Brought to you by: AngelList

How did we build the GTMfund back office? Easy!

We leveraged AngelList’s Rolling Fund product for Fund I, which was the perfect vehicle to scale up GTMfund in its first iteration. This structure allowed us to build our network, and add revenue leaders while we raised and deployed capital simultaneously, which was crucial for getting early points on the board and building relationships with founders.

For Fund II, we transitioned to a traditional closed-end fund structure through AngelList. This time with institutional investor support. This model allowed us to be more intentional about our portfolio construction. We worked closely with the AngelList team throughout this process, and they were incredible — always there to support us and our LPs every step of the way.

If you’re raising a fund or are looking to migrate your fund, we highly recommend you check them out. You can do so at www.angellist.com/gtmfund.

Who we sat down with

Cassie Young is a General Partner at Primary Venture Partners, a $1B AUM early-stage firm in New York backing category-defining SaaS, fintech, and vertical software companies. Before investing, she spent 15 years as a GTM operator, serving as Chief Revenue Officer at Sailthru and later Chief Customer & Commercial Officer at Marigold (Campaign Monitor, Sailthru, and other martech brands), where she scaled global sales, marketing, and customer success organizations.

Today, Cassie leads investments while also running Primary’s Impact program, giving founders access to a 30-person team across talent, GTM, and strategic finance, and she continues to teach operators through programs like Pavilion and Duke’s Innovation & Entrepreneurship board.

Discussed in this episode

- How Cassie “accidentally” became a VC after 15 years in GTM leadership.

- The career advice Bill Gurley gave her that changed her trajectory.

- Why Primary refuses to say “platform” and instead built a 30-person Impact team.

- How she actually sources pre-seed/seed founders before they leave their jobs.

- Primary’s 5-part Founder Outcomes Framework (vision, talent, JDCE, and more).

- The difference between real traction vs. “happy ears” and fake design partners.

- Why she’s picky on GTM/AI tools and looks for step-change, not incremental gains.

- How operators can actually break into VC (hint: it’s all about doing the work).

Episode highlights

00:35 — Clay, usage-based pricing, and the $100M ARR rocketship

09:10 — The real story on AISDR: where AI reps actually work (and where they really don’t)

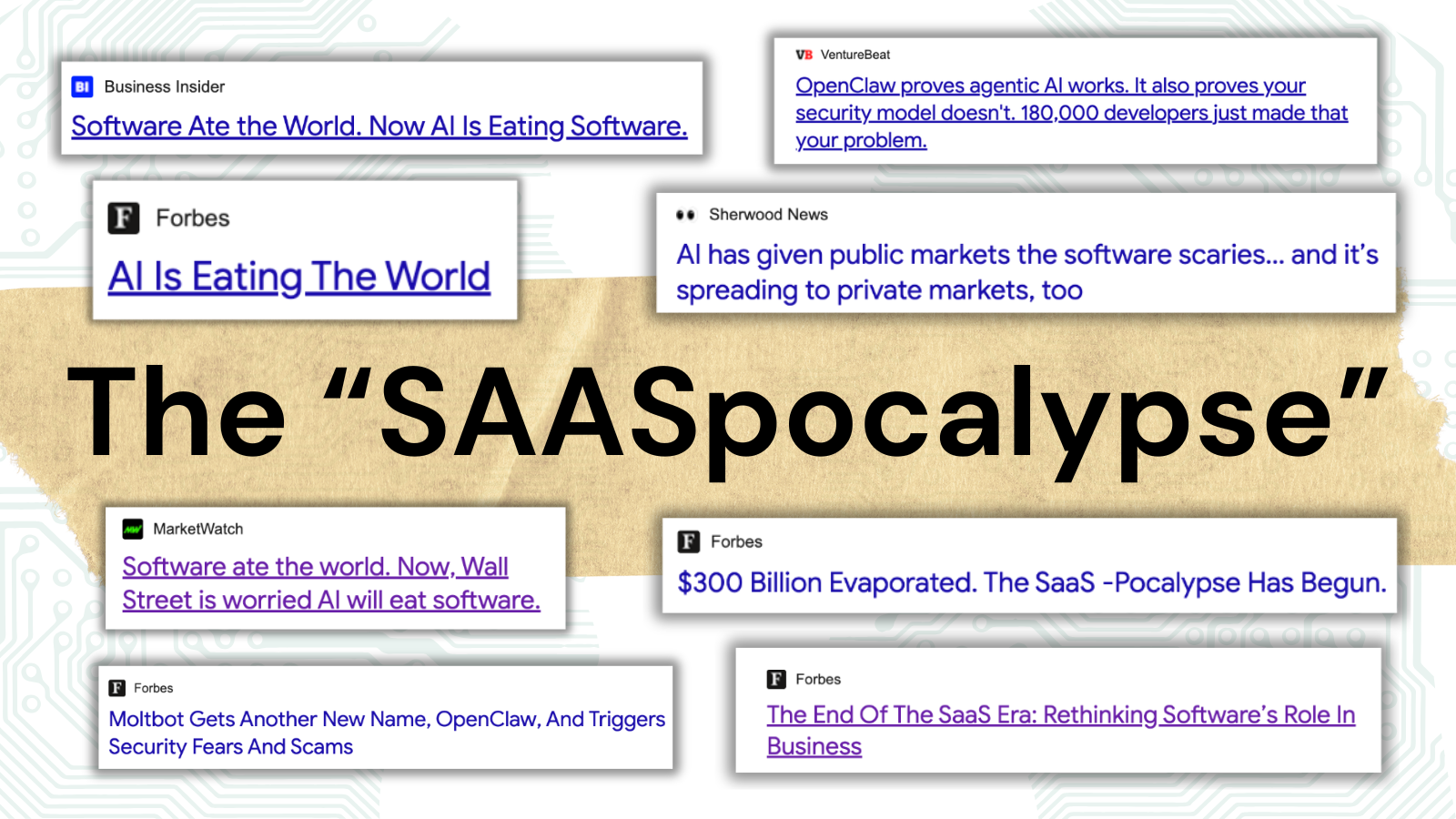

14:02 — Inside “The Gross Retention Apocalypse” and why AI experimental budgets are a ticking time bomb

22:46 — How Cassie accidentally became a VC and the Bill Gurley advice that changed her career path

27:17 — Why Primary hates the word “platform” and how Cassie built a 30-person Impact team for founders

36:10 — Cassie breaks down her 5-part founder outcomes framework (including “jaw-dropping customer experience”)

46:01 — Avoiding “happy ears”: how founders should really use design partners and MedPick-style rigor

57:48 — Time to value as the new north star and why nailing a tight wedge beats peanut-buttering features

1:01:29 — So you want to be a VC: Cassie’s playbook for operators to break into venture (without delusion)

Key takeaways

1. Operator to VC is a compounding game.

Cassie didn’t “switch” into VC so much as compound 15 years of GTM execution, board exposure, and trusted relationships with investors like Primary’s co-founders. Her story is a reminder that the best venture jobs usually come after a long track record of doing hard things in the trenches, not from a cold application.

2. Career inflection points reward non-obvious choices.

Bill Gurley’s advice (“your phone is about to ring with versions of the job you just had; don’t take them”) pushed her away from the comfortable CRO path and into something unfamiliar. Those moments where you say no to the default option often create entirely new surface area for your career, especially when you optimize for learning and leverage, not title.

3. Impact > platform if you’re serious about helping founders.

Primary’s deliberate rejection of the word “platform” reflects a deeper belief: portfolio support only matters if it materially changes a founder’s odds of success. By building a 30-person Impact team across talent, GTM, and strategic finance (twice the size of their investing team) they’re treating “helping” as an operating function, not a marketing line.

4. The best sourcing happens before someone updates LinkedIn.

Cassie’s strongest deals come from building relationships with would-be founders while they’re still employed and before any stealth scraper can flag them. That forces her to think like a GTM leader: who is about to have the right earned secret, what catalysts might push them to leave, and what unique value can she offer so her outreach isn’t “just another VC ping.”

