosive company growth. GTMnow highlights the strategies, along with the stories from the top 1% of GTM executives, VCs, and founders behind these strategies and companies.

A clear divide has emerged in early-stage fundraising, creating two distinct paths for founders:

- The Traditional Path: Where the average seed round still hovers around a healthy $4M.

- The AI “Mega-Round”: Where a new class of founder is raising $10M, $20M, or more, often before a product is even in market.

The key differentiator is clear: these mega-rounds are going almost exclusively to AI-native companies.

In this edition, we pulled the 10 largest Seed and Series A rounds and their fundraising timelines to understand this new reality.

Is this a permanent, two-track system, or a temporary gold rush fueled by the novelty of AI?

That is the golden question on every founder’s and investor’s mind.

What a “normal” round looks like

The mega-rounds happening are insane. But before we get into them, let’s level-set on the numbers so we have a real baseline for comparison.

The Seed Stage:

For most startups on the Traditional Path, the median seed round is between $3M and $3.6M. The goal of this capital is typically to find initial PMF over an 18-24 month runway. In contrast, the AI Fast Track operates on a different scale, with Seed rounds ranging from $6M to over $100M, driven by technical moats and founder pedigree rather than revenue.

The Series A Stage:

At the Series A, the divide becomes more tied to business metrics. For a company on the Traditional Path, the median round is between $10M and $12M, typically requiring $1M to $2M in ARR. The AI Fast Track sees rounds from $20M to over $200M based on user growth and foundational tech.

