In this blueprint, we provide insight into where growth comes from and how to structure your sales approach to capture that growth. The Winning By Design Blueprint Series provides practical advice for every part of a SaaS sales organization.

Traditional Sales Growth vs SaaS Sales Growth

Historically, growth of a sales team was based on the revenue starting with $0M on day 1 of the year. Doubling revenue would require hiring 2x as many people.

However, in a SaaS model, the customer acquisition team can grow revenue to $1M in year 1. If the same team keeps performing at the same growth it will achieve $2M in year 2 – whilst the renewals come in at 100%.

This misunderstanding in growth can cause many misunderstandings in a world where no one is educated in sales.

Figure 1. Growth rate depicted from traditional B2B sales teams vs. SaaS Sales teams

Growth rate reduces when a sales team keeps acquiring the same revenue [$]. To keep growing at the same growth rate requires a significant investment in the acquisition efforts as depicted in figure 2.

Figure 2. SaaS Growth Rate

Calculating Growth Potential

What is new in today’s B2B software world is that products sold against an OpEx (SaaS) model experience an exponential growth due to a variety of factors;

An increase in Online Spend – B2B customers are increasing their online spend. Previously they may have only spent $1,000 when buying a SaaS service online. Now the services have matured where buyers are spending 20x in online services is relatively comfortable. In-person meetings are no longer required.

Figure 3. Understanding Growth Potential

An increase in Market Size – Every seller now operates in a global marketplace with 10x more buyers, and buyers more accustomed to buying from remote providers.

A compressed Sales Cycle – Today’s B2B customers buy a lot faster than ever before. They no longer are buying for a solution 12-18 months from now, but rather they are shopping for a solution to solve an immediate problem.

When to Accelerate Growth?

Figure 4. Early stages of growth

One of the most recent trends is the use of “growth hacking.” Growth hacking is a process of taking shortcuts. One of the key shortcuts is to use automated forms of outbound to identify leads that want to have a meeting and use low-cost sales resources to run those meetings in an effort to close.

Originally this worked well. In particular, post-2008 when a SaaS solution with its OPEX offering stood out from the conventional CAPEX solutions.

Case in point with Salesforce’s cloud CRM vs. SAP and Oracle’s on-site/perpetual license model. Today everyone offers a SaaS/OPEX solution and hacks no longer provide the desired results.

CASE IN POINT: In 2015 Randy had grown sales from $800k to $4M in ARR. A formidable feat celebrated with a new round of funding. In 2016 Randy was on track to grow the business from $4M to $6M with a big deal that could take it close to $7M. Randy was let go in July. Why? In 2015 Randy had kept pace with the growth in the market. However, the growth accelerated substantially in 2016. Competitors were increasing their market share and Randy was falling behind.

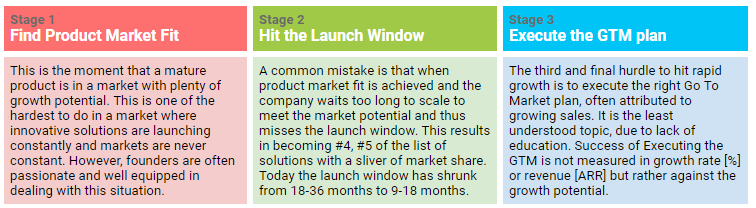

STAGE 1. FIND PRODUCT MARKET FIT

Figure 5. Impact of sales hacking visualized

One of the keys to growth in today’s business model is to identify the most effective and efficient GTM model using a variety of sales and marketing channels.

The challenge is that organizations are primarily looking at the result, not using metrics to measure effectiveness and efficiency of each GTM strategy. This is needed to scale the business.

To achieve growth, you have to identify the following during Product/Market Fit:

- WHAT is the value proposition that prioritizes the solution offered

- WHO is the audience that has a real problem and is willing to take action

- HOW to get to the audience with the real problem in an efficient and effective way

Due to the lack of measuring effectiveness and efficiency, the failures are also amplified by 10x. This means there is no real growth which results in a lower valuation of the company and the firing of the sales leadership. The replacement sales leader lacks the context of the growth hacking results and blames this on poor sales execution of the salespeople. The sales leader starts hiring new people… and with that, the downward spiral continues.

CASE IN POINT: Many SaaS companies can demonstrate the ability to get to $1M in ARR by pursuing 10,000 prospects with the “hack” of high-frequency email chains to set up demos. However, as these companies quadruple their sales teams they scale failure. This mimics tuna fishing with a fishing trawler using fine nets that destroy an entire ecosystem to catch a single tuna.

STAGE 2. HIT THE LAUNCH WINDOW

How do you know when you are in a launch window? There are three clear tell-tale signs;

- INCREASE IN PRICE – Instead of $24,000 in ARR you start winning clients at $48,000 ARR. This is indicative that you offer real value, and that your customers start to understand the impact of the value on their business.

- INCREASE IN WIN-RATE – Win-rate is measured as the number of Sales Qualified Leads needed to win one deal. Instead of winning 1 out of 4.8 deals you now win 1 out of 3 deals. This is indicative of a stronger position in the market.

- DECREASE IN SALES CYCLE – The Sales Cycle is measured between SQL and WIN stage. For example, the average sales cycle is now 71 days instead of 84 days. This indicates your customers are prioritizing your solution.

Figure 6. Tell tale signs of being in the launch window

What do these telltale signs have in common? They are data-driven – factors you can measure, and when entered accurately, (and interpreted correctly) they can be leveraged to make a data-driven decision.

CASE IN POINT: Common mistakes we find that can lead you to believe you are in a launch window:

Not distinguishing outliers: One of our client’s database showed a single $200,000 annual contract (ACV) Enterprise deal with a 270-day sales cycle among dozens of $12,000 ACV deals with 28 days sales cycles. Such a deal will offset all other deals.

Not entering the data correctly: An untrained sales manager gets a lead (SQL) and following a discovery call disqualifies it. Two months later the same lead re-enters and a new opportunity is created – the deal closes in a matter of weeks. The lead now is categorized with a short sales cycle as the history was never taken into account.

Both examples indicate you need to a) segment your data, and b) ensure correct data entry.

STAGE 3. EXECUTE THE GO TO MARKET PLAN

To meet the growth potential a Go To Market (GTM) plan is imperative.

Figure 7. When funding is used to scale growth

In this case we use the world’s most common GTM plan: to achieve $30M. Do 3x of what you were doing that got you to $10M. As you can observe in the figure below, even when we grow the sales team by 3x, and they perform admirably the scaling still remains a challenge.

Figure 8. Just growing the sales team does not achieve the desired growth rate

This is commonly experienced in companies who depend primarily on an “outbound” approach. They find out the hard way that tripling the sales team, and tripling the activities does not triple the result. What is required is a more modern GTM model that has layers of revenue.

To avoid a scaling problem you have to think of your revenue as if it has layers.

For example:

- Added regional teams to increase coverage and decrease dependence on your local market

- Add new products/services to uplift the price, and create upsell/cross-sell opportunities

- Pursue new accounts for example from SMB to Mid Market to Enterprise

- Add a strategic partnership that opens a new segment, for example, Healthcare, Government, etc.

Going after bigger deals is not just taking your best sales people and giving them a list of bigger companies. This requires that you segment the market, and develop a new GTM plan for that market.

Figure 9. Layering of revenue. Each layer may need a different GTM strategy