5. Founder evaluation is about outcomes, not vibes.

Primary’s Founder Outcomes Framework distills things into five questions: can you set a differentiated vision, sell stock, hire bar-raising talent, deliver a jaw-dropping customer experience, and operate as a learning machine. Instead of fuzzy “founder-market fit” talk, Cassie is looking for concrete evidence that a founder has done hard, ambiguous things before and will keep upgrading themselves as the company scales.

6. Customer pull is the fastest filter on any deal.

A simple test Cassie uses early in diligence is how quickly busy economic buyers will take a call and whether they sound “hair on fire” about the problem. If even warm contacts drag their feet, or treat the solution as a nice-to-have, that’s an early sign the founder may be mistaking politeness for demand.

7. Design partners can be your biggest GTM trap.

Cassie sees technical founders over-rotate toward friendly design partners who don’t own budget and haven’t defined success metrics. Her bar for “traction” is design partners that map to budget holders, measurable impact, and clear steps to move from pilot to contract—otherwise you’ve just built something cool for someone who will never pay.

8. Incremental GTM tools are a hard pass.

Coming out of martech and sales tech, Cassie is allergic to tools that promise 10% efficiency gains in already crowded categories. She’s far more interested in products (like OneMind) that change how buyers actually purchase or how organizations operate, even if half the market thinks the thesis is crazy at first.

9. Zero CAC founders still need product superpowers.

Cassie loves founders with deep Rolodexes and distribution advantages, but in the AI era that’s table stakes, not a moat. Without equally strong product vision and rapid product execution, even the most plugged-in operator will struggle to build something defensible as markets change and moats decay faster.

10. Breaking into VC starts with doing unscalable work.

Her advice to GTM operators is brutally simple: be excellent in your current seat, then go add value to portfolio companies via advisory projects, workshops, and hands-on help—often before anyone is paying you. When multiple founders and partners start independently name-dropping you as “the person we call for GTM,” the VC door opens much more naturally.

Follow Cassie Young (Guest)

Referenced

- Primary Venture Partners: https://www.primary.vc

- Sailthru: https://www.sailthru.com

- Marigold (CM Group / Campaign Monitor): https://marigold.com

- Duke Innovation & Entrepreneurship: https://entrepreneurship.duke.edu/profile/cassie-young-05

- Goldman Sachs: https://www.goldmansachs.com

- Oscar Health: https://www.hioscar.com

- Beehive (Beehiiv): https://www.beehiiv.com

- Apollo: https://www.apollo.io

- Clay: https://www.clay.com

- Outreach: https://www.outreach.io

- Gong: https://www.gong.io

- HubSpot: https://www.hubspot.com

- Salesforce: https://www.salesforce.com

- ZoomInfo: https://www.zoominfo.com

- Pavilion: https://www.joinpavilion.com

- Skillshare: https://www.skillshare.com

Follow Max Altschuler (Host)

- LinkedIn: https://www.linkedin.com/in/maxaltschuler

- X (Twitter): https://x.com/HackItMax

Follow GTMnow

- LinkedIn: https://www.linkedin.com/company/gtmnow

- X (Twitter): https://x.com/GTMnow_

- YouTube: https://www.youtube.com/@GTM_now

- Podcast directory: https://gtmnow.com/tag/podcast

VC 2 Episode Transcript

Cassie Young: 0:00

This was kind of an accident for me. I didn’t have a long-term career ambition of being in venture capital. We joke that we have an allergy to the word platform around primary. We are really looking for someone who has an earned secret or some type of market ed. Buying software sucks. Being sold to sucks. Speed is a really freaking important competitive advantage.

Max Altschuler: 0:35

Welcome to our very special VC series on the GTM Now podcast. I’m here with my partner Paul Irving from the GTM Fund. And we had a very special guest on podcast today, Cassie Young for Primary Venture Partners. Very fun podcast as uh she comes with this unique go-to-market lens. Uh, you know, she’s been an operator in the past and now she’s an investor. Not an operating partner, but investor, uh, which, you know, the typical path, right? It’s CRO, operating partner, whatever. She went a different way. And um uh very unique lens, interesting conversation. And um, you know, we’ll talk a lot about it, but I think uh well, one of the things that she said on the show, which coincides with an interesting timing, was um if she can invest in one GTM company, it would be Clay. And we’re not investor at Clay, so we’ll we have no bias in any direction here. But uh the news came out today that they passed 100 million in ARR, zero to one in like six years, and then one to a hundred in like two years.

Paul Irving: 1:43

Interesting. What’d you get from that? Yeah, very interesting. The important caveat we should mention uh for Cassie’s selection is that it was GTM Tech over a billion value. So we gotta give Cassidy that caveat. But uh a couple of things stood out. I mean, Clay did a great breakdown about you know what’s really worked for them mostly in the last two years when they’ve had this incredible growth path from Watt to Hunker. Uh one thing that stood out, and you and I have talked a lot about uh is usage-based pricing and how common usage-based pricing has become in today’s AI native world. But Clay made that decision before it was popular. It was against the grain at the time. Uh, and they talk about how, you know, whether it was their investors or advisors saying you’re gonna leave so much money on the table, every other GTM type company is pricing per seat. And you’re selling into these big companies, they top about how great their you know enterprise NRR and expansion and retention has been. Uh you’re gonna leave so much value on the table. But they knew because of the nature of the product, you know, such a product-focused company, uh, it was gonna be at you know, a handful, sometimes a few more core users on each team, but they’re gonna use it in ton. Uh, and it can power so much of your go-to-market motion. But a lot of that usage is gonna be concentrated into a few people. Uh and so if they were going to be pricing per seat in retrospect, you know, they’d be leaving way more value in the table than if they did the traditional per seat.

Max Altschuler: 3:03

Yeah, and it was um, you know, one of the the big reasons for investment in paid pay.ai, which has allowed everybody to essentially uh, you know, do margin management and metering, billing for all credit consumption, credit usage. And there’s so many different ways you can do credits. You can do credits based on data, you can do credits based on outcomes, actions, taken, all these different things. So I think we’ll start to see the world go in that direction. I wouldn’t be surprised if we see other layers in these spaces instead of selling these commoditized things like data, more go towards we’re gonna sell credits that get danged for uh the workflow or an action taken or other things like that. So excited to see where that goes. I think another thing that they they did very well on the category creation side, obviously, they paid a lot of attention to brand and Oaklay brand is great, but um the devil side, the devil has sort of of like the agency model that they created, which is these agencies all essentially built massive businesses on top of clay. Uh and you either have somebody internally that’s a growth engineer, or you have an external agency that’s a growth engineering agency that uses clay and and you know uh manages that process for you. It’s a double-edged sword in some ways, where it’s like you get these agencies marketing on your behalf, selling on your behalf, building their businesses with your product. Uh on the other side, it opens up opportunity for other companies to come along in the next iteration or you to have this conversation internally one day where it’s like, do we cannibalize that by making the product simpler to somebody else wanna make it simpler, allow people to use a top heading or growth engineer or having an agency? So we’ll see where that uh goes from here. But they’ve done a phenomenal job of getting buy-in from the community, we’re getting buying from those agencies. I think they did a very early out Slack community that was one of the best customer communities I’ve seen executed. So uh I’ve done a fantastic job from you know from the last two years. Yeah. And then, all right. So you’re what it was, one to a hundred nine?

Paul Irving: 5:04

One to a hundred million. I I I think uh where they did a great job of is pairing the brands and thought leadership side with the agency side of things because we’ve seen it too. You could get caught sometimes if you’re selling in initial customers ID agencies, they don’t want their customers using it because they want you know people coming to them. You get stuck selling to agencies and them kind of you know keeping the secret about you know the power of your product and what it can do. Uh they kind of you know double pronged approach where they had these agencies coming in and using it, empowering a bunch more customers and companies to be using clay, uh, but also had you know, there’s LinkedIn, Twitter, Slack community that you mentioned, uh almost evangelizing the product, crux. And so you don’t get kind of stuck in the agencies only, you get you know broad-based uh adoption across customers, across community, across uh the uh the agencies that started being you know the first changes of product.