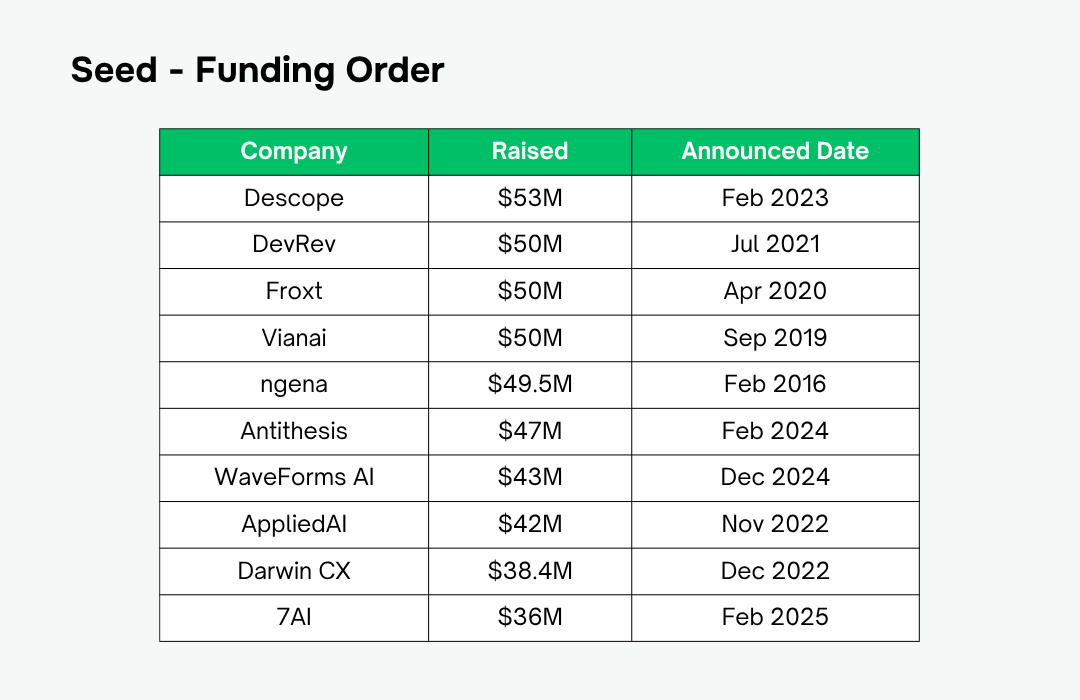

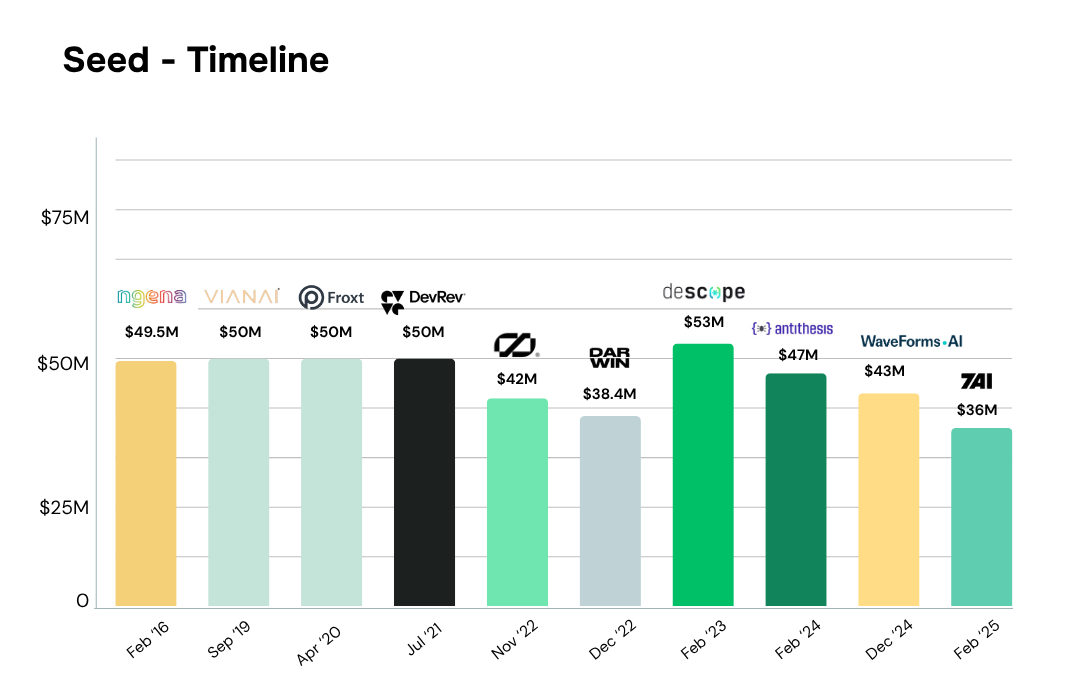

10 largest Seed rounds

The term “Seed round” has lost its traditional meaning for a certain type of company though. Rounds of $50M, $100M, and even $200M are historically the size of a healthy Series B or C.

The startups raising these mega rounds are building complex, defensible infrastructure. The “fast track” is primarily for two overlapping categories:

- AI/ML Platforms: e.g. Vianai, WaveForms AI, Froxt.

- Developer & Enterprise Infrastructure: e.g. DevRev, Descope, Antithesis, ngena.

Investors are willing to write massive, early-stage checks for companies tackling foundational problems for technical buyers. While the technical risk is high, the market opportunity for a company that becomes the new standard in cloud ops, developer productivity, or enterprise AI is enormous.

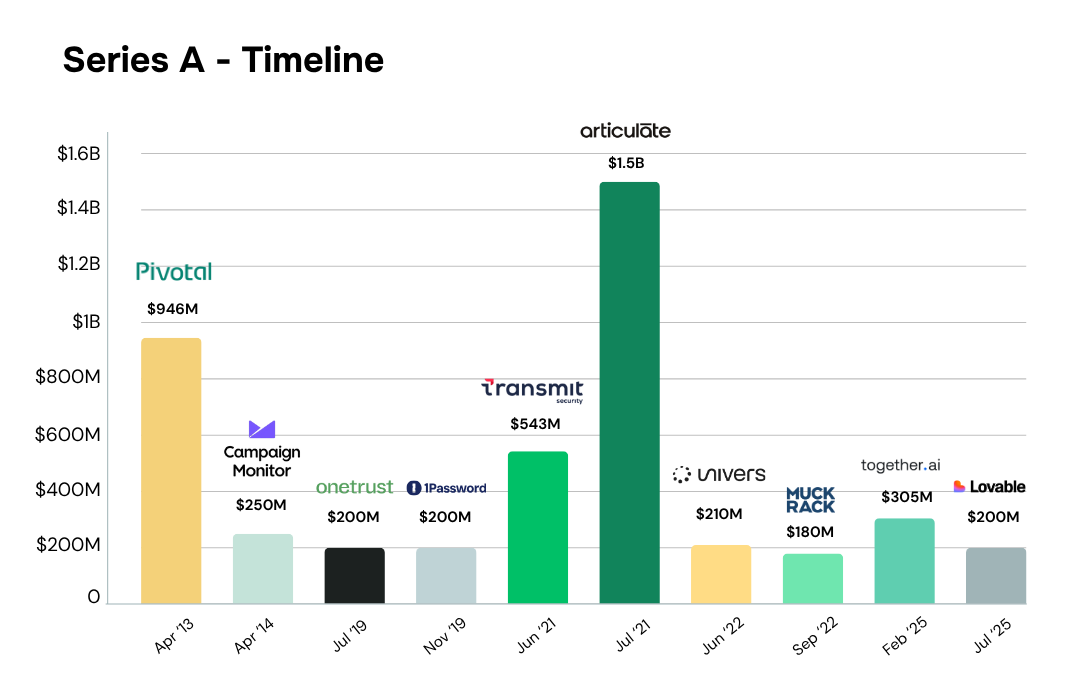

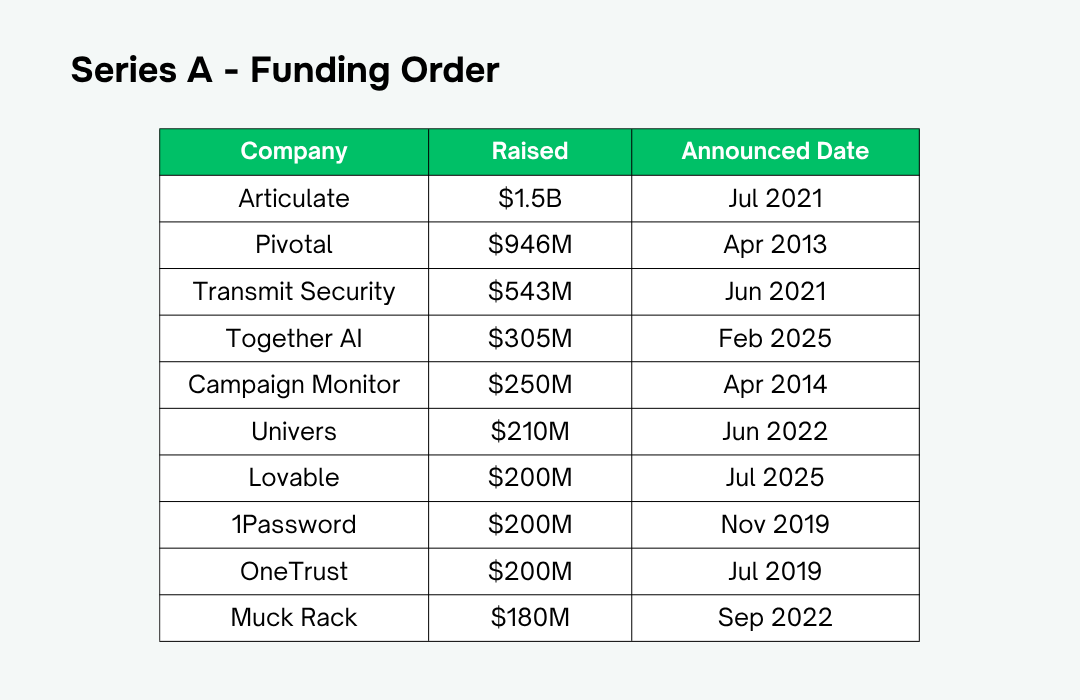

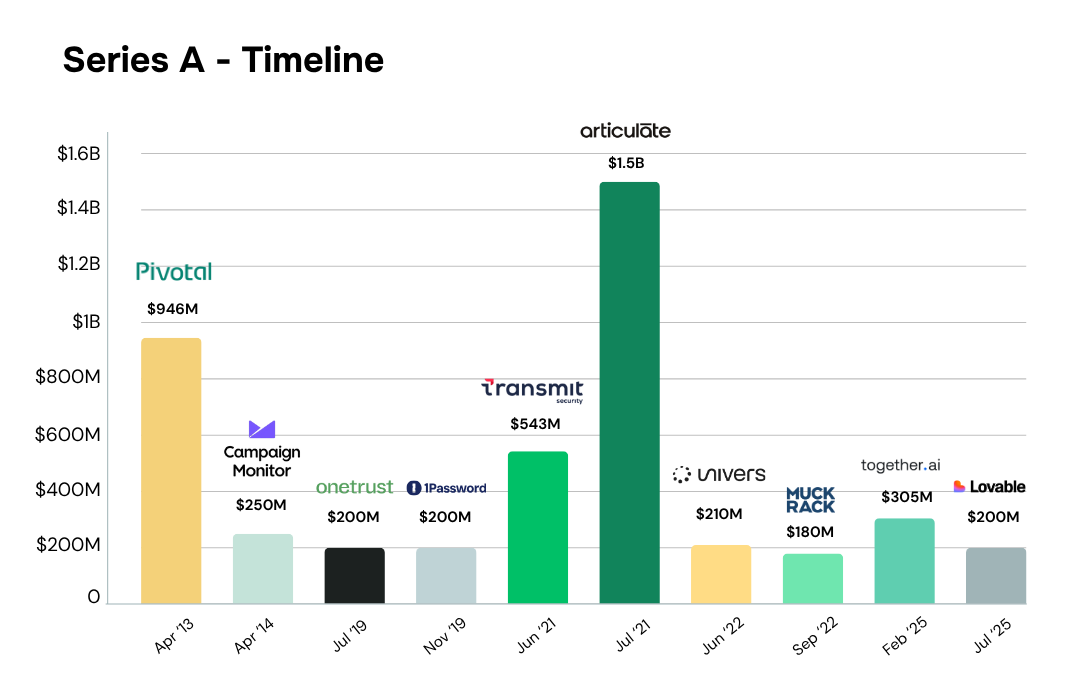

10 largest Series A rounds

When we look at this data, two core insights are visible:

1. The ‘AI Fast Track’ is real and happening now.

Of the top 10 largest Series A rounds of all time, the two most recent are from this year. This shows how AI-native companies are operating on a different fundraising track, raising historically significant capital at an unprecedented pace.

2. The criteria for a mega-round has changed.

Historically, raising a round of this magnitude required dominating a massive, well-understood market like cloud infra (Pivotal) or compliance (OneTrust). Today, investors are writing these checks for foundational AI shifts and the product-led GTM models that power them. The focus has shifted from proven business models to disruptive technology.

While these mega rounds only apply to a subset of companies, with the vast majority of companies falling into a traditional model, it’s a pattern that we and other investors are keeping our eyes on.

Tag GTMnow so we can see your takeaways and help amplify them.

✅ Recommendations

This report unpacks the findings from 619 B2B buyers, sellers, and marketers to uncover the exact types of customer proof that actually build trust and boost buyer confidence. The TL;DR? They want data, relevance, and actual proof.

67% of sellers have watched deals slip through their fingers because they couldn’t provide relevant, specific customer proof. Learn how to avoid this fate.

Grab this report and learn how to give them the evidence they need.

👀 More for your eyeballs

Sam Altman predicts AI will soon outperform humans in most white-collar jobs, automate CEO roles, and drive universal wealth through public AI ownership. He also sees breakthroughs like nuclear fusion and artificial wombs reshaping energy and human life.

Vanta raised $150M at a $4.15B valuation to help more businesses earn and prove trust. Over 12,000 companies now use Vanta to scale security and compliance as easily as they scale their software.

👂 More for your eardrums