Max Altschuler: 5:57

Yeah. Well, you know, they’re they’re also going up against kind of this new world that AISDR. Um and I don’t know how that manifests in terms of you know if if Clay uh adds a lot of firepower to those companies or if that ends up superseding. Uh, but there’s been a ton of debate on AISDR when AISDR came first came out, I think, with companies uh we’ll name them, but like there was a lot of spraying print. They had a lot of like, hey, this is gonna burn your beep list and this is gonna work, and you know, the the message isn’t good enough. So I think what you’re seeing right now is like there’s probably, you know, for every segment of your business, SMB, market enterprise, and the frame of view uns discussed, but like there’s probably eight steps you can get from a um, you know, in a sales process, from like the the the moment this company finds you to the the closed deal, and let’s call that like an eight-step sales cost. Well, an inbound use case might be able to get you, you know, from step one to step six with like SB customers, or even maybe the entire way. For mid market, it might do to step six. For enterprise, it might do to step three. Like all of that is super impactful. Like it’s it’s what we’re seeing is a lot of data points on like the buyer is a lot further along by the time they speak to a salesperson than they ever have been in the history. And I think like that’s the key thing is like they’re actually like closer to making a decision, a purchasing decision. And whether that’s the AISDR or their ability to do deeper research, but it’s like shortening these sales cycles, and I think AI is had a lot to do with it. And I had always thought that like AI sales will never exist until the buyers were completely AI. And it’s one of those things where it’s like um the incentives are not aligned because like the person, the the buyer never wants AI to be the buyer because then they’re out of a job. So like they almost like we’ll never implement that fully. So it’s one of those things that that’s gonna stick, but you’re actually able to get like so much further now. So we’re start I think we’re starting to see like AI BDR really start to take hold, start to work, move those PDRs into higher value roles, uh cash to the value there. I think obviously as you s as you move up in segments, a person matters more. Yeah. And there’s still a lot of the tri-truple books that matter, but uh, you know, we’re seeing companies like Abarra in one mind, Cast talks about what one more investors in Barra, uh, but coming out with a lot of these these you know role-playing or uh like virtuals, essentially reps that come in place SDRs, solutions consultants, customer success managers, and they’re full with all the knowledge bases that respond on time every time, right? So like two things that humans aren’t necessarily consistent at. So I think we’re actually starting to get from a coin of like the the base hysteria that we were at, like the the first inning hysteria to like this point where it’s oh, does actually have a a valuable use case here, and maybe it’s not the whole thing replacing everything and like spraying prey, but there’s something. What do you think about that?

Paul Irving: 9:10

Yeah, I it’s it’s almost like surprise, surprise, and new ones matters in this. Yeah. It was uh in the early days, it was it was binary. AIS CR works or it doesn’t work. It’s either gonna burn her bould lead list, and uh, you know, you’re gonna have your domain shot, and there’s gonna be all these problems, and your customers aren’t gonna like the experience on the other side of it, or it’s right, look at the amount of reads we’re booking and efficiency we’re gaining on the go-to-marketment side. It’s fantastic. In reality, just as you mentioned, every company is gonna be a little bit different. Every go-to-market motion is gonna be a little bit different, and there are some huge value gains for certain segments of the market or certain parts of your go-to-market potion. So in the in-bound BDR example is a huge spinchit. Sometimes a customer wants to top, sometimes they’re with checking out your website at 11 p.m. their time, and they don’t want to have to wait three days to get booked with a BDR who’s fresh out of college and might not even know all the product features and security features, you know, of your platform. Instead, you can talk to an AI booty r right there, get most of your questions answered, and move yourself through the buying funnel. I mean, Cassie talks about it, but the way buyers want to buy is also changing. And so you can meet them where they are. You can say the same thing with AI and some customer success uh use cases. Sometimes you have a big problem that you meet a human on the other side, but sometimes you just need something fixed. And an AI CSN is going to be available 24-7, any time zone is going to be able to triage a good percentage of your potential tickets, potential problems with customers. Uh, and so it’s not this binary, it either works for us or it doesn’t. I think uh products in the market and companies that are building are solved for this, but you’re seeing buyers be ready for it as well, where hey, there’s some real value to be had in our oracle. We just need to decide what the right fit is.

Max Altschuler: 10:52

Yeah. Yeah. What um where are we thinking that’s gonna go to? I guess what are what is the next evolution of that? Like are are people going to from here trend more in the direction of completely replacing their sales teams? Or do we think that this kind of there’s a little bit of like limited stasis for a while in where we are and like what are we optimizing for? I guess okay, because the that and like that you know, we don’t do a ton of GTM investing, I think for uh multitudes reasons, but um, you know, we’ll always take a look at the best companies that are out there, and we’re in quite a few of them. But there’s significant, I think, headways in a lot of these areas, and then there’s also turn in tots. It’s like what’s working now popular won’t be what’s here in five years.

Paul Irving: 11:47

Yeah, I almost look at it like incremental change versus overnight wholesale change, where you know, do we look at inbound BER in a year’s time? Is you know, a tech forward adoption is 70% of that job done by some of these AI five farms. I think you could see a world where that’s true. Uh, you know, outbound STR is that for high velocity SMB, you know, long tail market segments, is that adoption and success look something like 50% market penetration? I think that’s possible. Will that work in an enterprise? Probably not. Uh, it’s not a good fit there. I think you could see the same with some of these AI customer success platforms. Is it triaging 60, 70% of your tickets? Absolutely. Uh, but you would, I mean, Clark did this very publicly, but they was saying, you know, we’re placing our entire customer success or customer support or with AI seemed like a little bit of a, you know, a PR function to a certain extent. But then, you know, come back and say 12 months later, all right, we’re replacing 30% of it. That math seems about right. Uh, where it’s not that it’s gonna be this zero or one replacement one way or the other, but you’re gonna start seeing people adopt it and the penetration is just gonna creep to creep as long as the platforms uh that are providing AI native technology can deliver on the promise and that customers are still you know having more success interact with than they would if it was just human but job.

Max Altschuler: 13:12

Yeah. Um another thing that we’re seeing uh in the marketplace right now is you know, we had this very 2023 moment where it was declared that like GPT wrapper equals bad. And then a couple years later now, 2025, a lot of the GCB GPT wrapper companies ended up being like the fastest growing of all time companies. Um and so there were a lot of misses there. And you know, now we’re kind of seeing similar problems in some of these companies that are rip it, but maybe going to have a gross retention. Is she? Uh Cassie makes some valid points in the podcasts, and I’ve had some agreement, some disagreement with those. Yeah.

Paul Irving: 14:02

What are your thoughts in that and that area? Yeah, so Cassie wrote a great article on Topline uh called the Gross Retention Apocalypse. So she de she definitely stands uh definitively on one side of that argument. Uh, but we talked about it last month in sort of this ERR experimental, you know, revenue versus ARR to more traditional annual. Um and then there’s some great data points in Cassie’s argument, which is that there’s a gross retention apocalypse uh you know on the horizon for a lot of these apprehensive vast-growing AI companies, which is you know, 60% of AI purchases are being made from an innovation budget, which is a non-traditional budget that came from Menlo. Um people are typically by, we’re hearing it, you know, just from talking to potential customers, by multiple tools that have overlap so they can test and iterate and then end up sticking with the one they like. And Cassie wrote about it, but she, you know, wanted to, in a purely informational research capacity, call the logos on a lot of these basket companies’ website just to see how they’re using a tool. And then she would frequently hear, you know, we’re actually being determined. And so there’s a demand for adoption like we’ve maybe not seen before in a generation of technology where companies don’t want to be left behind on AI revolution, so they’re buying you testing tools faster than ever. Uh, but it also, and this is what Cassidy posts for, a you know, refocusing on customer success or a reinvigoration of customer success as a functional within go to market where you know, time to value, how fast can you get customers, you know, getting ROI from your product? How sticky can you make the product? Uh forward deploy customer success reps. I guess that’s something that we’re gonna see in some of your larger customer segments in the future. I know you have a slightly different take on it, but there is some interesting data point to say, hey, we we should be looking at this.

Max Altschuler: 15:47

Yeah. I mean, I think there’s there’s there’s a lot of uh there’s a lot of companies right now that are having problems with that time to value, that onboarding. Uh I think honestly, if you’re a PLG company, it’s much easier for you to kind of show that value quickly, get people all good running in your product. The companies that are more enterprise, stickier, uh, you know, we’re getting calls from a lot of those companies that are like, I have crazy pipeline right now, but like I can’t get people onboarded fast enough, so they’re trying to figure that out. So there’s a balance of different ends of the market. I think, you know, from a uh you know, ring the fire alarms emergency type situation where it’s like there’s all this experimental revenue and this churn that’s happening, you know, it’s one of those things where similar to the 2023 GPT wrapper thing to now, it’s like, well, is this a feature not a buck? Does this actually like get figured out over time? And like it’s okay that it’s a little bit of a leaky bucket because the products are just getting so much better so fast that as long as they’re getting a lot of the hype, a lot of the buzz, there’s people coming in and trying to like you’re going to build the mousetrap. It’s going it the the it’s going to work. And then when it does, it’s going to capture that to make you going. In the meantime, like instead of focusing on that fallout, that let’s just keep focusing on like this piece. And like once this is good, we focus on this piece, and like never almost focus on this piece. Like this piece doesn’t even end up like you have to catch anything falling if like this actually just keeps working. It’ll be interesting to see where that nets out. I think that’s the what the debate is. So I don’t necessarily like disagree with Cassie on this kind of uh ER, I spent on experimental revenue error that we’re in right now. I certainly think that’s a thing. I do think that uh in terms of like the retention side of things being from not getting the most value out of the product, I think that actually ends up getting fixed. I think the piece that we will lose probably in 26 or 27 is you’re not gonna have teams trying five different of the same products, right? Like you, you know, the the marketing team has to pick between anything lovable or ult or that they’re not gonna use all three. Um, whereas right now you might have one team using this, one team using that, one team using this, one team using all three just to see which one’s gonna be best, right? And they’re paying for the all, and then it’s like, okay, well, there’s gonna be a CFO record itself.

Paul Irving: 18:11

Yeah, I mean, we’ve seen it in in cycles before. I don’t understand why this would be any different. Quality wins out. So what what is likely happening is is the gross retention problem gonna happen for the best companies? Probably not. Those are the ones that build the best products, have the best brands, delivering the most customer value on the other side. The cause the companies that are gonna have a gross retention problem were the ones that aren’t delivering enough value, which are probable products that should have grown that fast in the first place. And so it’s almost like sifting out the you know, the silk for gold on the other side of it, but the quality companies and platforms wonder. Uh and then the other thing which we talk about, and we’ve got a few companies in the portfolio that that I would say meet this description, are going through, despite the fact they’re selling new age AI products, true enterprise buying cycles. And they still have to go through procurement and legal and security and have you know your economic buyer, multiple champions across the organization. When they’re in place, they don’t get crypto. It’s it looks like traditional enterprise B2B software. Yeah. And so even though the fastest growing sort of self-serf sign-up PLG tools are getting headlights, I think there’s this second wave of enterprise first AI companies that uh aren’t getting the same buzz on Twitter or LinkedIn today, but you’re gonna hear for the next 12 to 20 from Arts.

Max Altschuler: 19:27

Yeah. Last topic on on this is uh, you know, you are seeing so many companies get funded right now. Great ideas, cool, like, we know, innovative concepts, but that means a lot of competitors. Uh we just listed one set of anything lovable bull. Uh uh, you know, we talked uh at length about uh uh quite a few of these other categories where it’s just like wow, this is really cra cra crowded, uh Harvey, Libora, you name it. Um my comment. To you was that and it was an unpopular opinion. Was that I actually think it’s good to have really strong dependers. And then like two days later the Cal she hang out. You said sitting there was like, alright, I’m validated, but now I’m laid. So it’s like um but yeah, I like my unpopular opinion on on all this is that I think it’s really good to have great competitors. I think they push you to be better. Uh they help build the market, build the category. Uh and the third one is certainly nuance, but like I actually think it’s helpful when you have a competitor that’s good when you’re fundraising or have contacts. You know, in some cases, yeah, sure, they’ll be like, oh that cup that company raised a ton of money, they’re running over the space, like we don’t want to invest in over two. But I actually think it’s better than like, oh, you know, we saw a company that did this before, it didn’t work out, so we’re not gonna build with you. And it’s almost better when you have a successful competitor where it’s like, okay, cool, like this works. And it also means that like really smart people are building in your space, competent people are building your space, there’s a great pet. So I think that’s you know, one interesting wrinkle, one interesting nuance of this whole era that went right now where everything’s getting funded, is uh some really smart people working on some really awesome things, and even if there’s multiple companies in each space, that’s gonna push all those to be better.

Paul Irving: 21:23

Yeah, I know I gotta bring my hot take next time. I like this one. Uh and you lived it firsthand. I mean, outreach sales of was an incredibly competitive category, it was a new category, and you know, you were on the front lines of the brand and marketing and execution side of that one marketing. Yeah. We talk about it all the time in turn when we look at companies in competitive categories, but it can be the thing that pushes you to greatness in at speed, at a velocity, uh hiring the best talent. There is a gravity that comes with competition because there’s a gravity that comes with a category where there’s a lot of customer products to bring. You hire people who are competitive, which is great.

Max Altschuler: 22:02

Take pie in their company, it’s it’s community building. I think there are a lot of bros there. All right, without further ado, let’s kick it over to Cassie Young, general partner with primary venture partners. All right, Cassie, how you doing?

Cassie Young: 22:14

I’m doing great. Thanks for having me, Max.

Max Altschuler: 22:16

Yeah. In my mind, at least, you’re the person, um, at least the first person that comes to mind when I think of operator to VC pipeline. Um, you know, there’s a lot that go from operator to operating partner. Obviously, there’s quite a few folks that go from finance to VC, um, you know, founder to VC, even engineer to VC. But to be a GTM leader um kind of in your past life and now be an investor VC, I think that’s pretty unique. Um, how did how did that even go?

Cassie Young: 22:46

Well, first off, that’s very kind of you to say, and I would also say right back at you, because when I think about this category, I tend to say the same things about you. Um, so we’ll have a fun conversation today. Um, but I’ll actually tell you, this was kind of an accident for me, which feels weird to say, but I always tell people I didn’t have a long-term career career ambition of being in venture capital. But I think the road is long and everything happens for a reason. So, you know, as you know, I spent 15 years in venture-backed startups, all in go-to-market roles across marketing sales, customer success. And, you know, primary, the fund I’m at today, is a 10-year-old fund. But I like to say that I have a 15-year history with this firm. So the way this math checks out is Brad Srluga, who’s one of our co-founders here, had another fund before primary and led the series A investment in a business I was working on when I was in business school full-time in 2010. I wasn’t a founder, but I was a really early employee. And I got this amazing exposure to him through the board. And we kept up personally and professionally over the years. And when he started primary with Ben Sun in 2015, I met then and I shared that whole long-winded history because it’s ultimately the relationships that really spurred me even considering this as a potential path, right? And, you know, a lot of times I get asked this question of, well, how do I find those jobs? And what I tell people is you’re not going to find them, right? You have to be sort of sought out for them. And the number one way to do that, I think, is to build relationships with existing investors, right? Because even if they don’t have opportunities, they have networks of people, right? And getting in through a warm referral, just the same as any other go-to-market channel, right, is the fastest way to come in there. But very candidly, you talked about, you know, not just making this leap from operator, but to operating partner and then to investor. You know, I’ll share that when I came to primary in early 2020, I was very vocal with Brad and Ben, our co-founders, that I didn’t know if it was going to be a two-year home for me or a many decade home for me, right? And it actually came back to me. My last company sail through, you know, we had sold into a private equity roll-up and I stayed around and worked on that for a while. And um, you know, after I was like through the one year mark there, I ended up chatting with uh Bill Gurley from Benchmark, who had been on our board at Sale Through about just some career advice for my next move. And he said something to me that was probably one of the best pieces of career advice I ever got in my life, where he said, Your phone is about to ring for all these jobs that look like the one you just had. Do not take any of those calls. Meanwhile, I was like midway through process. I was like nearing the offer stage. And in the background, Brad at primary had been like, you should just come do this. We want to build a different type of venture firm. We really need operator DNA. And I thought to myself, well, maybe I’ll go try this. And I said to myself, there’s a couple of different paths that could play out here. Maybe I’ll like venture capital, but my husband would tell you, I actually thought that was like probably not gonna happen, right? Number two was maybe I’d want to be a founder after being a right hand to a CEO a few times over. Number three was maybe I would go become the CEO of a company that really outgrew its founders. Or fourth was maybe I would go do the CRO thing all over again, but in a totally different industry. And any which one of those paths, doing the venture thing was gonna fortify the personal balance sheet for doing that, right? More fundraising exposure, more business model exposure. And I accidentally fell in love with venture capital along the way, but I actually didn’t invest for my first two years at primary. And I did that by design. I took a number of board seats from Brad and Ben because they were just totally overloaded. So I got immediate board exposure across a number of different places. Um, but I wanted to make sure I was going to be here for the long time before I did that. And in hindsight, I think that was a very, very smart move. Um, I think I had a steep learning curve as an investor, regardless of waiting. Um, but I think it could have been really ugly, uh, quite frankly, you know, with with the benefit of hindsight if I had jumped right into it.