Erica Anderman is the co-founder and COO of Foodini, an AI-powered platform solving food allergy and dietary transparency through data infrastructure. With over 15 years of go-to-market experience across foodtech and vertical SaaS, Erica has led revenue at companies like Slice, Seated, and Odeko, and held roles across sales, customer success, partnerships, and RevOps. She began her career in door-to-door restaurant sales and now builds GTM from the ground up, helping 50% of the population with dietary needs find safe, personalized dining experiences.

Listen on Apple, Spotify, YouTube, or wherever you get your podcasts by searching “The GTM Podcast.”

🚀 Startup to watch

Volca, an AI-driven marketing platform for home services businesses, has raised $5.5M in seed funding to help local providers grow smarter and faster. Led by Pathlight Ventures, with backing from MetaProp, GTMFund, and others, Volca is poised to bring enterprise-grade marketing automation to Main Street.

Owner is turning up the heat with its Summer Product Release, rolling out fresh features designed to make running a small business even smoother

Armada has raised $131M to launch modular, megawatt-scale AI data centers designed to accelerate America’s energy and AI infrastructure. With backing from Founders Fund, Lux Capital, and others, Armada is building next-gen capacity to meet the surging demand for AI compute at the edge.

🔥 Hottest GTM jobs of the week

- Sr. Demand Generation Manager at CaptivateIQ (Remote – Austin, TX)

- Mid Market Account Executive at WorkRamp (Remote – US)

- Account Manager at Cube (Hybrid – New York)

- Business Development Representative at Document Crunch (Hybrid – Alpharetta, GA)

- Head of Growth Marketing at Vanta (Remote – US)

See more top GTM jobs on the GTMfund Job Board.

If you’re looking to scale your sales and marketing teams with top talent, we couldn’t recommend our partner Pursuit more. We work closely together to be able to provide the top go-to-market talent for companies on a non-retainer basis.

🗓️ GTM industry events

Upcoming go-to-market events you won’t want to miss:

- INBOUND 2025: September 3-5, 2025 (San Francisco, CA)

- Pavilion GTM Summit: September 23-25, 2025 (Washington, DC)

- Dreamforce: October 14-16, 2025 (San Francisco, CA)