Max Altschuler: 26:40

Yeah, well, you got that experience. Obviously, uh Brad and Ben were, you know, great mentors for you in that situation. Yeah. So we got uh Craig Rosenberg from Scale, Bill Binch from Battery, uh Dancy Andres at uh iconic, you got Hillary and Jeremy at um Insight Partners. You’ve got a lot of GTM operators who went into BC, but they became operating partners. Um here, with obviously the mentorship from Brad and Ben, you know, you’re an investor, but you also have a platform team as well that you manage that supports these portfolio companies. Can you share a little bit more about that?

Cassie Young: 27:17

That’s right. I’ll share more about it, but first I’m gonna do a little bit of a wrist slap situation because we joke that we have an allergy to the word platform uh on primary, right? Okay, the lowercase P platform. We’re cool if it’s the capital that bothers us. Yeah. So we call um our portfolio support team the impact team. We actually used to call it the portfolio impact team, but portfolio felt too primary and not enough about the founders, right? So we now just call it the impact program. But yeah, I have a bit of an interesting roll around here where, you know, I spend some of my time as an investor, some of it running the impact team. And then I actually run our broader firm operations as well. So I laugh when friends ask me, when are you gonna go back to operating? And I’ll tell them we we actually are an operating company at primary in many ways. But yeah, let’s talk a little bit more about the impact team. So I’m really gonna give the credit to Brad and Ben for having the vision to do this. And they really asked me to come on board to help them bring that vision to life, right? And professionalize what they wanted to do. So let me give you a little bit of history. Uh, Ben was an entrepreneur in a past life, and he likes to say that he was a customer of the venture capital asset class with a really crappy net promoter score, right? And when he started primary, he wanted to build the type of cap table that he wished he could have had as an entrepreneur. His view on how to do that was irrespective of who you are as a founder or how well connected you are, in the early days, your company doesn’t have brand, right? And you can’t attract or afford the level of talent you want, right? Maybe you can get some customers through the existing relationships. And so his view was what if we were willing to invest in bringing operating partners into seed, which was very, very unheard of at that time. And honestly, still you don’t see it in many places today, where we said, hey, we bring people who’ve had these C-level jobs and give the portfolio companies access to them. And the belief is not that these founders aren’t perfectly capable on their own, but that time is the scarcest and most valuable resource that they have. And if we can accelerate their ability to do the early work streams, it future-proofs the path to series A and also really accelerates the speed of getting to Series A. So that was kind of always the vision and mandate behind it. Um, so when I got to primary 2020, uh, we had, I’ll call it sort of three and a half people uh working in different portfolio-facing jobs. And um a huge part of my remit has been figure out how we scale that. And so today uh we have almost 30 people um working on that team. It’s um more than double the size of our investing team, which is a fun statistic. Um, but there’s really three core pillars of that program, right? And it comes back to what matters most to early stage founders. It’s um getting the right people in the right role. So for us, that’s what we call our people and networks function. The second is securing your early customers and making them rabid for the product, right, which is go to market. And then the third is making sure that you’re gonna have a really compelling narrative for downstream fundraising. So that’s the strategic finance bucket for us. What’s happened over the course of the past five and a half years that I’ve been here is that we’ve transcended just the operating partner model, right? So we still have a senior person eating, leading, excuse me, each one of those domains, but they are supported by more ICs, mid-level management resources that are doing really hands-on keyboard work for the portfolio company. So if we think about go to market, right? Um, that’s led by my partner, Jason Gelman, who’s an operating partner here, amazing revenue strategist, RevOps guy in a past life was with Compass from Series B to IPO. Jason has a couple of different things that sit in go to market right uh right now. He helps with go-to-market advisory and hiring and all that fun stuff. Um, but we also have a huge team that we call market development that’s actually going out talking to economic buyers and building pipeline on behalf of our portfolio companies. We most recently added a full-time resource to primary who’s tasked with go-to-market innovation and engineering, right? Who’s doing that for the portfolio companies full-time. So that gives you a taste of what impact looks like. But what I’d be remiss not to say is that I actually think the magic happens at the intersection of those functions and the connective tissue. So if we go back to go to market, you know, we also had this strategic finance function. A huge part of what we do when we help for series A readiness is thinking through what I call like the plan to hit plan, right on the other side of it. Um, Kurt, who runs our finance function, has a better line for already, calls it the path to the math, right? And so Gelman and Kurt work together, right, to go and do that. And then they bring in talent to help figure out how we’re gonna go and actually hire the AE capacity, right? To go and do that. So you have each of these silos, but really I think where the magic happens is as they um come together to support the portfolio companies.

Max Altschuler: 32:01

That’s great. I mean, it sounds like you have these kind of built-in playbooks that you bring to your portfolio companies and help help them increase the odds of success, you know, in various areas of their business. Yeah. How did we build the GTM fund back office? Easy. We leveraged Angelus rolling fund product for Fund One, which was the perfect vehicle to scale up GTM Fund in its first iteration. This structure allowed us to build our network, add revenue leaders, and deploy capital all at the same time, which was crucial for getting early points on the board and building relationships with founders. Fund two, we transitioned to a traditional closed-end fund structure through Angelus, this time with institutional investor support. This model allowed us to be more intentional about our portfolio construction. We worked closely with the Angelist team throughout this process and they were incredible. Always there to support us and our LPs every step of the way. If you’re raising a fund or looking to migrate your fund, we highly recommend you check them out. You can do so at Angelist.com slash GTM fund. That’s Angelist.com slash GTM fund. I want to come back to that later in this episode. What I want to get into now is how do you decide what companies you’re going to invest in? Yeah. So I’d like to understand from primary standpoint, like what percent of your deal flow is inbound? Yeah. What percent of it’s outbound? And you specifically, like, how do you find these companies and then also size them up for investment?

Cassie Young: 33:19

Absolutely. So lots of things to unpack there. So in no particular order, I would tell you that a lot of the deals that we do come inbound to us. Now, they may come inbound in lots of different ways, right? Um, very often they come inbound through a founder in our portfolio, right? So uh the number of healthcare founders in the primary portfolio who came out of Oscar is high, right? Because you back one of them and then they send you other amazing operators that were there. We also get quite a bit of deal flow from later stage investors, right? So I think about one of my portfolio companies, Lyric, which is now a series B business, it actually got sent to us by Goldman Sachs, right? Because the founder had had another business in a past life. He had worked with Goldman in more of a scaled capacity. Um, one of my colleagues, the principal who works with me, Zach Fredericks, had a great connection with a supply chain guy at Goldman, and it came about that way. So there’s a lot that happens that way, but we’re always thinking about outbound as well. And you get it, you do early stage deals. It’s always this question of like, where do you really find alpha with that? And I think for us, it’s this question of you, you there’s no such thing as finding someone too early, meaning the best deals we can do are the people who are still engaged in their full-time jobs at another company, right? So we do all of the stuff that every other venture fund on the planet does now, where it’s we have the LinkedIn stealth scraper, but all that stuff’s become commoditized, right? So the fun thing for me actually at primary is how do you use a go-to-market brain, right, to think about where you might find some of those people before they’re ready to actually pull pull the switch and go and do it. And I think this is the hardest part of the job because there’s a CTO in my personal portfolio, Bay Area-based, amazing guy. I had breakfast with him a couple of weeks ago and I said, humor me. When you were still in your last job, right, leading this engineering team, like how many people hit you up? And it was insane, right? So you really have to think about what’s the value exchange you could offer if you’re gonna go and do that. And I wish I had the perfect answer to that question. I’m like figuring that out week to week and just not afraid to try new stuff to get their attention.

Max Altschuler: 35:23

Well, it’s definitely good to go ask your portfolio companies like what was your criteria? What were you looking at? Or, you know, how would um how would I have an as an investor been able to get your attention earlier? That’s right. Um what were the things or catalysts that’ll that made you decide to start a company? And so how do I start looking for those same catalysts and trends? That’s exactly right. Okay, well, within this company, there’s a bunch of engineers who are gonna go start their own companies because when that same thing happened at this other company, a bunch of engineers went to start their own companies, right? So you’re always looking for that edge. You’re always looking for, you know, trying to understand the, you know, what what is gonna be the tipping point that’s gonna make somebody who’s, you know, happily employed at a larger company, but it’s gonna be a good founder one day, that’s right, decide to take that leap.

Cassie Young: 36:10

100%. And my thing is also like, even if they’re not gonna make the leap to be a founder, because of everything we do on the portfolio impact side, I just want to know the best talent, regardless. Right. So, you know, if they, if we think they’re gonna be an amazing founder and they’re like, I want no part of that, well, maybe they would be a great early product hire, right? Or whatever um the right path might be. But, you know, once we uh make contact, right, and are really thinking about how to invest, I mean, much to my chagrin as a self-proclaimed data junkie, I made my whole career on being good with data via GM, you and I both know in the early days, we don’t have that luxury, right? We have data on the market size, and that’s about all. And so at the end of the day for us, really we’re making a bet on the size of the market opportunity that the person’s going after, and then the team. And at the end of the day, particularly in the era of like the AI explosion, everything else, it comes back to this first principle of who is the founder that you’re ultimately backing. So let’s talk about the founder, right? Because at the end of the day, that’s the core of everything that we do. So we have this founder outcomes framework that we use that we’re always thinking about in the background, both when we do new deals and then when we reinvest in portfolio companies as they grow and scale. My partner Rebecca Price, who leads our people in networks practice, helped us put this together. There are five elements to this, right? So the first is this ability to set the vision. This is not rocket science, right? We all talk about it all day long, right? But what we don’t mean by that is just get people excited or an ability to be a great salesperson. We are really looking for someone who has an earned secret or some type of market edge, right? That, you know, people talking about the, you know, founder market fit, et cetera. I don’t think there needs to be founder market fit, but there needs to be some, you know, compelling uh component to that. Number two is the founder has to be able to sell stock, right? Because at the end of the day, right, you have to be able to raise capital for your business. It’s really important. So of course you need to be able to sell customers, you need to be able to sell employees, but you do need to be able to raise capital for the company. Number three, relatedly, is the ability to hire talent, but importantly, hire amazing talent. And I’m happy to spend more time on this later, but I see it particularly with young founders, where the make or break can be well, am I gonna hire someone who’s like a friend of mine, or am I gonna go find someone who’s totally gonna be a complete bar raiser for the business? And I have a couple of fun examples of that we could share later. Um, fourth for us is actually a newer one that we’ve really started talking about in the era of AI, which is this concept of what is the jaw-dropping customer experience? We call the JD State C E. Um, I think Neil Meta from Greenoaks was on Invest I think the Best talking like this recently. This actually came out of BOM at coupon, right? So Neil and my partner Ben are on the board there. BOM in the early days of coupon was like, I’m gonna blow customer expectations in terms of how quickly I can get them goods in the AI world where there’s so much stuff being built. We’re like, really, what is gonna be the undeniable magic for the customer? And then the fifth thing is really focused on are they a learning machine? Right. And that is really hard to tease out in a couple, maybe a two-week diligence process of what’s there. But the way we try to triangulate that is actually looking at their past in terms of the really hard things that they’ve, you know, had to figure out along the way. So that those are kind of the elements that we’ll consider on the founder side. Happy to dig in accordingly, like we there’s lots we didn’t talk about in terms of like what we look at on the market side or would be customers, et cetera. But those are just, you know, some of the broad strokes things that are top of mind.

Max Altschuler: 39:52

I think that lifelong learning piece and uh the passion that they have to have for the topic is so important. You know, people talk. About the 996 and all that. And it’s like, well, the hour, if you’re counting the hours, you’ve already lost. I actually think you like it’s, you know, we we’ve had this conversation at uh at the fund quite a few times. And, you know, we try to back a lot of operators turn founders, and we’ve got a huge network of it. Um, but there is something incredible about you know, three people in their 20s that really have nothing, no other responsibilities or priorities in their life. And they’re hyped up on coffee at 3 a.m. on a Saturday morning working through some kind of use case for their product. And just they’re doing that because they love it and that’s all they want. For sure.

Cassie Young: 40:37

I don’t know if you follow their at Beehive, but he has this great he builds in public. They’re not a portfolio company, but I’ve known Tyler for a long time, a huge fan of his. Um, I regrettably passed on that one, which was a which was a bad pack. And Sip Warful’s selfie. I don’t, but I know. But I I’ve known Tyler a long time, but he builds in public and he talks about I I don’t know if this is still the case, but months ago, he had this post about how being single was his competitive at BS hitch, which I totally buy. But here’s what I’ll say about even not the young founders. Um, Jason Gelman on our team has this term that he uses that I’ve started borrowing where he’s like, is that founder deeply serious about their craft? And it sounds like such an easy way to describe something, but I think about someone like, you know, Amanda Kalo in our portfolio who’s running One Mine, previously started Six Sense. Amanda, you know, has been around the block in her career. Amanda, I think I was joking with you when I came in here. I’m like, you know, she’s three hours behind me. And I’ve usually already spoken with her by 7:45 in the morning, right? And it’s I’m talking to her on a Saturday and she’s apologizing about her kids in the background. I’m like, why are you apologizing to me about your kids? But she’s so obsessed with the business problem that she can’t stop. And I would say if you don’t have that, venture scale businesses are probably not the right place to go be a founder, right? And there’s many other ways to be entrepreneurial in other ways. But as you and I both know, I always say like venture capital is not for everybody. Like, what happens if you put rocket fuel in a car? It explodes, right? So it’s uh I I do think it’s it’s just absolutely so important.

Max Altschuler: 42:05

Howard Lerman in our portfolios like that. I mean totally like that or retired tomorrow problem. Uh, the guy’s always on. Yep. As kids, always on. So it’s yeah, it’s but it is a passion thing.

Cassie Young: 42:17

It’s an intrinsic motivation thing too. And you see it even in non-founders, you see it in certain operators. Yeah. I remember Kurt, um, who runs our finance function, when we were in the final round interviews with him, I had a long format breakfast with him, and he made a comment to me that he may have since forgotten about, where he told me that, you know, his wife made this comment to him once that he can’t even take a shower without thinking about work. And I’m like, You’re hired. Right. That’s like exactly the type of people that I need around me. It’s a it’s a disease, but it’s a fun one.

Max Altschuler: 42:43

My my first year post outreach uh sales hacker outreach acquisition was like the most one of the most fun years of my life because it was just like, all right, cool. Now you’re in a massive business, you have a ton of responsibility, we trust you, go. And it was like the amount of stuff that I had to learn, yeah, the things I got to do, got access to, it just like completely brought in my horizons in this amazing way. And I was just like, I woke up every day, five in the morning, like just like, I’m on, let’s go. For sure, let’s start now. For sure. I probably pissed a lot of people off. I’d say HR, one of the first things they said to me was like, Hey, you send emails at all times, and like might be good for you to just preface that like just because you’re on now doesn’t mean everybody else has to be on right now. Like this isn’t urgent. And I had to send an email to like my 20-person team, like, hey, I’m going to send you emails at all hours. Totally. It does not mean that I I will let you know if I need a response in like the next, you know, 90 minutes or whatever. If not, you can get to it when you need to get to it. When you get to it for sure.

Cassie Young: 43:41

I think one disclaimer we have to put on this is there’s a difference between activity and productivity. Yeah. Right. So, you know, when you’re deeply serious, you also have to make sure that you are focused on all of the right things. Right. And for me particularly, you know, having run customer orgs in a past life, I just believe like if you want the ultimate hack to building an incredible category-defining business, you have to be obsessed with your customers. Yeah. So I think the other thing that these founders have in common is that they’re deeply serious about their customers, right? It’s their focus, yes, they’re focused. And there’s not a day that goes by that they’re not thinking deeply about the the customers and the prospects. And they know I always say, like, if you do everything in your power to make your customers wildly successful with your product, asterisk within the financial constraints of your business, you would have to catastrophically screw something up to not succeed as a company. And it sounds so stupidly obvious, but I think you and I have probably both seen the companies where it’s like, no, we’re just gonna like build for building’s sake. Or we have a belief, do you know what I mean, that this is the way the world is gonna go. That has to be married with the reality of meeting the buyer and more importantly, the end customer where they are.

Max Altschuler: 44:51

Yeah, it’s really an interesting topic, too, because I think a lot of um first-time entrepreneurs, first-time founders, they’ll go get what they call design partners and then they’ll start building for that design partner. And you can be very focused and aligned on what the design partner wants. But if the design partner is not the right person in that business, you’re gonna shoot yourself in the foot. So, in a lot of situations, you might have a founder who’s like, yeah, I’ve got um a friend who works at Stripe. They’re in the perfect role for what we’re servicing. I’m gonna go work with them, they’re gonna be a design partner. Well, if that person’s not the budget holder, then you need to make sure that they tag in the budget holder when you become a they become a design partner. That’s right. And you’re mapped to success metrics that will convert the design partnership to a paid pilot. Well, there are there are success metrics beyond that that convert it to an annual contract. And then when you get 10 of those, then it’s like, okay, we’ve got product market fit, let’s scale this, et cetera. But like if you are solely focused uh on this, uh, we’re gonna make this, we’re gonna blow this person’s mind, but they’re not the right person whose mind should be blown, or you’re just building something cool, but not actually something they would pay for, yeah, you’re gonna spend uh, you know, all these cycles on that in your business.

Cassie Young: 46:01

It’s so interesting that you bring this up because I feel like very often I get asked this pattern recognition question around go to market in the early days, right? Of like, what are the most common pitfalls? Right. And my number one thing I always say is happy ears syndrome, right? Where you come in, no one’s gonna tell you you have an ugly baby, right? And you don’t frame the questions the right way. And you and I both know as former commercial people, there’s a right and wrong way to do discovery and to map a process, et cetera. And I find, um, and this is not a fault of anyone’s, it’s just kind of the function that you grow up in, but particularly for technical founders, when you open their eyes to something like MedPick, they’re like, oh my God, this is so helpful, right? In terms of these are the things I must be able to answer to be able to look you back as the investor and say, I actually have a legitimate opportunity. And so, you know, I I often say, you know, when we see pitches, they’ll tell us, well, we had this many design partners or we had this many pilots. And one of my first orders of business, right, is to really understand are those actually viable opportunities based on all of the criteria that you just spelled out.

Max Altschuler: 47:05

Yeah. Yeah. So I really want to know what’s a signal that you see that makes you want to either pause on an investment or dig deeper.

Cassie Young: 47:13

Yeah. So let’s start very top of funnel. Like I’m just looking at an opportunity for a first time. A huge indication of my excitement of whether or not I’m gonna dig in is how quickly would-be buyers get back to me about taking a diligence call. Which I think is people, it’s to me pretty obvious, but I I think every time I share that to people are like, that’s really interesting. Because there have been pitches where I have reached out to would-be buyers and that night I have five people who are willing to do a demo later that week. If I have to nudge multiple people to be willing to throw me a bone and they’re in my close network to look at an opportunity, it kind of tells me what I need to know about market pull. Uh, so that’s one of my favorite cues that’s there. In general, I really over-index, um, that, although I don’t know there’s such a thing as over-indexing on the customer pull for it, but on those conversations and just sort of the level of excitement that I’m hearing and understanding the other solutions that are there. Um, so that tends to be just a huge decision factor for me.

Max Altschuler: 48:14

Are there any deals you did recently that you have an example of where this is kind of like a this was like the biggest no-brainer type thing going forward, or um even maybe one you paused on that you were like, oh, that’s a red flag?

Cassie Young: 48:26

Yeah, absolutely. So um I would tell you there’s a lot of red flag ones. I uh there’s many deals where I will have just said, I’m not gonna move forward because I’m just not feeling the hair on fire problem um that we’ve gone through. In terms of thinking through an example of one where it was so obvious, you know, it’s actually not that recent, but Lyric in our supply chain portfolio, that’s one where, you mean they’re selling into Fortune 1000 buyers. So these are really busy people. And I actually leverage a number of folks in our LP base to help us get in front of those people. And that was one where the speed at which people were willing to get on the phone from these large, slow-moving companies was really, really promising. Um, and has, you know, remained the case today. So that’s probably one of my favorite examples that these are, you know, big behemoth companies where inertia is the worst enemy. And so not only are they taking the call, but they’re open to evaluating something.

Max Altschuler: 49:17

Yeah. I mean, um, you know, I was on uh a phone call as a favor earlier this morning to a fund with a um, you know, up-and-coming uh native to AI CRM. Yeah. Right. We’re seeing a lot of these. Uh, and I think there’s there might be a couple in your portfolio even. I don’t know if you’re in day AI or Adio or so it’s interesting. As a GTM operator, um, GTM fund, we’ve kind of purposely stayed out of a lot of the GTM tech.

Cassie Young: 49:47

Yeah, I remember you telling me that. Yeah.

Max Altschuler: 49:49

Is are you seeing the same thing? I know you did uh One Mind, um, which I think you’d consider GTM tech. I think there are probably a couple others in the portfolio. What do you saw? I saw in the GTM tech space and we could.

Cassie Young: 50:00

I’m a butt for punishment.

Max Altschuler: 50:01

I was great.

Cassie Young: 50:02

I love them. Yeah, I love them because I was a buyer of them, but it’s really hard because there’s a ton of crap in that market. And so I would say we absolutely pursue deals in that category. My thinking on it is I’m probably gonna do one, maybe two per year that are there. Now, don’t mishear me. If there were like four amazing founders building in four totally different lanes, I would look at them. But we see a ton of go-to-market deals and we pass on almost all of them. Um, I think the way we’ve thought about it is just to be very, very thesis driven around our approach. And so, you know, right now, one thesis that I very much had, and you maybe, you know, uh uh prompted the thought for me when you talked about OneMind is that we’re really living in the age of the buyer, right? Buying software sucks, right? Being sold to sucks. Like I think about all of these AI SDRs, and I’ve been regularly saying, where’s my Gmail promotional tab for all this crap? Do you know what I mean? Because it all looks exactly the same. But it’s similar. Like you and I both came up to the enterprise sales, you know, school, and we know the, well, you have gating factors to move from stage one to stage two, and you can’t talk to the sales engineer until you’ve gone through that. Um, that’s not how buyers want to buy, right? And that’s really what helped us get conviction when we did the one-mind deal a year and a half ago, is we knew the world was going to change away from that. I think the second part of the thesis, and it plays into the one-mine deal as well, is so many of these solutions are still um really fixated on incrementality, right? It’s efficiency gains, 10% efficiency gains here or there. Those are great businesses, don’t mishear me, but I think that they’re really, really crowded categories. And what I get really excited about are the businesses that are saying you’re fundamentally doing things in a way that isn’t gonna exist in a couple of years. And we actually want to radically transform the way that you operate. And one of my favorite sales books of all time and still today, and I really ask every founder to read it, is Challenger Sale, right? And I’m like, I love what AI could potentially do by way of challenger selling, right? And Amanda from One Mind would tell you when she pitches that business of like, you know, your humans, they all hallucinate, right? Like they need to be replaced by AI. She’ll tell you 50% of the people like put fingers in their ears and think she’s crazy. And that’s how she knows she’s on to something. And I think that’s what has me really excited. So the incremental solutions and go to market, it’s like a pretty obvious no for me. Um, I do worry that I don’t even worry, I know I’m gonna miss something great, right, with that approach. I also think there’s some categories that I had like real allergies and hangovers to. I mean, you know, Sail Through was a Martech business. We sold that company for 3X ARR on the nose out of, you know, I had a number of years of blood, sweat, tears, 90 flights a year going to do it. I don’t want to sound like an in-grade and like we had an exit for the business, but I think like Martech just suffers from that. Yeah. It’s a, you know, particularly when I say Martech, I’m talking about selling into the B2C universe, like what that is. But surely that’s gonna be disrupted. So I’ll look at things, but I really, you know, I mean I I think I’ve given you an indication of the types of things I’m trying to triangulate in the background when we go and do that.

Max Altschuler: 53:07

Yeah, I certainly think we have a little bit of that too. Like we almost like know the space too well. Totally. And so we’re we just, you know, aren’t taking that much risk there. I think uh, you know, point you made is is fantastic, which is um it’s incremental gains, you know. So when you look at, oh, we’re gonna displace HubSpot or we’re gonna display Salesforce. I look at that and I say, okay, well, those are like minor nuisances that people have with those platforms, but they kind of do the job and do the job well, and they’re leveraging AI too. And so, yeah, like they’ll there’ll be some people that start their companies and get off them, there’ll be some people that you know are willing to move, but I think that’s a lot harder than put potentially going, you know, as an investor, I can make that bet, or I can make another bet, but I only have one bet to make. So then when I look at a lot of this vertical SaaS that we’re doing, it’s not just something exists and it’s a little slight nuisance. It’s like nothing exists or nothing’s been recreated since, you know, the 90s or something like that for these people. And so now all of a sudden there’s just like massive platform shift. So if I’m gonna make a bet as an investor, I’m gonna make a bet on this massive platform shift versus this kind of you know incremental increase in what’s happening over here. So I completely missed too.

Cassie Young: 54:19

I I completely agree. And I’ll tell you, you know, one area I have a lot of energy around that I’ve yet to find like the thing here is software implementations, right? And I keep getting pitched these things that are like auto-creating, they’re like the modern PSA tool. Do you know what I mean? Where it’s like, well, we’re gonna auto-create all of your artifacts. And I think to myself, that’s not the opportunity here to go and do that, right? Why are we still living in this world of 15-week implementations where you and I both know phase two never happens in them, right? Like let’s really address the systemic issue at hand. So I couldn’t agree more with what you said, but yes, I’m keenly aware of the fact that um I will miss some things along the way. Um, but it’s interesting, you know, we run twice a year an off-site for all of our investors. And one of uh the highest value things I think we do there is we bring in GPs and partners from other firms as guest speakers. And there’s always amazing nuggets that come out of that. And Tom Lavaro from IVP joined us last year, and he had this great line that really, really deeply resonated with me, where you just reminded everybody that, you know, you’re judged on the deals that you do, not the deals that you don’t do. Um, and I think that I have to just constantly remind myself of that, knowing that I’m I’m sure I’m gonna miss something great at some point along the way. Yeah.

Max Altschuler: 55:33

No, the anti-portfolio is a healthy thing to have, but it’s certainly we are judged on the deals that we do do. Um, you know, I think one of the things I definitely want to touch on in this um episode is um what are your thoughts on how you coach, you know, you invest in the pre-seed and seed, how they build the product for go to market. Yeah um I’m actually uh you know very close with uh uh CEO of a public company that’s kind of going through a second act right now. And we’ve had some conversations about some of the things we did at Outreach that I wish we would have done differently. And you know, one of those things is um we never built a self-serve motion. And that has so much to do with your sales process, your support process, all the other things that are downstream of that. And what I mean by that is, you know, it’s tough to build a profitable business long term when you don’t have that. At Outreach, um, we had an inbound sales development representative, an outbound sales development representative, a sales rep, a solutions consultant. So that was like we sold the product to you.

Cassie Young: 56:39

You’re getting 30% of commissions.

Max Altschuler: 56:40

Now, now now but now you’re a customer. Then you go to an onboarding specialist, ISR, yeah, right? Then you go to a um CSM who’s your customer success.

Cassie Young: 56:51

And you probably have an account manager is gonna be.

Max Altschuler: 56:53

You have an account manager, you have customer support, right? So like it is hard to build a profitable business when you have all you’re it that it’s touching everything like that. Meanwhile, you’ve got um the Apollo’s of the world. I you know, I personally I was always somebody who’s like, hey, we need to get into the data business. We should have that be our self-serve model, get people in and then get them onto the the um sales engagement platform. And I was saying this back in the you know teens, 2000 teens, but um, you know, that is i it’s a a I guess a way smoother way to get people into the product. It’s the self-serve uh onboarding motion, but then you actually have less people that it’s touching even along the way. And um, and you may do that differently, obviously, for SMB to mid-market to enterprise, but at Outreach, even at the mid-market, we kind of had to do that. Yeah. It gets tough to build a business like that. So starting at the pre-C stage companies, how are you coaching them on all the other aspects of go to market that are product related?

Cassie Young: 57:48

Sure. So I actually think it comes back to one of those core tenets of the founder outcomes framework we talked about, which was the jaw-dropping customer experience, right? Where it may not have to be self-serve, but it needs to be this transformational moment for the person on the other end of the product. And I think in the era of AI, time to value is like my new favorite metric on the planet, right? And not because of just like the financial implications of, you know, the card ARR lag of getting stuff live, but because everybody’s trying 20 different things. You know, I was down at the Pavilion Go to Market Summit a couple of weeks ago, and someone called GTM tooling uh the island of misfit toys, uh, which deeply resonated with me, right? So it’s how are you just getting them to those moments of magic and ROI that much faster than ever before? And so I think a huge part of the coaching that I give founders is again, that maniacal focus on the customer, but really the value reiteration back to the customer. Because at the end of the day, if you assert to a customer that this is what you drove in terms of incremental revenue or conversions or whatever, you and I both know they’re gonna argue that attribution all day long. But showing them something is still gonna get the gears turning, right? That you’re going and doing them. And I think beating that over the head as frequently as you can and as far reaching in the organization as you can is absolutely massive. But I would say to that point, I think it’s really, really important that people avoid the, you know, peanut butter trap, right? Of spreading yourself really thin by building these super wide products. I think nailing the wedges is massive, right? Because it’s not not only one, ensuring that you’re not going to have experimental revenue and people churn off it, but it then earns you the right, right, to kind of, you know, take wallet share from elsewhere as you build additional use cases, right? Or, you know, ultimately find the net retention levers for your business. But one point that came to mind when you asked me this question is if you and I had this conversation a year ago, and incidentally, I think you and I did a fireside chat about a year ago in San Diego, I was up on my soapbox around uh the zero CAC founder, right? Zach Fredericks works at primary, started this term zero CAC founder, people who you know grew up in the category and they have the role at X and can get the Running start on the go-to-market side. Cause we talk a lot about like land grabs, land grabs versus moats, which we can come back to. But today, I’m like, that’s just not enough. If you don’t have the zero, like you don’t have to be a zero tech CEO. We love it when you are, right? But if you don’t marry that with product vision and way more importantly, product execution, you’re going nowhere. Right. And, you know, Cloud of Judgment is one of my favorite weekly reads. And I feel like he had a great piece a couple of weeks ago. And I don’t know if I agree with like the 100% of the thesis, but something in there resonated where it was just talking about building moats in general right now. And if you think about it, like every moat you think you have is pretty short lasting. And so really um speed to getting to the next moat is the competitive advantage. So the provocative question that was asked is really is speed the moat? And I’m like, I don’t know if I 100% subscribe to that, but I I have said for the last decade of my career that speed is a really freaking important competitive advantage. And so I think that plays into go to market, but I actually think that’s even more important on the product execution side. It’s just again to belavor my customer obsession, really important that that’s not done in a vacuum.

Max Altschuler: 1:01:08

So we’ve got 300 LPs at GTM fund. And I can’t tell you how many times somebody’s like, hey, you’re are you hiring? Like, you know, I might want to get into VC next. What advice would you give to GTM operators or anybody that’s in operating role right now, even founders, um, to potentially go into VC in the next chapter of their career?

Cassie Young: 1:01:29